How to Buy Centrica Shares Online in the UK

Centrica is a UK-based company that specializes in the supply of gas and electricity. It has several household names under its belt – including British Gas, Direct Energy, and Spirit Energy.

The firm is listed on the London Stock Exchange, so you can buy its shares with ease. All you need to do is find a reputable online broker, deposit some funds, and choose how many stocks you wish to purchase.

In this guide, we show you how to buy Centrica shares online in the UK. We guide you through the end-to-end investment process, explore the best UK brokers to consider, and take a brief look at where Centrica shares are headed in the near future.

-

-

Step 1: Find a UK Stock Broker to Buy Centrica Shares

As noted above, Centrica shares are listed on the London Stock Exchange, so there are lots of UK stock brokers to choose from.

You do, however, need to ensure that your chosen broker is licensed by the FCA, and that it offers low fees and commissions. It’s also worth checking that your preferred payment method is supported – such as a debit/credit card or bank account.

With this in mind, below we discuss the best FCA brokers to buy Centrica shares from in 2020.

Step 2: Research Centrica Shares

So now that we have covered the best UK brokers to trade or buy Centrica shares from, you now need to perform some research on the stock. Don’t forget, there is never any guarantee that you will make money from an investment, whether you’re investing in Centrica or other companies like BP, Shell or National Grid. This is especially the case during the uncertainties of the coronavirus pandemic.

To help point you in the right direction, below we discuss the Centrica share price history, its current dividend policy, and where the stocks are likely to go in the near future.

Centrica Share Price History

Centrica PLC is a UK-based gas and electricity service company. It is the parent group behind a number of well-known suppliers, such as British Gas, Direct Energy, and Spirit Energy. On top of its core UK audience, Centrica also supplies consumers in Ireland and North America. In terms of its share price history, Centrica first went public in the mid-1990s. Back then, you would have paid in the region of 88p per share.

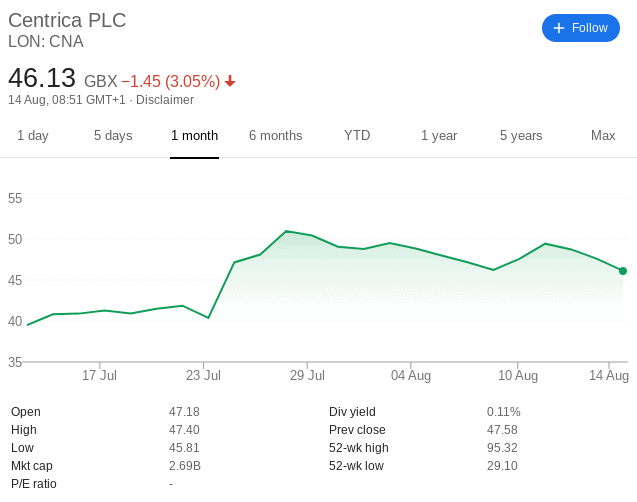

The stocks then went on an excellent run right up until 2007 – where they peaked at just under 390p. In response to the financial crisis of 2008 that was to follow, the shares reversed in direction – hitting lows of 220p. However, Centrica shares quickly recovered, reaching 390p in 2013. Since then, it’s been a woeful time for stockholders. In fact, as of August 2020, the shares are worth just 47p. This means that Centrica now has a valuation that is close to 50% lower than its 1995 price.

In more recent times, Centria shares were showing signs of positivity – going from 65p to 93p between August 2019 and February 2020. This represented growth of 43% in the space of just 6 months. But, as per the market sell-off that was spurned by the pandemic, the shares dropped to all-time lows of 29p in April. This is somewhat concerning, not least because Centrica offers products and services that should always be in demand – no matter how the wider economy is performing.

Centrica Shares Dividend Information

Although Centrica had a stable dividend policy for a number of years, the firm has since suspended this. The announcement was made in April in response to the wider concerns of the COV-19 pandemic.

Initially, the firm had planned to pay a final dividend of 3.5p per share, with the payment ear-marked for June. Ultimately, there is no knowing when Centrica will resume its dividend policy, so, for the time being, you will need to focus exclusively on capital gains.

Should I Buy Centrica Shares?

Centrica shares have struggled in recent years. In fact, since the shares peaked in 2013 at 390p – Centrica has been on a downward spiral. This doesn’t mean that you shouldn’t invest per-say. On the contrary, there is every chance that at current prices – you can buy the shares at a major discount.

Before taking the plunge, we would suggest reading through the following considerations.

Timing the Market

On the one hand, it is true that Centrica shares have been hit hard by the stock market sell-off as a result of the uncertainties of the pandemic. It is also true that the shares were already on a prolonged downward spiral before the pandemic came to fruition. However, the shares have recovered nicely from their 2020 lows.

For example, had you purchased Centrica shares in April at 29p, you would now be looking at gains of 62%. With that being said, the resurgence might not yet be over. After all, Centrica stocks were priced in and around the 70p to 90p-mark before the 2020 downfall begun. Even at the lower end, this would leave a potential upside of 48% if it is able to return to pre-pandemic levels.

Cost Cutting

Management at Centrica have announced their plans to cut operating costs by £2 billion. This is a somewhat ambitious target at a time when margins are already wafer-thin.

With that said, Centrica has already got the ball rolling. For example, it announced last month that it plans to cut 5,000 jobs, as well as re-visit its relationship with contractors. Additionally, Centrica has cancelled its dividend policy until further notice.

No Longer a FTSE 100 Share

Fully in-line with the firm’s recent downfall, Centrica has since fallen outside of the FTSE 100 index of companies. This can be highly detrimental, as large ETFs and other financial institutions will often place vast sums of capital into FTSE 100 firms as a way of tracking the primary UK stock index. With Centrica subsequently losing its FTSE status, this means that there will be less interest in the shares.

$3.6 Billion Sale of NRG Energy

Leading on from the above section on Centrica placing much of its focus on cost-cutting, the firm has since announced that it plans to sell its NRG Energy subsidiary. The proposed sale is expected to raise $3.6 billion. This will provide Centrica with some much-needed capital. When the announcement was made back in July, Centrica shares finished the trading day 22% higher.

The Financials

Centrica’s most recent earnings report did not sit well with stockholders. Its half-year results yielded a 9% drop in revenues, and a 14% decline in operating profits. This resulted in an operating loss of £135 million.

Centrica Shares Buy or Sell?

If you’ve read our guide up to this point, then you will know that Centrica shares are currently experiencing tough times on the London Stock Exchange. In fact, not only have the shares been on a downward spiral for near-on 7 years, but the stocks have since lost their place as a constituent of the FTSE 100.

However, not everyone is feeling bearish on Centrica – which is evident when looking at market sentiment at leading UK brokers Plus500 and IG. For example, while the former is seeing 99% of traders long on the stock, IG is at 97%. This could illustrate that at current market prices, investors believe that Centrica is undervalued.

The Verdict

Make no mistake about it – if you were in possession of Centrica shares in and around 2013 and you failed to offload them, you would now be looking at substantial losses. With that said, timing the market is everything when trading stocks, so you now stand the chance of making an investment at a huge discount.

FAQs

How much were Centrica shares when the firm first went public?

Centrica shares hit the London Stock Exchange in the mid-1990s. Back then, you would have paid around 88p per share.

Is Centrica on the FTSE 100?

Until recently, Centrica was a long-standing constituent of the FTSE 100 index. However, due to the firm's market downfall, it has since been removed.

Does Centrica pay dividends?

Centrica announced in April that it would be suspending its dividend policy until further notice. It has planned to distribute a dividend in June, albeit, this will no longer be the case. There i no knowing when Centrica will resume its dividend policy.

Does Centrica own British Gas?

Yes, alongside a number of other gas and electricity subsidiaries, Centrica owns British Gas.

Where can I buy Centrica shares?

As Centrica is listed on the London Stock Exchange, you can buy its shares from any online broker that gives you access to UK stocks.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

As noted above, Centrica shares are listed on the London Stock Exchange, so there are lots of UK

As noted above, Centrica shares are listed on the London Stock Exchange, so there are lots of UK