The price of AstraZeneca shares is slipping today after Denmark’s top health authority halted the rollout of the firm’s COVID vaccine after receiving reports about “possible serious side-effects”, including the formation of blood clots among a small subset of patients in Europe.

Denmark would be the latest of a group of European countries that have halted the rollout of AZN’s vaccine including Estonia, Lithuania, and Luxembourg, while an investigation has been opened by the European Medicines Agency (EMA) to confirm if these events were isolated situations or if they could be an unexpected side-effect of the treatment.

These concerns may have started with a decision from Austria’s top health authority to suspend the use of a specific batch of AZN’s vaccines after one individual was diagnosed with multiple thrombosis – the formation of blood clots within blood vessels – while another patient was hospitalised after suffering a pulmonary embolism shortly upon receiving a shot of the vaccine.

The thrombosis patient died only days after, while the second patient is recovering from the condition. The European health authority mentioned that these side effects are not among those listed by the drug company, while pointing to potential quality issues in a specific batch rather than in the components or design of the treatment itself.

The EU agency also indicated that the number of thromboembolic events evidenced in vaccine takers “is no higher than that seen in the general population”, with a total of 22 cases among approximately three million vaccinated individuals living within the European Union.

Nonetheless, AstraZeneca (AZN) shares are reacting negatively to Denmark’s decision today, with the price of the stock losing 2.5% in mid-day stock trading action in London at 7,015p.

The director of the National Board of Health in the Nordic country emphasised that the 14-day suspension of the AZN vaccine would give the agency enough time to evaluate the situation, while no conclusions against the effectiveness of the treatment have been drafted.

Meanwhile, in a statement given to CNBC, the British drugmaker said that the safeness of its vaccine has been “extensively studied in Phase III clinical trials and peer-reviewed data confirms that vaccine is generally well tolerated”.

How have AZN shares performed prior to the news?

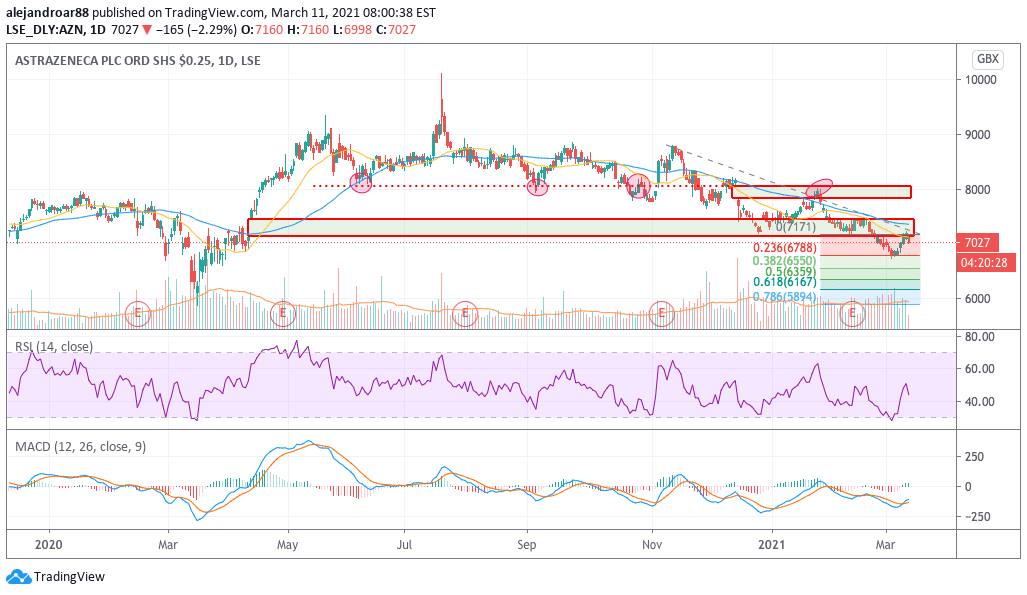

Prior to today’s downtick, AstraZeneca shares managed to snap a 5-day winning streak that started on 4 March, as the stock bounced off oversold levels after facing a strong downtrend that ended up plunging the stock price below the 7,000p level.

So far this year, the performance of AZN shares has been quite disappointing, with the stock reporting a 0.1% gain to investors until yesterday after sliding 1% during 2020.

As of today, the price action seems to be rejecting a move above the 7,000p level – a threshold that seems to be important for market participants as it served as support twice while it could be turning to resistance now.

What’s next for AstraZeneca shares?

The chart above shows how this 7,000p level coincides with the lower end of a bullish price gap that dates back to the time when the firm announced its participation in the race to launch a vaccine against COVID-19.

The RSI has stood below the 50 level for a while now, which indicates that the momentum for the stock has been on the negative end lately while the MACD has not been able to climb to positive levels since late January.

At this point, the latest bounce in the price of AZN shares seems to obey a technical rebound rather than a full-blown trend reversal.

If that were to be the case, today’s downtick could be the beginning of another move lower – possibly aiming to retest the 6,800p level corresponding to the 0.236 Fibonacci extension shown in the chart.

On the other hand, if the uptrend were to continue, the confirmation would come in the form of a clean break of that 7,000p threshold – in which case a first target of 8,000p per share could be drafted for AZN for the next few weeks.

Question & Answers (0)