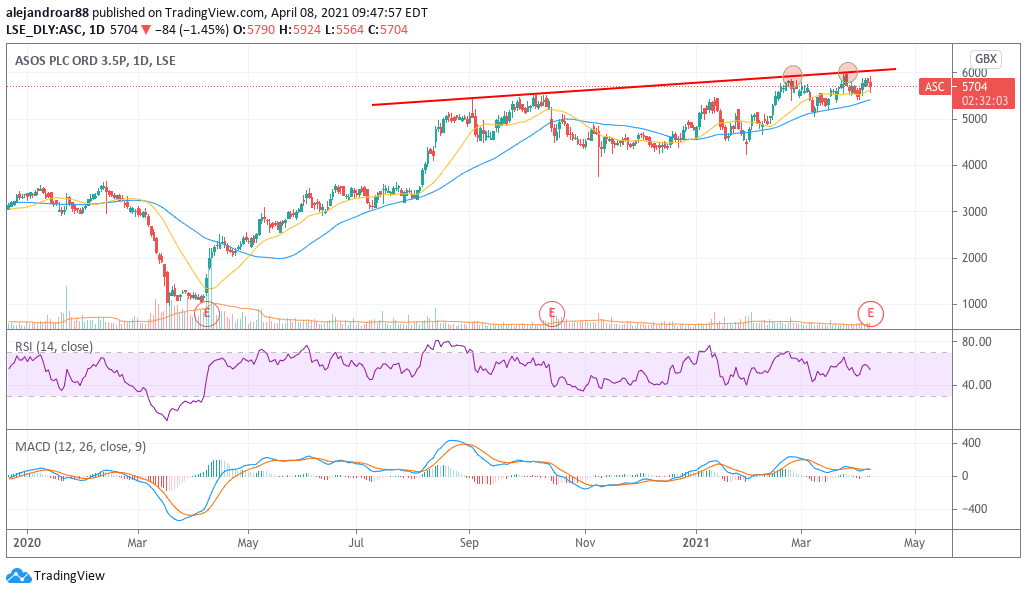

The price of ASOS shares is retreating 1.5% today in mid-day stock trading action at 5,700p per share following the release of the firm’s interim results covering the first six months of its fiscal year, despite the online fashion retailer posting strong sales and profitability growth during the period.

Revenues for ASOS (ASC) first half fiscal landed at £1.98 billion, which represents a 25% year-on-year increase, while the firm’s gross profit margin retreated almost 200 basis point at 45% as a result of lower average selling prices per unit – down 4% compared to the same period last year.

Higher sales in the United Kingdom – the largest market by revenue for ASOS – drove revenues higher, ending the period with a 39% increase at £800.4 million as a result of prolonged lockdowns.

Meanwhile, the number of active customers grew 12% from 22.3 million to 24.9 million, as ASOS has continued to take advantage of lockdown-led online shopping to grow its user base.

On the profitability front, ASOS EBITDA margin jumped 320 basis points to 9.2% by the end of these six months, resulting from a drop in distribution, warehousing, and other operating costs as a percentage of sales.

The company indicated that lower returns were the primary cause leading to this improvement in EBITDA margins, although marketing expenditures moved higher from 4.3% to 5.5% of total revenues as the firm increased its digital marketing efforts to “drive new customer acquisition”.

Moreover, ASOS reported adjusted profits before taxes of £112.9 million, representing a 275% year-on-year jump, while diluted earnings per share multiplied nearly three times, ending the period at 81.9p per share.

Data from Refinitiv shows that analysts are expecting to see annual after-tax earnings of £141.4 million and on sales of £3.95 billion.

ASOS expects slowdown in revenue growth as shoppers hit the streets

As a result of vaccinations, ASOS’s Chief Executive, Nick Beighton, indicated that the firm expects “a portion of consumer demand will move back to stores as restrictions are eased throughout our markets”.

Moreover, ASOS has repeatedly warned that it remains cautious about the economic impact that the pandemic could have had on customers in their 20s – possibly the most important demographic for the online retailer.

However, ASOS’s management team emphasised that the pandemic could have caused a long-lasting impact on consumers resulting in higher online shopping volumes in the foreseeable future as they have grown accustomed to buying apparel over the internet.

What’s next for ASOS shares?

Based on analysts’ profitability estimates ranging from £142 to £160 million, ASOS shares would be trading at 36 times the firm’s forecasted 2020-2021 earnings.

Notably, earnings have grown from £50 million in 2017 to possibly £180 million this year, if ASOS second semester’s profitability lands at around £70 million, while sales could end the year at around £3.5 and £3.9 billion.

Now, if we were to expect some degree of normalisation in the firm’s performance after the pandemic, one could possibly expect sales to keep growing at a compounded annual growth rate (CAGR) of around 23.5% – in line with the firm’s historical growth.

Meanwhile, net after-tax profit margins should also normalise to around 2% to 3% which would result in a three-year forecast of £6.6 billion in revenue and around £132 and £200 million in profits for ASOS’s 2023-2024 fiscal year.

In this regard, Sophie Lund-Yates from Hargreaves Lansdown said: “Operating margins came too close to the ground for comfort in recent years, and if return rates start to spike again, we could see some of the progress in margins come undone”.

Based on those conservative forecasts, earnings growth for ASOS doesn’t seem too promising unless the firm manages to maintain these above-average net profit margins seen during the pandemic – possibly in the range of 5% to 6% as a result of economies of scale.

If that were to be the case, earnings, under the scenario outlined above, could jump to £330 million. This would represent a three-year earnings CAGR of 10%, which still results in a price-to-earnings-to-growth ratio higher than 3 – a lofty valuation by all means.

Therefore, even in the most optimistic scenario for the firm, its current valuation doesn’t seem to be attractive enough when compared to its forecasted earnings growth.

As a result, market participants could start reducing their exposure to the firm now that the virus crisis in Europe is coming to an end on the back of en-masse vaccinations.

Question & Answers (0)