7 Popular Supermarket Stocks Among UK Investors

Supermarket stocks had a banner year in 2020, as consumers flocked to stores for food as restaurants in the UK shut down. While supermarkets might not see the same growth in 2021, these companies are still prime targets for UK investors.

That’s because the supermarket industry is in the middle of rapid change. In this guide, we’ll highlight some popular supermarket stocks in the UK and show you how to buy shares with a 0% commission.

-

-

List of Popular Supermarket Stocks in 2026

There are dozens of supermarket stocks trading in the UK and in international markets like the US. Here are some grocery store stocks to research for yourself:

- Sainsbury’s

- Tesco

- Morrisons

- Kroger

- Walmart

- Ocado

- Amazon

Popular Supermarket Stocks UK Reviewed

1. Sainsbury’s

Sainsbury’s

is one of the strongest supermarket companies in the UK. Since 2015, the grocer has managed to grow sales at 4% per year and increase its dividend yield to 4.5%. That’s in spite of increasing competition from discount grocery stores like ALDI and Lidl, as well as lagging companies like Ocado in the online grocery market.

is one of the strongest supermarket companies in the UK. Since 2015, the grocer has managed to grow sales at 4% per year and increase its dividend yield to 4.5%. That’s in spite of increasing competition from discount grocery stores like ALDI and Lidl, as well as lagging companies like Ocado in the online grocery market.What makes Sainsbury’s shares so attractive right now is that they’ve been beaten down by investors as a result of this increasing competition. Sainsbury’s stock is trading with a forward price-to-earnings (PE) ratio of around 14, compared to an average of 19.6 for the UK supermarket industry. That makes it one of the cheaper grocery chains you’ll find on the FTSE.

2. Tesco

Tesco

is the largest supermarket chain in the UK, with a whopping 26.8% market share. What makes this grocer particularly appealing for investors, though, is that it’s captured an even greater share of the online grocery market – 30.7%.

Tesco has invested heavily in online grocery shopping and delivery both before and during the coronavirus pandemic.

3. Morrisons – A Reliable High-yield Dividend Stock

On paper, Morrisons stock has a dividend yield of only around 3.8%. But in reality, this company pays out special dividends virtually every other year. If you include the special dividend that Morrisons announced in December last year, the company’s dividend yield is closer to 7.0% at the share price of 171p on the ex-dividend date.

The supermarket chain is also trading at a historic low right now, which means you could be getting a bargain. Morrisons shares are currently trading at just 185p, down from 266p as recently as 2018. The decline in share price is a result of Morrisons losing profits and market share to discount grocery chains, but the worst of the damage has likely already been done.

While this company has some of its own online shopping and delivery capabilities, it’s largely relying on a deal with Amazon to allow consumers to buy Morrisons products online.

4. Kroger

Kroger is a behemoth of a US supermarket chain, controlling 2,750 stores across the country along with 10% of the US grocery market (behind only Walmart). Kroger’s share price only rose 5% to $31.76 last year, which we think leaves this stock highly undervalued.

Over the same period, Kroger’s overall sales grew 11% and its digital sales more than doubled. At the same time, Kroger pays out a reliable dividend of 2.2%, which is above average for US grocery stocks. The company currently has a PE ratio of just 8.43.

The main issue that investors seem to have with Kroger shares is that this company only owns supermarkets. It’s not a full-fledged retailer like Walmart, leaving it fewer opportunities for growth. Still, Kroger has managed to steadily increase its bottom line by creating its own store-brand products to stock its stores.

5. Walmart

Walmart

is truly massive. This company is the largest company in the world by revenue, the largest employer in the US, the largest retailer in the world, and the largest supermarket chain in the US. Walmart also has a massive footprint in the UK and owns the ASDA supermarket chain – which controls 17.6% of online grocery shopping in the country.

The company has posted 25 consecutive quarters of sales growth in the US, something most decades-old companies can only dream of. At the same time, Walmart has consistently hiked its dividend and pays a yield of 1.47% at the current share price of $146.63. Walmart also trades at a PE ratio of just 21.2, well below the average PE of 36 for the S&P 500.

Walmart shares are impacted by the retailer’s competition with Amazon, which spans into general merchandise and not just grocery items. However, Walmart hasn’t been crushed by Amazon, as many analysts initially predicted. Rather, it’s evolved into a giant of eCommerce – including online grocery shopping – and leveraged its physical stores for pickup and logistics.

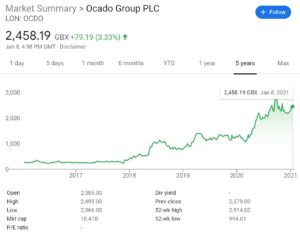

6. Ocado

Ocado

is unlike any of the other supermarket stocks on this list. In fact, if you ask the leadership at Ocado, they’ll tell you that this isn’t a supermarket company at all. Rather, it’s a tech company.

That’s because Ocado doesn’t have any of its own stores or even any of its own food products. What Ocado does is build automated warehouses and automation technology for grocers looking to make their supply chains more efficient. It has a joint venture with Marks & Spencer to facilitate grocery delivery in the UK and has partnered with Kroger to build as many as 20 automated supply warehouses in the US.

As a growth stock, Ocado does come with significantly more downside risk than most other supermarket stocks. The company has a valuation of nearly £19 billion, making it one of the biggest companies on the FTSE 100 list. That’s despite the fact that Ocado declared a £214.5 million loss in 2019 and failed to turn a profit in 2020.

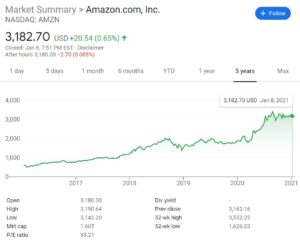

7. Amazon

Amazon

has been investing increasingly in the grocery market over the past few years, which makes sense given its goal to be the ‘Everything Store.’ The most notable push into groceries that Amazon made was its acquisition of Whole Foods in 2017. Whole Foods alone isn’t widespread – it only has 500 stores in the US and 7 in the UK – but it gives Amazon a foothold in both countries and sets up grocery supply chains.

What makes Amazon particularly exciting as a supermarket stock is that it is truly a supermarket. On Amazon, consumers can order not just food and household items but also general merchandise at the same time. While that won’t appeal to everyone, the convenience involved promises to give Amazon a leg up on the competition as it expands the number of cities it serves. Amazon has also mastered same-day delivery in major cities, so tackling grocery delivery won’t be as much of a challenge for this company as it is for many grocery-only retailers.

More generally, we think Amazon stock is a strong long term investment. With this company, you’re not only investing in online groceries, but also a massive eCommerce marketplace, Amazon Web Services, and more. Amazon trades with a pricey PE ratio of 93 and doesn’t pay a dividend.

Why do some people invest in supermarket stocks?

Many investors consider supermarket stocks a strong investment, especially when the broader stock market isn’t doing so well. That’s because consumers need food and staples like cleaning supplies no matter whether the economy is roaring or suffering. While many stocks fall during a recession, supermarket stocks often rise as investors look for a safe place to put their money.

During the coronavirus pandemic last year, supermarket stocks were particularly attractive to investors. Not only were grocers relatively insulated from the pandemic as essential businesses, but they experienced a surge in business as consumers were barred from restaurants and many stocked up on food and other supplies.

While supermarket stocks may underperform the broader market during times of strong growth, there is a silver lining to holding these companies for the long term. Since most supermarkets have relatively steady business over time, they are among the most reliable and high-yielding dividend stocks. For example, Sainsbury’s has a dividend yield of 4.5%, Tesco has a yield of 3.7%, and Morrisons has a yield of 7.0%.

That’s a huge plus for income investing. In addition, it makes supermarket stocks very competitive with other types of low risk investments in terms of total return on your investment.

Important Features of Supermarket Stocks

Choosing supermarket stocks for you comes down to what you want to get out of your investment. To start, it’s important to decide if you’re looking for long-term stock appreciation, high dividend payments, or a mix of both.

If stock appreciation is most important to you, it’s important to find a grocer that is undervalued in the current market. Most investors use the PE ratio to determine whether a supermarket is overvalued or undervalued. The average PE of the supermarket industry in the UK is around 19.6, although this changes over time as supermarket stocks rise and fall.

Right now, grocery stores are undergoing a massive change as their business shifts towards online ordering, pickup, and home delivery. That means that the market share of major UK grocers could change over the next few years, creating opportunities for investors.

Look for grocers that are making strides to reach consumers online and deliver groceries quickly. Major supermarkets like Tesco and Sainsbury’s are up against newcomers like Ocado, and it’s not clear who will win the battle for dominance in the online grocery market.

If dividend yields are most important for your investing style, look for large supermarket companies that have a history of paying dividends. For example, Morrisons offers a 7.0% dividend yield and the company has been steadily increasing its payouts to investors for several years.

Of course, it’s important that the stock holds its value even as the company focuses on dividends. Make sure that any company that is putting profits towards dividends rather than investing more heavily in delivery networks will still be competitive for years to come.

Supermarket Stock Brokers in the UK

In order to purchase supermarket stocks in the UK, you’ll need a stock broker or stock app. Your broker will determine what grocery store shares you can trade. In addition, different brokers have different fees for trading and place different trading platforms and tools at your disposal.

With that in mind, let’s take a closer look at two popular brokers you can use to buy supermarket shares in the UK.

1. XTB

XTB is a popular UK stock broker that offers trading on more than 2,100 shares and ETFs – all 100% commission-free. Furthermore, spreads at this broker start at just 0.015% for US-listed stocks, making it one of the cheapest options available for UK traders. XTB doesn’t require a minimum deposit to get started and the broker doesn’t charge deposit or withdrawal fees.

XTB’s custom-built stock trading platform – xStation 5, is also available for the web and mobile devices and it comes packed with research tools. You’ll find technical charts and dozens of studies to start, plus a market news feed that includes actionable trade ideas with annotated price charts. The platform also has a market sentiment gauge which allows users to easily see what other traders think about where a stock’s price is headed.

XTB’s platform also includes a stock and ETF screener, which can be really useful for traders. With this tool, users can easily scan the market for stocks that are taking off or that seem poised for a fall. Using the screener, it’s possible to create watchlists and narrow down your search to find better trading opportunities.

XTB is regulated by the UK FCA and CySEC and offers negative balance protection for all traders. In addition, the broker offers customer support by phone, email, and live chat, available 24/5.

76% of retail CFD accounts lose money.

2. AvaTrade

AvaTrade is a UK CFD broker that offers 0% commission trading on over 600 global stocks. The platform also carries dozens of exchange-traded funds (ETFs), stock indices, commodities, and forex pairs for trading. Notably, AvaTrade also offers trading on forex options – but it doesn’t offer stock options at this time.

AvaTrade has a few different trading platforms you may use to trade stocks. Like Pepperstone, this broker gives all traders access to MetaTrader 4 and 5.

Alternatively, the AvaTrade web trading platform and AvaTradeGO platform are available on iOS and Android devices as well . You get watchlists, a market news feed, and dozens of technical studies. On mobile devices, users can access full-screen charts and enter orders with just a few taps.

AvaTrade also has its own social trading app for iOS and Android, called AvaSocial. Although this isn’t integrated into AvaTradeGO, it’s simple to switch back and forth between sharing ideas and setting up trades. AvaSocial also enables copy trading, so you have the ability to mimic the portfolios of more experienced stock traders in just a few taps.

AvaTrade is regulated by the UK FCA and Australia’s ASIC. The platform requires a $100 minimum deposit to open an account and you may pay by credit card, debit card, or bank transfer. AvaTrader offers 24/5 customer service.

Your capital is at risk.

3. FP Markets

FP Markets is a highly regarded online forex and CFD broker known for its comprehensive trading solutions and customer-centric approach. Established in 2005, FP Markets has built a reputation for providing an extensive range of trading instruments, including forex, indices, commodities, and cryptocurrencies, which cater to a diverse range of trading preferences.

One of FP Markets’ standout features is its commitment to offering competitive pricing with tight spreads, ensuring that traders can maximize their profits. The broker also supports various trading platforms, such as MetaTrader 4, MetaTrader 5, and IRESS, allowing traders to choose the platform that best suits their trading style and needs.

FP Markets strongly emphasizes education and resources, providing traders with access to a wealth of educational materials, webinars, and market analysis. This dedication to trader education helps both beginners and experienced traders enhance their trading skills and make informed decisions.

Customer support at FP Markets is highly responsive and available 24/5, ensuring that traders receive prompt assistance whenever needed. Additionally, the broker is regulated by top-tier authorities like ASIC and CySEC, providing traders with a sense of security and trust.

In summary, FP Markets stands out as a reliable and versatile broker. It offers a robust trading environment supported by competitive pricing, excellent educational resources, and top-notch customer service.

Your capital is at risk

4. Pepperstone

Pepperstone is a popular UK stock brokers for traders who want to use MetaTrader 4 or 5. These popular trading platforms offer unparalleled tools for technical analysis, including the ability to create custom technical studies. You may also backtest trading strategies against historical price data to see how they are likely to perform.

This broker also offers a few extra tools that are built specifically for MetaTrader. For example, there’s a correlation heatmap so investors will be able to see whether the stocks you’re invested in typically move at the same time. There’s also an alarm management tool that lets you create custom alerts based on price changes, trading volume, and more.

Pepperstone carries thousands of share CFDs from the US, UK, Europe, and Australia. The broker’s charges vary based on the market you’re trading – US shares trade commission-free, while UK shares carry a 0.10% commission. So, this broker can be slightly more expensive than some of its peers.

Pepperstone is regulated by the UK FCA and the Australian Securities and Investments Commission (ASIC). The platform doesn’t require a minimum deposit to open an account, which is a major plus if you’re not ready to commit hundreds of pounds to trading just yet.

Your capital is at risk.

5. PrimeXBT

PrimeXBT is an innovative stock broker that caters to a diverse range of traders, from beginners to seasoned professionals. Known for its versatility and user-friendly interface, the platform offers an array of features designed to enhance the trading experience across multiple asset classes.

One of the standout aspects of PrimeXBT is its wide range of available markets. Users can trade in cryptocurrencies, forex, commodities, and indices all from a single account. This flexibility allows traders to diversify their portfolios and take advantage of different market opportunities without needing to switch between platforms.

PrimeXBT offers a suite of trading tools and advanced charting options to help traders make informed decisions. The platform integrates customizable indicators, drawing tools, and multiple timeframes, enabling users to tailor their charts to suit their individual trading strategies. Additionally, PrimeXBT provides leverage trading options, which can amplify potential profits for experienced traders.

The platform’s trading interface is sleek and intuitive, designed to make navigating the markets straightforward. Opening, managing, and closing trades can be done with ease, while the performance of live trades can be tracked in real-time. PrimeXBT also offers an innovative feature known as Covesting, which allows users to follow and replicate the trades of successful strategy managers, providing an educational and potentially profitable experience.

PrimeXBT also prioritizes the security and privacy of its users. The platform employs industry-standard security measures to safeguard user accounts and data, such as two-factor authentication and encryption. Customer support is available to assist traders with any queries they may have, ensuring a smooth and reliable trading experience.

In summary, PrimeXBT stands out as a comprehensive trading platform offering a variety of markets, robust tools, and an easy-to-use interface. Its emphasis on security, diverse asset offerings, and innovative features like Covesting make it an excellent choice for traders looking to explore and capitalize on global market opportunities.

Your capital is at risk.

6. Admiral Markets

Admiral Markets is a globally recognized online trading broker known for its comprehensive range of financial instruments and user-friendly platforms. With a presence in over 40 countries, the company has built a strong reputation for providing a reliable and secure trading environment for both beginner and experienced traders.

One of the standout features of Admiral Markets is its extensive selection of trading instruments, including Forex, stocks, commodities, indices, and more. This variety allows traders to diversify their portfolios and explore different markets with ease. The broker offers competitive spreads and flexible leverage options, catering to various trading styles and strategies.

Admiral Markets is also praised for its robust platforms, particularly MetaTrader 4 and MetaTrader 5, which are equipped with advanced charting tools, technical indicators, and automated trading capabilities. These platforms are available on both desktop and mobile devices, ensuring seamless trading experiences across all devices.

The broker places a strong emphasis on education, providing a wealth of resources such as webinars, tutorials, and market analysis to help traders make informed decisions. Additionally, Admiral Markets is regulated by several reputable financial authorities, ensuring a high level of trust and transparency.

Overall, Admiral Markets stands out as a top-tier broker, offering a comprehensive trading experience supported by excellent customer service and innovative tools.

Your capital is at risk

7. Trade Nation

Trade Nation is a well-established stock broker known for its reliability and comprehensive range of services. As an FCA regulated broker, traders can trust that their investments are in safe hands. Trade Nation offers a diverse selection of trading options, including stocks, CFDs, spread betting, and forex trading. One of the standout features of Trade Nation is its commitment to providing low-cost fixed spreads, starting from an impressive 0.6 pips for CFDs, ensuring traders can navigate the markets without any surprise fees.

In addition to its impressive range of services, Trade Nation offers compatibility with popular trading platforms, including MetaTrader 4 (MT4) and TN Trader. MetaTrader 4 is renowned for its user-friendly interface and advanced charting capabilities. It is a preferred choice for many traders due to its extensive range of technical indicators, customizable charts, and automated trading options through Expert Advisors (EAs). With Trade Nation’s integration of MT4, traders can access a seamless trading experience with all the familiar features they rely on for their trading decisions.

Trade Nation has developed its proprietary trading platform, TN Trader, catering to traders who prefer a platform tailored to the broker’s offerings and user experience. TN Trader boasts a user-friendly interface and is equipped with a suite of tools, including advanced charting, analysis tools, and real-time market data. It is an excellent option for traders who prefer a platform specifically designed to complement Trade Nation’s services and trading conditions.

Trade Nation also provides regulated signals software that can be used to guide stock trading decisions. As well as this, users can also access a variety of educational resources and analysis tools that can be used to improve trading strategies and make informed stock trading decisions. Users can practice different strategies with the free demo account.

75% of retail investor accounts lose money when trading CFDs with this provider.

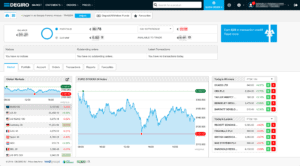

8. Degiro

Degiro

is a relatively new UK broker that offers access to a massive selection of global stocks. With this broker, you can buy and sell thousands of shares from the UK, US, Europe, Asia, and Africa. Degiro is particularly good if you want to invest in lesser-known supermarket stocks that aren’t available at other brokers.

Degiro only offers share dealing, not CFD trading. It’s not commission-free, but we think the broker’s fee structure is very competitive. Degiro charges £1.75 + 0.014% for UK shares and €0.50 + $0.004 per share for US shares. There are also more than 200 ETFs available completely commission-free.

This broker has a proprietary trading platform built for the web and mobile. It offers comprehensive charting with dozens of technical studies and drawing tools, as well as watchlists and advanced order options. One downside to the platform, though, is that it doesn’t include tools like a market news feed or an economic calendar. You also can’t set up price alerts using the mobile app.

Degiro is regulated in the Netherlands, but UK accounts are still protected by the Financial Services Compensation Scheme. This broker doesn’t have any deposit minimum or account fees. If you need help with your account, Degiro offers customer support 5 days a week by phone or email.

Stock Broker Minimum Deposit Fractional Shares? Pricing System Non-trading Fees Degiro $0 No Low commissions on stocks and ETFs None Your capital is at risk.

9. IUX.com

IUX.com is a forex broker designed to empower traders of all experience levels. They offer a comprehensive suite of trading tools, including a wide range of instruments, flexible account types, and the industry-standard MT5 platform. This combination allows you to tailor your trading experience and pursue opportunities across the forex market.

IUX.com boasts competitive spreads, a key factor for maximizing your profit potential. They also advertise high leverage, which can amplify gains (and losses) for experienced traders comfortable with calculated risks. The MT5 platform is a user-friendly and powerful tool, providing advanced charting functionalities and a robust set of technical indicators to help you make informed trading decisions.

IUX.com understands that every trader has unique needs. That’s why they offer a variety of account types, allowing you to select the option that best suits your capital and trading style. This level of flexibility ensures you can enter the market with confidence, knowing your account is set up for your specific goals.

If you’re looking for a forex broker that prioritizes your trading experience, IUX.com is definitely worth considering. Their diverse platform, competitive offerings, and focus on trader empowerment make them a compelling choice for those seeking to navigate the forex market.

Your capital is at risk.

10. Fineco Bank

Italian financial institution Fineco Bank recently entered the UK stock broker scene. It allows you to purchase and sell shares in a super-competitive manner at just £2.95 per trade. This is also the case for ETFs. If you’re looking to add some international shares to your portfolio, Fineco Bank gives you access to heaps of foreign markets.

Fineco Bank is also popular with UK investors as it allows you to get started with a small investment of £100. If you do feel comfortable investing on a DIY basis, Fineco Bank offers multiple research tools and ongoing market commentary.

When it comes to safety, Fineco Bank is heavily regulated. Your funds are protected by the FSCS and the broker holds that all-important FCA license

Commission Starting from £0 commission on FTSE100, US and EU Shares CFDs, market spread only and no additional markups. Deposit fee Free Withdrawal fee $0 Inactivity fee None Account fee None Minimum deposit £0 Stocks markets Access to 13 stock markets Tradable assets CFDs, Forex, Commodities, Stocks and ETFs, indices, mutual funds, bonds, options, futures, Available Trading Platforms Web-based trading platform, mobile trading app, desktop trading platform Your capital is at risk.

Conclusion

Supermarket stocks can be a good investment for anyone looking for a dividend-paying investment or a defensive investment that holds up during recessions. There are many changes happening in the grocery market right now, which could lead to major changes in the market shares and values of UK and US grocers over the next few years.

FAQs

Is Brexit expected to impact supermarket stocks in the UK?

Right now, analysts believe that Brexit will not have a big impact on UK supermarket stocks. Several companies saw their share prices rise on news of a Brexit deal in December, after being told to stockpile food in preparation for a no-deal exit from the EU.

Can I buy ALDI shares in the UK?

ALDI is a privately held company, so you cannot buy shares of this fast-growing discount broker.

What is the largest supermarket company in the UK?

Tesco is the largest supermarket chain in the UK, with 27% market share. Tesco has a market cap of over £24 billion.

Are any UK supermarkets offering delivery by drone?

Tesco is testing out a pilot program for home grocery delivery by drone. However, drone deliveries likely won’t be rolled out at scale until at least 2022.

What supermarket stocks pay dividends?

In the UK, Tesco, Sainsbury’s, and Morrisons offer dividends. Among US stocks, Walmart and Kroger offer dividends.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

On paper, Morrisons stock has a dividend yield of only around 3.8%. But in reality, this company pays out special dividends virtually every other year. If you include the special dividend that Morrisons announced in December last year, the company’s dividend yield is closer to 7.0% at the share price of 171p on the ex-dividend date.

On paper, Morrisons stock has a dividend yield of only around 3.8%. But in reality, this company pays out special dividends virtually every other year. If you include the special dividend that Morrisons announced in December last year, the company’s dividend yield is closer to 7.0% at the share price of 171p on the ex-dividend date. Kroger is a behemoth of a US supermarket chain, controlling 2,750 stores across the country along with 10% of the US grocery market (behind only Walmart). Kroger’s share price only rose 5% to $31.76 last year, which we think leaves this stock highly

Kroger is a behemoth of a US supermarket chain, controlling 2,750 stores across the country along with 10% of the US grocery market (behind only Walmart). Kroger’s share price only rose 5% to $31.76 last year, which we think leaves this stock highly

FP Markets is a highly regarded online forex and CFD broker known for its comprehensive trading solutions and customer-centric approach. Established in 2005, FP Markets has built a reputation for providing an extensive range of trading instruments, including forex, indices, commodities, and cryptocurrencies, which cater to a diverse range of trading preferences.

FP Markets is a highly regarded online forex and CFD broker known for its comprehensive trading solutions and customer-centric approach. Established in 2005, FP Markets has built a reputation for providing an extensive range of trading instruments, including forex, indices, commodities, and cryptocurrencies, which cater to a diverse range of trading preferences.

Italian financial institution Fineco Bank recently entered the UK stock broker scene. It allows you to purchase and sell shares in a super-competitive manner at just £2.95 per trade. This is also the case for ETFs. If you’re looking to add some international shares to your portfolio, Fineco Bank gives you access to heaps of foreign markets.

Italian financial institution Fineco Bank recently entered the UK stock broker scene. It allows you to purchase and sell shares in a super-competitive manner at just £2.95 per trade. This is also the case for ETFs. If you’re looking to add some international shares to your portfolio, Fineco Bank gives you access to heaps of foreign markets.