Earlier this month, Tilray and Aphria completed their reverse merger and the new entity trades under the ticker symbol “TLRY” on both the US and Canadian stock exchanges. Is Tilray a good cannabis share to buy after the merger with Aphria?

Tilray and Aphria announced the merger last year only. While Aphria shareholders had voted for the merger in time, Tilray had to delay the merger vote to the end of April. It also lowered the quorum requirement for the shareholder meeting to get the merger approved.

Tilray-Aphria merger

Meanwhile, the merger is now a done deal and has created the world’s largest cannabis company. However, the crown might not last for long with Tilray as Curaleaf has also announced the merger of Europe-based EMMAC Life Sciences. Post the acquisition, Curaleaf would become the world’s largest cannabis company, the title it held before Tilray and Aphria came together.

Last week, Tilray released its quarterly earnings unannounced. The move left the markets surprised as companies usually give ample time to markets and make the earnings date announcement beforehand.

Tilray quietly released its earnings

The results were for Tilray as a standalone company and going forward the company would post the results on a consolidated basis. That said, there wasn’t much to talk about in the company’s earnings and its revenues fell to $48 million in the quarter as compared to $52 million in the corresponding period in 2020. The company’s average net selling price also fell in the quarter. Cannabis companies are battling lower prices as competition heats up while the COVID-19 pandemic has led to some demand destruction.

Meanwhile, the consolidation in the cannabis industry is a welcome move as it would help support the pricing and lower the competition in the market. Tilray, for instance, is forecasting annual synergies of $81 million within the first 18 months of the merger completion. The proposed synergies would help the new entity reach profitability sooner. Before the merger, both Aphria and Tilray were lossmaking, so are almost all the other cannabis companies.

Sundial Growers

Last week, Sundial Growers, the penny cannabis company that was once very popular in the Reddit group WallStreetBets released its first-quarter earnings which showed that it turned EBITDA positive for the first time. However, a deeper dive into the earnings shows that the profitability came from its strategic investments in other cannabis companies and not from the core operations. The core cannabis operations actually posted a big loss in the quarter.

Simon on the merger

Irwin D. Simon, the new CEO and chairman of Tilray is bullish on the company’s prospects after the merger. “Our focus now turns to execution on our highest return priorities including business integration and accelerating our global growth strategy. Covid-19 related lockdowns have presented unique challenges across Canadian and German markets,” said Simon.

He added, “As these markets begin to re-open, Tilray is poised to strike and transform the industry with our highly scalable operational footprint, a curated portfolio of diverse medical and adult-use cannabis brands and products, a multi-continent distribution network, and a robust capital structure to fund our global expansion strategy and deliver sustained profitability and long-term value for our stakeholders.”

Piper Sandler lowered Tilray’s target price

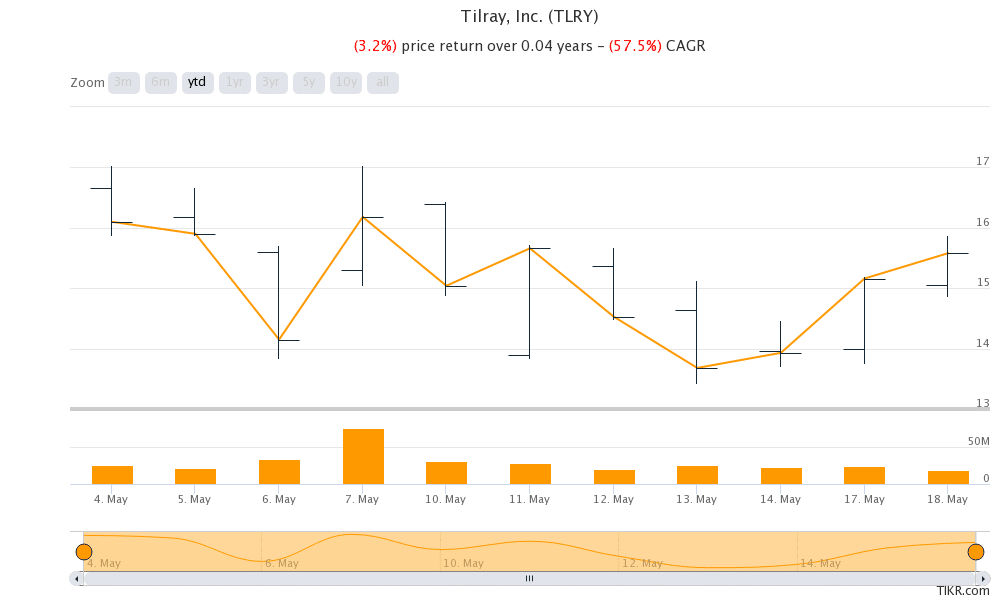

Here it is worth noting that Tilray now has geographically diversified operations. The erstwhile Tilray’s capabilities in the European medical cannabis market is complemented by Aphria’s position in the US adult-use market. Wall Street meanwhile has a mixed opinion on Tilray after the merger. After Tilray’s earnings release, Piper Sandler lowered the target price from $26 to $15.

Jefferies is bullish on Tilray

However, Jefferies issued a bullish note on the company and raised its target price from $4.77 to $23. “Tilray’s BS ($372mn cash) should support a near term entry into the US while the state by state structure persists. When full federal legalization comes, infrastructure/brand equity/awareness from its wider consumer businesses (hemp-food/CBD/alcohol) will then also be advantageous,” said Jefferies analysts in their note.

They added, “For us, when Aphria and Tilray combined, it was the perfect match. In Canada, a leading portfolio of brands, supported [by] an efficient cost structure. In Europe, the market is now picking up, while Tilray’s scale and Aphria’s unique German positioning make it perfectly suited to succeed.”

Notably, the Swiss Central Bank also increased its stake in Tilray shares and added 175,900 shares in the first quarter of 2021 which took its total holdings to 289,300.

Cannabis shares have been under pressure of late in the absence of any near-term bullish triggers. However, Tilray shares now trade at attractive valuations and look like a good way to play the cannabis industry.

The industry is a play on the federal legalisation of marijuana in the US as well as other countries. Also, medical cannabis is also seeing increasing adoption.

Tilray shares were trading almost 4% lower in US premarket price action today as the sell-off in the cryptocurrency market is also reflecting in US stock market futures with the Nasdaq down over 1.5% in premarkets.

Question & Answers (0)