While the EV industry is going through turmoil, the IPO of Zeekr which is backed by Geely sailed through easily last week with the company pricing the issue at the top end of the guidance and issuing more shares than initially planned.

The Chinese EV company sold 21 million shares in the IPO and raised $441 million from the offering. Geely, which also owns the UK’s Lotus and Sweden’s Volvo would continue to hold over a 50% controlling stake in Zeekr post the IPO.

In its SEC filings, Zeekr said, “Through developing and offering next-generation premium BEVs and technology-driven solutions, we aspire to lead the electrification, intelligentization and innovation of the automobile industry.”

Zeekr IPO sails through

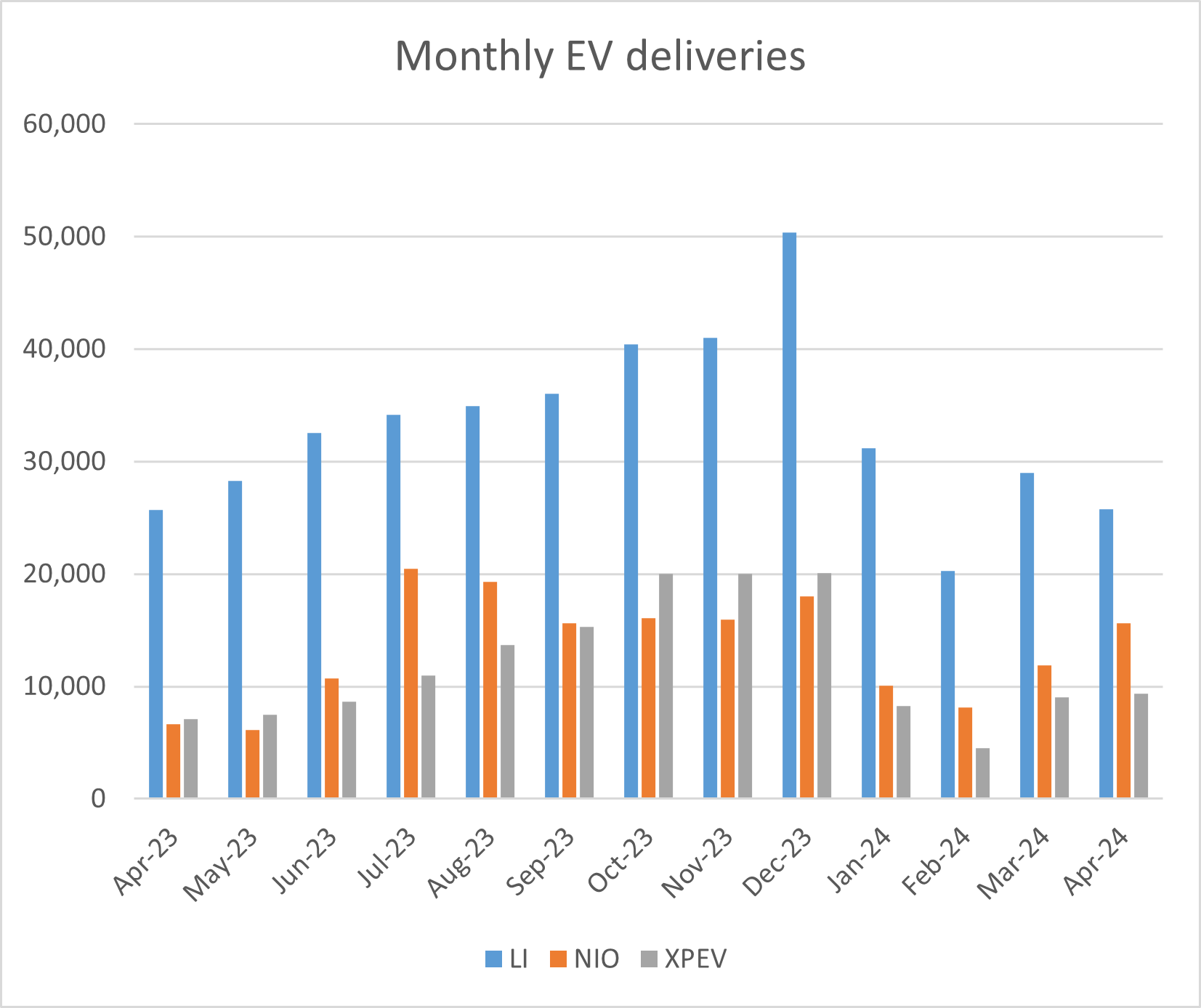

Zeekr delivered 49,148 vehicles in the first four months of this year as compared to NIO’s 45,673 deliveries. Its YTD deliveries also surpassed that of Xpeng Motors which delivered a mere 31,214 vehicles over the period with deliveries being below 10,000 units in all four months.

Zeekr’s cumulative deliveries of 245,781 however trail that of Xpeng and NIO, Zeekr has positioned itself as a luxury brand like NIO while Xpeng has been launching mass-market models.

Zeekr plans to expand internationally

Zeekr plans to expand its Latin America and Europe later this year and is outselling Tesla in parts of China. In an interview with CNBC last month, Zeekr CEO Andy An said “We’ve already outsold Tesla in some areas. Our sales gap with Tesla keeps on narrowing.”

Meanwhile, Zeekr went public at a valuation of $5.2 billion which is well short of the $13 billion that it was valued at a funding round early in 2023. The EV industry dynamics have changed over the last couple of years and markets are no longer giving companies the kind of mouth-watering valuations that we saw in 2021.

That year, Tesla’s market cap surpassed $1.2 trillion while Rivian’s topped $150 billion. Even NIO briefly became a $100 billion company. Cut to 2024 and EV names across the board have plummeted.

EV listings have also plummeted and Zeekr is only the second major EV company to go public since last year. In 2023, Vietnam-based VinFast went public through a special purpose acquisition company (SPAC) merger and while the shares soared initially they now trade at less than a third of the SPAC IPO price.

EV price war

There has been a price war in the EV industry, including in China which is the world’s biggest automotive market.

In an employee memo in February, Xpeng Motors’ CEO He Xiaopeng said that the price war in the EV industry could end in a “bloodbath.” Notably, there has been a brutal price war in the Chinese EV industry since Q4 of 2022 when Tesla started to cut car prices to spur sales.

Tesla’s price cuts were followed by similar announcements from other carmakers including Xpeng Motors, Ford, Toyota, and Nissan.

Last year, even NIO lowered car prices. Previously the company had categorically said that it wouldn’t join the price war.

The Elon Musk-run company has since lowered prices multiple times including in January. Last year, The China Association of Auto Manufacturers (CAAM) tried to bring about a truce in the EV price war but soon rescinded the pledge admitting it was against the country’s antitrust laws.

EV demand has come down

EV demand has been quite weak prompting companies to readjust their production plans. For instance, both Ford and General Motors which have committed billions of dollars towards building EV plants are delaying their investments. Startup EV companies have been under even severe stress and are grappling with continued cash burn. Several startup EV companies have either gone bankrupt or are on the verge of doing so.

Even Tesla has delayed the construction of its upcoming plant in Mexico while Musk delayed his India visit to discuss the construction of a plant there.

Tesla is also facing severe competition in China from domestic Chinese automakers. Musk meanwhile has been all praise for Chinese EV companies and during the Q4 2023 earnings call earlier this year he said, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

Would Zeekr be able to expand in Europe?

While Zeekr has plans to expand in Europe the journey won’t be easy the EU is contemplating imposing tariffs on imports of EVs from China. Also, President Joe Biden is also reportedly considering increasing the tariffs on Chinese EVs which could be announced as soon as Tuesday.

Coming back to Zeekr, while the shares rose almost 35% on its first trading day it remains to be seen how they perform in the coming days amid the turmoil in Chinese EV shares.

Question & Answers (0)