Best Blockchain Stocks UK To Watch

Blockchain technology forms the backbone of cryptocurrencies like Bitcoin and Ethereum. With blockchain, financial transactions can be recorded to a public digital ledger, enabling trustless decentralized transactions to take place online.

While you can invest in the future of blockchain by buying cryptocurrencies, this technology also has major implications outside of finance. In this guide, we’ll review 8 popular blockchain stocks you can invest in the UK and show you how to invest in blockchain stocks.

-

-

Popular Blockchain Stocks 2021

Blockchain technology has become so popular among investors that many companies claim an association with digital currencies. Here is a sneak peek of 8 popular blockchain stocks that you can look to invest in UK.

- NVIDIA

- Riot Blockchain

- AMD

- Visa

- IBM

- Marathon Patent Group

- Future Fintech Group

- BLOK

Popular Blockchain Stocks UK Reviewed

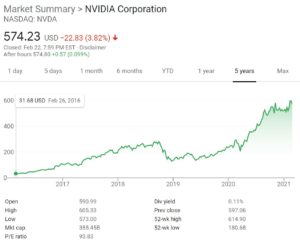

1. NVIDIA

NVIDIA (NVDA) is a classic picks-and-shovels play around the Bitcoin mining boom. NVIDIA makes the GPUs (graphics processing units) and other highly parallel processors that Bitcoin mining companies use.

In fact, NVIDIA has been one of the biggest winners from the emergence and growing popularity of cryptocurrencies. Over the past 5 years, the stock has gained an incredible 1,700%. Furthermore, in contrast to Bitcoin mining companies, NVIDIA’s share price doesn’t depend on the price of Bitcoin.

NVIDIA has been at the center of other enormous innovations, too. The company’s chips are widely used for Artificial Intelligence development as well as gaming. In addition, NVIDIA recently acquired ARM, a semiconductor manufacturer that licenses chip designs for a wide range of smartphone, auto, and other computing companies.

NVIDIA has a high P/E ratio of 93.8.

2. Riot Blockchain

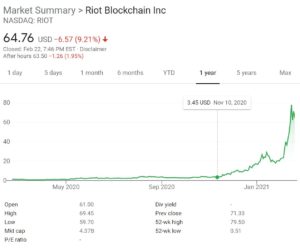

Riot Blockchain is a US-based cryptocurrency mining company that’s one of the biggest players in the industry.

Riot Blockchain recently deployed enough computing power to mine Bitcoin at a rate of 1 exahash per second – something very few cryptocurrency mining companies can claim. Furthermore, Riot Blockchain is in the process of getting more computers up and running. The company plans to more than triple its computing power by the end of the year.

The company’s share price has exploded over the past 6 months, since Riot Blockchain’s revenue is closely tied to the price of Bitcoin. When the price of Bitcoin rises, this mining firm makes more money – and investors pile into the stock.

Riot Blockchain shares are currently trading at over $64 a piece and the company has a market cap of $4.4 billion.

3. AMD

AMD is, much like NVIDIA, a semiconductor designer and manufacturer whose chips helped fuel the cryptocurrency boom. AMD’s GPUs (graphic processing units) are used by Bitcoin mining companies around the world and are essential equipment for any company that wants to operate a blockchain at high speeds.

AMD’s stock price reflects just how important the company has been to cryptocurrencies and blockchain technology. Since 2017, the stock is up over 4,000%. It trades with a P/E ratio of 41 – and a market cap of over $100 billion.

AMD is in the midst of developing a blockchain-based platform for gaming as well.

In addition, AMD is quickly gaining market share over Intel when it comes to cloud computing. However, make sure to track AMD’s future financial reportings and updates before investing in the stock.

4. Visa

The applicability of blockchain technology to fintech was obvious from the moment Bitcoin was launched. Despite this, banks, credit cards, and other financial service providers have been extremely slow to adopt blockchain or offer access to digital currencies.

Not Visa. This credit card company partnered with blockchain infrastructure company Chain in 2016, and soon after released Visa B2B Connect to enable businesses to make payments to one another using blockchain.

Since then, Visa has been busy linking its many credit and debit cards to popular Bitcoin wallets. For example, anyone who uses the Coinbase wallet and a Visa credit card can seamlessly exchange between cash and cryptocurrency.

5. IBM

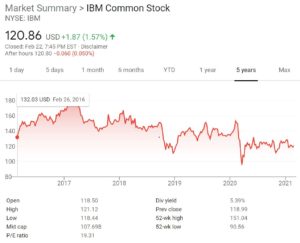

On first glance, IBM stock down 9% over the past 5 years and hasn’t had much involvement in the shift to blockchain technology or cryptocurrencies.

However, this company launched a blockchain team back in 2017, and today it has more than 500 projects in development. They include tools for logistics, healthcare, digital payments, and more.

Another thing to like about IBM is that this stock is at a relatively stable price with a decent P/E ratio of 19. In addition, IBM offers a dividend yield of 5.4%.

6. Marathon Patent Group

As recently as November last year, Marathon Patent Group (MARA) was a blockchain penny stock. However, over the past three months, the stock has soared from just $2.50 per share to nearly $50 per share – a nearly 1,900% increase. The stock has pulled back from its high, but only slightly.

Much of this rise can be attributed not to anything Marathon itself did, but rather to the explosion in the price of Bitcoin. That’s because Marathon is a cryptocurrency mining company – so the higher the price of Bitcoin rises, the more money that Marathon stands to make from its digital mining operation.

Marathon has a current market cap of $3.5 billion.

7. Future Fintech Group

Future Fintech is a popular blockchain startup company. This company makes eCommerce platforms built on blockchain, which is an interesting application in the growing Web3 sector. With Future Fintech’s technology, anyone could sell anything on a marketplace and the transaction would be secured with blockchain.

Future Fintech has released two new key reportings which may help the company’s future. First, the company’s eCommerce blockchain patents were approved in China. Second, the company finished building software that allows eCommerce sites to accept Bitcoin for payment.

Future Fintech has been one of the most volatile stocks to purchase, so make sure to plot out your investment strategy and only invest if you have a high-risk appetite. The shares traded at just $1.68 apiece at the beginning of the year before jumping to $7.62 in the span of 2 days. They jumped again, to $10.17, before falling back down to the current price of $7.29.

In addition, Future Fintech has been issuing shares to raise money. The company has come dangerously close to running out of free cash several times.

8. BLOK

BLOK ETF invests primarily in cryptocurrency mining stocks, including Riot Blockchain, Marathon Patent Group, Canaan Inc., and Microstrategy Inc.

The fund also invests in semiconductor companies like NVIDIA and AMD, plus major tech companies like Microsoft and Oracle. In all, the fund contains 55 stocks.

In the 3 years since this ETF was formed, it’s gained an impressive 101%. The ETF has an expense ratio of 0.70%.

The BLOK fund also changes over time. So, new blockchain companies are automatically added and underperforming companies are removed from the fund, without any work on your part.

Are Blockchain Stocks a Valuable Investment?

Blockchain is best thought of as a digital ledger. When you make a transaction, it’s combined with all the other transactions happening in the digital world and compiled into a ‘block.’ That block is then added to the existing blockchain, so your transaction – and all the others like it – are digitally recorded for all to see.

What makes blockchain so popular is that no single person or entity controls the ledgerbook. Making transactions doesn’t require trust between two parties, since the blockchain itself is beyond trustworthy and shows a perfect record of who has what assets. This is fundamentally different from how most modern transactions work, in which you need a middleman like a bank or a dealer to facilitate a transaction and provide the trust needed to make it happen.

Blockchain technology is one of the most transformational developments of the 21st century. The technology is still in its early days, but thousands of companies are already looking at ways that blockchain can alter the way they do business or even create new business models.

For example, blockchain could allow patient records to be transferred from one healthcare provider to another digitally, without any of the privacy or security issues that typically plague these transactions. This technology could also be used in logistics, to track when goods are sent and received.

How to Invest in Blockchain

Up until recently, the main ways to invest in blockchain all revolved around cryptocurrencies. You could either purchase digital currencies, all of which rely on blockchain technology or purchase stock in companies that mine them or provide the chips and computers to mine them.

At the same time, an increasing number of companies with well-established business models are working on blockchain applications. IBM, a technology giant, has over 500 blockchain projects in the works. Companies like Amazon, Salesforce, Microsoft, and Oracle are also working on blockchain technology, although they’re not quite as far along just yet.

While not all of these potential blockchain projects will come to fruition, it’s possible to invest in blockchain by investing in blue-chip stocks that have the resources to drive this technology forward.

However, users should make sure to carefully analyse and research every stock prior to making an investment.

Popular Blockchain Stock Brokers in the UK

In order to purchase blockchain stocks in the UK, you’ll need a stock broker. Ideally, your broker may offer a wide range of shares from the US and abroad – most blockchain stocks trade on the NYSE or NASDAQ stock exchanges, and they run the gamut from penny stocks to blue chip stocks.

In the sections below, we review some of the popular stock brokers that allow users to invest in blockchain stocks.

1. Fineco Bank

Fineco Bank

is an Italian broker that offers thousands of shares from the US, UK, and Europe. This broker’s wide selection also includes hundreds of ETFs, so users can quickly build a portfolio around blockchain and other emerging technologies.

Fineco Bank offers two ways to trade. You may purchase shares outright, which comes with a dealing commission of $3.95 for US shares. Alternatively, users can also trade stock CFDs with no commission.

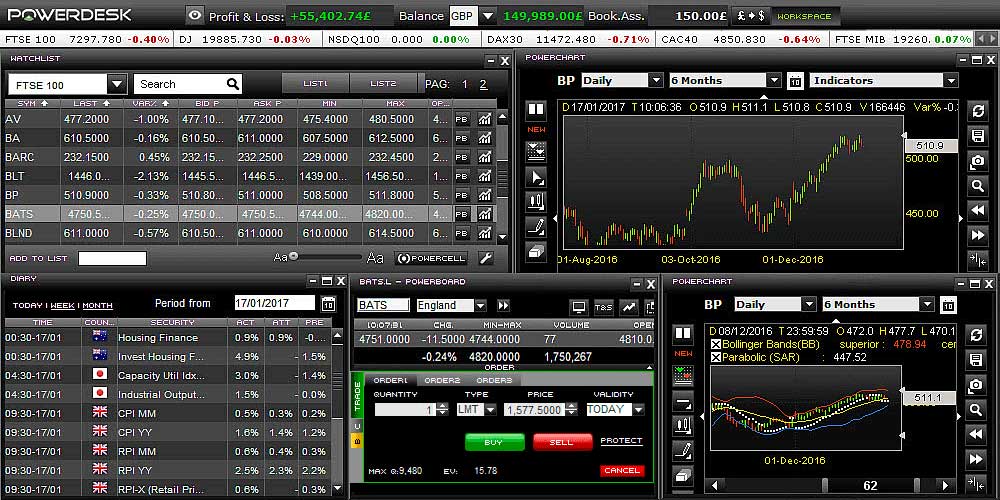

Fineco Bank offers a web-based trading platform as well as a mobile stock trading app. The web platform, called Powerdesk, is a highly versatile technical charting and analysis station. Users can access dozens of technical studies, drawing tools, a built-in news feed, and more.

The mobile app is less focused on technical analysis and more focused on monitoring your watchlists and placing trades. It’s streamlined design offers news and price alerts, but minimal charting and research tools.

Fineco Bank also has an built-in stock screener. You have the option to filter shares based on country, market cap, recent performance, market sector, and more. This is a smart way to find up-and-coming blockchain stocks that you might not otherwise hear about.

Fineco Bank is regulated by the Bank of Italy and the broker offers phone support 7 days a week.

Sponsored Ad. Your capital is at risk.

How to Purchase Blockchain Stocks in the UK

If you are interested in purchasing blockchain stocks in the UK, you may want to do so with a suitable stock broker that can provide you with the most suitable features that enhance your trading experience.

After choosing your preferred platform, here is how you can begin trading in blockchain stocks in 4 steps:

Step 1: Open Your Account

Head over to the homepage of your preferred broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Verification

Many popular brokers may require all users to verify their identities before trading. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit Your Funds

The next step is to deposit funds into your trading account. Choose a supported payment method that your broker provides – including credit/debit card options, e-wallets or online bank transfers.

After selecting your payment methods, insert the amount of funds you wish to deposit and confirm the transaction.

Step 4: Invest in Blockchain Stocks

Once your account has been funded, proceed to search for any blockchain stock you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

With so many blockchain shares to purchase, it can be hard to know which companies are really using this technology to its full potential and which are just scratching the surface. Users should make sure to assess a company’s financial performance and the stock’s history before making such an important decision.

Once you have picked your investment strategy, make sure to invest with a suitable broker of your choice.

FAQs

What is blockchain?

Blockchain is a digital ledger that stores information, such as information about financial transactions. A bunch of recent transactions are grouped into a ‘block,’ and then added to an existing blockchain to be recorded in the public digital record.

Is every tech company a blockchain company?

While some of the biggest names in the tech industry are also blockchain stocks, not every tech company is working on blockchain applications. Carefully vet companies to see how closely their business model is tied to advances in blockchain technology.

Are there other blockchain ETFs?

Other blockchain ETFs include the BLOK fund. Alternative blockchain ETFs include BLCN (Reality Shares Nasdaq NexGen Economy ETF), LEGR (First Trust Indxx Innovative Transaction & Process ETF), and KOIN (Innovation Shares NextGen Protocol ETF).

Can I buy Bitcoin to invest in blockchain?

Purchasing cryptocurrencies like Bitcoin is one way to invest in blockchain. You have the option to invest in Bitcoin with eToro, which is a full-service cryptocurrency exchange. However, cryptocurrencies represent just one application of blockchain’s future potential.

How much does the price of Bitcoin affect blockchain stocks?

Bitcoin has an outsized impact on the price of some blockchain shares, such as Bitcoin mining companies. However, Bitcoin’s price won’t impact companies that make semiconductors or traditional financial companies that are incorporating blockchain into their businesses.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael Graw

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

In fact, NVIDIA has been one of the biggest winners from the emergence and growing popularity of

In fact, NVIDIA has been one of the biggest winners from the emergence and growing popularity of