Chinese EV shares including NIO, Xpeng Motors, and Li Auto closed in the red yesterday after releasing their August deliveries. The broader US markets were also weak after reports that the country is restricting chip sales to China.

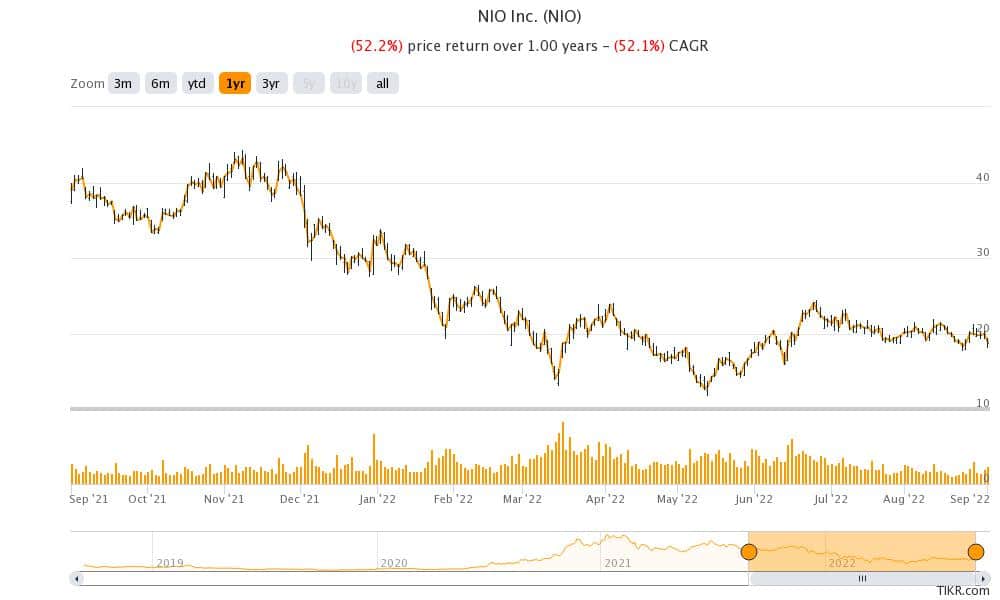

Chinese EV shares have whipsawed this year. Along with the broader market volatility, news flow over delisting in the US has also influenced their price action. However, the regulators in the two countries have reached an audit deal post which the risk of forced delisting of Chinese companies from US markets has subsided.

Chinese EV companies released August deliveries

Coming back to Chinese EV companies, they release their delivery reports monthly, while US peers like Tesla release them on a quarterly basis. The August delivery report was a mixed bag. While NIO and Xpeng Motors reported a YoY rise in deliveries, Li Auto’s deliveries fell on a yearly basis.

Also, when compared on a month-on-month basis, only NIO managed to deliver more cars in August as compared to July. Here are the key takeaways from Chinese EV companies’ August deliveries.

NIO delivered 10,677 cars in August

NIO delivered 10,677 cars in August, which was 81.6% higher YoY and 6% higher as compared to the June figures. Meanwhile, the deliveries are below 12,961 deliveries in June. June was a record month for NIO and came after two months of tepid sales.

The lockdowns in China took a toll on Chinese EV companies’ deliveries in April and May. Along with Chinese EV companies, Tesla’s production also fell in the second quarter. The company’s Shanghai Gigafactory is now widely believed to be its most efficient factory. Due to the lockdowns, Tesla’s production in China fell in the second quarter of 2022.

Tesla’s production was hit in China

The Elon Musk-run company reported a sequential fall in deliveries in the second quarter of 2022. It was the first fall in deliveries for the company since 2020 when COVID-19 lockdowns took a toll on its production.

However, despite the production loss, Tesla almost met its original guidance of half a million deliveries in 2020. Even this year, it has maintained its long-term guidance of 50% CAGR growth, despite losing production in China.

Meanwhile, after the slowdown in second-quarter production, Tesla lost its title as the world’s largest seller of new energy vehicles. However, it was BYD, a Chinese EV company, that took the top spot. BYD’s China production was not hit due to the lockdowns which helped it outsell Tesla. Berkshire Hathaway also owns a significant stake in BYD Motors.

Analysts are bullish on Chinese EV companies

Meanwhile, most analysts are bullish on Chinese EV companies, especially NIO. Deutsche Bank analyst Edison Yu is bullish on NIO due to its overseas expansion. He said, “We certainly don’t expect meaningful volume contribution anytime soon as management is very focused on organic brand building but note in Norway YTD, NIO has sold nearly 600 ES8 SUVs, putting it slightly behind Mercedes Benz EQB and BMW IX3.”

Other Chinese EV companies are also expanding in Europe. NIO might also look at an eventual entry into the US market, which happens to be the most lucrative automotive market globally.

Chinese EV companies might enter the US market

Commenting on NIO’s China entry, Yu said, “We think perhaps NIO’s desire to enter the US may be far greater than it appears especially given how competitive the domestic Chinese market is becoming.”

That said, after the passage of the Inflation Reduction Act of 2022, only the EVs assembled in North America would be eligible for the federal tax credit. Also, companies need to start sourcing the battery in North America and by 2029 only cars with batteries made in North America would be eligible for the tax credit.

Toyota has increased the outlay towards its battery plant in North Carolina in what looks like an apparent bid to qualify for the tax credit. The Biden administration has been working to increase domestic production of EVs as well as chips in a bid to take on China.

Chinese EV companies reported a fall in deliveries

Coming back to Chinese EV companies’ August deliveries, Li Auto could manage only 4,571 deliveries in the month which were 56% lower as compared to July and also fell over 50% YoY. The company’s cumulative deliveries are now just short of 200,000. It had crossed the milestone of producing 200,000 cars in July only. However, there is a lag between a car’s production and eventual delivery.

Xpeng Motors delivers 9,578 cars in August which was 33% higher YoY but 16% below its July deliveries. The company delivered 90,085 cars in the first eight months of 2022 and its cumulative deliveries rose to 229,578. NIO delivered 71,556 EVs in the first eight months of 2022 and its cumulative deliveries reached 238,626.

Meanwhile, the deliveries of Chinese EV companies are a pale shadow of Tesla which delivered 254,695 cars in the second quarter of 2022 despite the China lockdowns. Even Ford sells more electric cars than NIO, Xpeng Motors, and Li Auto.

Competition in the EV industry

The competition between EV companies would only intensify in the coming years as companies like Rivian and Lucid Motors ramp up their capacity. Tesla would also scale up the deliveries as its Berlin and Texas plants increase their production. Then we have new electric models from legacy automakers, which would make the market even crowded.

Also, startup EV companies like Fisker and Nikola would try to gain some traction. While it looks set to become a crowded EV market, Tesla has so far managed to not only protect its turf but also increase its market share. Tesla outperformed EV stocks in 2021. Despite being in the red this year, Tesla’s YTD losses are lower than most other EV companies.

Question & Answers (0)