Shares of British fashion retail company JD Sports (JD) were trading sharply higher in early London trading today after the company provided its trading update and lifted the guidance.

JD Sports released the trading update for the 22-week period ending 2 January today. It said that the group’s LFL (like for like) revenues increased 5% year over year during the period. The company attributed the strong sales to the steady consumer shift from physical to digital channels.

JD Sports trading update

While the company’s update on the top line looked encouraging, its estimates for the full year profitability look even better. In its trading update, JD Sports said, “The positive nature of the demand through the second half to date means that we are now confident that the Group headline profit before tax for the full year to 30 January 2021 will be significantly ahead of the current market expectations, which average approximately £295 million.” It expects the metric to be more than £400 million.

JD Sports share rise after the update

Expressing pleasure over the results, JD Sports said, “Against a backdrop of further forced temporary store closures in many of our global territories, it is pleasing to report that demand has remained robust throughout the second half, including in the key months of November and December.”

The trading update was received positively by the markets and JD Sports shares were trading 4.6% higher at 890.40p at 11:50 AM London time today. Notably, the share was trading higher even as the company talked about headwinds from the continued lockdowns in the UK.

JD Sports on the fiscal year 2022 outlook

In its release, the company said that “Looking ahead, it is clear that operational restrictions from the COVID-19 pandemic will also be a material factor through at least the first quarter of the year to 29 January 2022.” It specifically pointed to the scaling down of activity in stores and scaling up the online channel at short notices due to the intermittent lockdowns.

JD Sports also highlighted the “ongoing uncertain outlook with stores in the UK likely to be closed until at least Easter and closures in other countries possible at any time”. However, despite the challenges and the lockdowns, it expects its earnings in the fiscal year 2022 to be 5% to 10% higher over the fiscal year 2021.

Earnings estimate

The company will release its preliminary results for the fiscal year 2021 on 13 April. Analysts polled by TIKR, expect the company’s revenues to fall 5% in the fiscal year. Its revenues had increased by almost 30% in the fiscal year 2020. However, analysts expect the company’s revenues to increase by 15.4% in the fiscal year 2022

Shoe Palace acquisition

Last month, JD Sports completed the acquisition of US-based Shoe Palace Corporation for a total cash consideration of $325 million. The acquisition will enhance the companies revenues in the US market. It has been working to scale up its presence in the world’s biggest economy and recently opened its flagship US store in Times Square, New York.

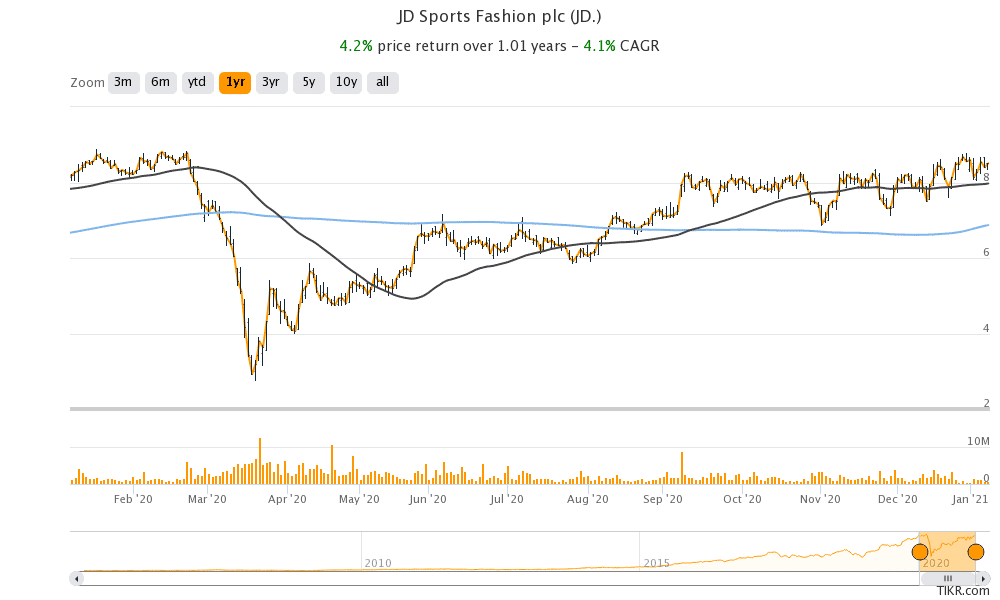

JD Sports shares

JD Sports shares are up more than 4% over the last year and have outperformed the FTSE 100, which is in the red over the period. In general, retailers that have been able to pivot their customers from physical stores to online shopping on their platforms have done better than rivals whose ecommerce operations are not well established. Incidentally, while almost all retailers including Walmart and Tesco see ecommerce as the future, Primark has been focusing on the physical stores model. The COVID-19 pandemic has seen more consumers shop online lifting sales for companies like Amazon.

Valuation

JD Sports shares trade above their 50-day SMA (simple moving average) and 200-day SMA, which indicates a short-term uptrend. Looking at the valuation multiples, the company’s shares trade at an NTM (next-12 months) enterprise value to revenue multiple of 1.5x while its NTM PE multiple is 28x. While the valuation multiples are higher as compared to what we usually see for retailers, they look reasonable considering the growth outlook and JD Sports’ strong online franchiseretailer

Question & Answers (0)