How to Buy Disney Shares Online in the UK

Many people know Disney for it’s classic animated movies, but there’s much more to the company than just that. Disney operates massive resorts and theme parks around the world, controls the sports broadcasting network ESPN, and recently launched an online video streaming service to compete with Netflix. The company has poised itself for aggressive growth, which has many investors in the UK excited about this stock.

If you’re thinking about buying Disney shares, this guide will cover everything you need to know. We’ll show you how to buy Disney shares online using a UK share broker and review two recommended brokers you can use. We’ll also take a deep dive into Disney stock and the company’s future to help you decide if Disney is a smart investment right now.

Step 1: Find a UK Broker to Buy Disney Shares

That said, it’s important to choose a broker carefully. Your broker will determine everything from how much it costs you to buy shares to what trading and research tools you’ll have at your disposal. To make it easier to get the best broker for you, let’s take a closer look at two of our most highly recommended online brokers in the UK.

1. Plus500 – User-friendly Trading Platform for Share CFDs

This broker is particularly nice because it presents a range of trading tools in an approachable way. The built-in charting interface is easy to get started with and offers dozens of common technical studies. While advanced traders might find the lack of custom indicators to be a downside, the simplicity is a major plus for beginner traders.

Plus500 also offers one of the best trading apps around. It comes complete with price alerts to help you stay on top of trades and a market news feed so you can monitor breaking stories.

Pros:

Cons:

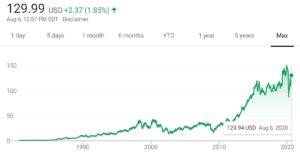

72% of retail investor accounts lose money when trading CFDs with this provider. Disney may have name recognition, but is it a good investment? Before you buy shares in Disney, or any other companies like Netflix shares, it’s essential that you do some digging into the company’s financial history and outlook. To help, we’ll cover everything you need to know about Disney’s share history, its dividend payouts, and its future prospects. The Walt Disney Company was founded in 1923 by Walt and Roy Disney. Originally, the company was a cartoon studio designed to produce entertainment in the early days of animation. Disney Studio was behind the first full-length animated film in the world, Snow White and the Seven Dwarfs, in 1937. The company continued to produce animated and live-action films throughout the 1940s and 1950s. In 1971, Disney opened Walt Disney World in Florida. All of these acquisitions led to what was perhaps Iger’s most significant move for Disney in decades – launching the Disney+ subscription streaming service. Disney+ is a direct competitor to Netflix and gives Disney not only a massive new revenue stream, but also control of its own studio distribution. Iger stepped down as CEO in February 2020, but has effectively maintained control of the company to help steer it through the disruptions caused by the coronavirus pandemic. Disney first went public on the New York Stock Exchange in 1957, trading at a price of $13.88. The Disney share price rose dramatically during the 1990s during the so-called “Disney Renaissance” in response to its box office success. Yet it wasn’t until around 2009, when Iger’s acquisition spree began in earnest, that the stock exploded in value. From 2009 to 2015, Disney’s share price jumped from $17 per share to $116 per share. The stock hit an all-time high in January 2020 at a value of $153.41 per share. Disney’s share price has suffered in response to the coronavirus pandemic, and understandably so. The company was forced to shutter its resorts, theme parks, and cruise lines for months, and distribution of summer blockbusters like its live-action remake of Mulan was suspended. Disney’s stock hit a bottom of $86 in April 2020, but has since rebounded to more than $128 per share. Disney has long been favoured by investors as a top dividend stock. The company has paid out a dividend consistently for more than a decade under Iger’s leadership and the payouts haven’t been affected even as Disney has suffered revenue hits from the coronavirus pandemic. To be fair, Disney’s dividend yield isn’t spectacular. In most years, the company targets a payout of 1.2 to 1.6% of the share value. However, you’re not likely to hear investors complaining given that the dividend payouts have kept up with share price appreciation and given that Disney shares appreciated by an astounding 32% in 2019. With Disney in the middle of dealing with the coronavirus pandemic, is now the right time to buy shares? There is plenty of reason to be optimistic about Disney’s future despite any short-term turmoil in the share price. Let’s take a look at some of the things that Disney has going for it. Disney is, very broadly speaking, an entertainment company. But when you look closer, it’s much more than that. Disney is a theme park and resort operator, a cruise line, a movie studio, a sports broadcasting leader, and a Netflix-style streaming service. If the pandemic has demonstrated anything, it’s that this diversification into different sub-industries has made Disney incredibly resilient. While cruise operators and hotels begged the US government for bailouts, Disney paid out a dividend. To be sure, the company has sunk quite a bit of capital into maintaining its ships and theme parks, and it recently reported a loss in its third-quarter earnings report. But the fact that such a massive company can float on the merits of a relatively new subscription service speaks to Disney’s ability to handle a crushing financial downturn. Expect that diversification to pay off in the future. While it may take several years for tourism to fully rebound, Disney has already reopened most of its theme parks in a limited capacity. Disney is such a cultural icon that its resorts could even benefit from increased domestic tourism over the next few years. Meanwhile, the streaming and television broadcasting revenues that Disney brings in should continue to increase. Disney has also moved to premier its live-action remake of Mulan on the service in September with an extra $30 price tag. Disney shares jumped 10% on the news alone, and they could move even higher if the premier proves successful. If all goes well, Disney will prove that it can use its streaming service as a distribution network for its studio productions, keeping a far larger chunk of revenue than it ever could from theater releases. Ultimately, analysts predict that Disney+ on its own could be worth as much as Netflix. That will take some years, but it bodes extremely well for investors who get in on the ground floor. One other important thing that plays in Disney’s favor is increasing Internet connectivity in emerging markets. The company made an aggressive push into China in the early 2000s, launching theme parks in Shanghai and Hong Kong. Before retiring, CEO Bob Iger pointed out that India could become the next massive market for Disney to address. The country has a high English literacy rate and a fascination with the US in pop culture. As India’s middle class becomes increasingly well-developed and 5G networks are built across the country, Disney stands to capture an audience of hundreds of millions of people for Disney+ and could potentially invest in additional theme parks. The coronavirus pandemic has created what many UK investors might see as an opportunity to buy Disney at a discount. While Disney has suffered financially from the pandemic as a result of park closures and a stoppage in sports broadcasting, the company has used the crisis as an opportunity to grow its Disney+ subscription streaming service. As the global economy restarts, Disney could return to its normal profitability while retaining tens of millions of new users who flocked to Disney+ in 2020. There are long-term risks for Disney, particularly if tourism takes longer than expected to rebound or subscribers decide to cancel their Disney+ service. However, these risks are much less likely than a scenario in which Disney’s growth continues largely unimpeded for years to come. Long-term investors in particular could benefit from the company’s growth without worrying as much about short-term disruptions to revenue.

Disney+, Disney’s subscription streaming service, launched on November 12, 2019. As of August 2020, the service has amassed more than 60 million subscribers.

Bob Iger, the CEO of Disney for 14 years, retired abruptly in February 2020. The current Disney CEO is Bob Chapek, who was groomed for the position by Iger. Iger has remained largely in control of Disney as chairman of the board to help steer Disney through the coronavirus pandemic.

Disney is headquartered in Burbank, California. Walt Disney Studios has been in Burbank since the 1930s.

Disney trades on the New York Stock Exchange under the ticker symbol ‘DIS.’

Disney currently operates theme parks in Florida, California, Tokyo, Shanghai, Hong Kong, and Paris.

Yes, you can collect dividends from Walt Disney shares when you own CFDs, just as if you owned the underlying shares. Disney pays out dividends twice per year.

Step 2: Research Disney Shares

Disney Share Price History

Disney Dividend Information

Should I Buy Disney Shares?

Disney is Diversified

Disney+ is Here to Stay

Emerging Demand

The Verdict

FAQs

When did Disney+ launch?

Who is the current CEO of Disney?

Where is Disney headquartered?

What is Disney’s ticker symbol?

Where does Disney have theme parks?

Can I collect Disney dividends when trading CFDs?