Main Project inside Telegram: TedefiBot

Main Website: Tedefi.com

Two months in, and TEFI token has risen 400% since its initial price $0.02. Some might say, that it was not the best time for a platform launch, since it was followed by a major market correction, however, Tedefi platform managed to gradually increase media coverage and keep up with its roadmap, providing weekly updates to the Tedefi Telegram Exchange bot, thus showing remarkable resistance toward the downward pressure of the market, and soared 150% in the last 30 days only.

Long Term strategy

Tedefi platform strives to present the first blockchain for Telegram dApps. Tedefi Exchange bot is a proof of concept running a PoSA chain forked from BSC in the background with Oracles that connect the chain to the Telegram API. Currently, the chain explorer and developer tools are not public since the development of the Oracles is still full ongoing, leveraging the relationship with the Telegram API to cover all the functionalities and make it as versatile as possible, to allow developers the freedom to create NFT Marketplaces, Play-to-Earn games, Exchanges, auctions and much more dApps on Telegram.

To keep the community supporting the platform and the TEFI price in a strong upward trend until the mainnet public announcement event, Tedefi Exchange receives regular updates and media coverage alongside them.

The latest updates are:

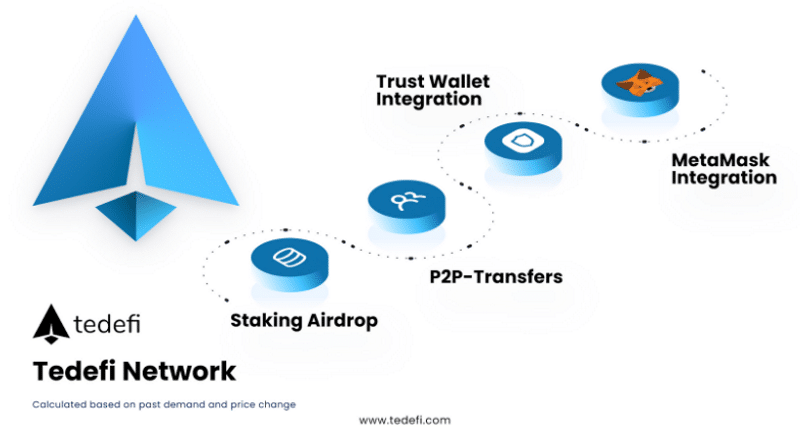

- P2P Transfers inside Telegram between Tedefi users.

- Metamask and Trustwallet integration

- SHIB Token added as a payment method

- Referral Program and Bounty Airdrop

And now Tedefi decided to reward their users win a rather generous Staking program.

Staking v1

To incentivize the long-term support from our community on our road to developing the first Blockchain for Telegram dApps, Tedefi allocated 11,284,000 TEFI to reward our users for staking their tokens, therefore allowing the value of TEFI to grow, attracting new people to the Tedefi platform.

Staking v1 is limited in time until the migration event of TEFI Tokens from BSC network to Tedefi network. The migration event is expected in Q2 of 2022, with the exact date being announced in the middle of Q1 2022. With the launch of the migration event, all the v1 stakings will be stopped and rewarded, with the further possibility to restake tokens to Staking v2.

Since TEFI price is directly impacted by demand and supply, the best strategy for constant community growth is the gradual increase of the demand of the token.

The main external factor of keeping the demand higher is media coverage, which has to be strategically planned to avoid high volatility which creates uncertainty and distrust of the users in the platform, therefore a marketing plan should be laid in correlation to the roadmap and network updates.

Internal factors to keep the price in an upward trend are staking, burning tokens to create scarcity, locked liquidity pools, trading contests, and constant updates to the system. To incentivize users to support TEFI growth until the migration event and release of the Tedefi Network to the public, Tedefi decided to allocate 11,284,000 TEFI as rewards for staking.

Locking the TEFI will reduce the downward price pressure, attracting new users to the platform until the Tedefi Chain will go live. As soon as Tedefi chain will go live, Staking v1 will be replaced, Staking v2 and developer tools will be provided, token deployment available for the public, and vast media coverage is will take place. TEFI token will be used as fuel for all the newly created dApps, for exchange fees discount, governance power, and staking, which will increase its intrinsic value.

How is APY Formed?

The allocated 11,284,000 TEFI will be proportionally spread across stakers, and APY will be recalculated for each 5,000,000 TEFI Staked, but limited to 289/367/512% for 30/60/90 days periods respectively, giving benefit to early stakers. Closer to the end date, 90 and 60 days periods will be removed and APY adjusted accordingly. If the pool will not be used in full amount, the remaining TEFI will be transferred to Staking v2 pool.

Conclusion

Tedefi Network is a very promising platform, given the growth speed of Telegram, and other IMs such as WhatsApp trying to catch up to crypto world adding cryptocurrency payments inside the app, next year we should expect a shift of dApps and Exchanges inside IM apps. Telegram however has an edge, providing an API to create Bots, which have vast possibilities, from Games to full-on Exchanges inside Telegram.

Staking v1 is a great way to reward the early Tedefi adopters for showing support on this path to becoming the first blockchain to allow dApps creation inside Telegram! Don’t miss it out!

Main Project inside Telegram: TedefiBot

Main Website: Tedefi.com

Question & Answers (0)