How to Buy Cryptocurrency UK – Beginner’s Guide

Cryptocurrency is one of the fastest-growing asset classes on the planet. So in this guide, we’ll show you how to buy cryptocurrency UK and explain everything you need to know to make a cryptocurrency investment UK today.

At a glance: How to Buy Cryptocurrency in UK 2026

You’re based in UK and want to buy cryptocurrency right away? You can get started in just 4 simple steps:

- Step 1: Open an Coinbase account – Quickly open an account with our recommended crypto broker

- Step 2: Verify your account – Upload a copy of your passport or driver’s license to verify your identity

- Step 3: Fund your account– Deposit funds with a UK debit card, bank transfer, or e-wallet

- Step 4: Buy Crypto – Buy crypto UK with low fees and tight spreads.

Where to buy cryptocurrencies in the UK?

Before we dive into how to buy cryptocurrency UK, you need to find the right broker or exchange. You can compare the best crypto brokers and exchanges, along with their features, fees and payment methods, below. You can even change the investment amount and cryptocurrency you’re investing in to see how much each broker charges!

Cryptocurrencies like Bitcoin, Ethereum, and Ripple now operate in a multi-billion pound trading arena. In fact, more than $250 billion worth of Bitcoin alternatives have changed hands in the last 24 hours alone. As such, it makes sense that more and more people in the UK are looking to get a piece of the crypto action. Therefore, you might be interested in how to invest in Terra or Bitcoin guides.

With that being said, you’re not buying a traditional asset like stocks or bonds here. On the contrary, cryptocurrencies are a new, innovative, and somewhat complex financial instrument. You can find non-familiar concepts like staking or ‘HODLING.’

How To Invest in Cryptocurrency Presales UK?

One of the best ways to invest in crypto for the long term is to take part in presales. During a presale, investors can buy new tokens at a low price before they are listed on exchanges. Some of the best presales have been known to 10x initial investment and are a great way to diversify your portfolio with new projects.

How to buy crypto- presale:

- Fund your crypto wallet with tokens. The tokens that you will need will depend on which blockchain the presale token is built on. For example, you will need ETH to invest in ethereum-based tokens.

- Connect your crypto wallet to the presale website.

- Swap crypto for presale tokens.

- Wait for the presale to end to claim your tokens.

Best Crypto Presales To Invest in UK 2026

Wall Street Memes | $WSM- The Next Big Meme Token

Wall Street Memes is a popular social media channel that has been around since 2021. Now, the platform have launched their very own meme token, $WSM, which is already making waves amongst meme coin investors. Some even believe that the erc20 meme token is the next to explode.

The aim of the Wall Street Memes token is to a build a community of investors who share a joint passion- to send $WSM to the moon. The meme token will troll the financial market by sending a ‘worthless’ coin to the moon whilst other tokens struggle in the volatile market. The presale has been underway since May and has already raised significant funds.

$WSM is a true meme token with no real utility. However, it has attracted the attention of Elon Musk who recently re-tweeted the project to his Twitter page. This puts Wall Street Memes in a strong position to do well.

Your money is at risk.

yPredict | YPRED

yPredict is a cutting-edge platform that revolutionizes the way traders navigate the unpredictable financial markets. With its array of predictive models and advanced AI technology, yPredict empowers traders to make well-informed decisions and optimize their trading strategies.

At the heart of yPredict lies its marketplace for predictive models, where AI developers can showcase and sell their models to subscribers. This unique marketplace model enables traders to access a wide range of predictive models, each offering detailed insights, trading suggestions, and price indicators. Subscribers have the freedom to handpick the models that align with their specific trading needs, ensuring a personalized and tailored experience.

To maintain the highest quality standards, all models available on yPredict are developed by the top 1% of AI developers, leveraging state-of-the-art AI and ML techniques. The platform takes pride in its rigorous selection process, ensuring that only the most relevant and effective models are made accessible to traders.

The platform is supported by the YPRED token which can be used to pay for models, reward developers and provide liquidity to the project. YPRED has a limited supply of just 100 million and the value of predictive models will increase along with the value of the token. The best time to invest is now whilst prices are low.

Your money is at risk.

Launchpad | LPX

In 2023, diversifying your cryptocurrency portfolio can be accomplished by investing in web3 projects, and one platform that stands out is Launchpad XYZ. Positioned to become a leading platform in the web3 space by 2025, Launchpad XYZ offers a comprehensive all-in-one solution for users to access various aspects of web3.

At the core of Launchpad XYZ lies its web3 portal, which serves as the gateway for users to explore and engage with a wide range of web3 products. From metaverse offerings and play-to-earn opportunities to NFTs, cryptocurrencies, exchanges, and DeFi wallets, Launchpad XYZ aims to cater to all web3 needs within a single platform.

The vision of the Launchpad XYZ team is to create an ecosystem that covers virtually everything users may require. Through Launchpad, users can browse NFTs and crypto tokens, participate in crypto games, stake tokens for passive income, perform token swaps, securely store crypto assets and NFTs, acquire trading knowledge, and access crypto analytics and market insights to enhance their trading strategies.

To get involved in this exciting venture, the ongoing presale event offers an ideal opportunity. During this event, investors have the chance to acquire LPX tokens, the native cryptocurrency of Launchpad XYZ, at a discounted price. LPX tokens serve as the gateway to accessing various features and functionalities within Launchpad.

Your money is at risk.

EcoTerra | ECOTERRA

There is a growing need for sustainable projects in the web3 space. EcoTerra is a brand new eco friendly project that will reward users for recycling in a bid to encourage more people to recycle everyday materials.

The entire platform will be Blockchain based, and users will be rewarded with ECOTERRA tokens. The asset is an ERC 20 utility token with strong use cases. The token can be cashed out by swapping it for other assets or used to access further components of the EcoTerra platform.

The platform provides two marketplaces that tokens can be used in. The first is a carbon offset market place through which users can use tokens to fund carbon offset initiatives. The second is a recycled materials marketplace. Here users can purchase materials that have been scanned in by other users. This part of the platform will expand as the user base grows.

EcoTerra is the first platform of its kind and it’s set to be a hit amongst those who want to improve their impacts on the environment. Each user’s impact can be tracked using their impact portfolios. In this part of the platform users can collect tokens points and valuable NFT is. Each digital asset shows that a user has recycled materials and made a conscious choice to do good for the environment.

Your money is at risk.

DeeLance | DLANCE

A great crypto project to consider investing in this year is DeeLance. DeeLance is the first of its kind and is set to be launched in quarter three 2023. The platform is an innovative freelancing platform that allows businesses to directly work with freelancers reducing the need for any third-party intervention.

The absence of a third-party means that transactions on the platform can be executed much faster. It also means that the platform offers very low fees which will benefit both freelancers and hiring businesses.

DeeLance is completely decentralized and has built on Blockchain technology, the platform will use smart contracts to manage all transactions. This will ensure transparency and will also mean that all requirements of the contract must be completed before any payment can be released.

Freelancers can choose to accept payment in feet currency or Cryptocurrency. The payments will be supported by the reputable escrow platform. Due to the fact that users can accept payments in cryptocurrency. There is no need to connect a bank account to the platform. This will make Freelancing more accessible to users all over the world.

Your money is at risk.

Dash 2 Trade | D2T

Dash 2 Trade launched its best-selling presale in October 2022. After much success, the presale only has weeks before it is likely to end. The Dash 2 Trade platform is a crypto social trading and analytics platform that aims to help investors make smart decisions and improve their trading.

Dash 2 Trade will offer everything that you need to make sense of the crypto market under one roof. The native token, D2T, will be used to pay for platform subscriptions, unlock advanced features and will also be used as a reward for exclusive trading competitions.

To buy D2T, connect your MetaMask or Wallet Connect to the website and swap ETH for D2T. The presale is set to end soon w

hich means that it won’t be long before you can claim your tokens.

Why we like this presale: The D2T token is completely tax-free and has a limited supply of just 1 billion. This makes it an extremally attractive option for long term investors.

Your money is at risk.

What is a UK crypto exchange?

In order to buy cryptocurrencies, you will need to use a crypto exchange.

A crypto exchange is a type of online platform that can be used to buy and sell cryptocurrency. Exchanges have access to crypto marketplaces and are able to carry out transactions across networks. There are two types of crypto exchange: centralized exchanges and decentralized exchanges. The main difference between the two is that centralized exchanges are controlled by a third party company whereas decentralized exchanges are built on the blockchain network and provide complete autonomy.

View our list of top crypto exchanges to find out more.

Tutorial: How to buy cryptocurrencies with Coinbase

This is a step-by-step walkthrough of how to buy cryptocurrency UK right now. We’ve used our number one recommended broker Coinbase, due to its low fees, wide range of cryptocurrencies and tight security, but the process is similar on most brokers and exchanges.

- 📍 Step 1: Open an Account

- 📍 Step 2: Submit KYC Details

- 📍 Step 3: Deposit Funds

- 📍 Step 4: Search and Buy Crypto

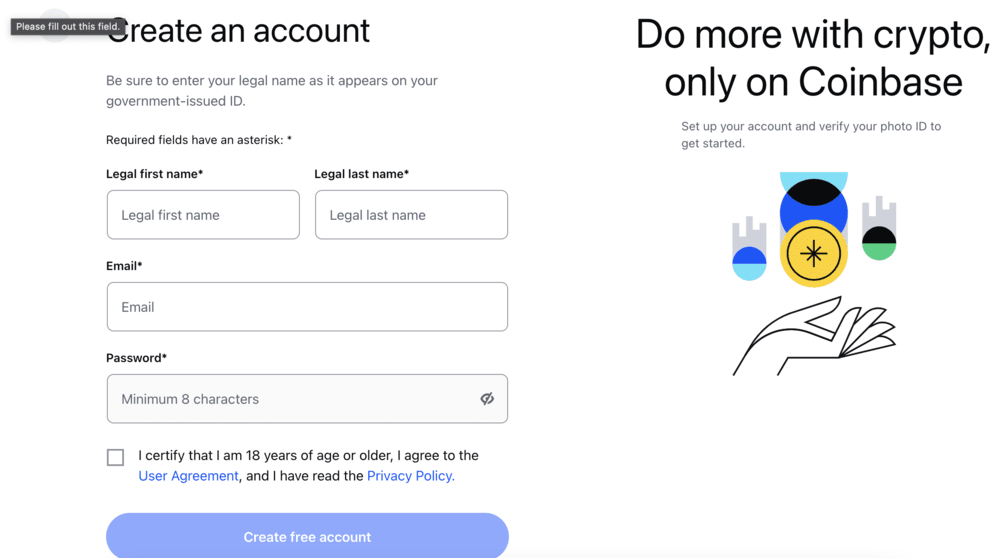

📍 Step 1: Open a Brokerage Account at Coinbase

The first step is to open an account with Coinbase.

The onboarding process is straightforward and requires some personal information, such as name and email.

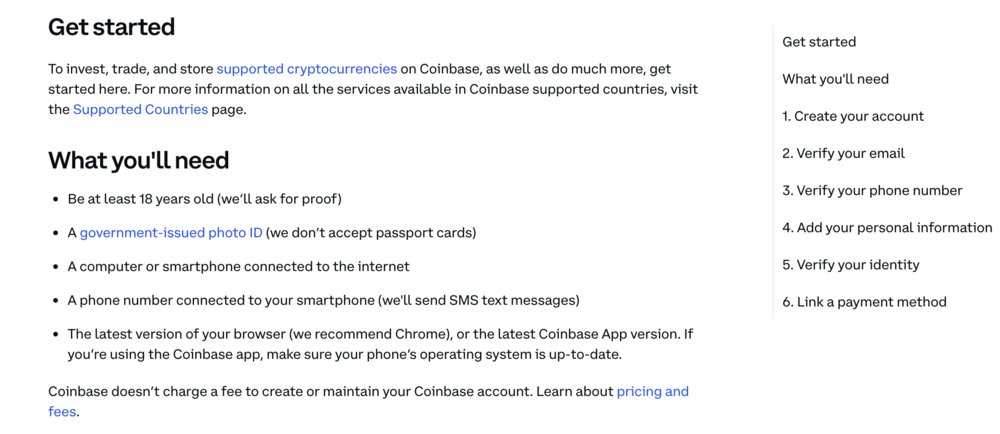

📍 Step 2: Verification

As part of the standard KYC (know your customer) regulations, you’ll need to upload copies of your passport and a recent bank statement as proof of ID and address.

You will also need a phone number.

This is to help prevent money laundering and identity theft.

📍 Step 3: Deposit

The next step involves funding your Coinbase brokerage account. As we’ve already discussed you can deposit funds using a variety of payment methods.

There are no deposit fees to pay and e-wallet transfers are processed instantly.

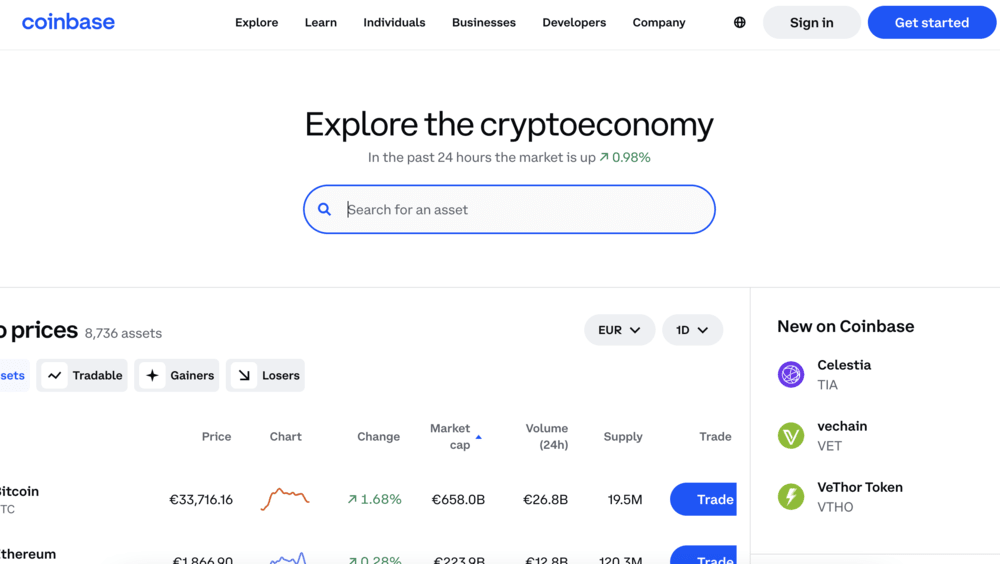

📍 Step 4: Search And Buy Cryptocurrency

The final step is to buy your crypto of choice. The easiest way is to type it into the search bar.

You will be taken to an order page to input how much crypto you want to buy, then click on ‘Open Trade’ to have it sent to your wallet.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

The best exchanges to buy cryptocurrency in UK – Reviewed

As we have explained throughout this guide, if you want to buy cryptocurrency UK you will first need to locate a good broker. There are many providers to choose from – some good, some bad, and others outright ugly.

As such, if you’re looking for the best new altcoin to buy right now, you might want to consider Lucky Block as it has most crypto-hungry investors on edge.

To help point you in the right direction, below you will find a selection of the best cryptocurrency exchanges currently serving UK clients.

- Coinbase – A good user-friendly cryptocurrency exchange for beginners

- Crypto.com – Popular Cryptocurrency Exchange with Low Fees

- BitDD – Licensed crypto exchange with 0% transaction fees for the first 90 days

- Huobi – Best Cryptocurrency Exchange for Derivatives Trading

- Binance – The best cryptocurrency exchange for experimented traders

- CoinCorner – Beginner-friendly & great customer service for buying cryptocurrency UK

- Coinjar – Great exchange for long-term cryptocurrency investing

- Luno – One of the best app to buy cryptocurrency easily

Other guides:

1. Coinbase – A good user-friendly exchange for beginners to invest in cryptocurrencies

Coinbase is a popular option for those who are looking to buy cryptocurrencies UK for the first time. The platform interface is clean, simple, and really easy to use – making it ideal for cryptocurrency newbies.

Coinbase has an excellent reputation in the Bitcoin and wider cryptocurrency brokerage scene – with more than 35 million client accounts now in operation. The platform is heavily regulated – both in the UK and US. Getting started at this cryptocurrency broker takes just a few minutes. You’ll need to provide some personal data and upload a copy of your passport or driver’s license.

After that, you’re good to go. Coinbase allows you to buy a wide selection of cryptocurrencies in the UK. This includes major coins like Bitcoin, you can buy Bitcoin Cash, Ethereum, Ripple, and Litecoin. You can also buy less liquid cryptocurrencies – like Basic Attention Token, Dash, and ZCash.

In terms of fees, we should make it clear that Coinbase is arguably one of the most expensive in the cryptocurrency broker scene. This is because you will need to pay a cryptocurrency trading commission of 1.49%. This needs to be paid when you buy cryptocurrency in the UK and again when you cash your investment out.

In addition to the aforementioned commission, you will also be charged to deposit funds with a debit card. This stands at a whopping 3.99% – which is huge. As such, if you’re going to use Coinbase to buy cryptocurrency, it might be best to deposit funds with your UK bank account. Nevertheless, once you have purchased your cryptocurrency at this platform, you can withdraw the coins out to a private wallet.

Or, you can keep the funds at Coinbase. Although web-wallets are usually deemed high-risk, Coinbase does have heaps of security controls in place. For example, 98% of its cryptocurrency holdings are kept in cold storage – meaning the wallet is not connected to the internet. Access to the funds also requires several signatures from Coinbase management.

Your money is at risk.

2. Crypto.com – Popular Exchange To Buy Cryptocurrencies with Low Fees

If you’re looking to buy cryptocurrency with low fees, then Crypto.com is worth checking out. Crypto.com is one of the best crypto exchanges UK, thanks to its stellar reputation, with the platform now having over 10 million users worldwide. The platform offers over 150 cryptocurrencies to trade, all of which can be exchanged using Crypto.com’s mobile app or the web-based exchange platform. The exchange also has an NFT app for buying and selling popular NFTs.

Crypto.com’s maker/taker fees start at 0.4% on either side of the trade, although these can be reduced by 10% if users hold CRO in their wallets. Notably, Crypto.com charges no fees for depositing crypto, although crypto withdrawals will come with a cost based on the specific coin. The great thing about Crypto.com is that users can buy crypto instantly using a credit or debit card – this usually accrues a 2.99% fee, although this fee is waived during the first 30 days of using the platform.

In terms of the user experience, Crypto.com’s trading app is designed with beginners in mind and has real-time price data and trending tickers highlighted on the homepage. Users can also view price charts and certain statistics on each crypto, with various timeframes offered. Finally, users can even utilise the Crypto.com VISA card and spend their crypto as if it was FIAT currency – with no annual fees and up to 8% cashback offered!

Your money is at risk.

3. BitDD – Licensed crypto exchange with 0% transaction fees for the first 90 days

BitDD is a credible cryptocurrency exchange that offers a secure, seamless trading experience. It currently provides advanced currency and derivatives transaction services for cryptocurrencies like BTC, ETH, and USDT.

BitDD is one of the fastest-growing crypto exchanges in the world, owing to its adherence to regulatory requirements. The platform, licensed by the United States Treasury Department, boasts over 500,000 customers globally. It has a large user base in the UK as well. The platform’s goal is to take the number further up to two million users by 2023. Keeping in line with that, BitDD has launched a welcome rewards program worth 8888 USDT.

BitDD is known for its attractive interest schemes that offer up to 14.5 p.a on crypto deposits. You can also earn up to 500 USDT by making crypto deposits on the platform.

However, BitDD’s key attraction is “Fast Trades,” where you can access a set of easy-to-use analytic tools and fine-tune your trading strategy to improve your profitability. If you’re new to crypto trading or have little time to devise investment strategies, the feature will come in handy.

Signing up on BitDD is super easy. If you have trouble getting acquainted with the platform’s features and functionalities, it offers 24/7 VIP support. Most importantly, BitDD offers free trading for the first 90 days of signing up.

BitDD is led by a team of industry experts who have over 20 years of track record in financial investment and blockchain technology. BitDD’s mission is to make crypto more accessible, reliable, and easier to use. Our detailed analysis of the project tells us that it is on the right path to realizing that. However, BitDD has to increase its number of trading pairs and analytic tools to reach a wider mass.

Your money is at risk.

4. Huobi – Best Cryptocurrency Exchange for Derivatives Trading

Another top cryptocurrency exchange to consider is Huobi. Huobi is one of the top ten largest exchanges worldwide, regularly boasting over $1.2bn in daily trading volume. The platform offers over 350 crypto assets to trade, including altcoins, DeFi tokens, and crypto-to-crypto trading pairs. Notably, Huobi also provides a selection of markets to trade aside from the spot market – including futures, swaps, and USDT-margined contracts.

In terms of fees, Huobi offers a transparent cost structure for all traders, equating to a 0.2% maker and taker fee. Interestingly, users can obtain a 50% reduction in trading fees by holding and paying fees in HT – the platform’s native token. Crypto deposits are free to make, and Huobi even supports FIAT deposits. Specific payment methods for FIAT currencies are also free, although Huobi will require users to complete KYC checks before making them.

Huobi is also well-known for its security level, as the platform holds 98% of users’ crypto holdings in cold storage. The platform also has an ‘Investor Protection Fund’, which is used as insurance in case the exchange is attacked. Finally, the Huobi trading platform is also packed with valuable features, such as staking, crypto loans, auctions, and even a dedicated crypto-education service!]

Your money is at risk.

5. Binance – The best cryptocurrency exchange for expirienced traders

The former is instantly processed while the latter will take a number of days to clear. Now, you will need to pay a 2% transaction fee if you buy bitcoin UK with debit card.

While this is cheaper than Coinbase, it’s still a lot more expensive than the 0.5% charged by other providers. Nevertheless, if you are interested in buying other cryptocurrencies – Binance covers hundreds of coins. This includes all major cryptocurrencies and heaps of ERC-20 tokens.

Unfortunately, if you want to buy a different cryptocurrency at Binance, you will first need to buy Bitcoin UK. Then, it’s a case of exchange Bitcoin with your chosen cryptocurrency. After that, you can withdraw the cryptocurrency out to your private wallet – or keep it at Binance.

Your money is at risk.

6. CoinCorner – Beginner-friendly & great customer service for Buying Cryptocurrency UK

CoinCorner seems to be a popular choice for those based in the UK that wish to buy a cryptocurrency or invest in DeFi for the first time. The platform is easy to use and the end-to-end purchase process should take you no longer than 10 minutes.

The easiest way to make a deposit at this cryptocurrency exchange is with your UK debit/credit card. What we also like about CoinCorner is that the exchange allows you to initiate recurring cryptocurrency investments.

For example, you might decide to transfer £100 from your bank account at the end of each month. This is an ideal way to utilize the previously discussed dollar-cost averaging strategy. As an additional bonus, CoinCorner runs a number of cryptocurrency reward programs that kick in when you make purchases.

Your money is at risk.

7. Coinjar – Great exchange for long-term cryptocurrency investing

Coinjar is a popular cryptocurrency exchange based in Australia. However, the provider has since moved into the UK market. Coinjar offers a wide variety of cryptocurrencies – both large and small.

For example, while the likes of Bitcoin and Ethereum are covered, as is Maker DAI. Although the provider is located Down Under, you can easily deposit funds with British pounds.

Best of all, the platform charges a competitive commission structure that averages 0.08% to 0.2%. Coinjar is also a good option if you have some experience in the cryptocurrency trading scene. This is because it offers heaps of advanced charting tools and order types.

Your money is at risk.

8. Luno – One of the best apps to buy cryptocurrencies easily

If you’re looking for a Bitcoin trading platform that is not only easy to use, but available via a mobile app – then you might want to consider Luno. This popular provider is great for buying and selling currencies on the move, as its mobile app is designed specifically for your operating system.

This covers both Android and iOS devices. Once you are set up, you can then deposit funds with a UK debit card. Take note, however, that this does attract a fee of 3.5%. In terms of what cryptocurrencies you can obtain, Luno supports Bitcoin, Ripple, Litecoin, and Ethereum.

When it comes to safety, Luno is regulated by the FCA. It also keeps 95% of client funds in cold storage – so external hacks are highly unlikely. We also like the interest accounts that Luno offers. Put simply, by leaving your Bitcoin at Luno, you could earn up to 4% interest annually. This is a no brainer if you are looking to hold onto your Bitcoin for several years.

Your money is at risk.

What is Cryptocurrency?

Whether you’re investing in stocks, ETFs, bonds, or any asset class for that matter – it is important that you understand the financial instrument you are interested in buying. After all, you will be risking your hard-earned money with the view of making a profit.

So, cryptocurrencies are also referred to as digital currencies, as they allow you to send, receive, and transfer funds. Everything is digital, meaning that cryptocurrencies do not exist in their physical form. Cryptocurrencies possess a range of characteristics that set them apart from traditional currencies like the British pound or Euro.

This includes:

- Cryptocurrencies are not owned or controlled by any government or central bank. Instead, they are decentralized.

- Most cryptocurrencies are backed by blockchain technology. This means that all transactions are secure and anonymous

- When cryptocurrency transfers are completed, the transaction is publicly viewable on the blockchain. This makes the network 100% transparent and free from abuse.

- Cryptocurrencies operate in a borderless nature. This means that transferring coins to the other side of the world will cost the same and a domestic transaction.

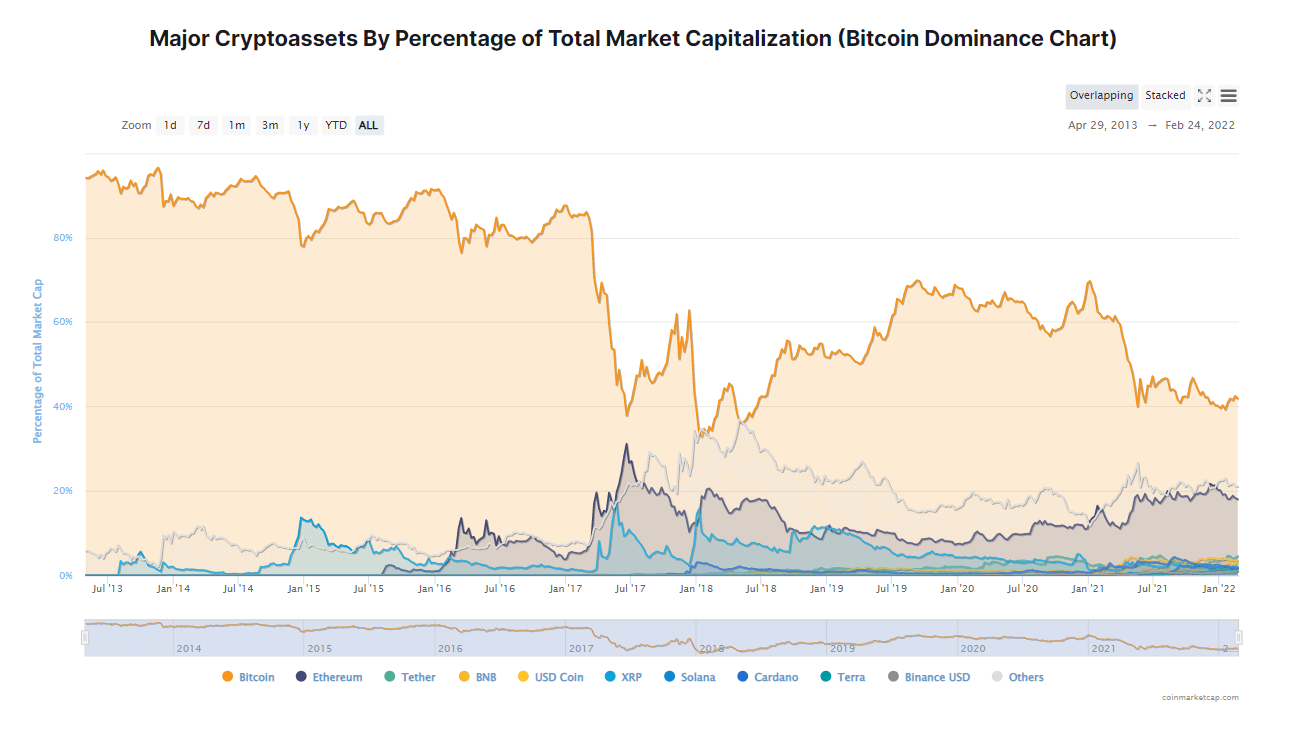

Now, it is important to note that you have likely heard of Bitcoin (BTC). This is because Bitcoin was the first and still is the de-facto cryptocurrency of choice. It holds the largest market capitalization and has the greatest mass awareness. However, Bitcoin isn’t the only cryptocurrency out there as you can now gain exposure to the hottest meme coins (for example you could buy Baby Doge Coin) and invest in Dogecoin with low fees.

On the contrary, there are now well over 15000 different cryptocurrencies in existence – totaling a market valuation of over $1 trillion. Of this figure, Bitcoin currently represents around 40%, Ethereum around 18%.

In terms of what you can do with a cryptocurrency – each project has a specific purpose. For example, while Bitcoin was created as a payments network, Ripple provides the technology for cross-border banking transactions. With that said, the vast majority of people buy cryptocurrency in the United Kingdom for speculative reasons. Alternatively, you could invest in the best meme coins for exposure to cryptos that are highly sensitive to social hype and impulsive investing.

That is to say, many believe that it is inevitable that cryptocurrencies will play a major role in the future of money – so it is hoped that the value of their investment will increase over time. This works much the same as any other asset class – meaning that the fundamentals of investing in cryptocurrency are relatively straightforward.

Cryptocurrency Prices and Making Money

Bearing in mind that people in the UK buy a cryptocurrency for financial gain, for example, those crypto holders who want to buy Solana, it makes sense that there is a huge marketplace that can facilitate this. Put simply, cryptocurrencies are listed on public exchanges. This allows people in the UK to buy, sell, and trade their preferred cryptocurrency.

Once again, this works the same as traditional shares – which are listed on stock exchanges. Similarly, the value of your chosen cryptocurrency will go up and down on a second-by-second basis. As the industry is borderless, the markets are open 24 hours per day, 7 days per week.

In terms of how cryptocurrency prices work, this is based on conventional demand and supply. That is to say, when there are more buyers than sellers, the price of the cryptocurrency will naturally rise. This is what allows you to make a profit, as you will hope to sell your cryptocurrency at a higher price than you paid.

For example:

- Let’s suppose that you buy £1,000 worth of Bitcoin today

- At the time of the purchase, Bitcoin is worth $19,000

- You hold on to your Bitcoin for five years

- When you eventually get around to cashing out, Bitcoin is worth $55,000

- This represents a price increase of 189%

- As such your original £1,000 Bitcoin purchase grew to £2,890

Past performance is not an indication of future results

As you can see from the above example, we quantified the value of Bitcoin in US dollars. This is because the US dollar is the de-facto fiat currency used to value cryptocurrencies in the marketplace.

As a UK investor, this shouldn’t concern you. After all, the best cryptocurrency trading sites in the UK allow you to deposit in British pounds with a debit card, bank account, or e-wallet. Then, the broker in question will simply perform a currency conversion into US dollars.

Everything you Need to Know Before Buying Cryptocurrency in the UK

Cryptocurrency has become a worldwide phenomenon, with both retail and corporate investors flocking to get involved. However, there are a few factors to consider before buying or selling any virtual currency.

Unpredictability and Liquidity

Because digital currencies are so risky, they are considered high-risk assets. Indeed, some have highlighted that they are unsuitable as a currency for this reason. For example, in the same 24-hour period, the leading crypto asset Bitcoin experiences huge market fluctuations.

If you want to purchase cryptos in the United Kingdom, you need be prepared to deal with the acute volatility.

Regulated vs Unregulated

Even though some nations, such as China, have openly outlawed cryptos, others are still developing frameworks to solve in the industry’s flaws. As a result, many crypto-related businesses are not regulated, therefore you should exercise caution when entering the crypto market via an unregulated exchange or DEX.

Threats from Hacking and Identity-Theft

Cryptos are more vulnerable to hacking attempts than traditional financial products because they are primarily available, minted and exchanged via the internet. According to statistics from Chainalysis, cryptocurrency-related crimes have jumped by almost 50% since 2020.

Why Buy Cryptocurrency in the UK?

Cryptocurrencies do not come without fault. For example, they are speculative, high-risk, and in most cases – do not offer anything in the way of regular income. However, there are many reasons why people in the UK buy cryptocurrencies – and are now doing so in their droves.

This includes the following:

Cryptocurrency Prices Continue to Outperform Other Assets

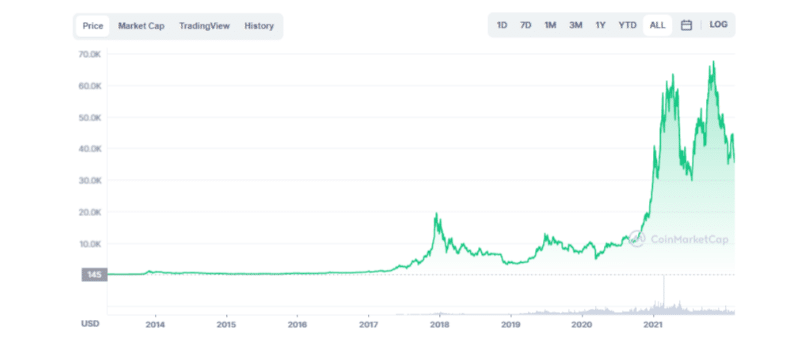

Let’s start with the obvious – the growth of cryptocurrency prices over the past few years. Put simply, investors have seen some uncanny financial gains on popular coins like Bitcoin, Ethereum, and Ripple.

- For example, while Bitcoin was priced at less than 1 cent a mere decade ago, it has since hit all-time highs of $20,000. This represents financial returns in the millions of percent.

- Then you have the likes of Ethereum, which began life at around $2.70 per coin. Fast forward to late 2017 and the same coin would have cost you over $1,400. This represents a growth of over 50,000%.

- In more recent times, cryptocurrency prices are once again on an upward trajectory. For example, while Ripple entered 2020 at $0.19 – it has since reached $0.70. That’s gains of over 260% in less than 12 months of trading.

Ultimately, there is no knowing just how big cryptocurrencies can one day get. This is especially the case with leading projects like Bitcoin and Ethereum. When you consider their global appeal and ability or solve age-old financial problems, the skies really are the limit.

Traditional Investments are Struggling

So how do cryptocurrencies compare to traditional investment classes? Well, it is no secret that leaving your money in a UK bank account will barely get you 1% in interest per year. The FTSE 100 is in dire straights too. For example, the index is worth less today than in 2015.

In fact, the vast majority of stocks listed on the London Stock Exchange have failed to recover their COV-19 losses – some of which are in excess of 50%. Even dividend stocks are having a horrid time this year – with scores of FTSE 100 companies either cutting or outright suspending their payments.

Taking all of this into account, people in the UK are looking at cryptocurrencies as an alternative to traditional investment classes.

New and Innovative Technology

As we briefly noted earlier, each and every cryptocurrency has a specific objective or purpose. In the case of Bitcoin, its anonymous founder wanted to challenge the status quo of the global monetary system. Bitcoin does this by taking control away from traditional banks and financial instruments and back into your own hands.

After all, Bitcoin – like most cryptocurrencies, are decentralized. As such, there is no single owner of the underlying network. Cryptocurrencies are also highly conducive for cross-border transactions.

This is especially useful in the case of remitting money to the third-world, where more than 2 billion people still do not have access to banking facilities. By using cryptocurrency to transfer value, the fees are super low and the transfer often takes just a few minutes.

The key point here is that when you buy cryptocurrency in the UK, you are essentially investing in a new, innovative, and highly disruptive technology. As we know from other revolutionary discoveries like online shopping or smartphones, this can often lead to serious financial gain for early backers. Recently, automated trading bitcoin robots and crypto signals telegram groups have gained momentum and interest in the crypto market, automated bitcoin trading robots such as Profit Revolution, Bitcoin Revolution, Brexit Millionaire, CryptoEngine, Immediate edge, QuantumAI, and BitIQ use algorithmic trading to place orders on crypto-based on predictions of returns.

Barriers to Entry are Low

Retail investors in the UK – meaning that you do not come from a professional or institutional trading background, are somewhat limited in the assets that can be accessed. Sure, the likes of stocks and ETFs are easy to buy – but bonds, government securities, emerging market equities are a lot more difficult to come by.

With that said, you can easily buy cryptocurrency in the UK – with the process often taking a matter of minutes. As we mentioned earlier, all you need to do at Coinbase is make a deposit with your debit card and decide how much you want to invest.

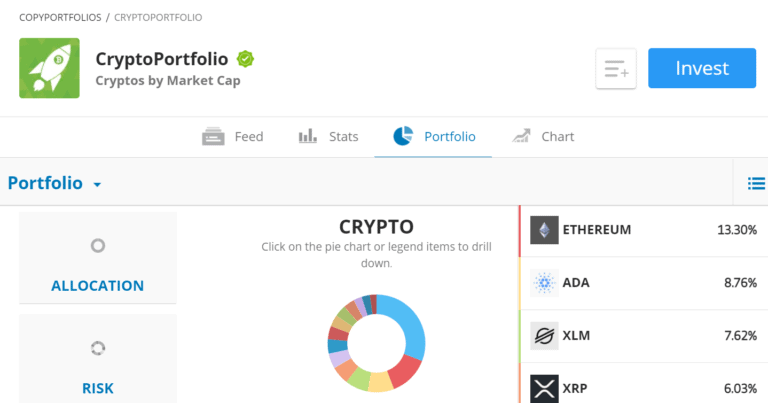

Diversification is Possible

While most cryptocurrency investors will stick with Bitcoin, it is also worth considering a more diversified approach to the sector. After all, there are almost 8,000 cryptocurrencies in existence, so you can easily spread out the risk by buying multiple coins.

Past performance is not an indication of future results

With that said, you’ll likely only want to focus on major cryptocurrencies – as the vast majority of tiny projects with a minute market valuation. For example, you might allocate 60% of your UK cryptocurrency portfolio to Bitcoin, 20% to Ethereum, and 10% each on both Ripple and EOS.

Cryptocurrencies are a Liquid Asset

Cryptocurrencies are an asset class with high liquidity, meaning that you can easily convert your coins back into cold-hard cash. This is because cryptocurrencies are traded on public exchanges 24 hours per day.

As such, all you need to do is exit your position by converting your cryptocurrency back to pound sterling, and then withdraw the money back to your debit card or bank account.

This is crucial, as it means your money is never locked up in times of financial need.

What Cryptocurrencies Can You Buy in the UK?

Although there are thousands of different cryptocurrencies can that be purchased, most of these are ERC-20 tokens. For those unaware, this means that the cryptocurrency was built on top of the Ethereum blockchain. In other words, the underlying technology is not proprietary to the digital currency in question, however, you can also invest in blockchain technology too.

With this in mind, very few UK cryptocurrency brokers will offer ERC-20 tokens – as demand is so low. Instead, you would need to use a crypto exchange to obtain one of these tokens – which can be a cumbersome process.

This is because conventional cryptocurrency exchanges are typically unlicensed and thus – do not have the legal remit to support fiat deposits (debit card, bank transfer, etc.). Instead, you would need to buy a popular cryptocurrency like Bitcoin, transfer it into the exchange, and then convert it to your desired ERC-20 token.

As such, you’re best to focus on cryptocurrencies that are listed in the top 20 in terms of market capitalization. This is because it is likely that your chosen UK broker offers some, if not most of these popular cryptocurrencies – which are listed below.

- Bitcoin

- Ethereum

- Ripple (XRP)

- Tether

- Litecoin

- Augur

- Bitcoin Cash

- Chainlink

- Dogelon Mars Coin

- Polkadot

- Binance Coin

- Stellar

- EOS

- Tron

- Monero

- Tezos

- Cardano

- NEO

- Dash

- Uniswap

- IOTA

- ZCash

- 1inch

- Ethereum Classic

- Cosmos

- The Graph

- Curve

- Samoyed Coin

- Metaverse Crypto

How to Invest in Cryptocurrency UK

Cryptocurrency isn’t just for short-term trading. You can also invest in cryptocurrencies and hold them for years to come.

The process for buying cryptocurrencies for investment is the same as for trading. However, instead of selling your cryptocurrency a short while later, you simply hold onto it. Some exchanges even offer crypto staking and interest when you deposit your cryptocurrency holdings. You could read more on this topic via our Celsius review.

Additionally, if you’re interested in crypto lending then you could read our Nexo review for everything you need to know about cryptocurrency lending in 2026. In order to invest in cryptocurrency UK, you’ll need a crypto wallet. This is a digital wallet where you can store cryptocurrencies just like you would store fiat currency in a bank account. Your cryptocurrencies can remain in your wallet safely until you’re ready to sell.

How To Buy and Sell Cryptocurrency UK Safely

If you’re wondering how to buy cryptocurrencies UK safely, there are several precautions that you can take.This includes:

Only Use a Regulated Cryptocurrency Broker

By using an online broker that does not have the legal remit to sell cryptocurrencies – you are asking for big trouble. After all, you will be required to deposit your hard-earned money into the platform. As such, we would strongly suggest that you only buy cryptocurrency in the UK from a regulated provider.

Dollar-Cost Average to Avoid Volatility

As we briefly noted earlier, not only are cryptocurrency assets speculative, but they are highly volatile. This means that the value of your cryptocurrency investment can go up and down in a parabolic manner. This is likely to put newbie investors off, as the emotional side-effects of high volatility can be daunting.

In order to counter this, it might be worth considering a dollar-cost average strategy when you buy cryptocurrency in the UK. Put simply, this means that instead of injecting a large lump sum into cryptocurrency, you invest small but regular amounts.

- For example, you might invest $25 per week when using Coinbase.

- In doing so, every time you make a purchase you will get a different cost price.

- Over the course of time, this cost price will average out nicely, subsequently ensuring that volatility has no impact in the long run.

After all, even if your cryptocurrency goes down in value, dollar-cost averaging allows you to take advantage of this by making a purchase at a lower price!

Consider a Hardware Wallet

Although a lot of people that buy cryptocurrencies in the UK will choose to leave their coins at their chosen broker, some of you might want to withdraw them to a private wallet. In doing so, you will retain full control over your cryptocurrency, and thus – you are not relying on a third-party to store them safely.

However, both desktop and mobile cryptocurrency wallets are vulnerable to remote hacking attempts. If successful, you could lose your entire cryptocurrency portfolio in one fell swoop. If you’re wondering how to buy cryptocurrency safely and then securely store it yourself, we would suggest considering a hardware wallet.

This is as safe and secure as it gets in the cryptocurrency storage arena, as your hardware wallet is never connected to the internet. As such, this makes a remote hacking attempt virtually impossible. Industry leaders in this space include Trezor and Ledger Nano.

Cryptocurrency Walletsf or Investing and Holding

There are also other forms of crypto storage from hardware, software and mobile crypto wallets. You can see our full list of cryptocurrency wallet reviews below:

What Payment Methods Can You Use to Buy Cryptocurrency UK?

A time not so long ago, UK cryptocurrency exchanges could not accept fiat currency deposits. This made it really hard to buy cryptocurrency in the UK from the comfort of your home. Then, a number of exchanges popped up that allowed you to deposit funds via bank transfer. At the now-defunct exchange MTGox, the bank deposit process often took up to one month to process.

Fortunately, the cryptocurrency scene has since opened up to regulated brokerage sites – meaning that they have the legal remit to accept a full suite of popular payment methods. For example, the likes of Coinbase allow you to buy cryptocurrency in the UK with many payment options.

Best of all, each of the above payment methods – with the exception of a bank transfer, are instantly processed. This means that as soon as you confirm the deposit, you can buy crypto in the UK straight away.

For more relevant reading, be sure to check out the following guides on how to buy crypto with various payment methods:

Buying cryptocurrency with a crypto wallet

To buy some cryptocurrencies in the UK, you will need to use a crypto wallet. This is typically the case for buying cryptocurrencies through decentralized exchanges.

To buy cryptocurrencies with a crypto wallet, you will first need to fund your wallet with popular tokens such as ETH, USDT, BNB or BTC. These tokens can be used to buy other cryptos that are built on the respective blockchain networks. For example, erc20 tokens can be purchased with ETH.

The easiest way to use a crypto wallet is to use a wallet that is connected to a crypto exchange. Coinbase Wallet is one example. You can purchase tokens from the Coinbase platform and store them in your wallet. Then, connect your Coinbase wallet to a decentralized exchange to swap tokens for new cryptos.

Buying cryptocurrency with a crypto wallet is relatively advanced. You must take safety precautions such as always using a secure wifi network and never sharing your private keys. It is also a good idea to always double-check the wallet address you use before confirming any transactions.

Risks When You Buy and Sell Cryptocurrency UK

Whether you’re looking to invest in cryptos or trade tokenised cryptocurrencies, it is only right that we also discuss the risks.

This includes:

You can Lose Money

Sure, all investments can potentially result in you losing money. However, the risk of loss is substantially higher in the world of cryptocurrencies. This is especially the case with smaller coins – such as the previously discussed ERC-20 tokens.

For example, there are thousands of cryptocurrencies that during the boom of 2017 saw triple and even quadruple-digit percentage gains.

However, the vast majority of these collectively burned out – subsequently resulting in losses as high as 95%. This means that by investing £1,000 into one of these virtually-dead cryptocurrencies, you would now be left with just £50.

Take note, such as nose-dive is not relevant to just ERC-20 tokens. On the contrary, major cryptocurrencies – including Bitcoin, have encountered huge losses in recent years. For example, had you bought 1 Bitcoin in late 2017, you would have paid a price of just under $20,000. Fast forward just 12 months and the same 1 Bitcoin was worth $3,000.

This means net losses of 85%. As we now know, Bitcoin has since recovered. At the time of writing, the digital currency is inching very close to its previous all-time high of $20,000. All in all, this also highlights that you need to be patient when you buy cryptocurrencies in the UK – much like you do with stocks and shares.

Cryptocurrency Regulation is a Grey Area

Not only is cryptocurrency regulation a grey area in the UK, but globally. This is because in most jurisdictions there is no cryptocurrency-specific legislation. Sure, you have the likes of Malta, Japan, and Gibraltar that have since enacted laws and regulations, but most countries – including the UK, haven’t.

So what does this mean for you and your UK cryptocurrency investment?

- Well, the FCA has taken somewhat of a lead in providing cryptocurrency guidance. This does make sense when you consider the multi-billion pound trading scene that digital currencies operate in.

- However, this is largely linked to anti-money laundering regulations – such as brokers being required to verify all UK cryptocurrency buyers.

- The key problem is that the UK – or any nation for that matter, cannot truly regulate Bitcoin in the truest form.

- After all, it is a decentralized technology meaning that no single person or entity controls the network.

On the other hand, there is always the risk that the UK government could one day ban cryptocurrency transactions outright.

Although technically it could not prevent you from sending coins from one wallet to another, it could easily place an outright ban on brokers offering cryptocurrency services. If it did, this could have a major impact on your ability to get a return on your cryptocurrency investment.

Risk of Hacking Attempt

Although we briefly discussed third-party hacks earlier, it is important to clarify that should you encounter one yourself – your entire cryptocurrency balance could be stolen. This is because whoever has access to the wallet itself has the ability to transfer coins out. As soon as this happens, your coins will be gone forever. Some wallets like the Neo wallet have multi layer security.

This is in stark contrast to having your bank account hacked. In the vast majority of cases, UK banks are legally required to reimburse you for the loss – and quickly. However, no such third-party exists when you decide to store cryptocurrencies in a private wallet, so do bear this in mind.

Selling Cryptocurrency and Making a Profit

Once you have made a cryptocurrency purchase in the UK, you are then at the mercy of the markets. That is to say, in order to make a profit, you need the value of the cryptocurrency to increase. The only way that this can happen is if demand outpaces supply and thus – there are more people buying your cryptocurrency than selling it.

Here’s a basic example of what a profitable cryptocurrency investment might look like:

- You buy £2,000 worth of Ethereum coins at a market price of $200

- You leave the coins at Coinbase for 3 years

- The value of Ethereum is now at $2,000

- This means that the cryptocurrency has increased by 900%

- As such, your £2,000 Ethereum purchase is now worth £20,000

Now, as you opted to buy the cryptocurrency at Coinbase, realizing your profit is easy. All you need to do is click on the ‘Sell’ button within your portfolio, and that’s it – the sale will be executed instantly. Then, the £20,000 proceeds would be added to your Coinbase cash balance – and available for withdrawal back to your debit card, e-wallet, or bank account.

On the other hand, if you withdrew the coins from your chosen cryptocurrency exchange into a private wallet, you would need to add an extra step. This is because you would first need to transfer the coins from your wallet back into the exchange, convert them to USD, and then make a withdrawal. This would incur additional fees, so do bear this in mind.

Latest Crypto News

Finally, given the cryptocurrency market’s fast-moving nature, numerous news events can affect prices every week. With that in mind, let’s take a look at some of the most talked-about events for the week beginning September 25th, 2023:

- It was an uneventful week in the crypto market, with most coins and tokens showcasing low volatility. All told, Bitcoin rose 0.32%, while Ethereum dropped 1.97%

- Huobi Global’s HTX exchange suffered a $7.9 million hack on September 24th. However, the exchange claims to know the hacker’s identity and has offered a bonus if the funds are returned.

- Finally, on-chain data has revealed that a wallet linked to Ethereum co-founder Vitalik Buterin sent 400 ETH (around $632,000) to Coinbase on September 25th. In total, Buterin has transferred roughly $3.9 million worth of ETH in September.

Conclusion – How to Buy Crypto UK

This how-to buy cryptocurrencies in UK guide has covered all bases. As you now know, there are many brokers and exchanges that now allow you to buy cryptocurrency with a debit card, bank transfer, and even an e-wallet.

You do, however, need to spend some time finding a platform that meets your needs. If you’re looking for the best FCA-regulated broker to buy cryptocurrencies from today, Coinbase gives you access to many digital coins – all of which can be purchased with low fees and tight spreads.

You can get started at Coinbase by clicking on the link below!

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.