Amazon (NYSE: AMZN) has expanded its same-day delivery service to include fresh, perishable groceries. This expansion, which is being rolled out to more than 1,000 US cities and is planned to reach over 2,300 locations by the end of 2025, marks a major step in the company’s efforts to provide a comprehensive, one-stop shopping experience for its customers.

Amazon bets big on groceries with same-day deliveries

The new service allows Prime members to order thousands of fresh grocery items, including produce, dairy, meat, seafood, and frozen foods, alongside millions of other products like electronics, household essentials, and apparel, all in a single cart for same-day delivery. This integration is a key component of Amazon’s strategy, addressing past customer confusion where groceries and other items were separated into different online shopping carts.

For Prime members, the same-day grocery delivery service is free on orders over $25 in most cities. For orders below the minimum, a small fee of $2.99 applies. Non-Prime members can also utilize the service for a fee of $12.99, regardless of the order size.

Grocers under pressure as Amazon targets grocery market

Amazon’s entry into the same-day perishable delivery space puts direct pressure on competitors like Walmart, Kroger, and Instacart, which have also been vying for a larger share of the online grocery market. Shares of grocers fell yesterday after Amazon’s announcement, with Instacart falling in double digits. The price action is not surprising, as we usually see share prices of incumbents fall whenever Amazon makes an entry into an industry.

By leveraging its vast logistics network and offering a consolidated shopping experience, Amazon aims to attract a wider customer base and deepen its relationship with existing Prime members.

Early results from test cities like Phoenix, Orlando, and Kansas City have been promising. Amazon reports that many of these were first-time grocery shoppers who, after using the same-day service, returned to shop twice as often. Interestingly, strawberries have even outperformed popular electronics like AirPods in the top five best-selling products in these regions, highlighting the strong consumer demand for this new service.

Amazon already has Amazon Fresh and Whole Foods

This expansion is part of Amazon’s larger strategy to make grocery shopping simpler, faster, and more affordable. It complements Amazon’s existing grocery offerings, which include Amazon Fresh and Whole Foods Market.

While Amazon Fresh focuses on a wide range of groceries at competitive prices, Whole Foods Market caters to customers seeking organic and premium products. The new same-day delivery service provides another option, giving customers the flexibility to choose the best service for their specific needs, from a full grocery haul to a quick, one-off purchase.

North America is AMZN’s biggest market

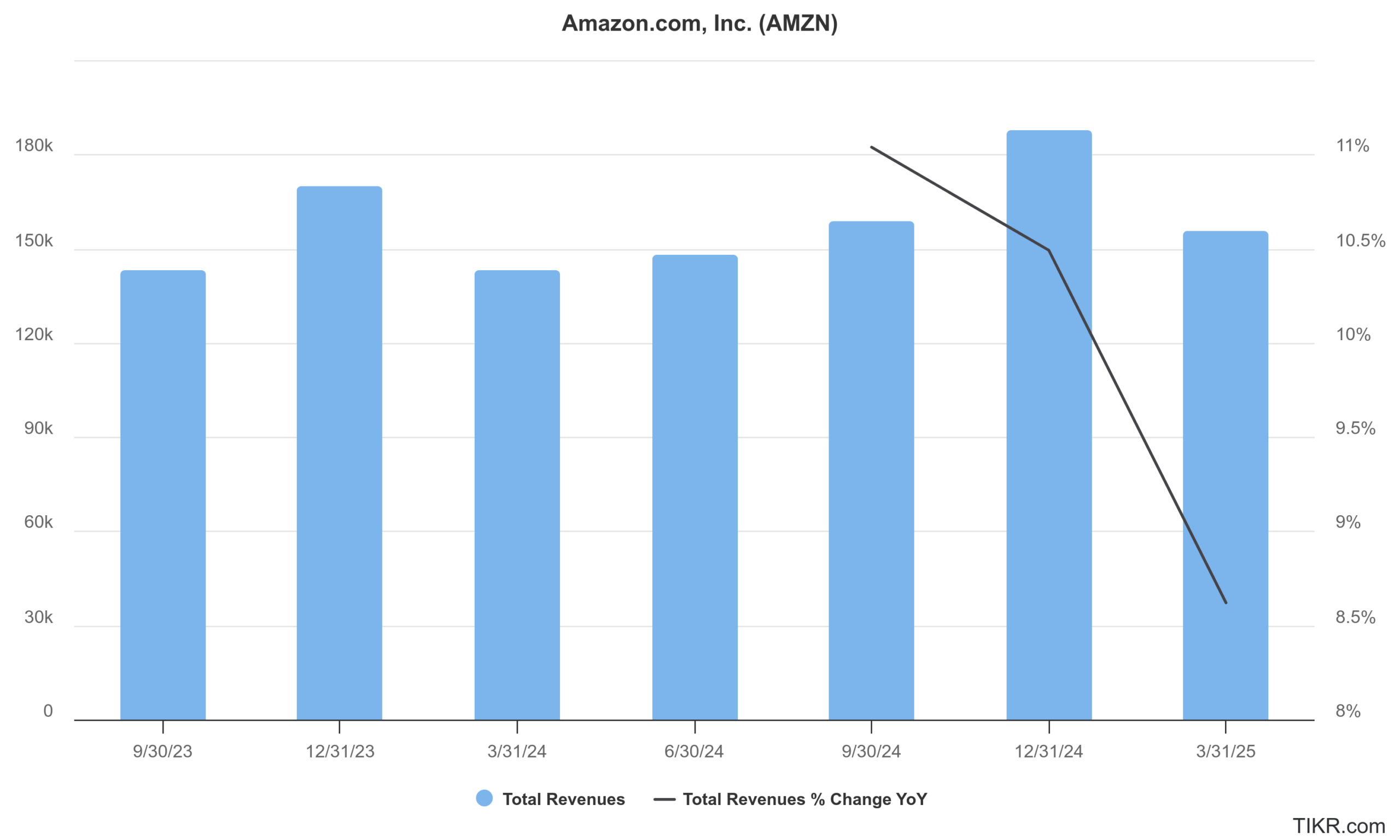

The North America segment, which includes the US and Canada, is Amazon’s biggest market by revenue. In Q2 2025, the North America segment sales increased by 11% year-over-year to $100.1 billion. This growth was particularly notable given the company’s already massive scale. Operating income for the segment also saw significant improvement, surging to $7.5 billion from $5.1 billion in the same period a year ago.

Amazon’s strategic re-architecture of its US fulfillment network into a regional structure is paying off. This has allowed the company to store inventory closer to customers, resulting in faster delivery times and a more efficient supply chain.

The company reported a 40% year-over-year increase in the share of orders moving through direct lanes, a 12% reduction in the average distance packages travel, and a nearly 15% decrease in handling touches per unit. This has translated into a record-breaking delivery speed for Prime members, with 30% more items delivered same-day or next-day in Q2 2025 compared to the previous year.

Amazon is investing billions of dollars into AI

The company is making a big bet on AI with a sweeping strategy that is integrating generative AI across every facet of its vast business.

Amazon is using AI in its logistics business to improve efficiencies. The company is using AI to optimize its logistics network, with models like DeepFleet coordinating its vast network of robots to improve productivity and delivery speed.

Amazon is actively using generative AI to improve the customer journey. This includes new tools like “Hear the highlights,” which uses AI to create audio summaries of product reviews, and an AI-powered shopping agent that helps customers with product discovery and decision-making. These features are designed to make shopping on Amazon more intuitive and personalized, driving higher engagement and sales.

AWS is seeing a growth rebound amid the AI pivot

The heart of Amazon’s AI strategy lies within its cloud computing division, AWS. AWS is positioned as the go-to platform for businesses building and deploying their own AI models. The company offers a wide range of services, from purpose-built AI infrastructure to managed services like Amazon Bedrock, which provides customers with a choice of leading foundation models from companies like Anthropic and others.

Amazon is building custom chips

Amazon is also making significant investments in developing its own custom AI chips, such as the AWS Trainium, to provide customers with a cost-effective and high-performance solution for AI training and inference. The company’s partnerships with AI startups like Anthropic further solidify its position in the competitive AI landscape.

These ambitious AI initiatives come with a hefty price tag. Amazon is pouring billions into capital expenditures to build out the data center capacity and infrastructure required to power its own AI ambitions and to serve the booming demand from AWS customers. While this heavy investment is expected to weigh on short-term profitability, it would help the company over the long term.

Question & Answers (0)