Big-tech names such as Apple (AAPL) and Nvidia (NVDA) saw one of their worst days since the February sell-off amid yesterday’s tech-driven stock market meltdown, which plunged the shares of the two companies by 8% and 9% respectively.

However, pandemic stocks seem to be seeing the worst of this runoff as prospects of a vaccine have started to materialize as reflected by a mandate from the US Centers for Disease Control and Prevention (CDC), which told states to prepare for vaccine distribution as soon as late October.

The New York Times was the first to report the news – which was later on confirmed by the CDC – after seeing a series of documents that showed the agency has outlined various scenarios that aim to help states in preparing for an upcoming vaccine and for the hassles involved in getting it to the public.

“Right now I will say we’re preparing earnestly for what I anticipate will be reality … that there’ll be one or more vaccines available for us in November, December — and we have to figure out how to make sure they’re distributed in a fair and equitable way across the country”, said CDC Director Dr. Robert Redfield.

Although an imminent vaccine is positive news for the world, it is not as good as it sounds for stocks that have emerged as pandemic winners – as their products and services are likely to face lower demand once the health emergency is over.

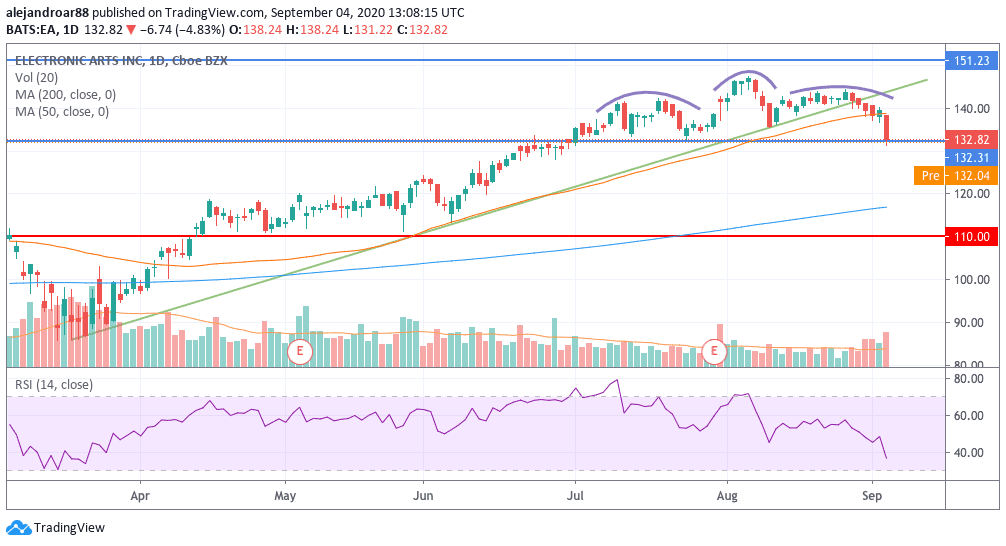

The impact of this news in pandemic stocks such as Zoom Video Communications (ZM) and Electronic Arts (EA) has been massive, with Zoom losing 20% in just two days and EA plunging 5% during yesterday’s sell-off while both are also heading lower during today’s pre-market stock trading activity.

Meanwhile, other smaller companies that have shined during the pandemic such as Overstock.com (OSTK) and Docusign (DOCU) have also been plunging as the demand for their services is likely to diminish once the world returns to its normal routines – at least partially and progressively.

Pandemic stocks out of favor as sector rotation kicks in

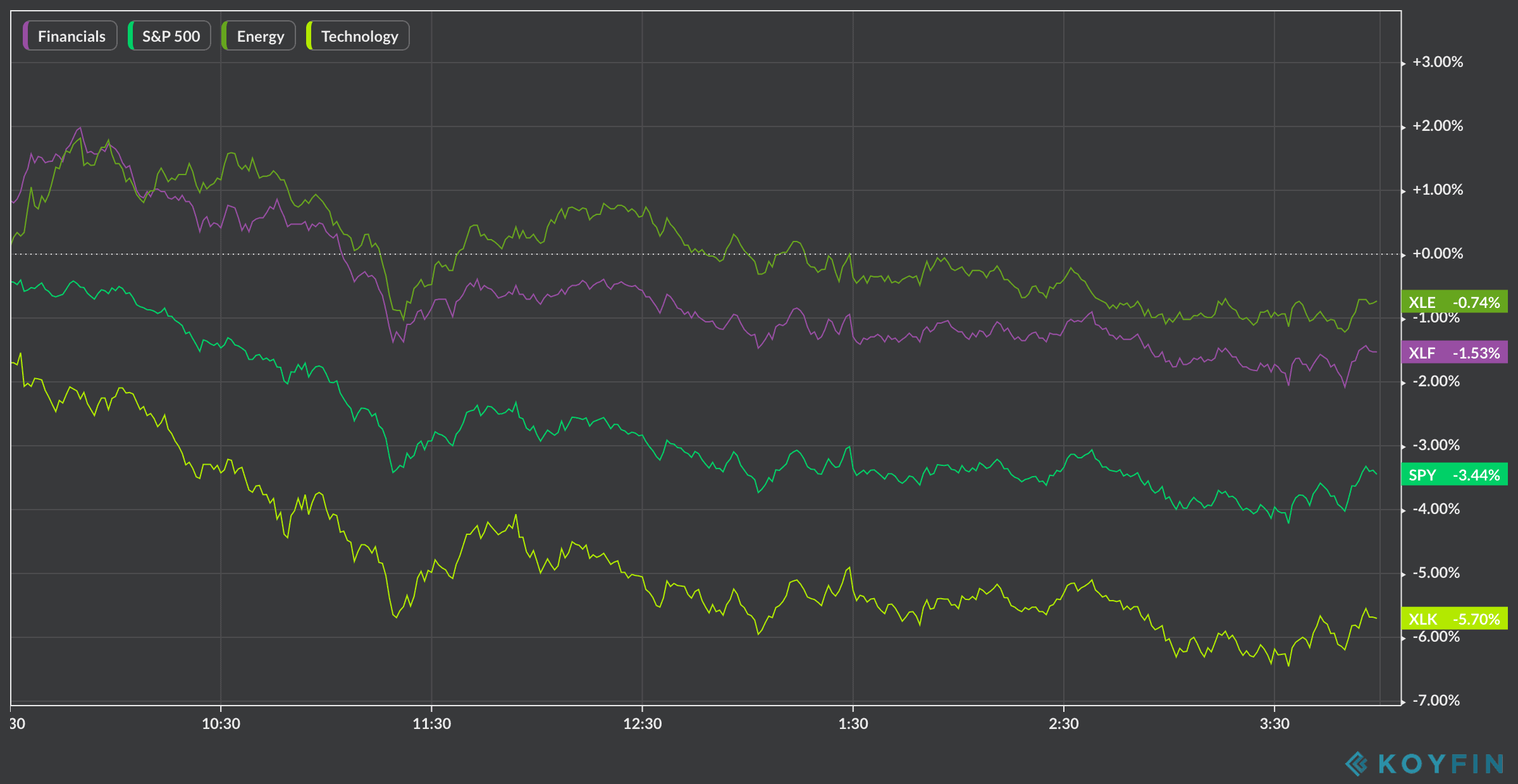

Yesterday’s sell-off seems to have been kinder to value stocks and to shares within the sectors that were the most battered by the virus situation, including financials, travel & leisure, and energy, as they all saw milder losses compared to the tech segment.

The S&P 500 Financials Sector ETF (XLF) went down only 1.5% and it is going up 2.3% as of this morning while the S&P 500 Energy Sector ETF (XLE) was down only 0.7%, also inching higher this morning by 1.2% in contrast to the 6% plunge seen by the S&P 500 tech sector ETF, which dropped by nearly 6% while the S&P 500 index went down 3.4%.

How to benefit from this rotation from pandemic stocks to value shares?

There are two ways in which investors can benefit from the sector rotation that should progressively kick in as prospects of an effective vaccine materialize.

First, there’s the opportunity of taking a long position in stocks that have been the most battered during the virus crisis.

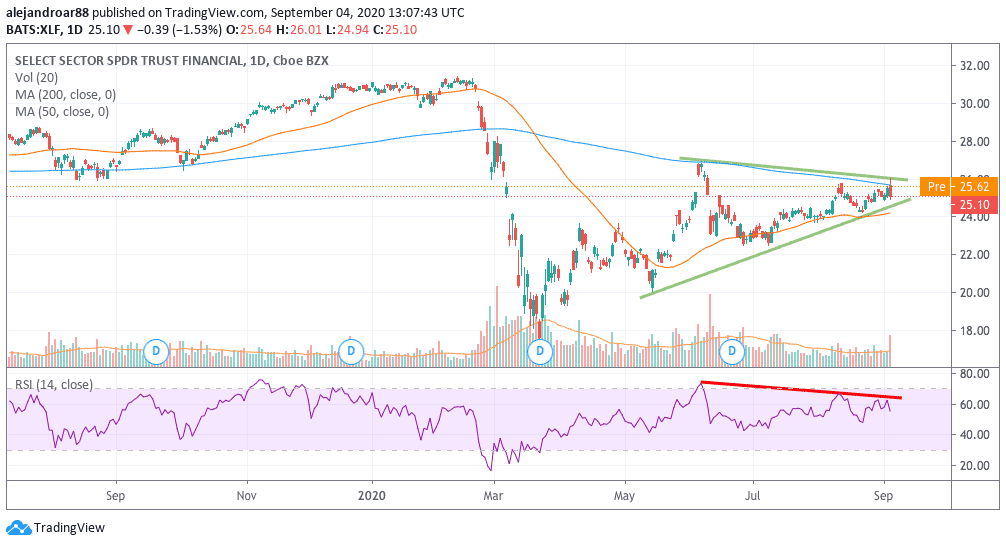

Financial companies emerge as perhaps one of the best candidates for doing that, as they have both the financial strength and enough upside to emerge as the next winners in the stock market – in contrast to energy and travel companies, which are still struggling with the financial impact of the pandemic.

That said, the latest price action on the S&P 500 Financial Sector ETF (XLF) seems to be forming a rising wedge, which is a reversal pattern that could be indicating that actually the opposite is to occur – as shares could actually go down as a result of this tightening wedge.

Additionally, the RSI is showing a bearish divergence as the oscillator is going down although the price is going up.

To have confirmation that this sector rotation is actually taking place a break above that wedge should be accomplished and a higher high in the RSI should be posted as a result. Failing to do any of those two things could actually prove that this potential rotation hasn’t yet kicked in.

On the other hand, there’s the possibility of benefitting by short selling one of these pandemic stocks such as Electronic Arts (EA), whose price action has formed a clear head and shoulder pattern that slightly went below the neckline yesterday.

If the price dips below that purple line chances are that the stock is going to be taking some further downward pressure, with the next support levels found at $120, $115 and $110 per share.

Question & Answers (0)