Can You Get Rich By Trading Forex? The Ultimate Guide to Profitable FX Trading

The internet is jam-packed with so-called ‘forex experts’ that claim to have made millions from buying and selling currency pairs. As such, fast cars and bundles of cash seem to synonyms with the FX space. But, these claims are rarely the reality.

With that being said, it is entirely possible to make a full-time living by trading forex. In order to do this, you need to have a firm grasp of how the industry works, which can take time.

In this guide, we explore whether or not it is possible to get rich by trading forex. We teach you everything you need to know to be successful in the currency arena and, crucially, what steps you need to take to ensure you are able to trade in a risk-averse manner.

-

-

Choose an Online Forex Broker

Before we get to the specifics of making money, you first need to choose an online forex broker that will allow you to meet your trading goals. There are hundreds of such brokers active in the space, so you need to do some homework.

Some of the most important factors that you need to look out for are as follows:

- Regulation: You will be trusting your chosen broker with your hard-earned cash. As a result, you must ensure that the platform is regulated by a tier-one licensing body. If you’re based in the UK, this should be with the Financial Conduct Authorty (FCA). This comes with several regulatory protections – such as ensuring the broker keeps client funds in segregated bank accounts.

- Fees and Commissions: You also need to check what fees your chosen broker charges. After all, forex trading platforms are in the business of making money. This is why you should consider using a commission-free broker. In doing so, the only fees that you need to look out for are the spread and overnight financing.

- Tradable Pairs: As we cover in more detail later on, there are dozens of currency pairs that you can trade. Most brokers will give you access to major and minor pairs – as these are the most traded. You might also have access to exotic pairs. These are pairs that contain a currency from an emerging market. Either way, check what pairs are supported before signing up.

- Payments: One way to get money into the platform is via a debit/credit card or e-wallet, as the payment will be processed instantly. Most platforms also support UK bank transfers, albeit, this usually takes a few days to process.

There are many other factors that you need to consider before choosing an online forex broker. Nevertheless, taking into account just how time-consuming it can be to pick a platform that meets your needs, below you will find the most popular UK forex brokers of 2020.

Learn the Basics

Once you have you chosen a forex broker that meets your needs, the next step is to spend some time learning the basics. As such, the following sections will explain the fundamentals of buying and selling currencies with the view of making money.

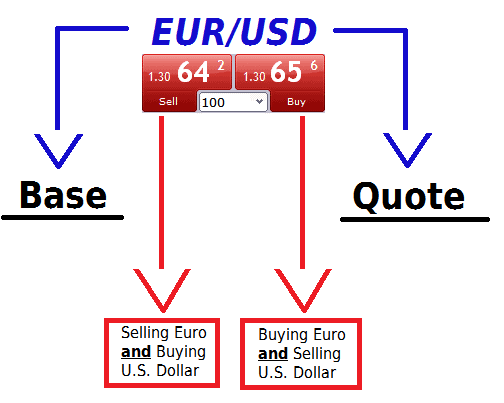

Currency Pairs

First and foremost, let’s start with currency pairs. As the name suggests, a forex pair will consist of two currencies. Each pair will have an exchange rate, which will change on a second-by-second as per market demand and supply. A basic example of this is GBP/USD.

This particular pair consists of the British pound against the US dollar. If the exchange rate (commonly referred to as the ‘price’) of the pair was 1.31, then you would need to speculate whether you think this will increase or decrease in the short-term. More on this later.

As we briefly covered earlier, there are three types of currency pairs that you will find at an online forex broker – majors, minors, and exotics.

- Majors: Major pairs consist of the most traded currencies in the world. Crucially, major pairs will always contain the US dollar, not least because it is the reserve currency of the world. The dollar will then be paired against another major currency – such as the British pound, Euro, Japanese yen, or Australian dollar.

- Minors: Minor pairs are also heavily traded in the forex scene, and always contain two major currencies. However, the key difference is that minors will not contain the US dollar. Some examples of minor pairs include GBP/EUR, EUR/AUD, and AUD/NZD.

- Exotics: Most forex brokers will also give you access to exotics. This will always contain one currency from an emerging market, such as Kenya, Mexico, or Indonesia. Alongside it will be a major currency, such as the US dollar or Japanese yen. Take note, exotic pairs are much more volatile than majors and minors, and typically come with much wider spreads.

As a side tip, we would suggest avoiding exotic pairs if you are just starting out in the world of forex trading. In doing so, you’ll benefit from stable market conditions, tighter spreads, and more consistent trends.

Buy and Sell Orders

Once you have decided which currency pair you wish to trade, you then need to determine which way you think the markets will go. By this, we mean whether you think the price of the pair will increase or decrease. This can be achieved by choosing between a ‘buy’ or ‘sell’ order.

For example, let’s suppose that you are trading AUD/USD, which is priced at 0.75.

- If you think that the price of USD/AUD will increase, then you will need to place a buy order

- If you think that the price of USD/AUD will decrease, then you will need to place a sell order

Once your order has been placed, it will remain active until you exit the position. In order to do this, you need to place the opposite order to the one in which you initially placed. For example, if you placed a buy order, then a sell order will close the position (and visa-versa).

Market and Limit Orders

Leading on from the above section on buy and sell orders, you will also need to choose from a ‘market’ or ‘limit’ order. Put simply, this dictates which price you enter the market at.

- A market order will simply execute your buy/sell order at the next available price. As exchange rates change in value on a second-by-second basis, you will likely get a price just above or below the current price.

- A limit order allows you to select the exact price that your order is matched at. For example, if GBP/USD is at 1.27, you might not want to enter the market until it hits 1.28. Limit orders remain pending until your specified price is matched by the markets.

Seasoned traders will almost always opt for a limit order. This is because they can enter the trade at a specific entry price. The only exception to this rule is if the trader spots an opportunity that needs to be actioned immediately.

Pips

In terms of calculating your profits and losses, you will need to have a firm understanding of how forex ‘pips’ work. In its most basic form, every time a currency exchange rate moves, the size of the movement is determined in pips.

In the examples we have given so far, we have limited our prices to two decimal points. For example, GBP/USD at 1.27 and AUD/USD at 0.75. However, forex pairs are actually priced with four numbers after the decimal point. This means that GBP/USD might look like 1.2708 and AUD/USD at 0.7585.

Here’s a clearer example so that you can see why calculating pips is so important when trading forex.

- Let’s suppose that you are trading EUR/GBP

- The pair is currently priced at 1.1792

- A few hours later, EUR/GBP is priced at 1.1772

- This means that the price of the pair is 20 pips lower

- As such, your profit or loss is calculated by multiplying your stake ‘per pip’ against 20

- So, at £1 per pip, you would have either made £20 or lost £20

It is important to note that pairs containing the Japanese yen will only have two numbers after the decimal, as opposed to four.

Spread

You should also have a firm understanding of how the spread works, as this will have a direct impact on how much you are able to make from your forex trades. In the examples we have given so far, we have only displayed one price for each currency pair.

However, forex brokers will always display two prices. The difference between the two prices – which is also calculated in pips, is the spread. The spread ensures that the broker always makes money – regardless of how the markets move.

Here’s a basic example of how the spread works.

- You are trading USD/CHF

- The buy price is 0.9117

- The sell price is 0.9116

- This means that the spread is 1 pip

Now, the size of the spread is what you need to make just to break even. In other words, as soon as your buy or sell position is placed, you would instantly be 1 pip in the red. As such, only the gains above 1 pip will amount to your profit. You also need to factor in the spread when you exit your position.

Focus on Bankroll Management and Targets

In the world of forex trading, bankroll management is potentially one of the most important things that you need to master. In simple terms, this refers to the amount of capital that you have available for trading. It also refers to the amount of risk that you take in relation to your trading capital.

Before we go any further, it is important to remember that your chosen forex broker will have a minimum deposit amount in place.

Maximum Trade Size

Your first port of call when creating a bankroll management strategy is to think about trade size limits. This should always be viewed in percentage terms, as opposed to pounds and pence. The general rule of thumb in this respect is to never stake more than 1% of your current bankroll.

For example:

- Let’s suppose that you deposit £1,000 into your forex trading account

- If you follow the 1% rule, this means that you should not risk more than £10 per trade

But, your account balance will, of course, go up and down as you place trades. As such, we would suggest re-visiting your maximum trade size at the end of each week. So, if you managed to build your capital up to £1,200 by the end of week one, your new maximum trade size, at 1%, would be £12.

This will ensure that you are able to constantly grow your bankroll. At the same time, it will ensure that you do not risk too much in the even you have a bad week.

Leverage

Make no mistake about – staking £10-£12 per forex trade is not going to make you rich. In fact, you would barely be able to make a part-time living, let alone generate enough income to supplement your current lifestyle. In other words, if you made 3% on a trade at a stake of £10, you would make just 30p.

This is why many forex traders will utilize leverage. For those unaware, leverage is offered by most brokerage sites and it allows you to trade with more money than you have in your account. The more leverage you apply, the more your profits and losses will be being amplified by.

In the UK, retail traders are governed by the rules imposed by ESMA. This means that you will not be able to apply leverage at more than 1:30 when trading major pairs, and 1:20 on minors and exotics. As noted earlier, these limits are significantly higher if you are deemed to be a professional trader.

Nevertheless, here’s an example of how leverage works.

- Let’s say that you are trading GBP/USD – which is currently priced at 1.2760

- You have £500 in your trading account

- You decide to place a buy order with leverage of 1:30

- A few hours later, GBP/USD is priced at 1.2887

- This means that the price has increased by 1%, so you decide to cash out your gains by placing a sell order

Ordinarily, on a stake of £500, you would have made just £5 profit (1% of £500). However, you applied leverage of 1:30, meaning that your gains are multiplied by 30x. As such, you actually made a profit of £150 (£5 x 30).

Of course, there is always the risk that your leveraged order will result in a loss. If you actually lost 1% from the above trade, your total losses would have amounted to £150. This is why you need to be extremely careful when applying leverage. Sure, it can amplify your profits by up to 30x, but it can also do the same for your losses.

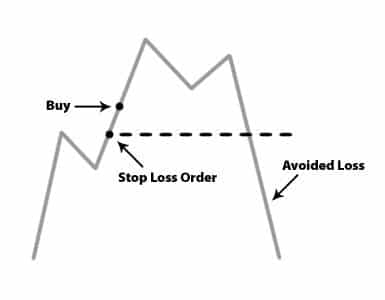

Stop-Loss Orders

At this point in our guide, you should have a firm understanding of both buy/sell and market/limit orders. We now need to explain the importance of stop-loss and take-profit orders, and how this relates to bankroll management. So, and as the same suggests, a stop-loss order allows you to exit a position when you are in the red by a certain amount.

For example, let’s say you are looking to trade AUD/NZD, but you don’t want to risk more than 1% of your bankroll. In order to achieve this, you simply need to state this in your stop-loss order. If the price that you specify in the stop-loss order is matched by the markets, then your position will be closed automatically.

Let’s look at how this would work in practice.

- You place a buy order on AUD/NZD at 1.1060

- A 1% loss would take you to 1.0950, so this is what we set our stop-loss order at

- Over the course of the next few hours, the price of AUD/NZD begins to tank. This is bad news for you, as you have placed a buy order

- By the end of the trading day, AUD/NZD is down by 3%

- However, your stop-loss order was activated at 1.0950, meaning you only lost 1%

Crucially, had you not set-up a stop-loss order, you would have lost 3% of your trading capital.

Take-Profit Orders

On top of minimizing your losses, you also need to have clear profit targets in mind. To achieve this, the most popular forex traders active in the space will always have a take-profit order in place. This works in exactly the same way as the previously discussed stop-loss order, but in reverse.

For example, you might decide that you want to make 3% on your AUD/NZD trade.

All you need to do in this example is to calculate what a 3% profit-target amounts to in terms of pricing. If and when the respective price is matched by the markets, your chosen forex broker will automatically exit the position and thus – you’ll lock in your gains.

Choosing a Forex Trading Strategy

Just like with stock trading, once you are comfortable with the basics, you then need to start thinking about strategy. That is to say, you will not make money in the forex space unless you have at least one trading strategy in place. This will ensure that you have a clear objective when you open a trade, as opposed to ‘hoping for the best’.

There are many strategies utilized by seasoned traders. While some will suffice for your trading objectives, others won’t. With this in mind, below we discuss some of the most common forex strategies used in the space.

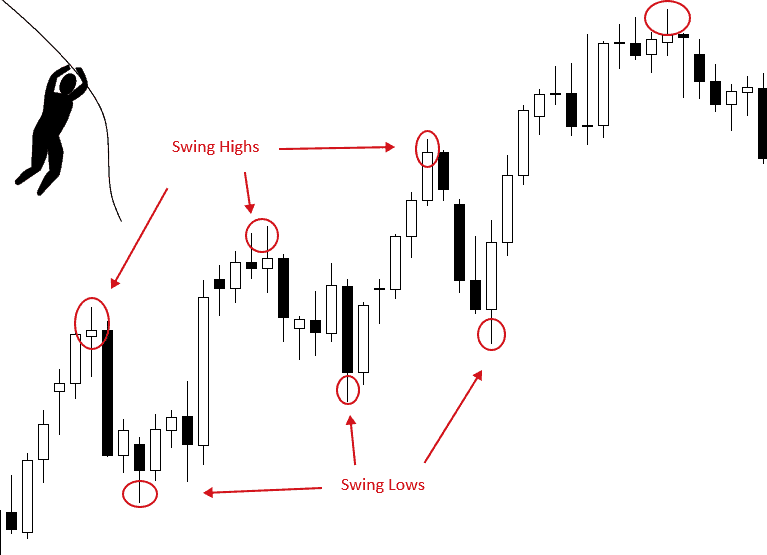

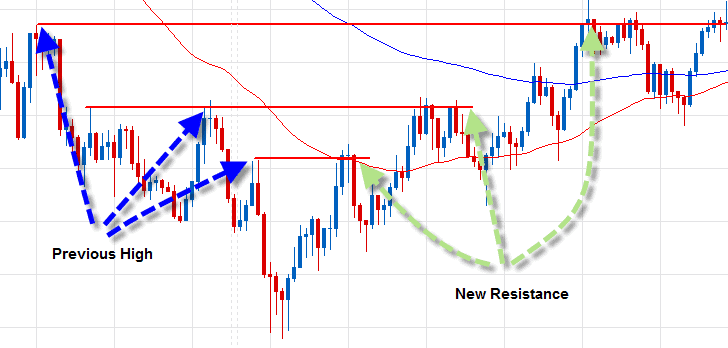

Swing Trading

Swing trading is likely to be an option for you if you are just starting out in the world of forex. In its most basic form, swing trading is a short-term strategy that gives you an element of flexibility. That is to say, while swing traders might keep a position open for just a day or two, equally, they have no issues keeping a position open for weeks or months.

Crucially, this allows you to follow the trend. For example, on the announcement that the UK population had voted to leave the European Union in 2016, GBP/USD went on a prolonged downward spiral.

A seasoned swing trader would have likely shorted the pair for a number of months and thus – made some healthy profits along the way. However, the very same swing trader likely would have placed a buy order when GBP/USD begun to recover from its lows.

Day Trading

Unlike swing trading, day trading offers virtually no flexibility in terms of trade duration. This is because – and as the name suggests, day traders will rarely keep a position open overnight. Instead, traders will keep a position open for a matter of hours or minutes.

On the one hand, this does mean that potential profit margins are going to be much thinner. To counter this, day traders will typically place dozens of traders per week – many of which will have leverage applied. Furthermore, as day traders typically close open positions before the end of the trading day, this allows them to avoid overnight financing fees.

Scalping Trading

Scalping trading can be a profitable strategy to utilize when buying and selling forex pairs. However, it is a strategy that can take many months to master, not least because it is somewhat sophisticated. In its most basic form, scalping attempts to profit from small price movements that occur through the trading day.

In order to capitalize from this, the trader might place dozens, if not hundreds of individual orders in the space of a few hours. In doing so, the trader will hope to ‘scalp’ ultra-small profit margins every time a currency pair moves within a specific range. Although scalping is a lot more advanced than swing or day trading, it is also considered a low-risk strategy.

This is because the trader will set up sensible stop-loss and take-profit orders to ensure that risks are minimal. Crucially, although profit targets will be micro-small, this can build up very quickly when you consider just how many positions a scalper will enter throughout the day.

Demo Accounts

As we have discussed, it can take a considerable amount of time before you begin making money from your chosen forex trading strategy. In the meantime, you stand the very real chance of losing money. This is why we would suggest choosing an online forex broker that offers a demo account facility.

Consider Automated Trading or Forex Signals

Make no mistake about it – learning the ins and outs of a forex strategy and then making consistent profits requires a significant amount of dedication. This is why most newbie forex traders end up losing interest, or worse – burning there entire bankroll.

Although the best course of action is to continue building your currency trading knowledge, a number of alternative options are available for those of you that don’t have the time or patience to study.

This includes:

Automated Trading

As the name suggests, automated trading allows you to buy and sell currency pairs without doing any of the work. This typically comes in one of two forms – copy trading or expert advisors (EAs).

Copy Trading

Copy trading allows you to copy an experienced forex trader like-for-like. That is to say, every time your chosen forex trader places a buy or sell order, the position will be reflected in your trading account.

You get to do some homework on your chosen trader, by looking at metrics such as average monthly returns, trade sizes, trade duration, and preferred currency pairs.

Once you have selected a trader, you then get to specify your stakes. After all, you likely won’t want to stake the same amount as an experienced investor. Instead, you’ll want to risk an amount proportionate to your bankroll.

For example:

- Let’s suppose that you decide to invest £1,000 into the copy trader

- The trader has a bankroll of £100,000

- They enter a £10,000 buy position on USD/JPY, which amounts to 10% of their bankroll

- As your total investment amounts to £1,000, 10% of this would be allocated to the USD/JPY position

- This means that you would be staking a total of £100 on the trade

Forex EAs and Robots

Forex EAs – otherwise referred to as forex robots, also allow you to buy and sell currency pairs in an automated manner. The process is slightly different from that of copy trading, as you won’t benefit from a human trader. Instead, you will be allowing a pre-built algorithm to trade for you.

The underlying software will have a strict set of criteria that it is instructed to follow, and it will scan the markets on a 24/7 basis. Forex EAs and robots do not suffer from emotions or fatigue, unlike human traders.

Once you have found a forex EA that you like the look of, you will be required to download the respective file to your desktop device. Then, you will need to upload the file into a third-party trading platform like MT4 or MT5. The platform needs to be supported by your chosen broker.

Forex Signals

An additional option that you might want to consider if you don’t have the required time or knowledge to perform research is that of a forex signal service. Put simply, your chosen provider will send you trading suggestions in real-time. The signal will tell you what pair the suggestion relates to, and whether you need to place a buy or sell order.

Conclusion

If trading forex and getting rich along the way was simple, we would all be doing it. Unfortunately, things are not that simple. There are heaps of investors out there that make a full-time living by trading currencies.

The traders in question will have no-doubt dedicated a serious amount of time learning their trader – so we hope our guide has helped point you in the right direction. Alternatively, you might also consider an automated EA system or copy trading feature.

FAQs

Is forex trading easy?

Forex trading is anything but easy. On the contrary, it takes many months – if not years to master. This is why so many traders either fail or give up.

How much can you make trading forex?

There really is no hard and fast answer to this question, not least because there are just too many variables in play. Crucially, the amount you make will be determined the number of successful trades you place, the size of your profit margins, and how much you stake.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

Make no mistake about – staking £10-£12 per forex trade is not going to make you rich. In fact, you would barely be able to make a part-time living, let alone generate enough income to supplement your current lifestyle. In other words, if you made 3% on a trade at a stake of £10, you would make just 30p.

Make no mistake about – staking £10-£12 per forex trade is not going to make you rich. In fact, you would barely be able to make a part-time living, let alone generate enough income to supplement your current lifestyle. In other words, if you made 3% on a trade at a stake of £10, you would make just 30p.