Lyft shares were trading higher in pre markets today. On Monday, the shares zoomed 24% higher amid positive news over Pfizer’s COVID-19 vaccine candidate. The shares are up almost 58% so far in November. Why is Lyft stock rising and can the uptrend continue?

Lyft released its third-quarter earnings yesterday and they were ahead of analysts’ estimates. The ride-hailing firm accompanied the earnings statement with a rosy outlook, which added fuel to the buying spree in its stock.

Lyft Q3 earnings

Lyft reported revenues of $499.7 million in the third quarter, while analysts were expecting it to post revenues of $486.6 million. It posted an adjusted loss per share of $1.46. Meanwhile, the company’s ridership numbers increased sharply in the quarter.

Lyft’s active users in the US rose 44% in the third quarter to 12.5 million. It reported revenue per active user of $39.94 in the quarter. Also, it said that it expects to be positive on the EBITDA (earnings before interest, tax, depreciation, and amortization) by the fourth quarter of 2021 despite the COVID-19 pandemic.

Lyft stock price

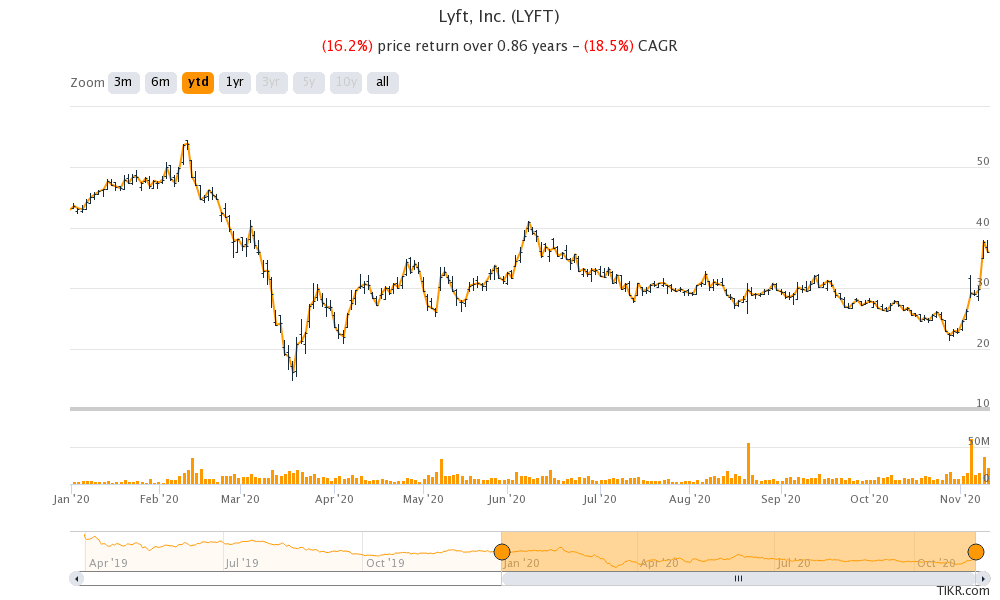

Lyft shares have been on fire this month and have gained almost 58% so far in November. However, it is still down 16.2% for the year. There are three main reasons behind the rally in Lyft stock this month. These include.

- The uptrend in broader markets: US stock markets have soared to record highs this month as the uncertainty over US elections has eased. The positive momentum in broader markets has also helped Lyft stock move higher.

- Positive news flow over Pfizer’s COVID-19: The vaccine candidate, that Pfizer is developing along with biotech form BioNTech, has proven to be effective in 90% of the cases in protecting against the COVID-19. Albert Bourla, Pfizer’s chairman and chief executive called the results a “game changer”. Stocks that would benefit from a COVID-19 vaccine, including ride-hailing apps like Uber and Lyft rallied on the news. The news over Pfizer’s vaccine candidate also triggered a sector rotation from growth to value stocks.

- California’s Proposition 22: California has passed Proposition 22 that would let gig economy companies like Uber and Lyft classify their workers as contractors and not employees. The resolution was passed with the support of 58% of the Californians who voted for the resolution alongside the presidential elections. The resolution helped remove a key overhang for both Uber and Lyft as classing drivers as full-time employees would have hit their business model and led to higher expenses and allowances.

Lyft’s current stock price

Lyft stock, that lost 4.4% in regular trading today, was trading 6.5% higher at $38.42 in pre markets today. The shares have a 52-week trading range of $14.56 to $54.50. The shares are still down almost 30% from their 52-week highs.

Lyft vs Uber stock price

Lyft shares are underperforming Uber this year. Uber shares have gained 58% so far in 2020. Lyft’s underperformance is primarily due to the fact that Uber has diversified its business towards food delivery. While the ride-hailing business has sagged this year for both Uber and Lyft, higher food deliveries has helped Uber compensate for the revenue loss from its ride-hailing business.

Uber released its fiscal first quarter 2020 earnings last month and reported a 14% year over year increase in revenue in the quarter, largely on the back of the strength in its food delivery business.

Food delivery

Meanwhile, globally restaurants have been at loggerheads with food delivery apps that can charge almost a third of the bill amount from restaurants as fees and charges. During their third quarter earnings call, Lyft talked about expanding its food delivery business.

Lyft’s president John Zimmer lashed out against Uber Eats for charging a high fee from restaurant partners. He said, “what we’re hearing from these restaurants and retailers, especially during the pandemic, is they want to partner not someone that’s going to be taking 20% to 30% but they want to just have the delivery capabilities, which obviously the 1 million plus drivers we have on the platform, we can provide.”

He added that instead of a consumer platform, Lyft will build a B2B approach, “which we think is differentiated and where we can say, hey, we’re not going to step between you and your customer unlike other platforms.”

What could Lyft stock price be in one year?

According to the estimates compiled by CNN, Lyft’s median price target is $41, which represents a potential upside of 13.7% over the next 12 months. Lyft’s highest price target of $66 is a premium of 83% over current prices while its lowest price target of $10 is a discount of 72% over current prices.

Of the 40 analysts covering Lyft, 24 have a buy or higher rating while two have a sell rating. The remaining 14 analysts have a hold or equivalent rating on the stock.

How to buy Lyft stock?

You can buy Lyft shares through any of the good online brokers. Once you open the account you can fund the account and place the order for Lyft shares

Question & Answers (0)