How to Buy Nvidia Shares Online in the UK

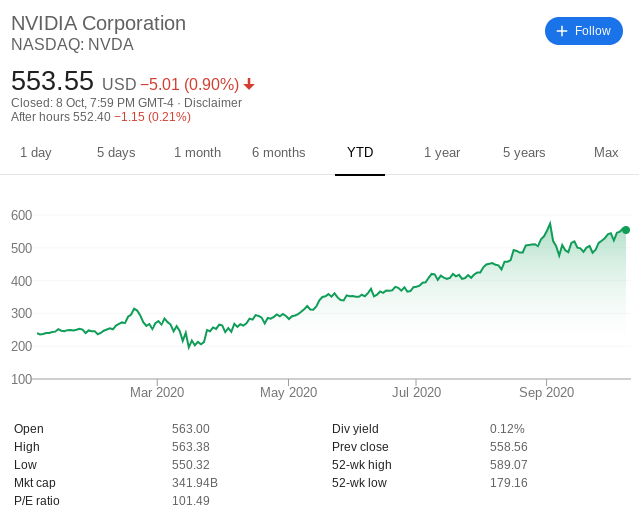

Had you bought £5,000 worth of Nvidia shares at the start of 2020 – your investment would now be worth £11,500. As such, this established tech stock is one of the best performing shares of the year.

Although Nvidia shares are listed on the NASDAQ – making a purchase from the UK is easy. All that is required is a UK share dealing account that gives you access to the US markets.

In this guide, we show you how to buy Nvidia shares online in the UK. On top of walking you through the investment process, we also discuss the best UK stock brokers to make the purchase with.

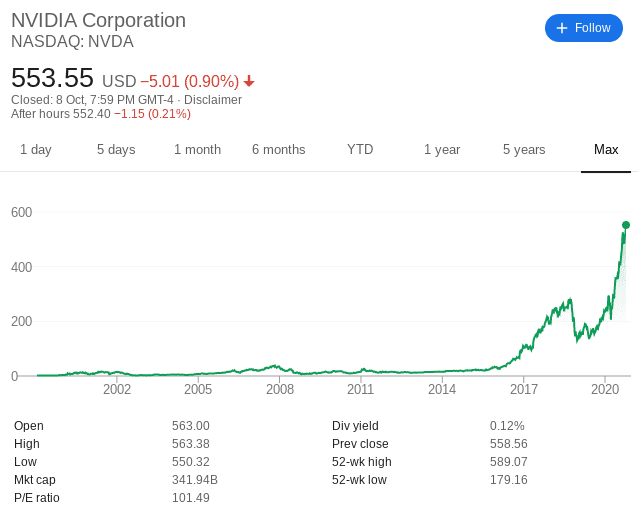

Irrespective of which stock exchange your chosen company is listed on – in order to buy shares online, you need to open an account with a broker. The broker in question needs to give you access to the NASDAQ – which is where you will find Nvidia shares. Additionally, your chosen stock broker must offer competitive fees and commissions, as well as being in possession of an FCA license. With that in mind, we have hand-picked two leading UK stock brokers that allow you to buy NVIDIA shares in the simplest, cost-effective, and user-friendly manner. While most UK investors will simply look to buy Nvidia shares and keep hold of them for several months or years – some traders are more interested in placing short-term positions. In other words, you will be looking to speculate on what the future price of Nvidia shares will be in the coming days or weeks. When doing this through a CFD trading platform like Plus500, you will have access to a much wider scope of tools. For example, Nvidia share CFDs can be traded at Plus500 on margin. This stands at just 20% if you want to maximise your available exposure. As such, a £1,500 position on Nvidia would require an account balance of just £300. Plus500 is also worth considering if you are looking to profit from both rising and falling markets. This is because you have the option of going long if you think the price will increase, or short if you think the opposite. A major plus-point of trading CFDs at Plus500 is that the platform does not charge any trading commissions. It is also behind some competitive spreads. For example, Nvidia stock CFDs can currently be traded at a spread of just 0.12%. This is highly conducive for short-term trading and targeting small margins. Outside of Nvidia, Plus500 is home to thousands of other stock CFDs. This covers markets in the US, UK, Germany, South Africa, New Zealand, and more. You can also trade other asset class CFDs – such as indices, ETFs, interest rates, commodities, forex, and cryptocurrencies. In terms of getting started at Plus500 – the account opening process can be completed online or via the provider’s mobile app. The minimum deposit amount is £100 – and the platform supports debit/credit cards, Paypal, or a UK bank transfer. Not only is Plus500UK Ltd authorised & regulated by the FCA (#509909) – but its parent company is listed on the London Stock Exchange. Pros: Cons: 72% of retail investors lose money trading CFDs at this site So now that we have discussed the best UK platforms to trade or buy Nvidia shares, we are now going to look at some background information about the stock. This is important, as you need to ensure that the firm is right for your long-term financial goals. Additionally, you need to consider where the stocks are likely to go in both the short and long-term before taking the plunge. As such, we would suggest reviewing the following sections before you proceed with an Nvidia share purchase. Additionally, Nvidia is involved in several other product ranges. This includes its Shield Tablet and Android TV, alongside cloud gaming. Outside of its core gaming and media lines, Nvidia also provides services to the academic and research community. This allows the respective facility to run high-performance data. Nvidia is listed on the NASDAQ exchange in the US and first went public in 1999. Back then, the shares were initially priced at just under $20 each. However, we need to readjust this price as Nvidia has since initiated 4 stock splits. This includes a 2-for-1 split in 2000 and further 2-for-1 split just a year later. The firm then proceeded with another 2-for-1 split in 2006, followed by a 3-for-2 split in 2007. Taking all of this into account, Nvidia’s IPO price can be adjusted to approximately $1.66. Since then, the shares have been on a constant upward trajectory. Moving forward to late 2018 – Nvidia stocks hit highs of $281. Interestingly, the shares went on a rapid decline over the proceeding couple of months – dropping to as low at $129. However, there has been no stopping the tech player since. At the time of writing in October 2020 – Nvidia shares are priced at a staggering $553. This translates into an end-to-end stock increase of over 34,000 since the company went public in 1999. In real terms, this means that a £5,000 investment during its IPO would now be worth in the region of £175,000. It is important to note that Nvidia shares have performed particularly well in 2020 – which is a feat achieved by very few public companies. For example, the firm started the year at $239. This means that the stock has weathered the coronavirus storm with ease – providing investors with a YTD return of 131%. When it comes to valuation, Nvidia now has a market capitalisation of over $340 billion. This makes Nvidia the 8th largest company on the NASDAQ 100 – with a weighting of just under 3%. Taking into account the sheer size of its market valuation – alongside its consistent revenue and operating profit growth, it makes sense that Nvidia is a dividend stock. However, Nvidia paid out just $0.64 per share over the past four quarters – which amounts to a trialling dividend yield of 0.12%. As such, the vast bulk of your upside potential on Nvidia shares is going to come from capital gains. With that in mind, if you are looking for companies that pay a much higher yield – check out our article on the best dividend stocks of 2020. You might be kicking yourself that you hadn’t jumped on the Nvidia bandwagon earlier – with the stocks up a whopping 131% for the year. This does leave you in somewhat of a conundrum. On the one hand, it doesn’t matter if you buy Nvidia shares right now if the upward momentum continues for the foreseeable future. On the other hand, the stocks cannot continue to rise at 2020 levels indefinitely. After all, the company is now the 8th largest on the NASDAQ in terms of market capitalisation – with a current valuation of over $340. To put this into perspective, the only companies on the NASDAQ that are worth more than Nvidia is Alphabet (two listings), Tesla, Facebook, Amazon, Microsoft, and Apple. Ultimately, this is why you need to explore the good and bad points of a stock before making an investment. To help you along the way, below you will find a range of considerations that you need to make before you buy this metaverse stock. During times of economic uncertainty – investors will flock to stocks that have the potential to defy a wider bear market. While you wouldn’t have thought that Nvidia sits within this category – the proof is in the pudding. That is to say, while the vast bulk of the US and global stock markets are either on par or below pre-pandemic levels (as of October 2020) – Nvidia has smashed through all expectations. As we have noted, the stocks are up a huge 131% YTD. To put that into perspective, it is wise to look at two stocks in particular that are viewed as a defence against a downward economic spiral – GlaxoSmithKline and British American Tobacco. During the same period, these two ‘stable’ stocks are down 19% and 16%, respectively. As a result, there is every reason to believe that Nvidia could be a great stock to hold in these uncertain times. Just a few weeks ago it was announced that Nvidia’s interest in ARM has finally been realised – with a huge $40 billion acquisition. This is great news for stockholders, as it essentially opens up the doors to other connectable devices for Nvidia and its core chip products. This includes everything from robotics, smartphones, laptops, and even 5G. Crucially, UK-based ARM processes chips for some of the largest electronic makers globally – including Apple. We should note that this isn’t the first multi-billion dollar acquisition that Nvidia has made in recent years. In fact, just last year it completed a $6.9 billion takeover of Mellanox Technologies. Baring in mind just how well its shares have performed this year, it makes sense that Nvidia’s half-year financial results were extremely good. Firstly, the firm reported increased Q2 revenues of 50% in comparison to the prior year – taking sales to just under $4 billion. Free cash flows were also up by just under 64% to $1.3 billion. Taking a closer look at some of its core divisions – the Date Centre saw even bigger revenue increases at 167% compared to the prior year. Its gaming division also performed well with a 26% rise of its own. The only division that fell below market expectations was that of its automotive and visualisation segments – which dropped by 47% and 30%, respectively. All in all, its half-year results were well received by Nvidia stockholders. The consensus on Nvidia shares at present is a strong buy. However, you should never invest in a company just because other analysts are bullish. After all, stock market investments are purely subjective. As such, whether or not you decide to buy Nvidia shares should be a decision you make yourself based on independent research. As we have uncovered in this guide – to the processing of buying Nvidia shares from the UK is simple. All it takes is a quick brokerage account application and an instant deposit with a debit/credit card or e-wallet. Then, it’s just a case of deciding how many Nvidia shares you want to purchase.

Nvidia is a US-based provider of Graphics Processing Units (GPUs). Its core market is that of gaming computers and devices - albeit, it has since diversified into other sectors.

Nvidia is listed on the NASDAQ. This shouldn't concern you as a UK investor.

During its IPO of 1999 - Nvidia shares were priced at just under $20 each. However, we need to take into account the various stock splits that have since occurred. This puts its original IPO price at around $1.66 per stock.

You can easily short-sell Nvidia shares by using a regulated CFD broker. To do this, you will need to place a sell order.

You will need to use an online broker that allows you to buy US-listed shares. Once opening an account and depositing funds - you simply need to determine how many shares you wish to buy. Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers. WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

Step 1: Find a UK Stock Broker

1. Plus500 – Commission-Free Platform for Trading Nvidia Stock CFDs

Step 2: Research Nvidia Shares

What is Nvidia?

Square Share Price History

Nvidia Shares Dividend Information

Should I Buy Nvidia Shares?

Nvidia has Defied the Pandemic

Huge $40 Billion Acquisition of ARM

Half Year Results

Nvidia Shares Buy or Sell?

The Verdict?

FAQs

What does Nvidia do?

What stock exchange is Nvidia shares listed on?

How much were Nvidia shares originally worth ?

Can you short Nvidia shares?

How do you buy shares in Nvidia?

Kane Pepi