Coinjar Review UK 2024 – Features, Fees, Pros & Cons Revealed

If you’re based in the UK and looking for a cryptocurrency exchange that allows you buy digital coins with ease, you might want to consider Coinjar. The Australian-based platform allows you to quickly deposit funds via a UK bank transfer. Then, it’s just a case of deciding which cryptocurrency you want to buy.

In this Coinjar Review UK – we cover everything there is know about the platform. This includes tradable cryptocurrencies, supported payments, fees and commissions, and safety.

-

-

What is Coinjar?

Launched in 2013, Coinjar is the largest cryptocurrency exchange in Australia. However, the provider has since expanded its reach to the UK market, meaning that you can easily buy, sell, and trade digital coins.

In fact, unlike a lot of cryptocurrency brokers in the online space, Coinjar offers markets in GBP. This means that you can buy Bitcoin with British pounds without needing to worry about exchange rates. In the terms of what the platform offers, Coinjar is behind a variety of services.

This includes a traditional brokerage offering, meaning that you can buy cryptocurrencies directly. Alternatively, you might decide to use the platform to trade one cryptocurrency to another. In what it calls Coinjar Bundles, the platform also allows you to diversify into several cryptocurrencies via a single trade. This is like a mini index-fund.

When it comes to payments and fees, Coinjar does not support debit/credit cards or e-wallets. But, you can deposit funds via a UK Faster Payments bank transfer – which is usually credited in just a few minutes. This won’t cost you anything, but you will need to pay a commission of 1% on all purchases and sales.

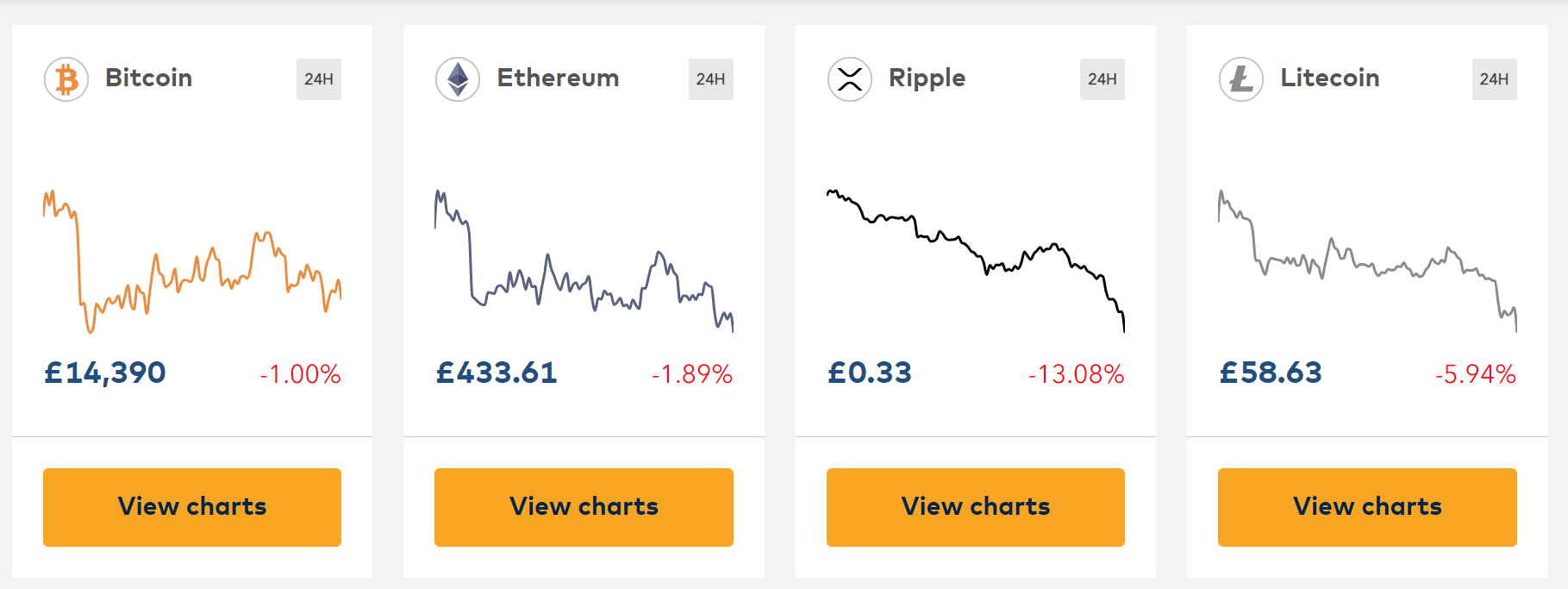

Supported Coins

Coinjar essentially offers two core platforms – a brokerage service and a cryptocurrency exchange. The former is for those of you that simply want to buy or sell a digital currency. The latter is for those that wish to actively trade cryptocurrencies on a short-term term basis. We’ll cover the Coinjar exchange in more detail later.

Nevertheless, if you want to use the platform to buy cryptocurrency – Coinjar supports the following coins:

- Bitcoin

- Ethereum

- Ripple

- Chainlink

- Stellar

- USD Coin

- Uniswap

- Yearn.Finance

- Maker Dai

- Maker

- Compound

- 0x Token

- Basic Attention Token

- OMG Network

- Litecoin

As you can see from the above, there is a good blend of major cryptocurrencies and smaller, less liquid projects. However, there are some notable exceptions. For example, Coinjar does not allow you to buy Bitcoin Cash, EOS, Cardano, Binance Coin, or Ethereum Classic.

So that you know which cryptocurrencies you can buy at the platform, in the next section of our Coinjar Review UK we are going to see what’s available on the provider’s digital exchange.

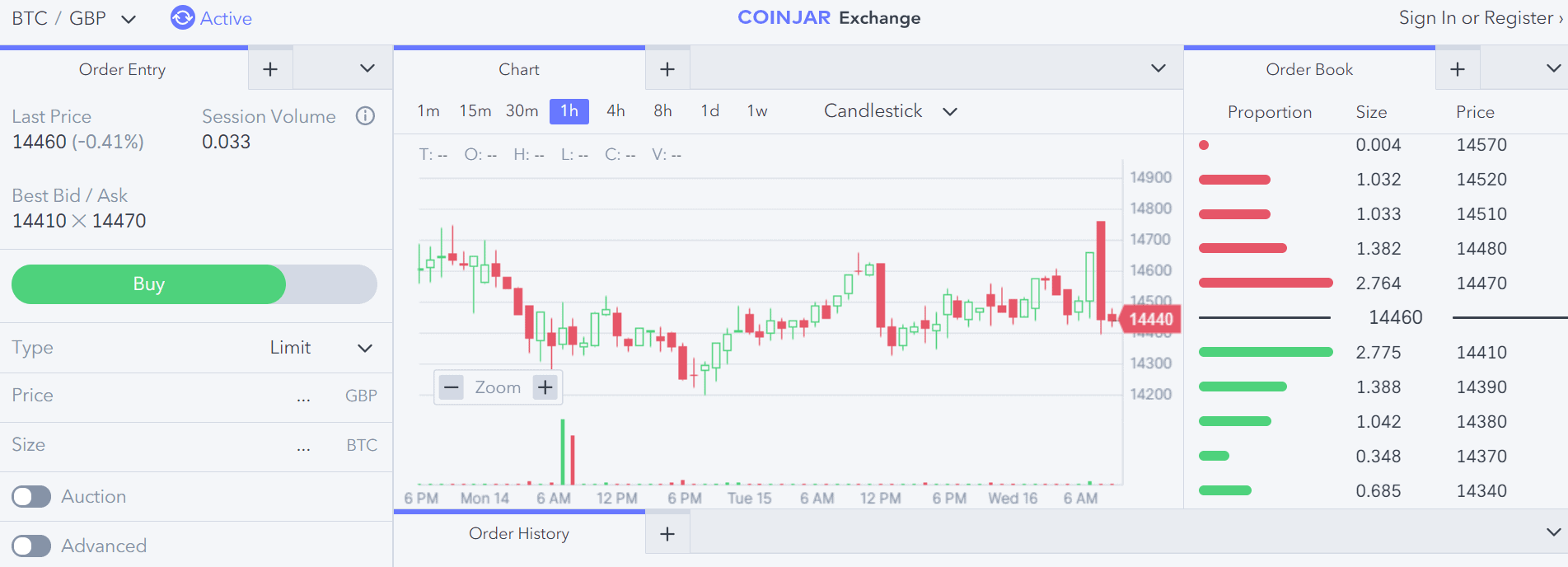

Coinjar Exchange

The Coinjar exchange is not too dissimilar to Coinbase Pro. That is to say, this section of the platform is arguably suitable for those with a bit of experience in cryptocurrency trading. This is because you have access to more features and tools – especially when it comes to charting.

In terms of what you can trade on the exchange, Coinjar supports both fiat-to-crypto and crypto-cross pairs. The former means that you will be trading a real currency against a digital coin like Bitcoin or Ethereum. On the Coinjar exchange, supported fiat currencies include the British pound and Australian dollar.

Examples of popular fiat-to-crypto pairs hosted by Coinjar are listed below:

- BTC/GBP

- ETH/GBP

- LTC/GBP

- BTC/AUD

- XRP/AUD

If you fancy trading the exchange rate between two competing digital coins, these are known as crypto-cross pairs. On the Coinjar exchange, all crypto-cross pairs contain Bitcoin.

This includes the likes of:

- ETH/BTC

- XRP/ETH

- LTC/BTC

- XLM/BTC

- LINK/BTC

In addition to Bitcoin-denominated pairs, the Coinjar exchange also supports stablecoins. For those unaware, these are digital currencies that are pegged to a fiat currency like the US dollar.

Allegedly, these projects are backed by cold-hard cash receives of the respective currency. At Coinjar, you can trade USDT (Tether) against a variety of cryptocurrencies. All in all, the Coinjar exchange is relatively thin on the ground in terms of tradable pairs.

For example, our Binance review found that the platform offers hundreds of cryptocurrency pairs to choose from, subsequently giving you much more in the way of flexibility.

Coinjar Fees

When it comes to Coinjar fees, this will depend on the product or service you are interested in.

Let’s break these fees down so that you have a firm 360-degree overview of what you will likely need to pay to use the platform.

Deposit/Withdrawal Fees

Before you can use your Coinjar account to buy or trade cryptocurrencies, you will first need to fund it. In this respect, you have two options – which we cover in more detail later on.

Nevertheless, if you deposit funds with a cryptocurrency then there are no fees. Similarly, if you transfer from your UK bank account, there are no fees. It is also fee-free to withdraw funds out – whether that’s via a bank transfer or digital currency.

So far, so good.

Buy and Sell Fees

Not to be confused with buy and sell orders on the Coinjar exchange, if you wish to purchase one of the platform’s supported digital currencies, then you will pay a variable fee of 1%.

For example, you might deposit £1,000 into the platform via a bank transfer, which is fee-free. But, if you then use that £1,000 to buy Bitcoin, your 1% commission will kick in – totaling £10. This is also the case when you decide to sell your cryptocurrency back to GBP.

For example, let’s suppose that when you get around to cashing out, your Bitcoin investment is worth £3,000. In turn, your 1% commission will cost you £30.

So how does this compare with other cryptocurrency exchanges in the UK? Well, our Coinbase review found that the popular broker charges 3,99% on debit card purchases and a further 2% when you cash out back to the same payment method. Or, if using a bank transfer, you’ll simply pay a trading commission of 1.49% per slide.

Exchange Trading Commission

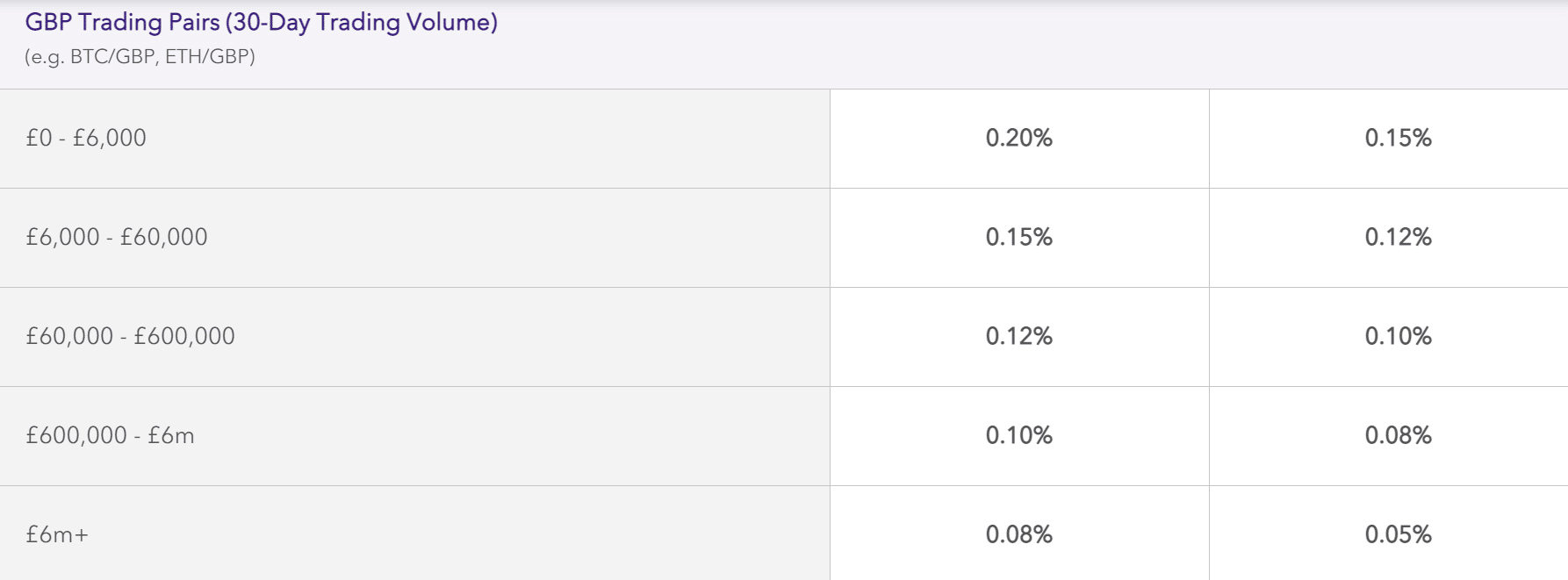

If you decide to use the Coinjar exchange to trade cryptocurrency pairs, there is a different pricing structure. Like a lot of cryptocurrency exchanges, the provider utilizes a market ‘maker’ and ‘taker’ system.

The former means that you are providing liquidity for Coinjar. If you’re just a casual trader, then you will be a market taker.

- In turn, you will pay a commission of 0.20% if you traded less than £6,000 in the prior month.

- Anything between this figure and below £60,000 in the prior month reduces the commission to 0.15%.

- The lowest trading commission available at Coinjar is 0.08%, which requires a 30-day volume of £6 million or more.

Are these trading fees commission? Well, Binance charges a trading commission of just 0.10% – and even less for larger volumes.

Coinjar Buying Limits

Coinjar offers high limits of £10,000 per day when you are transferring funds with your UK bank account. Anything more than this and you might be deemed a corporate account user – which will require additional documentation. The minimum stands at just £5, which is great for first-timers.

Coinjar Wallet

Coinjar does not offer a conventional ‘private’ currency wallet. By this, we mean that your digital currency holdings are stored in the Coinjar web wallet.

In turn, this means that you will not have access to your private keys – so you trusting Coinjar to keep your funds safe. This is the least secure way of storing cryptocurrencies.

Nevertheless, Coinjar notes that it offers several safeguards in keeping your funds safe, which includes:

Cold Storage

The vast majority of client crypto-funds are held in ‘cold storage’. For those unaware, this means that they are kept in hardware wallets that are never connected to a live server.

As a result, this makes it extremely difficult for the funds to be hacked remotely. The small percentage of client funds that are held online are for liquidity and withdrawal purposes.

2FA

Two-factor authentication (2FA) is a crucial safeguard that Coinjaer offers. Although not compulsory, we strongly suggest that you set this up if you are planning to keep your crypto funds at the platform.

Put simply, every time you log in to your account or attempt to make a withdrawal request, you will need to bypass an additional verification step.

This comes in the form of a code that is sent to your mobile device. In theory, this means that unless somebody had both your Coinjar login credentials and mobile phone, it would be very difficult for them to gain access to your account.

Machine Learning

The team at Coinjar also claim to have machine learning technologies in place. This allows the platform to automatically flag suspicious activities. For example, if a login attempt comes from a non-UK IP address or you deposit a significant amount.

Coinjar Mobile App

While most traders use the main Coinjar website, some of you might want to gain access to your account while on the move.

If so, you’ll be pleased to know that Coinjar offers a fully-fledged mobile app. This is available on both iOS and Android devices. Both versions of the app can be downloaded free of charge and allow you to perform all account features.

This includes the ability to:

- Buy and sell cryptocurrencies

- Trade cryptocurrencies via the Coinjar exchange

- Deposit and withdraw funds

- View the value of your portfolio

In addition to the above, the Coinjar app comes with a handy QR code feature – which works for both incoming and outgoing transactions.

For example, if you wanted somebody to transfer funds into your Coinjar wallet, they would simply need to scan your unique QR code. Or, if you wanted to transfer funds out of your wallet, you could scan the QR code via your phone camera.

In terms of reviews in the public domain, this is mixed depending on which version of the app you are using. For example, the Coinjar app has an excellent rating of 4.7/5 on the Apple Store.

This is across more than 3,500 individual reviews. However, on Google Play, the Coinjar app has a rating of just 3.6/5. This is across just 300 reviews though, which isn’t really a large enough sample size.

Coinjar User Experience

Our Coinjar Review found that one of the most appealing aspects of the platform is that it is really simple to use. In other words, if you are looking to buy cryptocurrencies for the very first time, Coinjar would be a suitable option.

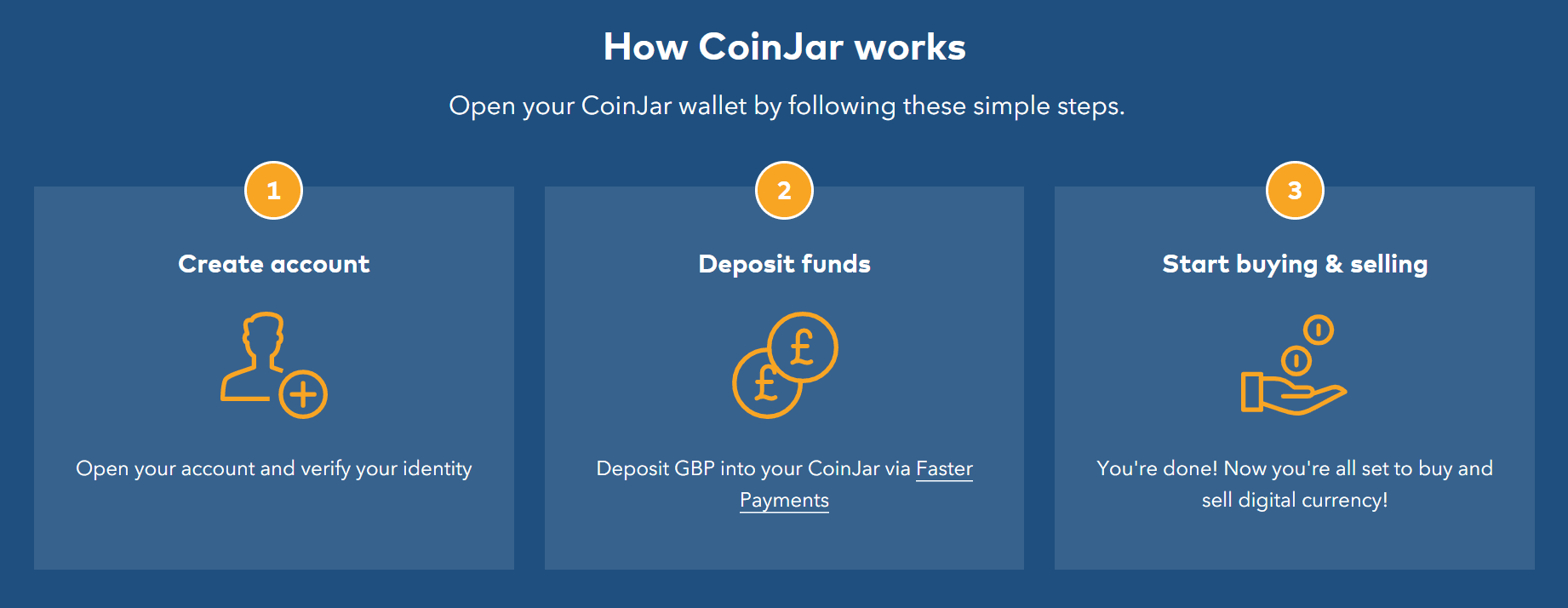

For example, when you first head over to the website you will see that the platform uses a clean, concise, and super user-friendly layout. Everything is displayed clearly, so it’s easy to navigate to your required product or service. This is also the case when it comes to opening an account and depositing funds.

You simply need to follow the on-screen instructions – so again, there is no requirement to have any prior experience. Additionally, when you get around to buying or selling your chosen cryptocurrency, it’s simply a case of selecting the coin you are interested in, entering your stake, and confirming the transaction.

When it comes to the Coinjar exchange, this also offers a seamless experience. Even if you have never traded cryptocurrencies previously, you shouldn’t run into any issues. On the flip side, if you are a seasoned trader that knows how cryptocurrency exchanges work, you might find the platform somewhat basic.

Coinjar Trading Tools and Features

While we have already discussed the platform’s cryptocurrency brokerage and exchange services, Coinjar offers a number of other features that you might be interested in.

This includes:

Coinjar Bundles

This is an interesting Coinjar feature that we briefly mentioned earlier. Put simply, Coinjar Bundles allow you to invest in cryptocurrencies in a diversified manner.

In other words, instead of buying just one cryptocurrency, you can hedge your risk by investing in a group of digital coins via a single transaction.

There is a range of Coinjar Bundles to choose from, which includes:

- ERC-20 Bundle: This consists of all ERC-20 tokens hosted on the Coinjar website.

- Stellar/Ripple: This consists of an even split between Stellar Lumens and Ripple

- CoinJar Universe: This Bundle will see you purchase a weighted split of all digital currencies available on the Coinjar website.

On the one hand, Coinjar Bundles are great for buying several cryptocurrencies through one trade – subsequently allowing you to create a diversified portfolio of digital currencies. However, other than the Coinjar Universe Bundle, these are not diversified enough.

OTC Services

If you are looking to invest at least £25,000 into a cryptocurrency, Coinjar offers an OTC (Over-the-Counter) service. This means that the platform will personally execute a buy or sell order for you with a large-scale provider. In turn, you will benefit from wholesale market rates and super-competitive commissions.

Coinjar Debit Card (Coming Soon)

Moving into 2022, UK residents will have access to the Coinjar debit card. This will allow you to purchase goods and services online and in-store. Each transaction will be converted by Coinjar at the point of purchase.

For example, if you with £100 from an ATM with your Coinjar debit card, the transaction will be paid for with your cryptocurrency holdings – and exchanged at the current rate.

Blog

Although it’s not the most comprehensive, Coinjar is also behind a blog. This contains market insights and discussions of key developments in the world of cryptocurrencies. There is also a selection of newbie-friendly guides on offer – such as cryptocurrency-related tax and how to safely store digital coins.

Coinjar Payments

When it comes to supported payment methods, our Coinjar Review UK found that the provider offers two options. Firstly, if you already have access to a cryptocurrency – and it is supported by the Coinjar wallet, then you can quickly transfer the funds in.

Alternatively, if you want to deposit funds with British pounds, the only option here is a UK bank transfer. While most online brokers make you wait several days for the funds to be credited, Coinjar has partnered with the Faster Payments Network.

This means that after your initial deposit, you should be able to add funds to your Coinjar account in just a few minutes. However, the first payment that you take might take a few hours – as per verification checks. In terms of withdrawals, Coinjar notes that the funds should arrive in your bank account the next working day.

On the other hand, it is disappointing that Coinjar does not offer additional fiat payment gateways. For example, you can’t buy Bitcoin with a debit card, nor can you buy Bitcoin with Paypal.

Coinjar Minimum Deposit

The minimum deposit at Coinjar is just £5. This is ideal for those of you that want to dabble in the cryptocurrency arena for the first time, but don’t want to risk larger amounts.

Coinjar Regulation & Licensing

When you visit a trusted cryptocurrency exchange that is fully licensed, you can normally find information about its regulatory status with ease. In most cases, this is either highlighted on the homepage or displayed as a footnote with the respective license number.

However, our Coinjar Review UK could not find any information on the platform itself, so we had to do a bit more digging. In a nutshell, Coinjar is a ‘registered business’ in the UK.

But, it is not regulated by the Financial Conduct Authority (FCA).

So what does this mean for the safety of your funds? Well, when you use an FCA broker they are required to keep client money in segregated bank accounts. It is also required to have its books audited on a regular basis, and keep a minimum amount of working capital.

And of course, FCA brokers need to go through a highly cumbersome and costly process just to get the license itself. All in all, using Coinjar might prove somewhat problematic if you are seeking a fully regulated platform (which you should).

The only safeguard that you is that Coinjar claims to keep 90% of client crypto-assets in cold storage. But of course, there is no way of verifying this independently – so the entire investment and trading process so based on trust.

Coinjar Contact and Customer Service

Customer service at Coinjar is lacking. There is no contact method that allows you to receive support in real-time – meaning no live chat or telephone assistance.

Instead, everything must go through a support ticket. It remains to be seen how long it takes to get a reply. When you initially click on the ‘Contact’ button, you are redirected to an FAQ section.

Although reasonably extensive, this might not be sufficient to resolve your account query.

How to Use Coinjar

If you’ve read our in-depth Coinjar Review 2020 up to this point and feel the broker is right for you, we are now going to show you how to get started.

The steps below will show you how to register, deposit funds, and ultimately – buy cryptocurrency your chosen cryptocurrency.

Step 1: Open an Account

To get the ball rolling, visit the Coinjar UK website and click on the ‘Sign Up’ button. You can do this online or via your mobile phone.

Next, you will be asked to enter some personal information.

This includes:

- Full Name

- Residential Address

- Date of Birth

- Email Address

- Mobile Number

You also need to create a strong password, which you’ll need to access your Coinjar account.

Step 2: Account Verification

As per UK anti-money laundering laws, you will need to verify your identity.

The only exception to this rule is you plan on using Coinjar to store and transfer digital currencies. But, if you want to fund your account via a bank transfer, you need to provide two documents.

This includes:

- Valid UK passport or driver’s license

- Bank account statement or utility bill (this can be a digital statement)

If the quality of your document does not meet Coinjar’s expected standards, the system will ask you to reupload it.

Finally, you need to take a selfie of yourself holding your government-issued ID next to your face. This is slowly but surely becoming standard practice in the online verification space, as it ensures nobody is fraudulently trying to open an account on your behalf.

Step 3: Transfer Funds

It remains to be seen how long it takes Coinjar to manually verify your documents. You will, however, receive an email letting you know when the verification process is complete.

When it is, you can proceed to transfer funds from your UK bank account. Coinjar will display the bank account details that you need to send the funds to.

You will also be asked to enter a unique reference number when making the transfer so that Coinjar can credit the funds quickly. Don’t forget, the minimum transfer is just £5 and there are no fees.

Step 4: Buy Cryptocurrency

As soon as your Coinjar account has been funded, you can proceed to buy a cryptocurrency.

In your main account dashboard, click on the cryptocurrency that you want to buy. Then, enter the amount that you wish to invest in pounds and pence.

When you confirm the purchase, the funds will be taken from your cash account. In turn, the digital currency will then be placed into your Coinjar web wallet. You can leave the coins there or withdraw them to a private wallet.

The Verdict

On the one hand, if you want to buy and sell cryptocurrencies in a fast and user-friendly manner, Coinjar is well worth considering. However, the platform does fall short in several areas. At the forefront of this is a lack of FCA regulation and no support for debit/credit cards and e-wallets.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

FAQs

How much does Coinjar UK charge to buy Bitcoin?

You can deposit funds into your Coinjar account via bank transfer for free. But, when it comes to making the purchase, you will pay a commission of 1%

Is Coinjar regulated in the UK?

No. Although Coinjar is a registered UK business, it is not regulated.

Does Coinjar accept Paypal?

No, Coinjar does not accept Paypal. The only supported payment method is a UK bank transfer or cryptocurrency deposit.

What trading fees does Coinjar charge?

If you are buying or selling cryptocurrencies directly, Coinjar charges 1%. If using the Coinjar exchange to trade, commissions start from 0.2%.

What is the Coinjar minimum?

The minimum Coinjar deposit is just £5.

What cryptocurrencies can buy at Coinjar?

At the time of writing, Coinjar supports 15 digital currencies.

Does Coinjar offer live chat?

No, Coinjar does not offer live chat. The only contact method available is a support ticket.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2024 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

Launched in 2013, Coinjar is the largest cryptocurrency exchange in Australia. However, the provider has since expanded its reach to the UK market, meaning that you can easily buy, sell, and trade digital coins.

Launched in 2013, Coinjar is the largest cryptocurrency exchange in Australia. However, the provider has since expanded its reach to the UK market, meaning that you can easily buy, sell, and trade digital coins.

When you visit a trusted cryptocurrency exchange that is fully licensed, you can normally find information about its regulatory status with ease. In most cases, this is either highlighted on the homepage or displayed as a footnote with the respective license number.

When you visit a trusted cryptocurrency exchange that is fully licensed, you can normally find information about its regulatory status with ease. In most cases, this is either highlighted on the homepage or displayed as a footnote with the respective license number.