Square, which has changed its name to Block, released its fourth-quarter earnings last week. Markets gave a thumbs up to the release and the shares gained over 26% on Friday. What’s the forecast for Block shares and should you buy or sell now?

Despite the surge last week, Block shares are still down 25% in 2022. It is now down over 58% from its 52-week highs and is in deep bear market territory. Block is not the only fintech share that has tumbled in 2022. Other companies like SoFi, Affirm, and PayPal are also trading with massive YTD losses.

Block reported better than expected earnings

Block reported revenues of $4.08 billion in the fourth quarter of 2021, which were 29% higher than the corresponding period last year, and were also higher than what analysts were expecting. In the full year, it reported revenues of $17.66 billion, a YoY rise of 86%. The company’s revenues might look inflated due to the contribution from the sales of bitcoins. In the fourth quarter, Block generated $1.96 billion as revenues from the sales of bitcoins. Its net revenues, after excluding bitcoins, were $2.12 billion, 51% higher than the fourth quarter of 2020. In the full year 2021, the company reported net revenues of $7.65 billion which were 55% higher than what it posted in 2020.

Profits surpass estimates

Block reported gross profits of $1.18 billion in the quarter, which were 47% higher than the corresponding period last year and were ahead of analysts’ estimates. The company’s gross profits have increased at a CAGR of 50% over the last two years. The subscription and services business is the biggest contributor to Block’s gross profits and in the fourth quarter, it generated gross profits of $622 million on total revenues of $772 million. Its transaction-based revenues and gross profits were $1.31 billion and $545 million respectively in the quarter.

While bitcoin sales help prop up Block’s revenues, they are not a key driver of the profits and contributed only about $46 million to the company’s fourth-quarter gross profits. Overall, it reported an adjusted net income of $140.4 million in the quarter which was ahead of the $115.1 million that analysts were expecting.

Cash App performance surprised on the upside

Many analysts have been concerned about Block’s Cash App. However, the business reported an 18% rise in revenues in the fourth quarter. After excluding bitcoins, revenues increased 42% YoY.

Commenting on the performance, Square said “For our Cash App ecosystem, we have achieved positive annual gross profit retention for our historical cohorts, demonstrating that existing customers have remained on the platform and increased their engagement with Cash App over time.” It added, “We have seen strength in retention during recent years, with annual gross profit retention of greater than 125% for each of the past four years.”

Cash App had 44 million MAU (monthly active users) in the quarter, which was higher than 40 million at the end of June. Susquehanna analyst James Friedman said “Fears that Cash App users would not outlast stimulus checks seem to have been overblown as user and engagement metrics look strong. Gross profit per monthly active grew 13% year-over-year to $47 in the fourth quarter.” Jefferies was also impressed with the performance of the Cash App.

Block acquired Afterpay

Earlier this year, Block completed the acquisition of the Australian BNPL (buy-no-pay-later) company Afterpay. After the earnings release, RBC Capital analyst Daniel Perlman said “Management gave some color around Afterpay, but left many details out in anticipation of their investor day in May.” He added, “Management noted the significance of Afterpay to the omnichannel strategy, enabling Square to serve customers with the large global merchants.”

KeyBanc analyst Josh Beck said, “Afterpay synergies were an earnings call focus, with early achievements including day-one online merchant/BNPL integration and 100,000 Cash App leads to Afterpay merchants with a compelling vision to unite the consumer/seller ecosystems across channels and countries.”

Block’s guidance was also better than expected. Markets seemed impressed with the earnings and the shares rose sharply after the earnings release.

Block share price forecast

According to the forecast estimates compiled by CNN Business, Block has a median price target of $189, which is a premium of 57.7% over current prices. Its highest price target of $322 is a premium of 168% over current prices, while its lowest price target of $120 is similar to the current share price.

Of the 41 analysts covering the shares, 29 have rated the shares as a buy or some equivalent while 10 analysts have a hold rating. The remaining two analysts have a sell rating on the shares.

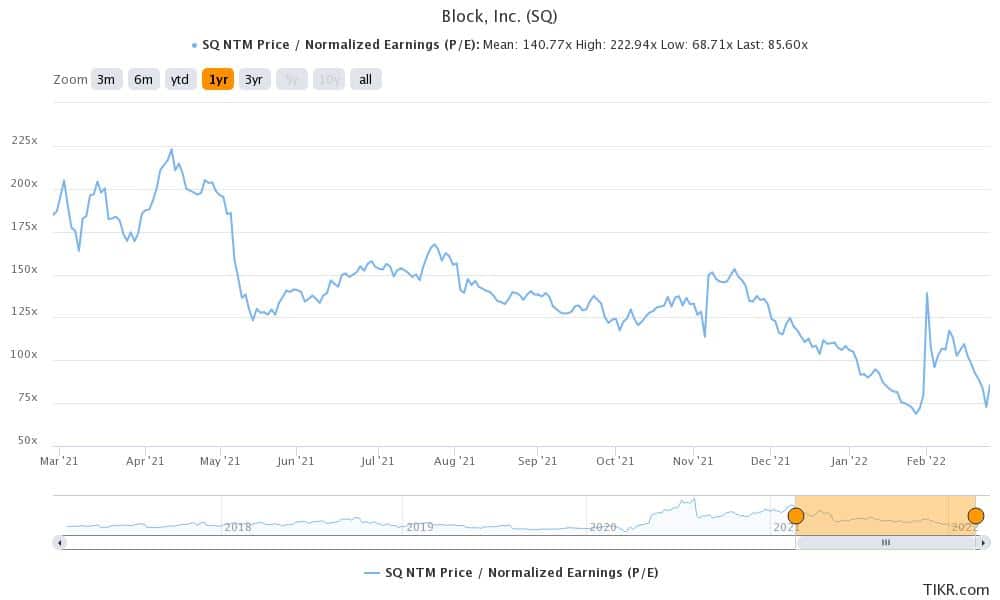

Several analysts lowered their target prices on Block after the earnings release. More than anything related to the company’s earnings, the price cuts seem more of a reaction to the current macro environment, where we have seen a structural deterioration in valuation multiples of growth shares.

Key drivers for Block shares

Block has been diversifying its business and increasing cryptocurrencies are becoming a major driver. Amrita Ahuja, the company’s CFO believes that there is a $100 billion TAM (total addressable market) for the Seller App and a $60 billion TAM for the Cash App. The company only has a 2-3% share of these markets even as the market share has been expanding.

The company plans to increase its market share through a mix of increasing penetration among existing customers, reaching new customers, and increasing its product portfolio. Notably, the new customer acquisition costs for Block are much lower than legacy financial institutions. While most of the company’s customers are millennials, it has also been expanding its reach among older demographics.

International expansion is also a big opportunity for Block and it has also expanded into Spain, its fourth market in the European Union.

Should you buy or sell Block shares?

Block and its CEO Jack Dorsey are among the biggest backers of cryptocurrencies. Block also holds bitcoins on its balance sheet. The company is looking to develop its own bitcoin mining system which would ease the process of bitcoin mining. Dorsey has quit Twitter and is focusing his energies on Block now.

Fintech companies are giving traditional banks a run for their money and have been gradually snatching away market share from them.

The digital payments industry is witnessing strong secular growth, both in the US as well as internationally. Block is in a pole position in the transformation. The company also has a strong management team and is led by the charismatic Dorsey.

Block is among the best names in the fintech industry. The shares look attractive now after the steep fall from the peaks. However, in the short term, we could see more volatility amid the Russia-Ukraine crisis.

Question & Answers (0)