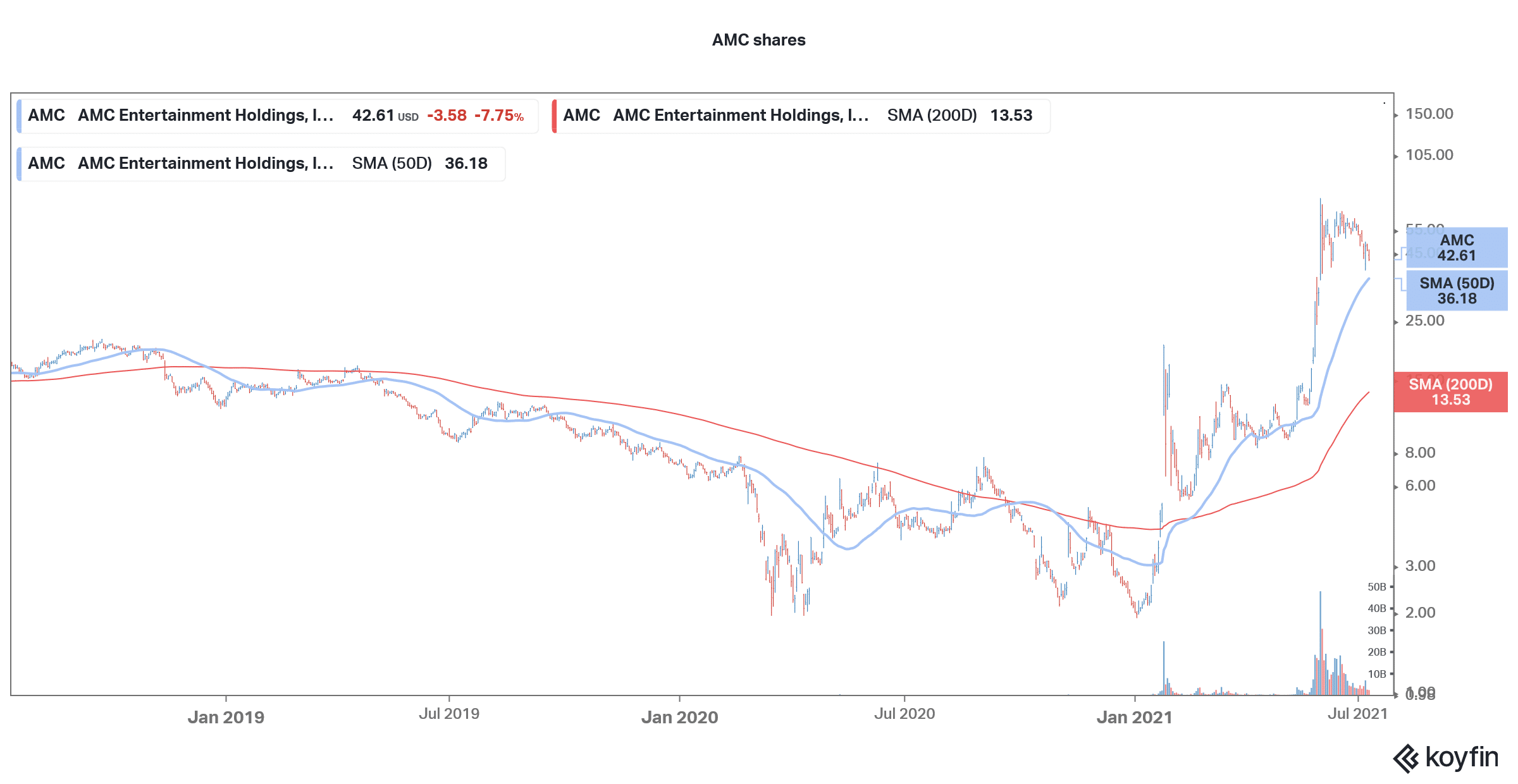

AMC Entertainment shares fell almost 8% yesterday and were trading lower in US premarket price action today. The shares are falling despite reporting a record weekend during the COVID-19 pandemic.

To be sure, Disney’s “Black Widow” reported weekend collections of $80 million in the US and Canada which is the highest collection since the COVID-19 pandemic began. The international collections were also similar.

AMC weekend collections

AMC sounded upbeat and said, “For the third time since Memorial Day weekend and the second time in two weeks, AMC sets another record for post-reopening weekend attendance in the United States, and globally, making this the busiest weekend since AMC theatres closed in March of 2020 due to the pandemic.”

The company reported 2.5 million moviegoers between Thursday and Sunday in the US. Combined with the 650,000 guests in the Middle East and Europe, the company welcomed 3.2 million people during the period. AMC also said that eight of the top 10 busiest cinemas in the US were owned by it. The company has previously said that it is winning market share as some of the smaller cinema chains have closed down due to the pandemic.

Why is AMC falling

However, AMC shares fell despite the record collections. The anomaly is due to a couple of reasons. Firstly, “Black Widow” collections are below the $135 million opening collection from the franchise since 2008. Also, and perhaps more importantly, Disney reported revenues of $60 million from the on-demand video sales of the title. In 2020, Disney had restructured its business to put streaming at the centre. While it had termed the streaming of “Mulan” then as an exception, it now looks more of a rule as the company releases the new titles simultaneously in theatres as well as streaming.

“The weekend performance of ‘Black Widow’ across its theatrical and premium streaming windows probably poses more questions than it answered,” said Cowen analyst Doug Creutz. He added, “The recovery of global box office still appears likely to be painfully slow and potentially permanently incomplete.”

Streaming versus moviegoing

To be sure, streaming has been a big challenge for cinema chain companies and the problem has been further compounded by the fact that movie production houses have launched their own streaming platforms. While streaming cant fully replace the moviegoing experience for everyone, many would find watching a new title from the comfort of their homes as a good alternative.

This is what precisely seems to be happening. Many may argue that once the pandemic is over more people, especially those with kids, will feel more comfortable visiting cinemas. However, just like the pivot from brick-and-mortar retail to online shopping has gained traction during the pandemic, the same holds true for streaming. Many of the people who have tried a new title on the streaming platforms might continue to do so even after the pandemic.

Valuation

Meanwhile, another factor behind the fall in AMC shares is their high valuation. The company still commands a market capitalization of over $20 billion. It is burning millions of dollars every month and has raised a lot of cash by selling shares. The company’s proposal to sell another 25 million shares was however thwarted by retail shareholders. The company is now majority-owned by retail shareholders who have helped pump the prices even as they have run way ahead of fundamentals. AMC has over $11 billion in total liabilities and it would have to raise cash to repay the debt and other liabilities.

Meanwhile, the management has praised retail shareholders for their support and also offered perks like free popcorns at the cinemas as a gesture.

None of the analysts is bullish on AMC shares

Rich Greenfield of LightShed Partners tweeted “Imagine being a theater owner and realizing studios need you less and less every day,” He added, “Leverage is shifting rapidly in the streaming era toward the studios.” Indeed, cinema chains don’t have much leverage now as studios now can showcase their titles on streaming also.

None of the analysts rate AMC shares as a buy. Earlier this month, Loop reiterated its sell rating on the shares pointing to an oversupply of theatres in the US. “Old theaters don’t die, they just get repurposed into new theaters. There are simply too many screens for the movie-going public. We thought one silver lining of the pandemic is that it might finally rationalize the number of screens in the US,” said Loop in its release.

AMC shares fall

Last month, while Wedbush had raised its target price on AMC by $1 but cautioned against investing in the shares. “We expect significant volatility in shares of AMC to continue, driven by trading momentum unrelated to AMC’s fundamentals. As such, we do not recommend buying shares of AMC here,” said Wedbush in its note.

AMC shares were trading lower in US premarket trading today. While the shares have fallen 41% from their 52-week highs, they are still up over 2,000% for the year.

Question & Answers (0)