How to Buy Aurora Cannabis Shares UK – with 0% Commission

As the name suggests, Aurora Cannabis is a cannabis producer based in Canada.

Its shares are listed on the Toronto Stock Exchange, so if you want to invest in the UK, you need to find a broker that gives you access to the Canadian stock markets.

In this guide, we explain how to buy Aurora Cannabis shares online in the UK. On top of discussing the best UK brokers to do this with, we also give you a bit of background information on Aurora Cannabis.

-

-

Step 1: Find a UK Stock Broker to Buy Aurora Cannabis Shares

Although many UK stock brokers now give you access to international markets, very few cover the Toronto Stock Exchange. This is because, in comparison to the likes of the NASDAQ and NYSE, there is very little appetite for Canadian companies in the UK.

Nevertheless, we have sourced the best two stock brokers that allow you to buy Aurora Cannabis shares online in the UK.

1. Fineco Bank – Affordable Share Dealing Platform

In fact, you will have access to dozens of exchanges and markets – including that of Canada.

This means that you can easily buy Aurora Cannabis shares at the click of a button. I

You will also need to pay an annual maintenance fee of 0.25% if your investment balance is less than £250,000. Fortunately, there are no fees to deposit and withdraw funds.

With that said, if you were to trade Aurora Cannabis shares via CFDs at Fineco Bank, you won’t pay any commission. Additionally, this comes with the added option of being able to apply leverage of up to 1:5 – as well as engage in short-selling.

Fineco Bank requires a minimum deposit of just £100. It doesn’t support debit/credit cards or e-wallets, so you will need to transfer funds from your UK bank account. In terms of safety, Fineco Bank is regulated by the FCA and your funds are protected by the FSCS.

Pros

- Charges just £2.95 per trade when buying and selling shares

- Access to thousands of UK and international shares

- Deposit funds with a UK bank account

- Heavily regulated, including an FCA license

- Suitable for both newbies and seasoned investors

- Great research and educational department

- Established way back in 1999

- All personal data protected

Cons

- 0.25% annual fee

Your money is at risk.

Step 2: Research Aurora Cannabis Shares

Once you have decided which stock broker you want to use to buy Aurora Cannabis shares, you are advised to take a step back momentarily.

This is because you should perform some research on the Canadian company before taking the financial plunge.

With this in mind, below we outline some key data points surrounding Aurora Cannabis – such as its historical stock price action, dividends, and reasons to consider adding its shares to your portfolio.

What is Aurora Cannabis plc?

Founded in 2006, Aurora Cannabis is a legal cannabis producer based in Canada. It now operates in over 25 countries – supplying licensed cannabis dispensers with over 600,000 kg per year. Aurora Cannabis also has a selection of retail stores in Canada, which sells cannabis to the recreational marketplace.

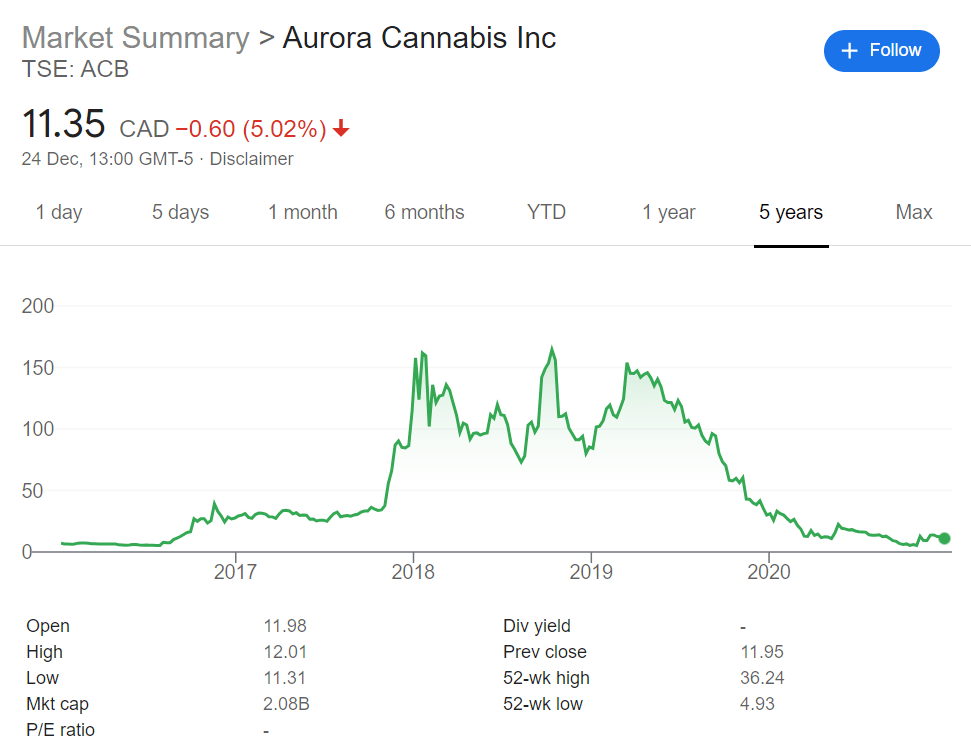

Aurora Cannabis Share Price History & Market Capitalisation

Aurora Cannabis shares have traded on several stock exchanges over the past decade. This includes the TSX Venture Exchange, which lists small-to-medium Canadian firms. However, it has traded on the primary Toronto Stock Exchange since mid-2017. Back then, the shares would have cost you in the region of $26 (CAD).

In less than 6 months of joining the Toronto Stock Exchange, Aurora Cannabis shares hit highs of $135. This represents gains of over 400%. Since then, the stocks have been on somewhat of a rollercoaster ride. Most notably, the stocks last peaked in March 2019 at just over $153 each.

Unfortunately for shareholders, Aurora Cannabis has been on a downward trajectory ever since. At the time of writing in late 2020, you’ll pay just $11 per share. This means that the stocks are worth significantly less than they were when first being listed on the Toronto Stock Exchange.

On the other hand, this does present an excellent opportunity to buy Aurora Cannabis shares at a major discount. This is, of course, on the proviso that you believe the company is undervalued and thus – will be worth considerably more in the near future.

Aurora Cannabis EPS and P/E Ratio

In its most recent filing, Aurora Cannabis carried a price-to-earnings ratio of -3.04. For those unaware, a negative P/E ratio means that the company made a financial loss in the prior quarter.

It goes without saying that this is highly unfavorable for those in possession of Aurora Cannabis shares – which is fully evident in the firm’s stock price.

In terms of its earnings-per-share, this stood at -$26.29 as of Q3 2020. Once again, this represents huge losses for investors.

Aurora Cannabis Shares Dividend Information

Aurora Cannabis is yet to pay a dividend to shareholders and this will likely remain the case for the foreseeable future. After all, the firm is currently making a financial loss.

Should I Buy Aurora Cannabis Shares?

As we have discussed, not only have Aurora Cannabis shares been on a downward trajectory since 2019, but the firm currently possesses a negative EPS and P/E ratio. But, this doesn’t necessarily mean that Aurora Cannabis is a bad investment.

To help clear the mist, below have listed some of the most notable factors that might influence your decision to buy Aurora Cannabis shares today.

Invest at a Huge Discount

The most notable benefit of investing in Aurora Cannabis is that of its current share price. In other words, you’ll pay just over $11 as of late 2020 – which represents a major discount in comparison to its historical peaks.

In fact, this is less than half of what Aurora Cannabis shares were worth when they first joined the Toronto Stock Exchange in mid-2017.

Crucially, while the risks associated with an investment are much higher than you’ll find with a traditional blue-chip stock, the upside potential is also high.

Cannabis is a High Growth Industry

If you’re the type of investor that is interested in growth stocks, then cannabis is likely to be an industry that you are keen to explore.

While there are many such companies active in the space, Aurora Cannabis is one of the largest suppliers in Canada.

However, the firm is also active in 25 other countries. As and when more and more governments begin to relax cannabis-related laws, this will benefit Aurora greatly.

Aurora Offers a Diversified Portfolio of Products

While Aurora’s core division is that of its conventional cannabis production unit, the firm is also behind a number of other, growing product types. This includes cannabis in the form of vaping, edibles, infusion, and beverages. This ensures that Aurora Cannabis isn’t overly exposed to a single product line.

Share Dilution is a Real Problem

One of the biggest issues facing Aurora Cannabis is that of its access to capital. Sure, since the firm replaced its long-standing CEO Aurora has managed to take an element of control of its spending.

However, it is still burning through cash at the rate of knots. In turn, this has forced Aurora Cannabis to raise capital through new share offerings.

In fact, in the last few years alone the number of shares in circulation has increased by almost 12,000%. In turn, this results in Aurora Cannabis shareholders getting diluted – subsequently reducing the value of their investment on each stock sale.

Aurora Cannabis Shares Buy or Sell?

It’s difficult to make a really strong case for Aurora Cannabis shares. Sure, the firm operates in a high growth industry. Plus, you do stand the chance to invest at a major discount – based on its current stock price.

However, Aurora Cannabis is still burning through way too much cash, which has resulted in the company initiating yet another share offering.

In turn, Aurora Cannabis now carries a negative EPS and P/E ratio. Ultimately, there are plenty of more attractive cannabis stocks available to UK investors – if this is an industry you wish to gain exposure to. Or, you might even consider a cannabis ETF – which offers a basket of stocks operating in the space.

The Verdict?

In summary, if you want to buy Aurora Cannabis shares online in the UK, there are several brokers that allow you to do this with ease.

This is because you can buy Aurora Cannabis stocks commission-free, and the minimum investment is just $50. You can complete the end-to-end process in less than 10 minutes when using a debit/credit card or e-wallet.

Simply click the link below to get started!

FAQs

Are Aurora Cannabis shares a good buy?

The only attractive aspect of choosing Aurora Cannbis is that its share are trading at a huge discount in comparison to its prior heights. While the upside potential could be huge, so are the risks.

What stock exchanges are Aurora Cannabis shares listed on?

Aurora Cannabis has its main stock exchange listed on the Toronto Stock Exchange. The company also has a secondary listing on the NYSE.

What is the Aurora Cannabis P/E ratio?

As of late 2020, Aurora Cannabis has a negative P/E ratio of -3.04. This is because the company is currently making a financial loss.

Does Aurora Cannabis offer dividends?

No, Aurora Cannabis does not pay dividends and it is unlikely to do so for a long time.

How much is Aurora Cannabis valued at?

At the time of writing, Johnson & Johnson has a market capitalization of over $2 billion (CAD).

Who is the Chief Executive Director of Aurora Cannabis?

Miguel Martin is the current CEO of Aurora Cannbis. Martin begun his post as CEO as recently as September 2020.

Can I invest in Aurora Cannbis via an ISA or SIPP?

Yes, both ISAs and SIPPs allow you to invest in international stocks such as Aurora Cannabis.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up