Chinese EV (electric vehicle) companies have released their October delivery reports. Here are the key takeaways.

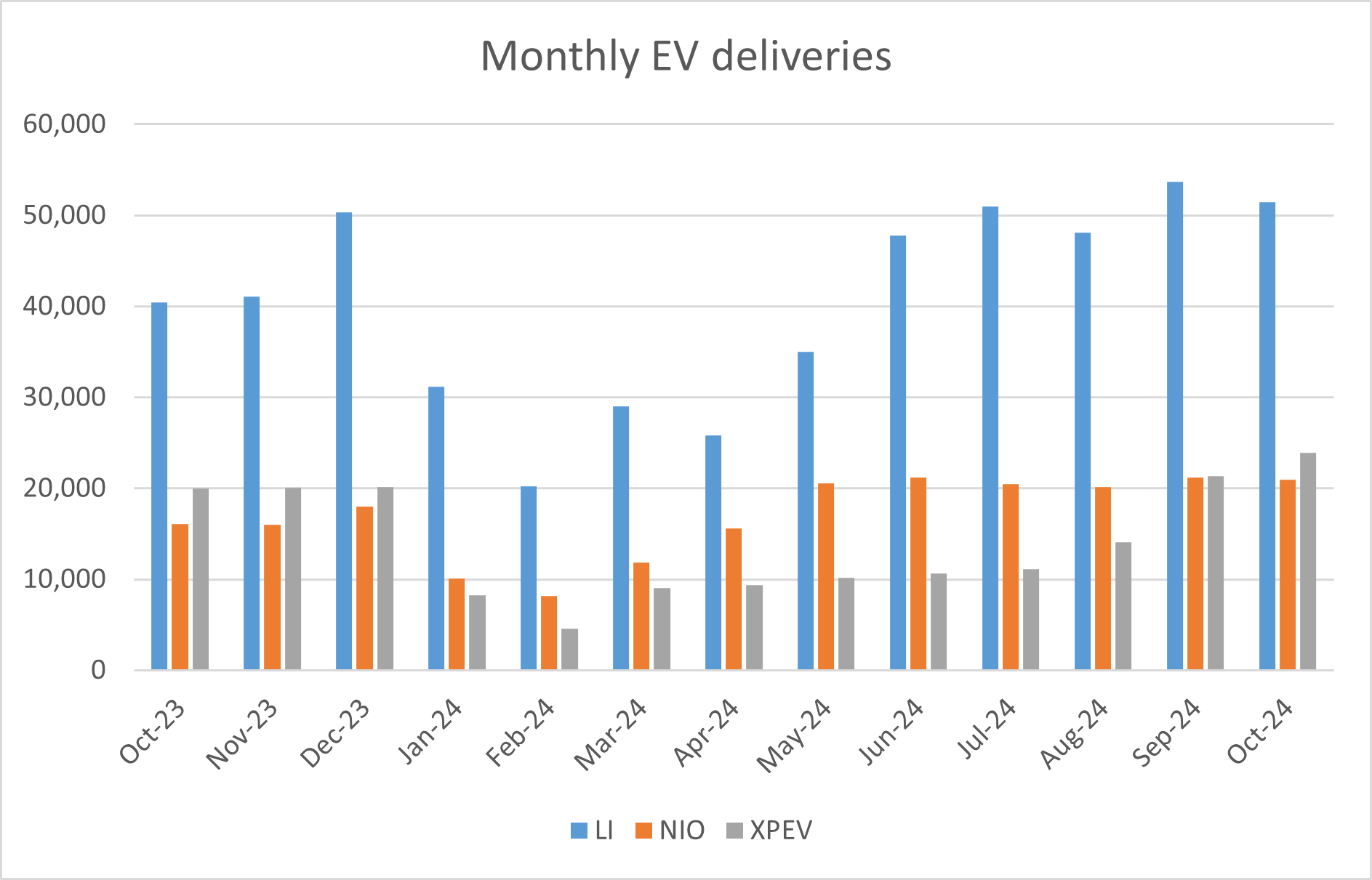

NIO delivered 20,976 vehicles in September, which was 30.5% higher YoY. Its deliveries have been over 20,000 for six consecutive months now, and its cumulative deliveries reached 619,851 at the end of October.

Meanwhile, while NIO’s monthly deliveries were below the highs that it hit earlier this year, several Chinese EV companies reported record deliveries with Zeekr’s deliveries almost doubling in October.

Zeekr’s EV deliveries almost doubled in October

Zeekr delivered 25,049 cars in October which was 92% higher YoY and ahead of both NIO and Xpeng Motors. Its cumulative deliveries reached 364,555 at the end of October and while the number is below NIO and Xpeng Motors, Zeekr is fast catching up thanks to the 82% YoY rise in its EV deliveries in the first ten months of the year.

The company began delivering its new five-seat SUV Zeekr Mix late last month. “As the first model built on the Company’s SEA-M architecture, the ZEEKR MIX boasts up to 93% in-cabin space utilization, maximizing interior space through innovative packaging and a capsule-style exterior,” said Zeekr in its release.

Xpeng Motors also reported record EV deliveries

Xpeng Motors’ EV deliveries rose 20% YoY to 23,917 in October making it a fresh record high for the company. It said that the deliveries of its newly launched MONA M03 were more than 10,000 in the month.

The company’s cumulative deliveries reached 522,809 at the end of October and it surpassed the milestone of delivering half a million cars. Last month, Xpeng Motors also officially entered the UAE market as the company continues to expand in MENA countries.

Xpeng Motors also has autonomous driving capabilities which are among the most advanced in China. In its release, Xpeng Motors said that it “has become the only Chinese automaker to deliver industry-leading urban ADAS that does not rely on HD maps or LiDARs, providing the most competitive cost in China and accelerating the mass adoption of autonomous driving.”

JPMorgan is bullish on Xpeng Motors shares

JPMorgan analyst Nick Lai who has an “overweight” rating and $14 target price on Xpeng Motors, added the share to its positive catalyst watch list and sees the shares rising in the short term.

“In addition to our positive sector stance into the year-end (i.e. 35% QoQ PV growth in 4Q24 vs. seasonality ~20%), XPeng’s upcoming new product strategy, advancing in-house technology and solid 3Q earnings as well as strength in 4Q vehicle delivery should altogether support its share price,” said JPMorgan in its note.

JPMorgan expects Xpeng Motors to deliver 300,000 vehicles in 2025 while Citi expects the Chinese EV company to deliver 400,000 vehicles in 2026. Xpeng has started delivering the budget model Mona which is expected to spur its deliveries.

Last year Volkswagen invested in Xpeng Motors and as part of the agreement, XPEV will build two EVs on its platform. The deal was a milestone for the Chinese EV ecosystem as it reflected the confidence of Volkswagen in a startup EV company. It was also a testimony to Xpeng Motor’s self-driving capabilities which the company intends to further build upon. The two companies are also said to be exploring international partnerships.

JPMorgan expects Xpeng Motors to launch extended-range electric vehicles (EREVs) which are quite popular as they come with a generator that can extend the battery range. The brokerage also expects XPEV to launch a robot in the future. “We believe XPeng’s future models will all adopt [a] visual-based solution with [a] competitive price point for buyers (e.g. Max version of Mona 3 sedan at ~Rmb150k from 1Q25),” said Lai in his report.

Lai expects Xpeng Motors to report positive free cash flows in 2025 and a net profit in 2026.

BYD delivered half a million cars in October

Meanwhile, BYD which is the world’s largest seller of NEVs (new energy vehicles) hit another milestone in October as the company delivered 502,657 vehicles. It was the first time ever that the company’s monthly deliveries surpassed half a million cars. For context, Tesla’s quarterly deliveries have never surpassed half a million vehicles.

The sales mix shows BYD delivered 310,912 PHEV (plug-in hybrid) cars in October while 189,614 were battery-electric vehicles.

Li Auto’s cumulative deliveries top 1 million

Li Auto delivered 51,443 vehicles in October and while the number was 27.3% higher YoY it was slightly below the record high it set in September.

“Driven by robust sales across its model lineup, the Company remained the sales champion of Chinese automotive brands in the RMB200,000 and above NEV market for seven straight months,” said Li Auto in its release.

The company’s cumulative deliveries reached 1,026,619 and it reached the milestone of hitting 1 million deliveries. It expects to deliver between 160,000 to 170,000 vehicles in the fourth quarter whose midpoint implies a YoY rise of 25%.

Li Auto points to “intense” competition in Chinese EV industry

During their Q3 earnings call last month, Li Auto said that it managed to increase its market share in China despite “intense competition.

Notably, there has been a brutal price war in the Chinese EV industry since Q4 of 2022 when Tesla started to cut car prices to spur sales. Tesla’s price cuts were followed by similar announcements from other carmakers including Xpeng Motors, Ford, Toyota, and Nissan. Last year, even NIO lowered car prices. Previously the company had categorically said that it wouldn’t join the price war.

As new EV models hit the road, the price war might only escalate in the coming months as companies try to push sales through aggressive pricing. These price cuts have meanwhile taken a toll on the margins of all companies – including Tesla, whose margins were once the envy of the automotive industry.

Question & Answers (0)