Best Ethical Investment Funds UK to Watch

As social, environmental, and diversity issues come to the forefront of our everyday discussions, ethical investing is now more popular than ever.

In this guide, we’ll highlight 10 popular ethical investment funds in the UK.

-

- iShares MSCI KLD 400 Social ETF (DSI)

- SPDR SSGA Gender Diversity Index ETF (SHE)

- First Trust Water ETF (FIW)

- Invesco Solar ETF (TAN)

- iShares ESG MSCI EAFE ETF (ESGD)

- SPDR S&P 500 Fossil Fuel Reserves Free ETF (SPYX)

- Organics ETF (ORG)

- Vanguard Health Care ETF (VGHCX)

- SerenityShares Impact ETF (ICAN)

- Invesco Powershares Cleantech Portfolio (PZD)

-

- iShares MSCI KLD 400 Social ETF (DSI)

- SPDR SSGA Gender Diversity Index ETF (SHE)

- First Trust Water ETF (FIW)

- Invesco Solar ETF (TAN)

- iShares ESG MSCI EAFE ETF (ESGD)

- SPDR S&P 500 Fossil Fuel Reserves Free ETF (SPYX)

- Organics ETF (ORG)

- Vanguard Health Care ETF (VGHCX)

- SerenityShares Impact ETF (ICAN)

- Invesco Powershares Cleantech Portfolio (PZD)

10 Popular Ethical Investment Funds UK List

Here are 10 popular ethical investment funds in the UK based on trading volumes:

- iShares MSCI KLD 400 Social ETF (DSI)

- SPDR SSGA Gender Diversity Index ETF (SHE)

- First Trust Water ETF (FIW)

- Invesco Solar ETF (TAN)

- iShares ESG MSCI EAFE ETF (ESGD)

- SPDR S&P 500 Fossil Fuel Reserves Free ETF (SPYX)

- Organics ETF (ORG)

- Vanguard Health Care ETF (VGHCX)

- SerenityShares Impact ETF (ICAN)

- Invesco Powershares Cleantech Portfolio (PZD)

Ethical Investment Funds UK Reviewed

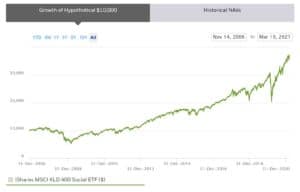

iShares MSCI KLD 400 Social ETF (DSI)

The MSCI KLD 400 Social ETF from iShares is a fund that contains over 400 stocks, mainly from the US, and looks a lot like the S&P 500 index.

It’s biggest holdings are in Microsoft, Google, and Tesla, and it’s rounded out with stocks like Nvidia, Disney, and PayPal. Notably, this fund is heavy on tech and finance companies – so the fund’s performance depends heavily on the fates of these market sectors.

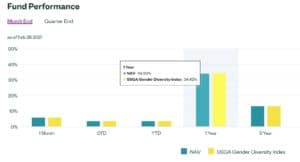

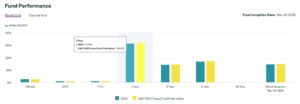

SPDR SSGA Gender Diversity Index ETF (SHE)

The SHE ETF is designed to invest primarily in companies that have women in leadership roles – including in the C-suite and on the board of directors. The fund primarily holds large-cap US stocks and it has a selection of 165 different shares from a wide range of market sectors.

One thing to note about this fund is that female representation in US stocks is low across the board, especially compared to the UK. For example, the company in the SHE fund, PayPal, only has 4 women on its 11-person leadership team.

This fund has largely matched the performance of the S&P 500 since its 2016 inception and returned 34.2% last year alone. It carries a low management fee of just 0.20%.

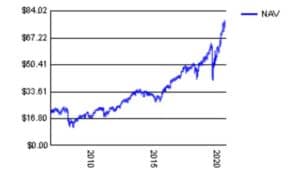

First Trust Water ETF (FIW)

The First Trust Water ETF is a unique ETF that allows you to invest in water and a sustainable future. The fund holds 36 different companies, all of which focus on making drinking water more widely available or treating wastewater.

Since the companies inside the FIW fund tend to be small-cap growth stocks. It returned 37% over the past year, edging out most major stock indices like the S&P 500. In the past 5 years, it’s returned 21% for investors.

Of course, small funds like this can have a high degree of volatility. It’s also worth noting that the expense ratio of 0.55% is somewhat pricey, even for one of the ethical investment funds.

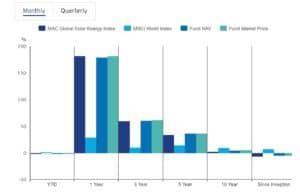

Invesco Solar ETF (TAN)

The Invesco Solar ETF returned a whopping 181% in 2021. The fund invests in companies that manufacture solar panels, install solar panels, and develop the materials and technologies needed to improve solar energy efficiency. Notably, the fund invests heavily in China as well as in the UK, US, and Europe.

Investors should expect this ETF to be one of the more volatile investment options in the renewable energy space. It only has 55 holdings, and they tend to be small cap stocks with an average valuation of less than $10 billion. After last year’s incredible performance, these shares may consolidate for a while before moving another leg higher.

The TAN ETF has a high 0.69% expense ratio. However, that is more than justified given that the fund beat the broader US stock market by nearly 6x last year.

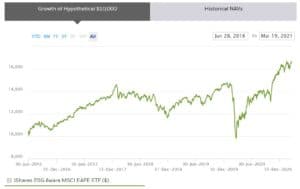

iShares ESG MSCI EAFE ETF (ESGD)

The iShares ESG MSCI EAFE ETF is an international stock fund that primarily invests in clean energy technology and social responsibility projects in emerging markets. The fund was pummelled by the coronavirus pandemic last year, and many countries with emerging economies simply shut down for the year.

SPDR S&P 500 Fossil Fuel Reserves Free ETF (SPYX)

The Fossil Fuel Reserves Free ETF is an ethical investment fund in the UK that offers a mainstream investment with a sustainability twist. This fund mirrors the S&P 500, except that it eliminates any companies that produce oil and gas or other fossil fuels.

The result is a list of 460 of the biggest US stocks, many of which have their own renewable energy initiatives in place. The largest holdings, like Apple, Amazon, Microsoft, and Google, are the same as for the S&P 500 index.

This fund has matched or even outperformed the S&P 500 over the past three years. That’s not all that surprising given that fossil fuels have been steadily falling out of favor in the marketplace. The 0.25% expense ratio is slightly higher than what you would pay for a standard S&P 500 index ETF.

Organics ETF (ORG)

The Organics ETF is a possible option for investors who care deeply about organic foods, eliminating animal testing for products, and environmental stewardship. The fund invests in companies that produce 100% organic foods or that help to bring organic beauty and other products to market.

The fund isn’t all that diversified, with just three companies making up nearly 45% of its holdings: Chr. Hansen Holdings, The Hain Celestial Group, and Sprouts Farmers Market. As a result, the fund was very exposed to the coronavirus pandemic last year and took a 22.4% loss in 2020.

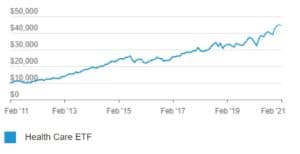

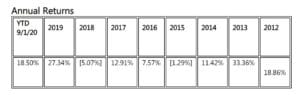

Vanguard Health Care ETF (VGHCX)

The Vanguard Health Care ETF isn’t specifically an ESG fund. Rather, it’s a low cost healthcare stock fund that boasts returns and above-average marks for the sustainability of its holdings.

In fact, this Vanguard fund ranks in the 8% of similar ETFs for the ESG scores of the stocks it holds. The fund also returned 30.3% last year and beat the S&P 500 over the past 3 years.

The fund invests in a mix of health insurers, pharmaceutical stocks, biotech stocks, and medical equipment manufacturers, with a heavy focus on US stocks. The Vanguard ETF blends small-cap and large-cap stocks, so it offers a fully diversified investment in the key healthcare market sector.

SerenityShares Impact ETF (ICAN)

The SerenityShares Impact ETF is a relatively small fund that can be somewhat difficult to buy into or sell out of.

This ETF invests in a hand-picked selection of around 106 US stocks. Most of them are small-cap growth stocks and they are chosen specifically because of their social responsibility and governance initiatives. So, you can be sure when investing in this fund that it takes ESG seriously.

The fund lagged the broader stock market in 2020, returning just over 20%. However, it beat the S&P 500 in 2019.

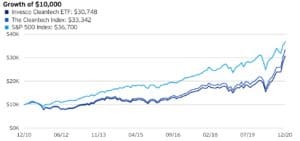

Invesco Powershares Cleantech Portfolio (PZD)

This renewable energy ETF from Invesco invests in a selection of 53 companies, primarily from the US, that derive more than half their revenues from clean energy technology. Holdings include wind turbine manufacturers like Siemens Gamesa and Vestas Wind Systems.

Only around half of the fund is centered in the US, with the remaining holdings spread throughout Europe. In addition, no single renewable energy stock makes up more than 3% of the overall fund.

What are Ethical Investment Funds?

Ethical investment funds are ETFs, mutual funds, and investment trust funds that invest in companies with strong environmental, social responsibility, and corporate governance initiatives. You can buy and sell any fund on our ethical investment fund list just like you would buy a standard ETF.

Many responsible investment funds have specific themes, so you can match the fund you want to invest in with your personal values. For example, some funds focus specifically on the environment, some on human rights, and others on social and governance projects.

Notably, there are no set ESG criteria to define what companies are ‘ethical’ or not. Some ethical investment fund managers take a strict approach to social responsibility and only invest in companies that commit a certain portion of profits to positive impact projects. Others take a broader view of ethical investments and buy shares of any company that has ongoing ESG initiatives.

The Fundamentals of Ethical Investment Funds

Ethical investment funds can be a potential investment, but it’s important to do your research and know what you’re getting into. These funds range widely from modified index funds to hand-picked selections of individual stocks.

First, many ethical funds offer returns that lag the S&P 500, NASDAQ Composite, or FTSE 100 indices. If you are okay with giving up on some potential returns in exchange for investing in values you care about, that’s not a problem.

Another important thing to know about ethical investment funds in the UK is that they often carry higher expense ratios than non-ESG funds. This means that you are paying more in management fees. Typically, the difference isn’t huge and most ethical investment funds have expense ratios of less than 0.75%.

In some cases, ethical investment funds – and particularly environmental sustainability funds – can outperform the broader market. This may be increasingly the case as climate change and emissions reduction efforts come into focus. If renewable energy technology does take off, sustainable funds could be among the biggest market winners.

Ethical Investment Funds UK Investment Platforms

In order to invest in ethical funds in the UK, you’ll need a stock broker that offers trading on a wide range of ETFs. When choosing a broker, it’s important to look at the breadth of ESG funds that are available and how much it costs to buy and sell ETFs as opposed to individual stocks.

With that in mind, let’s take a closer look at 2 UK stock brokers you can use to invest in ethical funds in the UK.

Impt.io- The Best Alternative Ethical Investment Opportunity With Excellent Potential Returns

In this article, we have discussed the best ethical investment funds and why they might be worth considering in 2026. However, funds are not the only way to invest your money ethically this year. The crypto space is also a great place to look if you’re wanting to invest in environmentally friendly projects.

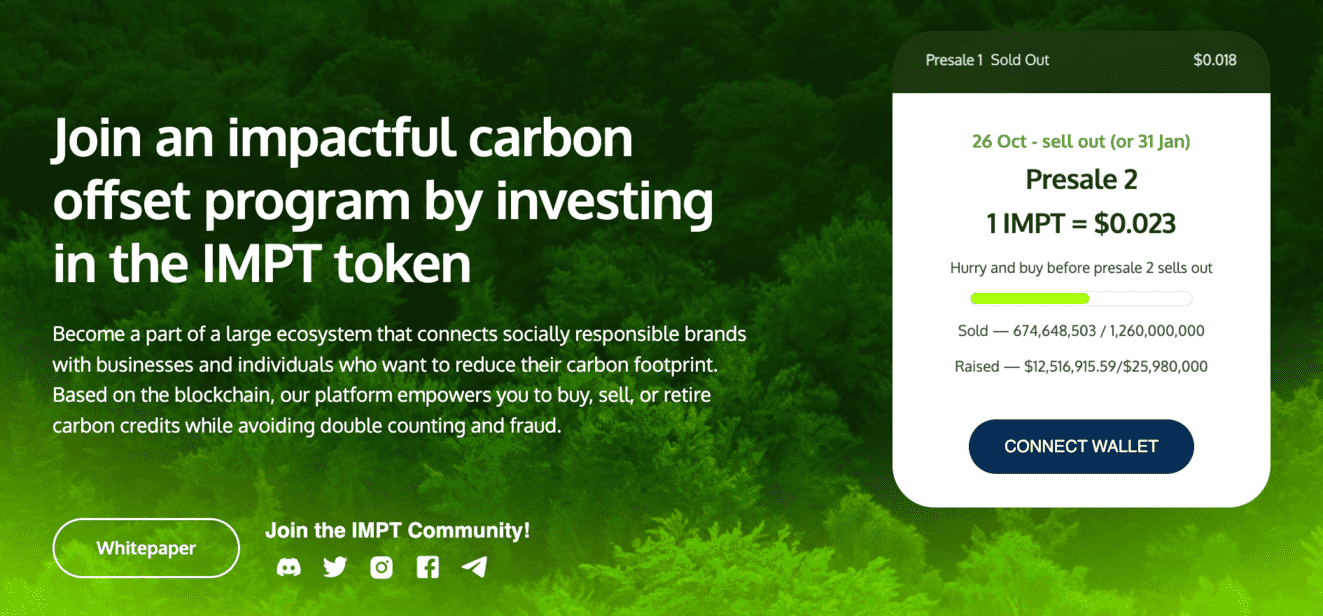

In particular, Impt.io is a completely carbon-neutral crypto project that aims to transform the carbon credit industry in the foreseeable future. Impt.io is a carbon credit exchange that will use blockchain technology to resolve problems such as carbon credit fraud and double spending which will result in a more transparent and reliable system. The platform aims to encourage more people to make eco-friendly decisions and will reward users for doing so.

The Impt.io platform will be supported by the IMPT token- a native crypto token that will a limited supply of just 3 billion. The token will be given to users as a reward for offsetting their carbon credits and choosing sustainable alternatives when shopping. Impt.io gives users a way to objectively track their environmental impact and be rewarded with real-world value for making ecofriendly changes.

Use cases of the IMPT token include making payments on the Impt.io platform, unlocking advanced platform features and participating in the DAO. The token can be traded on exchanges for other cryptocurrencies and holds real-world value. This will provide users with an incentive to choose sustainably.

Early investors can purchase the IMPT token via the ongoing presale event. This is a limited event that will end in 2023. After the presale, IMPT will be available on major crypto exchanges and the price is expected to rise.

Investing into Impt.io is a great way to diversify your ethical portfolio and invest in a new project with exciting prospects.

Your money is at risk.

Conclusion

Ethical investment funds allow you to invest in the stock market while staying true to your values. These funds can perform just as well as traditional ETFs, and some clean energy funds even outperform the broader market.

FAQs

Can I invest in an ethical fund through an ISA or SIPP?

Yes, you can invest in an ESG ETF through an ISA (Individual Savings Account) or SIPP (Self-invested Personal Pension). Your plan provider must offer a selection of ethical investment funds.

Is there a management fee for ethical investment funds?

Most ethical investment funds have an annual management fee, also known as an expense ratio. This typically ranges from 0.20% to 0.75% depending on the fund.

Can I invest in the UK stock market through an ethical investment fund?

While many ESG funds are focused on US stocks, you can invest in UK stocks through a sustainable fund. Look for funds that are offered by UK firms and that trade on the London Stock Exchange.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up