Passive Investing UK – Best Passive Investments 2020

Passive investing is the cream of the crop in the UK financial scene.

The main concept is that you will be investing in assets that require no input from yourself. Instead, the theory is that you can sit back and allow the investment to work for you. This might come in the form of bonds, ETFs, index funds, or even Copy Trading.

In this guide, we discuss 5 of the best passive investments available to UK residents. We’ll also give you some background information on what to expect from a passive asset class and how to get started with an investment today.

-

- 1. iShares Core High Dividend ETF – Best Passive Investment for Dividends

- 2. Vanguard Total Stock Market Index – Best Passive Investment for Diversification

- 3. Vanguard Total Bond Market Index Fund – Best Passive Investment for Bonds

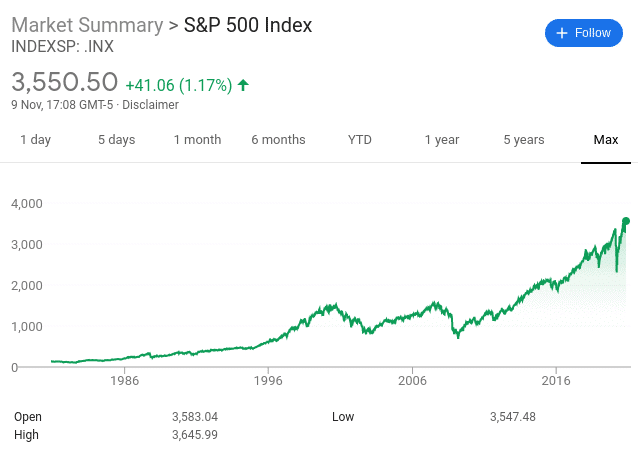

- 4. S&P 500 Index – Best Passive Investment for Historical Performance

-

- 1. iShares Core High Dividend ETF – Best Passive Investment for Dividends

- 2. Vanguard Total Stock Market Index – Best Passive Investment for Diversification

- 3. Vanguard Total Bond Market Index Fund – Best Passive Investment for Bonds

- 4. S&P 500 Index – Best Passive Investment for Historical Performance

What is Passive Investing?

Passive investing is a type of investment strategy that strives for minimal effort. This means that you won’t be required to perform heaps of research on your chosen asset. In addition to this, you won’t be regularly chopping and changing your portfolio.

Instead, you’ll get to sit back and take a long-term approach to investing. In its most basic form, bonds are a great example of a passive investment. This is because as soon as you purchase the bond instrument there is nothing more for you to do.

After all, you will receive coupon payments (interest) every 6 or 12 months until the bonds expire. When they do, you will then get your original investment back in full.

At the other end of the spectrum, passive investing won’t be for those of you that not only enjoy the thrill of picking and choosing stocks but timing the market, too. This is known as active investing as it requires a lot of time and knowledge of the financial markets.

Taking the above into account, passive investing is likely the best option if you:

- Want to invest in the financial markets but you don’t have any experience in the space

- Want to grow your money over many, many years

- Are looking for financial assets that yield regular income – such as ETFs, index funds, or bonds

- Don’t want to spend any time managing your investment portfolio

Active vs Passive Investing

There is often some confusion about the active vs passive investing conundrum. As we noted above, the key difference between the two is the amount of time and amount you are required to put into your investment endeavors. For example – and as the name suggests, active investing requires you to be active in the financial markets.

This means that you will be regularly buying and selling assets and looking to time the market to perfection. In order to achieve this goal, you will need to dedicate lots of time to researching the asset in question. This also means that you have a direct interest in shorter-term market trends.

On the other hand, passive investing meets none of the characteristics mentioned above. This means that you won’t need to keep tabs on what is happening in the here and now. On the contrary, you are only interested in the long-term game. In addition to this, passive investing requires very little, if any, knowledge of the financial scene.

This is because you will be investing in strong, stable, and proven assets that have held their own over the course of time. In turn, passive investments usually allow you to combine capital growth with income. This means that you might get stock or ETF dividends while at the same time – seeing the value of your passive investment grow.

Note: Some asset classes – such as mutual funds and investment trusts are classed as ‘active funds’. This is because the mutual fund will actively buy and sell assets with the view of outperforming the wider market. However, from your perspective – the investment is passive. After all, once you make an investment you are not required to make any investment-based decisions!

Passive Investing vs Growth Investing

Growth investing is the process of injecting money into assets that focus on capital growth as opposed to income. For example, growth stocks like Tesla and Square do not pay dividends and likely won’t for many years.

But, these stocks provide above-average returns in the form of increased stock prices. In other words, growth investing is focused on assets that allow you to increase the value of your money through market forces as opposed to dividends or bond coupon payments.

Passive investing is a completely different type of financial strategy. That is to say, a passive investment can focus on growth, income, or a combination of the two.

Types of Passive Investments

So now that you know what passive strategy involves, we now need to dig a little dipper to see what investment opportunities are available in the UK.

Dividend Stocks

Dividend stocks are a great passive investment to consider. As the name suggests, you will be investing in stocks that pay dividends. This means that you will receive a regular payment from the respective company – which is usually every three months.

Not all stocks pay dividends – especially those that are still in the early days of their corporate journey. But, those that do are typically strong and stable firms with a long-standing track record in the industry or sector that they are involved in.

In fact, if you’re looking to passively invest in stocks in a risk-averse manner, you might want to focus on ‘Dividend Aristocats’. These are publicly-listed companies that have increased the size of their dividend payment every year for 50 consecutive years. At the time of writing, this exclusive club consists of over 65 stocks.

This includes the likes of:

- Johnson & Johnson

- Procter & Gamble

- Chevron

- Pepsi

- Walmart

- 3M

We should make it clear that this type of stock investment doesn’t only yield dividends. On the contrary, you also stand the chance of growing your money when the value of the firm’s share price increases over time. For example, had you invested in Johnson & Johnson 40 years ago, you would have paid in the region of $1.78 per share (adjusted for stock splits).

Fast forward to 2020 and the same stocks are worth over $146. In simple terms, not only does this mean that you would have enjoyed 40 years’ worth of increased dividend payments, but the value of your passive investment would now be worth 8,000% more!

Index Funds

Next up we have index funds. These are financial assets that track a specific section of the stock market. For example, if you wanted to invest in the largest UK stocks listed on the London Stock Exchange, you’d want to invest in the FTSE 100 index. This is because the index fund provider will buy all 100 shares listed on the index at the appropriate weighting.

Every time a new company enters the FTSE 100, the index fund will buy the respective shares. All of this goes on behind the scenes, meaning that the investment is 100% passive. In fact, you don’t need to do anything until you decide to cash out your passive investment.

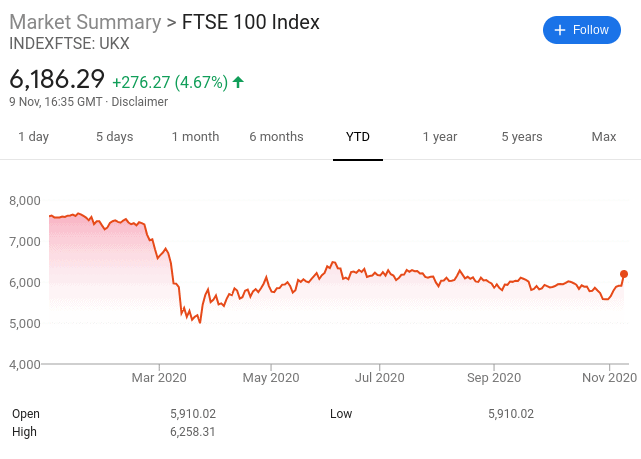

With that being said, you might want to re-think backing the FTSE 100. After all, the UK’s primary stock index is now worth less today than it was five years ago. Over in the United States, however, things are a lot different. For example, the S&P 500 – which is an index that tracks 500 large-scale US companies, is worth 76% more during the same period.

Note: We discuss the best passive investments to consider further down in this guide.

In terms of the fundamentals, index funds are usually operated by ETF providers. Popular examples include iShares and Vanguard.

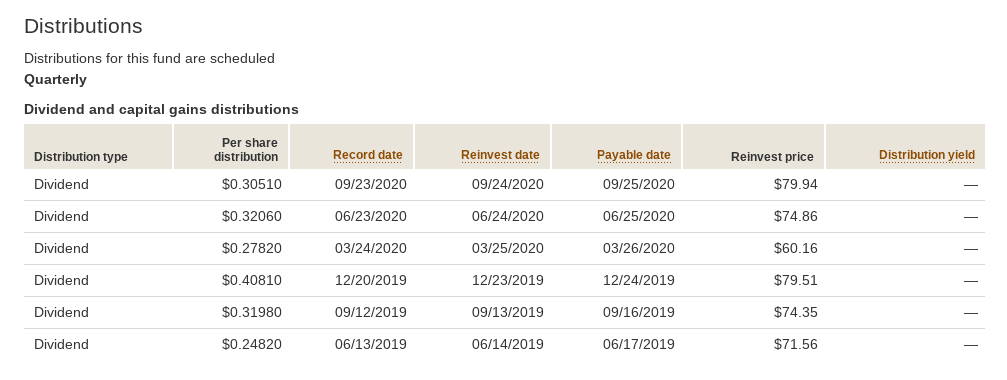

It is also important to note that index funds not only yield capital growth but dividends too. After all, you’ll be passively investing in dozens, if not hundreds of companies, many of which will be dividend-paying firms. As such, you should receive a dividend payment from the fund provider every three months.

ETFs (Exchange-Traded Funds)

Index funds are a sub-division of ETFs. This is because ETFs can invest in virtually any asset class or market possible.

This includes everything from:

- Dividend stocks

- Growth stocks

- Corporate and government bonds

- The emerging markets

- Real estate

- Gold and silver

Crucially, we would argue that all ETFs are passive investments. This is because once you make an investment into your chosen ETF provider, there is nothing more for you to do. As we mentioned earlier, the ETF provider will determine which assets to buy and sell.

But, we should make it clear the ETFs do not look to outperform the markets. Instead, they look to track the respective benchmark index that you are interested in. For example, an ETF tracking aristocrat dividend companies will only have said stocks in its portfolio. If a company misses a dividend as it no longer falls within the remit of an aristocrat stock, the ETF will subsequently sell the shares.

Bonds

Bonds are as passive as it gets int he financial space. As we noted earlier, you will receive regular interest payments from the bond issuer. This will happen every 6 or 12 months until the bonds expire. Both corporate and government bonds are classed as passive investments.

Mutual Funds

Mutual funds operate much the same way as index funds and ETFs. That is to say, once you inject capital into the provider you won’t be required to make any investment decisions. Instead, this role is reserved for active managers of the fund.

With that said, the key difference with mutual funds is that they look to outperform the wider markets. In order to achieve this, fund managers will actively manage your portfolio. But, from your perspective, this is still 100% passive.

Other Types of UK Passive Investments

There are many other types of passive investments available to UK residents that we are yet to discuss.

This includes:

- Real Estate: Invest in properties to benefit from two forms of income – monthly rental payments and appreciation. If you only have a small amount of money to invest you might want to consider a REIT.

- Peer-to-Peer Lending: This allows you to lend money out to consumers and businesses. In return, you will receive your money back in installments with interest added on top.

- Robo Advisors: A somewhat innovative approach to passive investing, robo advisors build custom-made portfolios based on your financial goals and appetite for risk. Nutmeg is a popular robo advisor based in the UK.

- Ready Made ISA: ISAs allow you to invest in the financial markets in a tax-efficient manner. Although most brokers require you to choose stocks on a DIY basis, some offer ready made ISAs

Benefits of Passive Investing

The benefits of passive investing in the UK are plentiful.

This includes:

No Experience Needed

Looking to invest in the financial markets but have little to no experience? If so, you should know that research stocks and other asset classes can be challenging.

In fact, it can take many months to truly master the skill of knowing where to put your money and when.

This doesn’t need to prevent you from accessing the financial markets as you can elect to invest in passive assets. Whether that’s ETFs, index funds, or the CopyTrading feature – you don’t need to have an ounce of knowledge in the stock markets.

No Time Commitment Needed

Actively investing in the financial markets means that you will be required to spend ample time researching and analyzing potential money-making opportunities.

For example, if you’re looking to focus on stocks, you need to spend time reading company earnings reports and financial statements.

If this isn’t something that you wish to do, then passive investing allows you to sit back and let your money work for you. After all, once you make an investment there is nothing more to do until you decide to cash out.

Regular Income

In the vast majority of cases, passive investments in the UK will yield some form of regular income. If investing in passive stocks, this will likely include dividends that are paid every three months.

You then have ETFs and index funds will also distribute dividends on a quarterly basis. The main point here is that this allows you to reinvest your income payments into other passive assets. In doing so, you can grow your money much faster.

No Need to Worry About Short-Term Volatility

All financial assets go through periods of volatility – even those that are defined as strong and stable. This is especially the case during periods of market bearishness or worse – a wider recession.

But, by sticking with passive investments you don’t need to worry about shorter-term pricing swings, as you are in it for the long run. For example, while major stock markets lost up to 50% in value in the midst of the financial crisis.

Active investors would have likely attempted to cash out these losses as a means to salvage their capital. At the other end of the scale, passive investors would have sat back and allowed the markets to recover organically.

Low Costs

When you invest actively, you will be placing lots of trades. In turn, this is likely going to start adding up in the fee department. This is especially the case if you are using a UK stock broker that charges a flat fee every time you buy or sell an asset.

This isn’t a problem when investing passively, as you will be placing very few orders. For example, by investing in a passive instrument like an ETF, annual maintenance fees are often less than 0.2%.

Limitations of Passive Investing

While passive investing in the UK appeals to a lot of people, this segment of the financial arena won’t be for everyone. As such, you should also consider the following drawbacks of passive investing.

- You won’t be able to time the market: Being able to time the market well can amplify your earning potential. Although easiest said than done, this will give you the chance to buy the drip and sell the rip. But, as you will be passive investing, you will not be looking to benefit from short-term price action.

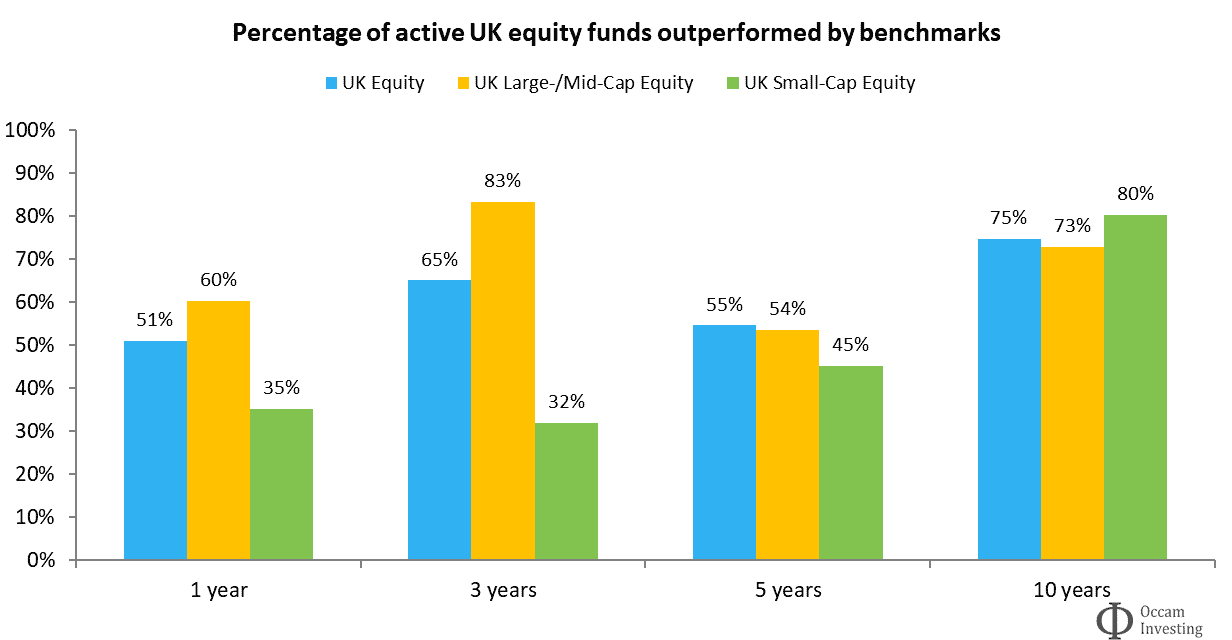

- You will follow the market, not outperform it: When you invest in passive funds – such as ETFs or an index tracker, you are simply looking to track a specific marketplace. For example, by investing in the FTSE 100, you will mirror the index’s rise and fall. This means that you won’t be able to outperform the market.

- No Guarantee of recovery: A big mistake that passive investors make is that they assume that the asset will always recover. Unfortunately, this just isn’t always the case. For example, UK banking stocks like HSBC are still worth considerably less than pre-2008 – meaning that they failed to recover from the most recent financial crisis.

Passive Investing Strategies

As you might have guessed, although passive investing requires virtually no input in terms of investment decisions, you still need to come up with a long-term strategy. This will ensure that you give yourself the best chance possible of growing your capital in the long run.

Here are some ideas that you might want to consider before investing in UK passive investments.

Diversification

Irrespective of which assets you decide to purchase, it is imperative that you diversify your passive investment portfolio as much as you can. This will ensure that you are not overexposed to a single asset.

For example, let’s imagine that you invested in a dividend stock like BP. Sure, this oil and gas giant has been one of the best dividend payers on the FTSE 100 in recent years – with yields as high at 7-8%. However, BP shares are down by over 50% in 2020 – meaning the aforementioned dividend yield no longer sounds so attractive.

Crucially, by ensuring that you are exposed to dozens – if not hundreds of different financial assets, you won’t feel the effects of a BP-like scenario anywhere near as much.

For example, if you’re looking to invest in index funds, make sure that you back several different markets as opposed to just the FTSE 100 or Dow Jones. If opting for dividend stocks, consider going with an ETF that contains hundreds of companies. The most important thing is that you do not put all of your eggs into one passive investment basket.

Dividend Reinvestment

This particular UK passive investing strategy is crucial. Put simply, every time you receive a form of income from your passive investment – such as stock dividends or bond coupon payments, you should re-invest it. In doing so, your money will grow much, much faster.

For example, let’s suppose that you invested £5,000 in a passive fund. In year one, the fund generated 10% in income – or £500. By withdrawing this £500 out, you would still be left with £5,000. But, by reinvesting it into other passive investments, you will earn ‘interest on the interest’.

This becomes evident once we look at what happens in year two. For example, if you were to generate a further 10%, your portfolio would grow by £550, as opposed to just £500. This is because you re-invested your dividends from the prior year, meaning you made 10% of £5,500 and not £5,000!

Regular and Consistent Investments

The best thing about passive investing is that you are creating a long-term plan that could take you up to your planned retirement age. This gives you ample time to build a considerable pot through regular investing.

You don’t need to be wealthy for this to be realizable, as investing a bit at the end of each month is perfectly feasible. The most important thing is that you religiously stick to your monthly investment plan.

For example:

- Let’s say that you started with a passive investment of £2,000

- At the end of each month, you invest an additional £100

- You repeat this process for 25 years

- Over the course of your investment journey, you make average annualized returns of 10% (like the S&P 500 Index has over the past 90+ years)

- When it comes to cashing out your investment, you would walk away with £156,636

As you can see from the above example, even with a small lump sum of £2,000 and a monthly injection of £100 – you can successfully grow your money over the course of time by sticking with a plan. If, for example, you invested £5,000 and increased your monthly sum to £200, the end result (based on 10% per year) would increase to £325,086.

An additional benefit of opting for regular monthly investments is that you will get to take advantage of dollar-cost averaging. This means that every time you make a new investment, you are buying at the current market rate. Over the course of time, this will average out and thus – allow you to beat negative market cycles.

Passive Investing Example

We have discussed a lot of valuable information in this Passive Investing UK Guide. With that said, it can sometimes clear the mist to look at a real-world example. As such, below you will find a simple example of how passive investing works in practice.

S&P 500 Index

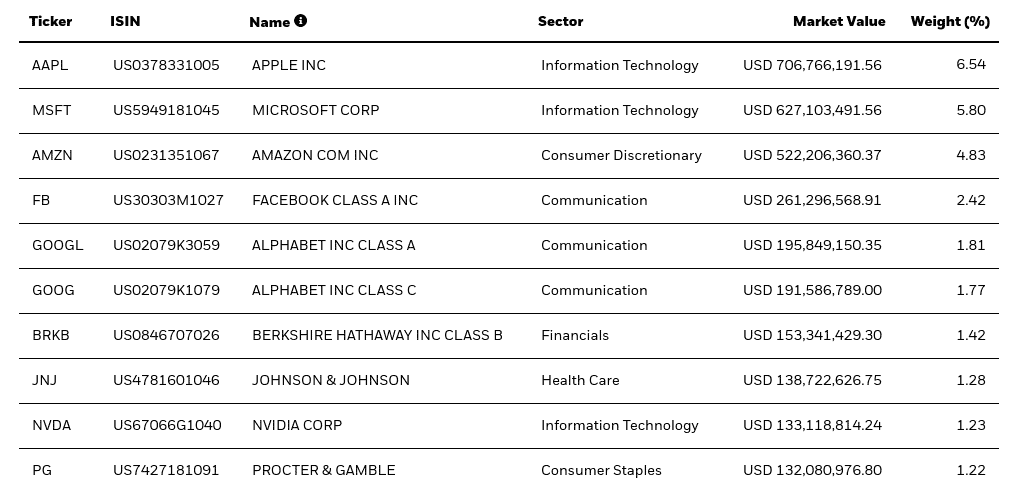

As we briefly covered earlier, the S&P 500 is a stock market index that tracks 500 large companies in the US. Some of the most recognizable constituents of the index include Apple, Microsoft, Amazon, Facebook, IBM, and Disney. In order to get started, you will first need to choose an ETF provider that backs the S&P 500.

Vanguard is a good example as fees are super-low. In fact, you can invest in the Vanguard S&P 500 ETF at commission-free. Once you make a single investment, you will then own 500 of the shares that make up the S&P 500. Your investment will be weighted based on the same system used by the index provider.

For example, while Apple is weighted at 6.5% of the entire index, Paypal makes up just 0.8%. Many of the firms listed on the S&P 500 are dividend-paying companies. As the ETF provider will likely receive payments on different days throughout the month, it doesn’t make financial sense to keep distributing each dividend individually.

Instead, you will receive a batch of dividend payments at the end of each quarter. This will be paid into your brokerage account. In the meantime, the value of your passive investment will rise and fall depending on how the underlying shares are performing. In other words, if the stocks contained within the index are collectively rising, as will the valuer of your passive investment.

Moving forward, by taking into account our suggested passive investing strategy, you would see yourself injecting more into the index at the end of each month.

Best Passive Investments UK

So now that you have a good understanding of what passive investments are, we are now going to discuss some of the best options in the market. As such, below you will find five of the best passive investments available to UK residents right now.

1. iShares Core High Dividend ETF – Best Passive Investment for Dividends

If you’re looking to focus on long-term stocks that pay dividends, this ETF is for you. In a nutshell, the iShares Core High Dividend ETF will track companies that have a long-standing track record of paying above-average dividends. In fact, by making a single investment into this passive ETF, you will gain instant access to 75 dividend-paying firms.

This includes companies like AT&T, Exxon Mobil, Johnson & Johnson, Coca Cola, Pepsi, and Cisco. On the one hand, this particular passive investing idea hasn’t had a great year – as the ETF is just over 11% down in 2020.

On the other hand, it is important to remember that a good chunk of companies either cut or suspended their dividend payments this year due to the impact of the pandemic. With this in mind, you do stand the chance of buying this passive investment at a competitive discount at current prices.

2. Vanguard Total Stock Market Index – Best Passive Investment for Diversification

If you’re looking to diversify into the stock markets and 75 dividend-paying stocks doesn’t quite cut it, you might want to consider the Vanguard Total Stock Market Index. This index-tracking ETF will give you access to the wider US stock markets at the click of a button.

In fact, your portfolio will contain hundreds of shares – covering both small-cap and large-cap companies. Regarding the latter, this includes the likes of Tesla, Facebook, Procter and & Gamble, Amazon, and Berkshire Hathaway.

And of the former, you’ll also have a large selection of small publicly-listed companies such as those found on Russell 200 index. All in all, this passive investment will allow you to combine the fruits of long-term capital growth and regular dividends.

3. Vanguard Total Bond Market Index Fund – Best Passive Investment for Bonds

Vanguard once again makes our list of the best UK passive investments. Only this time, its ETF is focused exclusively on bonds. In fact, by making a very small minimum investment of $200 – not only can you purchase this ETF commission-free, but you will be buying over 9,900 bond instruments.

This allows you to invest in the multi-trillion pound bond space in a super-diversified manner. The ETF is relatively low-risk, too. For example, just under 60% of the portfolio is passively invested in US government securities, Then, almost 20% of the basket is made up of bonds rated between AAA and A.

You also have exposure to some higher risk markets, with 20% invested in bonds rated BAA. In terms of growth, you will receive your share of bond coupon payments every three months. You also stand the chance of growing your capital through an increased ETF price. This happens when the fund sells some of its bonds for more than it originally paid.

4. S&P 500 Index – Best Passive Investment for Historical Performance

We don’t need to go into too much detail about the S&P 500, as we have spoken about the index several times in this guide. But, what we will say is that since the index was launched over 90 years ago, it has averaged annual returns of 10%. Sure, the index gets dragged down when the wider economy goes through challenging times.

However, the S&P 500 has always bounced back. After all, you are not investing in a few companies here. On the contrary, you are backing 500 large-cap American brands. In other words, by making a passive investment into the index, you are effectively backing the US economy.

In addition to this, the S&P 500 is rebalanced every three months. Not only does this mean that constituents are reweighted, but new entrants might end up being added. This ensures that your portfolio remains flesh and in-line with the wider US financial markets

We should also make it clear that despite the coronavirus pandemic, the S&P 500 has performed tremendously well over the past 6 months. Valued at just 2930 points in May, the index is now worth 3,550 points. This represents a growth of 20% in half a year.

Best Platforms for Passive Investing

Regardless of what asset you are interested in, you will need to find a UK broker that allows you to make passive investments. There are many options to choose from in the online space, so you’ll need to spend a bit of time researching the broker in question.

For example, not only does the broker need to offer your chosen passive investment, but it needs to do so at competitive fees.

We have independently reviewed dozens of trading platforms to save you from countless hours of mundane research. You’ll find the best three passive investing platforms listed below.

1. Fineco Bank – Advanced Platform with Portfolio Management

Fineco Bank is an established financial institution based in Italy. It has since expanded to the UK trading scene by offering everyday investors share dealing services. This includes heaps of stocks and markets at super-competitive prices.

In fact, you’ll pay a share and ETF dealing fee of just £2.95 – plus an annual platform charge of 0.25%. In particular, Fineco Bank is a great option if you are looking to engage in a long-term, passive investing plan.

You can get yourself set up at just £50 per month. There is nothing more for you to do another than commit to a minimum amount each month, as Fineco will create a portfolio based on your passive investing goals. There is also the Fineco Bank asset management tool.

This comes pre-loaded with dozens of passive investment strategies based on your target market and financial goals. For example, the MegaTrends fund focuses on cutting-edge growth sectors like smart cities, fintech, and electric vehicles. Each and every strategy is automatically rebalanced and reweighted to ensure that you never need to lift a finger.

Pros:

- No commissions or inactivity fees

- Includes portfolio management tools

- Excellent fundamental analysis and commentary

- Simple system for tracking investment performance

Cons:

- 25% annual management fee

Your capital is at risk

2. IG – Trusted UK Broker With ISA Accounts

If asset diversity is your main objective when taking a passive investing strategy then IG is likely to be your best bet. This is because the UK-based broker offers over 12,000 financial markets. On top of stocks and shares, this also includes heaps of ETFs, investment trusts, and index funds. This ensures that you can invest passively while at the same time take a fully diversified approach.

This popular UK broker also offers ISAs. This allows you to invest passively in a tax-efficient way. Fees are slightly higher at IG, with a flat dealing charge of £8 per trade. This is reduced to £3 when you trade actively. You might also consider the Smart Portfolio tool at IG.

This is a fully managed portfolio of assets that is built and maintained by trading experts. Most importantly, this passive portfolio is tailored to meet your financial needs. At just 0.5% per year, this offers great value. Trust should be of no issue when choosing IG. Launched in 1974, the platform is heavily regulated and your funds are covered by the FSCS.

Pros:

- Trusted UK broker with a long-standing reputation

- More than 12,000 traditional assets

- Good value share dealing services

- Leverage and short-selling also available

- Spread betting and CFD products

- Various account types

- Great research department

Cons:

- A minimum deposit of £250

- US stocks have a $15 minimum commission

Your capital is at risk

Conclusion

Passive investing is one of the best ways to grow your money over time. After all, why spend countless hours every week researching the financial markets when you don’t need to? Instead, this is a role that you should consider leaving to the experts. Whether that’s in the form of an ETF, index fund, or a CopyPortfolio – your options are virtually limitless

FAQs

Which is an example of passive investing?

There are countless ways that you can invest passively in the UK. Some examples include ETFs, index funds, investment trusts, ETFs, bonds, and dividend stocks.

What is an active and passive investment?

Active investing will seek to outperform the wider markets by actively buying and selling assets. Much of this also depends on timing the market well. On the other hand, passive investing takes more of a back seat approach. Investors are not so interested in short-term volatility. Rather, they are happy to ride out market waves in the long run.

Is an ETF a passive investment?

A passive ETF will look to track a specific market like-for-like. For example, if the ETF was passively tracking the Dow Jones, it would purchase all 30 stocks that make up the index. In turn, if the Dow Jones increases by 3%, as should the ETF.

Are stocks passive investing?

Yes and no. If you were to pick and choose individual stocks, then arguably, this is active investing. However, by investing in an ETF that backs a full basket of shares - such as dividend stocks, this is well within the reach of passive investing.

How do I make passive investments in the UK?

In order to make passive investments in the UK - such as ETFs or index funds, you first need to find a good broker.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Passive investing is a type of investment strategy that strives for minimal effort. This means that you won’t be required to perform heaps of research on your chosen asset. In addition to this, you won’t be regularly chopping and changing your portfolio.

Passive investing is a type of investment strategy that strives for minimal effort. This means that you won’t be required to perform heaps of research on your chosen asset. In addition to this, you won’t be regularly chopping and changing your portfolio.