Best Spread Betting Strategies UK

Spread betting allows you to go long or short on your chosen financial instrument, benefit from 0% commissions, apply leverage, and most of all – none of your profits will be liable for capital gains tax. With that said, spread betting instruments are complex financial derivatives – so it’s crucial that you have a number of strategies in place before taking the plunge.

In this guide, we discuss some of the popular spread betting strategies utilized by seasoned traders that are successful in this financial sector.

Popular Spread Betting Strategies UK List

Below you will find a breakdown of the popular spread betting strategies UK. By scrolling down, you will see that we explain each strategy in great detail.

- Support and Resistance Levels: Find out where the spread betting asset finds support and resistance and enter positions accordingly

- Hedging: Valuable for covering potential losses if a market movement is unfavorable for your portfolio

- Market Corrections: This will see you capitalize on a spread betting instrument that goes through a temporary market correction

- Consolidation Period: Make the most of periods then an asset trades within a tight range

- Trade the News: This strategy will see you place spread betting positions when an important financial news development is announced

- Spread Betting Signals: Signals are trading suggestions that tell you what spread betting positions to place in real-time

78% of account lose money money when trading CFDs with this broker.

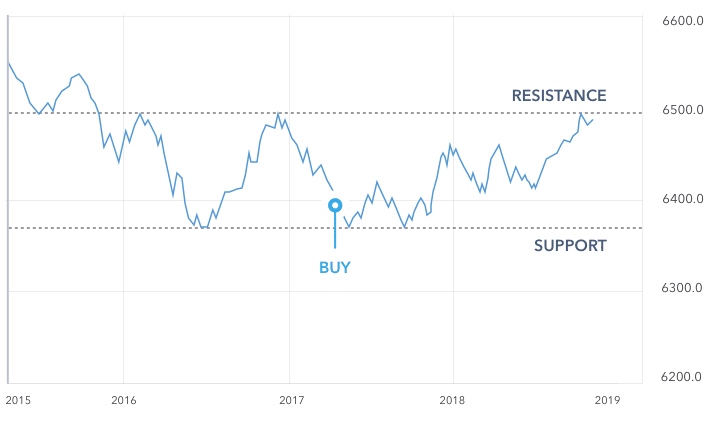

Support and Resistance Levels

Perhaps a popular spread betting strategy to begin with is to spend some time identifying the various support and resistance levels on your chosen market. In its most basic form, these are pricing levels that have traditionally gained ‘support’ from the global markets – or acted as ‘resistance’.

An example of a support level:

- Let’s suppose that you are spread betting crude oil – which is currently priced at $56 per barrel

- On several occasions over the past few weeks – the price of oil has not fallen below $50 per barrel

- In fact, on each occasion falling oil prices approached the $50 level – the trend reversed upwards

- As such, a major support level on oil can be identified at $50

An example of a resistance level:

- We’ll be sticking with the same oil trading example as above – which is priced at $56 per barrel

- On several occasions, oil has inched towards a pricing level of $60

- But, oil has failed to break past this level – subsequently dropping back down on each attempt

- As such, a major resistance level on oil can be identified at $60

The above examples are simplistic – but explain how support and resistance levels can be identified nonetheless. There will be a number of such levels at different price zones – some stronger than others. But, once you have identified where these levels are based – you can then place a series of risk-averse spread betting positions.

Let’s elaborate on the above examples to show how seasoned traders might look to profit from identified support and resistance levels.

- To reiterate, a support and resistance level on crude oil has been identified at $50 and $60 respectively

- At the time of writing – oil is trading at $56 per barrel

- The first trade that should be placed is a long position just above the resistance level. This could, for example, be entered at $61 to ensure the breakout is valid

- The second trade could be placed just below the support level – say at $49.

Now, if oil manages to smash through the resistance level of $60 – your long spread betting trade will be openeded at $61. In theory, if this does happen – there is every likelihood that oil will go on a prolonged upward trend.

On the other hand, if oil falls down below the support level of $50 – your short spread betting trade will be opened at $49.

Hedging

Hedging is a strategy that all seasoned traders will deploy at some point in time – as it allows the individual to ‘hedge’ against an unfavorable market movement. In simple terms, hedging will see you place an opposite trade to the one you currently have in the market.

There is no better way of doing this than to use a commission-free spread betting broker – as a hedging strategy can be executed quickly, easily, and in a cost-effective way.

To help clear the mist, let’s look at a scenario where you might consider a hedging spread betting strategy.

- You currently have an open position on gold – where you are long on the precious metal

- Although gold has enjoyed a fine run of form in recent months – it will soon be approaching all-time highs

- This might see investors offload their gold positions as a means to cash out their profits

- If this does happen, this will negatively impact the price of gold and thus – the value of your investment

Now, at this stage of your hypothesis – it should be noted that there is no guarantee that gold will [A] surpass its prior all-time price or [B] result in a sell-off should the all-time price be breached. But, as a shrewd investor – it’s valuable to have a trading plan in place to cover you in the event that your hypothesis is correct.

78% of account lose money money when trading CFDs with this broker.

Let’s explore what outcomes might come to fruition once we decide to hedge our open gold position.

- Let’s say gold is currently priced at $2,000 per ounce and that its prior all-time high is $2,100 per ounce

- This means that should gold surpass $2,100 – it will be worth more than any time in history

You decide to hedge your open position by placing a short order at your chosen spread betting platform

- Let’s say that a few weeks later – gold hits some resistance and has since dropped by 10%. This means that the value of your gold portfolio has dropped by 10%. But, the value of the short position you placed at your spread betting broker has increased by 10%. As such, the end result is break-even – meaning your overall portfolio value has not declined.

- Alternatively, let’s say that gold continues to rise – and is now worth 20% more. Your original long position on gold will also be worth 20% more. You will, however, have lost 20% on your short spread betting position. Again, the end result is break even.

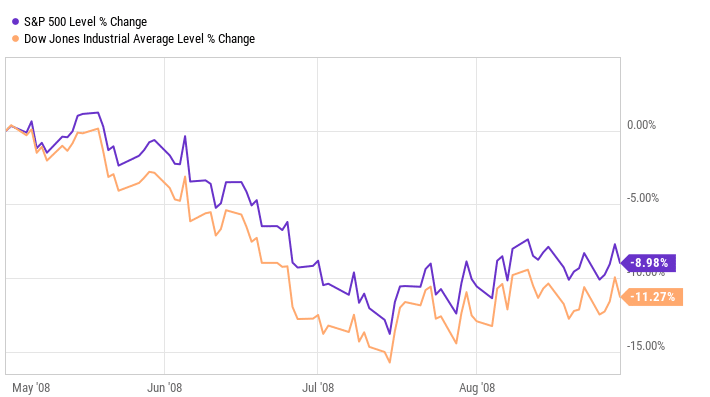

Market Corrections

Market corrections are something that all asset classes and financial instruments encounter at some point. In its most basic form, a market correction is a ‘temporary’ trend reversal.

It’s temporary, as in most cases a short-term trend reversal happens when investors decide to cash out a profitable position. Once the temporary dip is over, the trend will once again resume in its upward or downward direction.

For example:

- Let’s say that over the past 60 days – Tesla stocks have increased by over 90%

- This has resulted in Tesla hitting a share price of $650

- There is no reason to believe that the trend will end any time soon – albeit, the stocks have dropped to $630 over the past couple of days

- This is a market correction – as the trend has since resumed and Tesla stocks are now priced at $680

In another example:

- Let’s say that BP stocks have declined by 30% over the last two months due to a major decrease in global oil demand

- This week, BP stocks finished 5% higher

- This is a market correction – as the price increase is due to short-sellers cashing out their position

- Next week, the downward trend continues and BP stocks continue to lose value

The key point here is that if you are able to identify a market correction, this allows you to enter a position at a discounted price. For example, we noted that Tesla stocks were enjoying an upward trend and subsequently hit a price of $650 before it dropped to $630. Had you entered a long position in and around the $630 mark – you would have bought the drip.

That is to say, once the market correction was over and the upward trend resumed – your long trading would be in profit. The same is true for a downward trend that enters a market correction. Only this time, you would enter a short position at a higher price – allowing you to profit once the downward trend resumes.

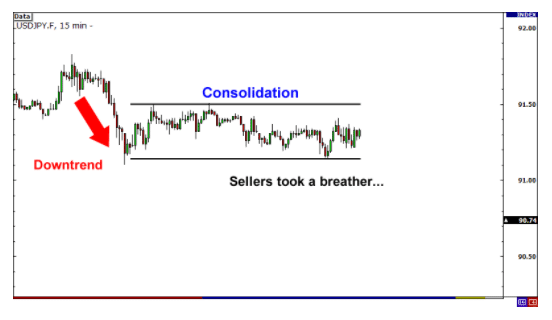

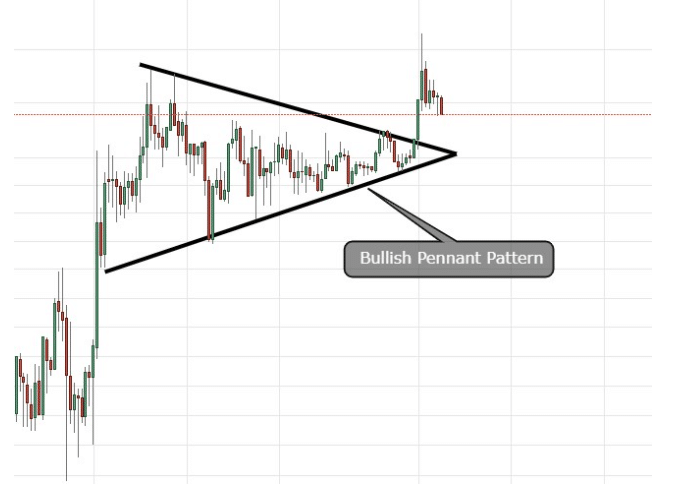

Consolidation Period

When a financial asset enters a ‘consolidation period’ – this means that it trades within a tight range for a prolonged period of time. For example, let’s say that the FTSE 100 index has traded in a range of 6,800 points and 6,900 points for a period of 15 days.

This means that during this period, the FTSE 100 index has not fallen below 6,800 points – nor has it surpassed 6,900 points. This is most definitely a consolidation period – as the FTSE 100 has traded in a range of just 1.47% for over two weeks.

In this scenario – we would look to place to initial FTSE 100 spread betting position:

- We would place a ‘long’ position just above the lower end of the range – for example, 6,820 points

- We would then place a ‘short’ position just below the upper end of the range – for example, 6,880 points

Crucially, for as long as the identified consolidation period remains in place – we will continue to make gains.

For example:

- When the FTSE 100 approaches the upper end of the range but then bounces back down – our short position will make money.

- Similarly, when the FTSE 100 approaches the lower end of the range but bounces northwards – our long position will make money.

With that said, we can go one step further with this spread betting strategy by deploying a couple of risk-management orders. After all, the identified consolidation period will not remain in place forever. On the contrary, at some point, the FTSE 100 will either break above the upper range of 6,900 or below the lower range of 6,800.

When this does happen, the break out is likely to be quite parabolic. This means that the FTSE 100 will either drop below 6,800 or above 6,900 very quickly. If and when it does, your open spread betting positions are at high risk of financial loss.

For example:

- To protect your short position – you should place a stop-loss order just above 6,900 points. This means that a bullish breakout is protected – as your chosen spread betting platform will close your short position when your stop-loss price is reached.

- Then, it’s just a case of doing the opposite at the lower end of the range of to protect your long position. As such, you would place a stop-loss order just below 6,800 points.

In order to make the most of this spread betting strategy – it is imperative that you use a broker that offers zero-commission trading and tight spreads. This is because you will be target very small margins.

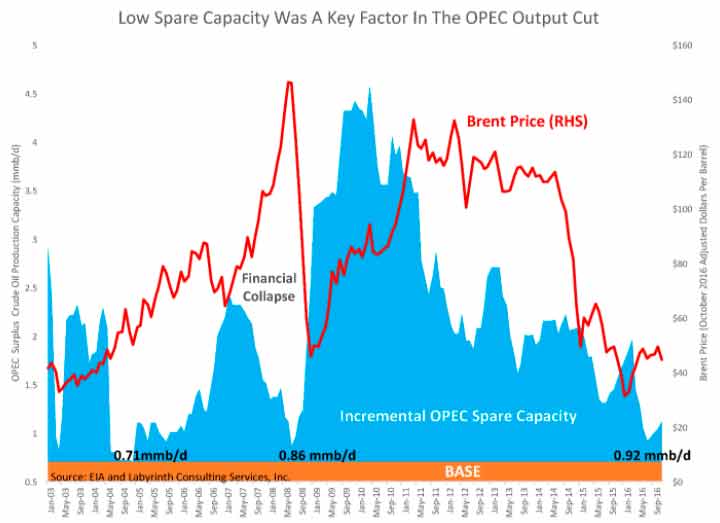

Trade the News

If you are a complete trading novice – perhaps one of the popular spread betting strategies to start with, is to simply trade on the back of a major news development. After all, the value of an asset – irrespective of whether that’s a stock, currency, or commodity – is directly impacted when a new piece of information is released to the markets. This can, of course, go both ways in terms of whether the news story is positive or negative.

An example of a possible news story impacting the value of an asset:

- Let’s say that oil is currently priced at $35 per barrel

- A news story breaks announcing that OPEC (Organization of the Petroleum Exporting Countries) has decided to cut oil production levels by 20%

- In turn, this will mean that supply levels will decrease, and thus – the global price of oil will naturally increase

An example of a negative news story impacting the value of an asset:

- Let’s say that Rolls-Royce stocks are currently priced at 110p

- Its most recent earnings report notes that revenues for the quarter have decreased by 60% year-on-year

- As this is bad for the company – there will likely be a major sell-off on Rolls-Royce stocks

- In turn, the value of the stocks will decrease

In both of the examples above – it’s fairly easy to determine whether the news story will be positive or negative for the value of the respective asset.

78% of account lose money money when trading CFDs with this broker.

On the contrary, there are several ways in which you may choose to streamline the process. At the forefront of this is signing up to a financial news alert website. In doing so, you have the option to choose which assets you are interested in – and the platform will send you real-time notifications any time a news story develops.

For example, if you elect to receive a notification on commodities – an alert will be sent to your phone or email in real-time. Then, it’s just a case of heading over to your spread betting platform

Use Spread Betting Signals

Unless you have an in-depth understanding of technical analysis – being able to consistently outperform the financial markets will be difficult. As such, you might find that your spread betting endeavors are not as successful as you had hoped. To counter this, one of the popular spread trading strategies to consider is signing up for a signal service.

- In a nutshell, signals are trading suggestions sent to you by a third-party provider.

- The provider in question will typically perform technical analysis on behalf of its members – and when it spots a trading opportunity it will send you a real-time signal.

- This will tell you what asset to trade, whether you should go long or short, and what entry and exit orders to place.

- Then, it’s just a case of heading over to your chosen spread betting site and placing the suggested positions.

There are many trading signal services active in the UK – so you need to do to some homework on the provider before singing up. After all, the analyst performing the technical research will be doing so in return for a monthly subscription fee.

Fundamental Analysis vs Techincal Analysis

In you are looking for the popular spread betting strategies that will allow you to make consistent gains – technical analysis is a must. After all, spread betting is a short-term form of online trading – meaning that you will look to enter and exit positions throughout the week.

For example, you might speculate on the price of the Apple stocks increasing over the next few hours or the price of gold to decline over the course of the next couple of days. Either way, the overarching objective with spread betting is to make small but frequent gains.

In order to do this, you need to learn the ins and outs of price analysis – which is fully backed by an understanding of technical indicators. There are many indicators that can help you gauge market sentiment and ultimately – which way the price of the asset is likely to go in the short term.

With that said, fundamental analysis can also be a powerful spread betting strategy to master. As we discussed just a moment ago, trading off of the back of financial news is a simple strategy that can be undertaken by traders of all skill sets. You will, however, be limiting the number of spread betting opportunities you have at your disposal by relying on fundamental news only.

This is because there are only so many important developments that a stock, commodity, or currency will encounter throughout the month. As such, we would strongly suggest that you learn how to read pricing charts if you want to make consistent gains in the spread betting scene.

Popular Spread Betting Platforms UK

Many of the popular spread betting strategies we have discussed on this page have one thing is common – they require a quick entry and exit into the market. That is to say, these strategies will see you target modest gains in a risk-averse manner – but on a very regular basis.

This is why most popular betting trading strategies focus on day trading systems. With this in mind, it is crucial that you choose a financial spread betting broker that offers low fees and spreads, heaps of markets, and access to risk management tools.

Below we discuss two brokerages that allow users to participate in spread betting.

1. Pepperstone

All three of these platforms come pre-loaded with dozens of technical indicators, charting drawing tools, and advanced order types. This makes Pepperstone highly suited for those who wish to deploy an advanced spread betting strategy. There are three accounts to choose from at Pepperstone – two of which are aimed at experienced traders. If you opt for the Razor account, you will be trading directly with other market participants.

This means you’ll get competitive spreads available in the market. Alternatively – if you meet the required criteria of a professional-client – you’ll have access to a number of perks that can enhance your spread betting strategies. At the forefront of this is being able to trade with leverage of up to 1:500 on forex spread betting and 1:200 indices. Other supported markets at this spread betting site include stocks, hard metals, energies, and cryptocurrencies (professional-client only).

| Broker | Commission | Inactivity Fee | Deposit Fee | Withdrawal Fees |

| Pepperstone | £0.02 per 0.01 lot or 0.0035% | None | FREE | $5 (about £4) |

75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

How to Start Spread Betting with Strategy

In the next sections, we will show users how to conduct spread betting with a suitable broker of their choice.

Create Spread Betting Account

Getting started takes a matter of minutes. Simply make your way to your brokerage’s website and begin the sign-up process. This will open a sign-up form and you’ll be required to enter your name, email address, as well as choose a username and password for your new trading account.

Verification Process

Users may be required to complete a simple KYC process, if they invest with a regulated broker. Upload a copy of your passport or driving license as proof of identity, and a copy of a recent utility bill or bank statement as proof of address.

Deposit Funds

With a fully verified account, you’re one step closer to start trading a range of assets with the click of a button. Depending on the broker you choose, you can transfer funds using a debit card, credit card, bank wire transfer, as well as e-wallets such as PayPal, Neteller and Skrill.

Choose your preferred payment method and deposit your funds into the account.

Place Spread Betting Order

You will first need to search for the spread betting market that you wish to deploy your newfound strategy on. The easiest way to do this is to type the name of the asset you wish to trade on the search bar of your account.

Then, you will need to set up an order. As we covered earlier, if you think the spread betting instrument will increase – you need to place a long (buy) order. Place a short (sell) order if you think the price of the asset will fall.

Then, you just need to add your stop-loss and take-profit orders – in line with the spread betting strategy you have opted for.

Once you confirm the order – the spread betting position is live.

Spread Betting – Further Strategies

Before we conclude this guide on the popular spread betting strategies – we thought it would be a good idea to present you with a couple more trading strategies and tips.

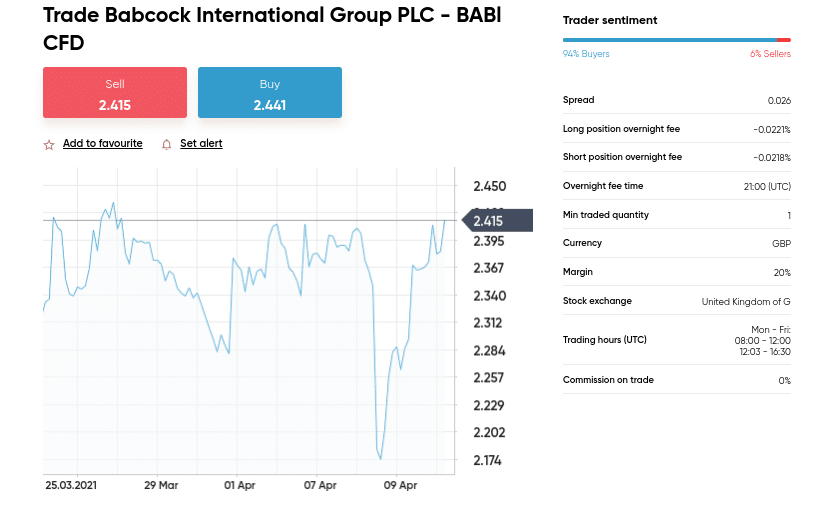

Always Deploy a Stop-Loss

Irrespective of which spread betting strategies you are planning on using – it is crucial that each and every trade you place comes with a stop-loss order. As we covered earlier, this ensures that you cap the amount of money that you may lose on a particular spread betting position.

Most spread betting sites require you to do this by entering the number of points that you wish the trade to close at. For example, let’s suppose that you are long on Babcock shares at 241p each. You decide to stake £10 per point. The most you are willing to lose from this trade is £150.

Opt for Quarterly Duration Markets

The vast bulk of spread betting platforms in the UK offer two trade durations. The first is a quarterly duration market – which has an expiry date of three months. The other is a daily duration market – which closes by the end of the trading day. We would suggest sticking with quarterly markets – as this will give you enough time for your spread betting strategy to mature.

This is especially the case if you are opting for a consolidation period strategy – which might remain in place for a number of days or even weeks. This is also the case if you are planning to trade off the back of financial news – as this strategy needs to be deployed on a swing trading basis.

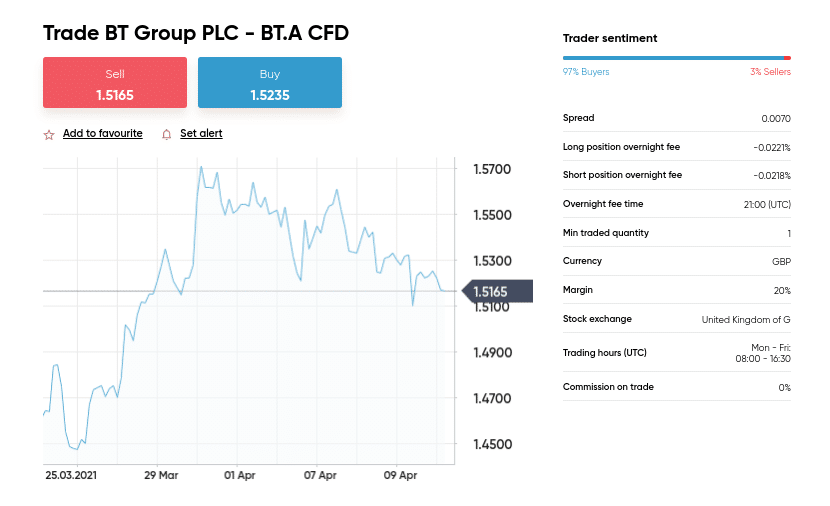

Understand Funding Fees

When you use a spread betting broker – you will be charged an overnight funding fee when you keep a position open beyond standard market hours. This is the same with CFD brokers – as you are trading financial derivatives. You can read our CFD vs spread betting guide to learn more about how the two differ. The specific overnight funding fee is usually displayed in percentage terms – and broker down on a daily basis.

This allows you to assess how much you are paying. Of course, if you are day trading and never plan to keep a position open for more than a few hours – overnight funding isn’t an issue. But, if you want the flexibility of keeping spread betting positions open for several days or weeks – it’s fundamental that you have the ability to assess whether the trade is viable – taking these additional fees into account.

Conclusion

There are a plethora of benefits that spread betting offers over traditional investing. Whether that’s the ability to avoid stamp duty and capital gains, apply leverage, or short-sell – spread betting allows you to trade in a highly flexible and cost-effective manner.

With that said, it is important to remember that spread betting is a complex form of financial trading – so you need to have an effective strategy in place. This guide has discussed some of the popular spread betting strategies to consider – and which brokers to do this with.