What is Spread Betting? Spread Betting UK Explained

Spread betting allows you to trade a wide variety of financial instruments – with all profits exempt from tax! You can apply leverage, choose from a long or short position, and generally trade without paying any commission.

Here we discuss the ins and outs of how Spread Betting UK works and how you can start spread betting without tax today.

75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

How to Start Spread Betting UK

If you’re looking to try spread betting UK for the very first time. The FCA-regulated platform offers a free spread betting demo account that allows you to trade without risking any money. Then, if you want to start spread betting with real money – the minimum deposit is just £20.

Here’s a quickfire guide on how to start spread betting UK right now:

- Step 1: Open an account with a spread betting broker.

- Step 2: Deposit a funds or start trading via the free demo account

- Step 3: Search for the financial instrument you wish to trade

- Step 4: Place a long or short order – depending on whether you think the asset will rise or fall in value

- Step 5: Once the position is live – you can close it manually or through a stop-loss and take-profit order

What is Spread Betting?

There is often a misconception that spread betting is a form of gambling. Although HMRC views the industry of gambling – insofar that profits are exempt from tax, spread betting is actually a form of short-term trading. In a similar nature to CFD trading, your primary goal is to speculate on whether an asset will rise or fall in value.

Most financial spread betting platforms give you access to thousands of markets – covering everything from gold, stocks, and ETFs, to indices, bonds, and oil. As we cover in more detail shortly, spread betting platforms allow you to go long or short on your chosen asset. This means that you can benefit from both rising and falling markets.

Spread betting UK platforms also permit leverage. This means that you can boost the size of your trade – in line with FCA limits. Unlike CFD trading, however, spread betting markets typically come with an expiry date. This means that when the market expires – your trade will be automatically closed by the broker. More on this shortly. You can read our spread betting vs CFD guide to learn more about how these types of trading differ.

How Does Spread Betting Work?

If you’re looking to invest in shares or ETFs over the course of many months or years – spread betting UK will not be for you. But, if you’re a short-term trader that likes to enter and exit positions in a matter of hours, days, or weeks – spreading betting is well worth considering.

You do, however, need to understand the basics of spread betting UK before taking the plunge.

Going Long or Short in Spread Betting

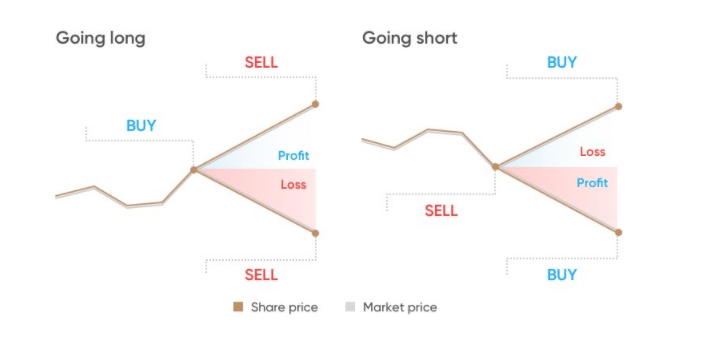

Your first port of call is to determine whether the value of your chosen financial instrument will increase or decrease in the short term.

- If you think the price of the asset will increase – then place a ‘long‘ order

- If you think the price of the asset will decrease – then place a ‘short‘ order

Crucially, this is why spread betting UK is so popular with short-term traders – as you always have the option of benefiting from rising and falling asset prices.

Here’s a quick example of how going long and short works in spread betting:

- GBP/USD is currently priced at 1.45

- You think that the exchange rate will rise in the next few days, so you place a long order

- Your speculation was correct as by the end of the week – GBP/USD is priced at 1.47

- You close your spread betting position and cash in your gains

Had you thought that GBP/USD was overpriced and thus – would decline in value, you would instead have placed a short order.

Spread Betting Price Movements

Perhaps the most challenging aspect of spread betting UK is that price movements are determined in points. Ordinarilly, when trading online, the asset price movement is determined in pounds and pence.

- For example, if Aviva shares move from 400p to 420p – that’s a price movement of 20p per stock.

- But, in the world of spread betting, this price movement would instead be identified as 20 points.

The above example is fairly easy to grasp – as on each stock price movement of 1p – that’s 1 point. However, the unit of each market can and will vary depending on which asset you are trading.

- For example, let’s say that you are trading gold at your chosen spread betting UK platform

- The broker is quoting £1,209 per ounce

- A few hours later, gold is priced at £1,298 per ounce

- In this example, 1 point equates to £1 of movement

- As such, the spread betting market increased by 89 points

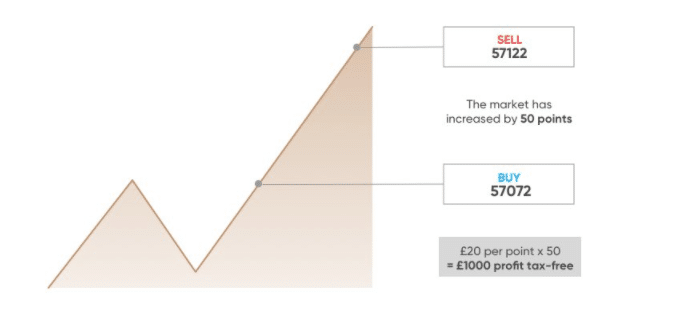

As we cover in the section below, your profit or losses are determined by the amount you stake ‘per point’.

Spread Betting Stake Per Point

So that you know how spread betting price movements are calculated – you then need to think about stakes. This simply refers to the amount of money you wish to risk on the respective spread betting trade.

In the example above, we noted that the price of gold increased by 89 points. If you had stakes £1 per point and you went long on the position – you would have made a profit of £89.

Let’s look at another quick example to help clear the mist:

- You are looking to trade BT stocks at a regulated spread betting broker

- The broker is quoting a price of 154p per BT stock

- You think the stocks are overvalued so place a short order

- You decided to stake £20 per point

- A few days later, BT stocks have dropped to 149p

- This amounts to a price movement of 5 points – which is in your favor as you went short

- At a stake of £20 per point – you made a profit of £100

It is important to note that in the above example, 1 point amounts to a stock price movement of 1p. However, some spread betting platforms might stipulate that 1 point equates to 0.1p of a stock price movement.

For example, is BT stocks were priced at 154.50p and dropped to 154.10p – that’s a price movement of 40 points. This means that your profits and losses are going rise and fall in a much faster manner – so make sure you understand the unit structure of your chosen spread betting market.

How Does Leverage in Spread Betting UK Work?

A major attraction of opting for a spread betting platform over a traditional brokerage firm is that you will always be offered leverage. If you’re new to this financial term – leverage simply means that you can amplify the size of your spread betting position.

This can be beneficial if you only have access to a small amount of trading capital. Additionally, leverage is also beneficial if you are looking to target small margins on each position and thus – want to boost the value of your potential gains.

Here’s an example of how a leveraged spread betting trade would work in practice:

- You want to trade the FTSE 100 at your chosen spread betting UK site – which is priced at 6,900 points

- You want to place a long position at a stake of £5 per point

- You also decide to apply leverage of 10x

- In essence, this will amplify your profits or losses by a factor of 10

- A few hours later, the FTSE 100 is priced at 6,970 – which is an increase of 70 points

- On a stake of £5 per point – you would have made a profit of £350 without applying leverage

- However, you applied leverage of 10x – so your profit is amplified to £3,500

It is important to note that leverage will also magnify your losses. This is why spread betting leverage is now governed by the FCA. In simpler terms, if you’re a retail client (meaning you do not trade in a professional manner), the amount of leverage you can apply will be capped.

This is based on the financial instrument you are trading and looks like the following:

- 5x on stocks and shares

- 10x on minor indices and non-gold commodities

- 20x on major indices, gold, and minor forex pairs

- 30x on major forex pairs

The above limits ensure that you do not risk more than you can afford to lose.

How Does Margin in Spread Betting UK Work?

If you are interested in applying leverage to your spread betting trades, you also need to understand how ‘margin‘ works. In its most basic form, this is the amount of money you need to cover the leveraged trade that you wish to open. This is not too dissimilar to a security deposit.

- In the example above, you applied leverage of 10x – meaning you were trading with 10 times the amount you staked.

- This means that you would be required to put up a margin of 10% (100/10).

- If you were trading with leverage of 20x, the margin would amount to 5% (100/20).

Crucially, if your leveraged spread betting position goes against you by an amount equal to the margin requirement – your trade will be closed by the broker. Before this happens, most spread betting UK sites will send you a notification (usually via email) – which is known as a ‘margin call’.

This will let you know that your leveraged trade is close to automatic liquidation – so you might want to consider adding additional margin to your account to avoid this happening.

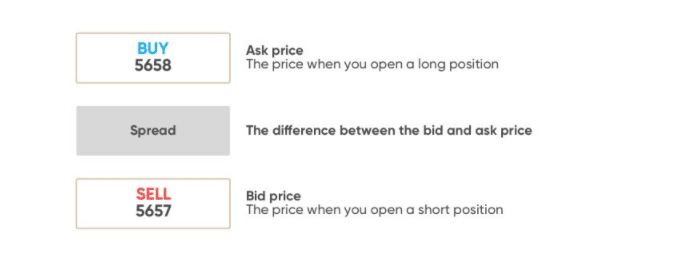

How Does the Spread Work?

The terms ‘spread betting’ and the ‘spread’ actually refer to two different things. We have already explained how spread betting UK works, so allow us to elaborate on the latter.

83.45% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Irrespective of how you trade online – whether that’s via spread betting, CFDs, or traditional stock investing – brokers always charge a spread. This is the difference between the buy and sell price of your chosen instrument. In the case of spread betting, this will be the gap between the long and short prices that your broker offers.

For example:

- You want to trade oil at your chosen spread betting UK site

- The long price on this market is $55.40

- The short price on this market is $55.30

- The broker is quoting 1 point for each cent that the price of oil moves

- As such, the spread on this market is 10 points

In simple terms, this means that you need to make gains of 10 points to break even on this trade. If your position increased by 15 points, your actual profit would stand at 5 points. Ultimately, the spread is how commission-free brokers make money irrespective of which way the marketers move.

As such, this is why Pepperstone is a great option to consider in your search for a spread betting UK site – as spreads are typically very competitive.

Trade Duration in Spread Betting

When you invest in a traditional asset like stocks or ETFs, you can keep your position open for as long as you want. This is because by investing in your chosen asset – you retain ownership until you decide to sell. But, when you trade via spread betting instruments – you do not own the asset. On the contrary, you are simply speculating on whether the price of the asset will rise or fall.

Most importantly, spread betting markets always come with a ‘trade duration’. This means that at some point in time – the market will expire. When it does, your trade will be closed by the broker automatically. We find that trade duration times at spread betting brokers are typically broken into two – daily bets and quarterly bets.

- Daily Bets: If your spread betting market is based on a ‘Daily Bet’ timeframe – it will expire by the end of the trading day. This will usually be at a fixed time – for example, 5 pm.

- Quarterly Bets: If you don’t fancy taking a day trading strategy, it might be best if you opt for a ‘Quarterly Bet’ timeframe. This means that the market will remain active for three months and thus – gives you much more flexibility in terms of strategy.

Once again, the fact that all spread betting UK markets have an expiry date in place should remind you that this form of online trading is best suited for short-term strategies

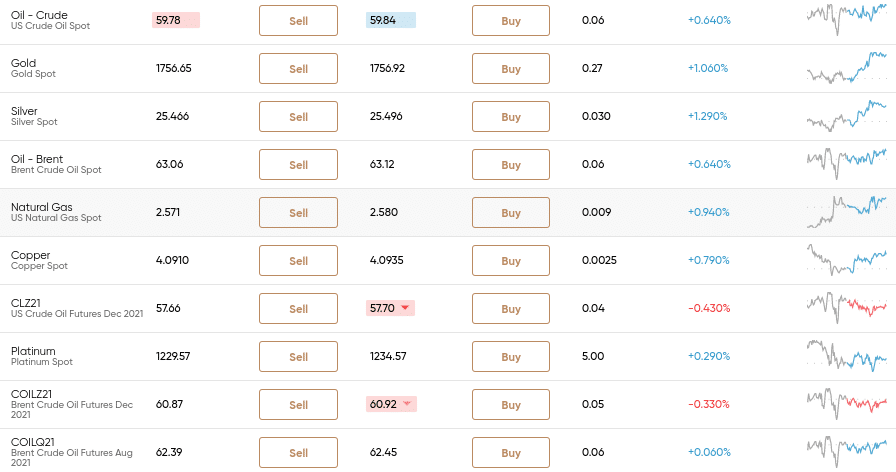

What Instruments Can You Spread Bet On?

A huge advantage of trading via a spread betting platform is that you will have access to thousands of financial markets. Don’t forget – irrespective of which market you trade – you do not own the underlying asset.

Instead, spread betting instruments simply track the real-time price of the market. For example, if BP stocks go from 298p to 301p – the spread betting instrument will mirror the exact same movement like-for-like.

With this in mind, the best spread betting UK sites typically allow you to trade the following markets:

- UK Stocks: Shares listed on the London Stock Exchange and sometimes the Alternative Investment Market, too

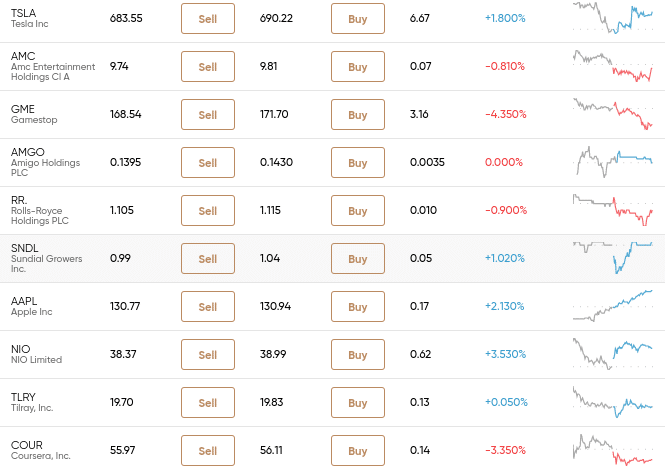

- International Stocks: Platforms like Pepperstone offer spread betting markets on stocks listed in the US (e.g. Apple and Tesla), Asia, Europe, and more.

- Indices: Trade popular indices like the FTSE 100, FTSE 250, Dow Jones, S&P 500, and more.

- Precious Metals: Spread betting is particularly popular with those looking to speculate on gold, silver, and platinum.

- Energies: You can also spread bet energies like WTI Crude oil, Brent Crude oil, and natural gas.

- ETFs: Some spread betting UK sites also allow you to trade ETFs.

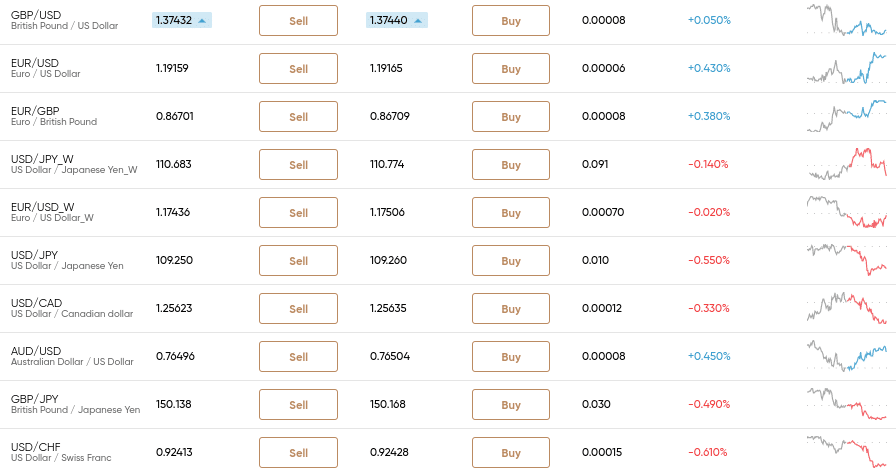

- Forex: If you want to speculate on the future value of currency pairs – such as GBP/USD or EUR/USD – most spread betting UK platforms permit this.

The one asset class that you can no longer trade when spread betting in the UK is cryptocurrencies. This falls within the remit of cryptocurrency derivatives – which were prohibited by the FCA in early 2021.

Benefits of Spread Betting

If you’re still wondering whether or not spread betting UK is right for you – below you will find an overview of what benefits this popular trading arena offers.

Spread Betting Tax

Since 2010 – gambling winnings in the UK are not subjected to taxation. Spread betting is defined as gambling by HMRC – meaning that all profits are yours to keep. This is a major benefit – like all other financial markets – whether that’s CFD trading or traditional stock investments – are liable for capital gains tax.

Additionally, when spread betting in the UK, you are not purchasing the underlying asset. This also means that you will avoid stamp duty tax. This is ordinarilly payable when you buy shares or ETFs that are listed on the London Stock Exchange.

Other Core Benefits

In addition to being able to trade without paying any capital gains tax – there are a number of other benefits to consider when spread betting, such as:

- Small Stakes: Some spread betting UK platforms allow you to stake from just 10p per point. This means that you can try spread betting without needing to break the bank.

- Leverage: All spread betting markets can be traded with leverage. As we mentioned earlier, UK retail investors have access to leverage of up to 1:30 when trading major currencies, and less on other markets.

- Commission-Free: We find that most spread betting UK sites allow you to trade without paying any commission. This means that the only fee payable is the spread.

- Asset Diversity: By using a top-rated spread betting UK site, you’ll likely have access to thousands of markets. This should include stocks, ETFs, commodities, forex, bonds, indices, and more.

- Regulated: Spread betting is heavily regulated in the UK. Brokers must hold a license with the FCA and implement a series of investor protections and safeguards.

Spread Betting Strategies

Spread betting consists of speculating on complex financial instruments – so it’s crucial that you have a strategy in place. This is no different from any other type of online trading and will ensure that you have clear financial goals and an appreciation for risk management.

Below we discuss some of the best strategies to consider when using a spread betting UK platform.

Trade on the Back of Financial News

One of the easiest spread betting UK strategies to implement is to keep an eye on key financial news. After all, important news developments will impact the value of an asset.

For example:

- Let’s say that the Bank of England announces that it will increase interest rates.

- In turn, this will demotiviate institutional investors from putting capital into the stock markets.

- In turn, this could lead to the FTSE 100 dropping in value.

- The simple strategy in this scenario would be to place a short position with your chosen spread betting UK site.

If your speculation was correct and the FTSE 100 did decline as a result of increased interest rates – you would make a profit on this trade.

Ex-Dividend Date Strategy

Another popular spread betting strategy is to take advantage of an upcoming dividend payment. For those unaware, the ‘ex-dividend date’ is typically the day before the ‘record date’. Any investor that buys share on or after the ex-dividend date will not be entitled to a dividend.

Now, when the dividend amount is announced, you will often find that the respective stock price drops by the same amount. For example, if HSBC announces a dividend yield of 2.5%, in theory, the stock price will also decline by this amount. This is because dividends are paid with cash – which comes out of the company’s balance sheet.

Taking the above into account, some spread betting traders will look to place a short position on a stock the day before the ex-dividend date. This would allow them to profit if and when the stock price declines in correlation to the size of the proposed dividend yield.

Best Spread Betting Brokers

Once you have a firm grasp of how spread betting UK works, you then need to find a suitable broker.

The most important metrics that you need to look for when choosing a spread betting platform are as follows:

- Supported spread betting markets

- Commissions and spreads

- Minimum stake per point

- Minimum deposit

- Supported payment methods

- Reputation and regulation

To save you from having to perform in-depth research, below we discuss a selection of the best spread betting UK sites for 2021.

1. Pepperstone – Best Spread Betting Platform for Advanced Traders

In fact, Pepperstone is compatible with various third-party trading platforms – including MT4, MT5, and cTrade. Each of these platforms will get you instant access to advanced charting indicators, trading signals, drawing tools, and order types. In terms of supported assets, Pepperstone offers a broad range of markets. This includes indices, forex, hard metals, energies, stocks, and more. Pepperstone offers two account types to choose from.

If you’re an advanced spread betting pro that is planning to trade with large stakes – the Razor Account is likely to suffice. This is a raw spread account that will allow you to trade directly with other market participants. In turn, you’ll benefit from industry-leading spreads and a small commission of $3.50 per trade. You can easily open an account at Pepperstone and supported payment types include debit/credit cards, bank transfers, and Paypal. The broker is authorzied and regulated by the FCA.

- Spread betting – no capital gains tax

- Compatible with numerous platforms

- 0% commission accounts

- Raw accounts for zero spreads

- FCA licensed

- Accepts PayPal

- No proprietary platform

- Doesn’t offer ETFs

75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

How to Start Spread Betting

If you want to get started with a spread betting account right now – we are going to walk you through the process with Pepperstone. From start to finish, the process of registering, depositing funds, and placing a spread betting UK trade should take no more than 10 minutes.

Step 1: Open a Spread Betting UK Account

Before you can start spread betting in the UK – you need to open an account. Head over to the Pepperstone homepage and begin the registration process.

You will need to enter the following details:

- First and last name

- UK address

- Date of birth

- Telephone number

- Email address

Once you confirm your email address – your Pepperstone account is open.

Step 2: Upload ID

As a spread betting UK platform that is regulated by the FCA – Pepperstone is legally required to verify your identity. All you need to do is upload a copy of your passport or driver’s license.

Step 3: Deposit Funds

To benefit from this low account minimum, you need to deposit with a debit/credit card or an e-wallet. These payment methods are processed instantly.

If you elect to deposit funds with a UK bank account, the minimum deposit jumps up to £250. Plus, this will take a couple of days to arrive.

Step 4: Search for Spread Betting Market

Pepperstone supports thousands of financial instruments – so you are best advised to search for the one you wish to trade. You can also browse what markets are offered by clicking on the asset class – such as stocks or forex spread betting.

Step 5: Place Spread Betting Order

When setting up a spread betting order – there are two key instructions you need to send to Pepperstone.

- Stake: The stake you enter is based on each point movement. For example, if you want to risk £1 per point – enter £1 into the ‘Amount’ box.

- Long or Short: And of course – you also need to specify whether you are long or short on the asset.

Additionally, you also have the option of applying leverage and setting up a stop-loss and take-profit order.

Conclusion

If you’re looking to access a wide variety of financial markets, have the option of going long or short, and be able to apply leverage – spread betting is likely to be of interest. Best of all, by trading via a top-rated spread betting UK site – all of your profits are exempt from capital gains tax.

Looking to start spread betting right now? If so, Pepperstone is arguably the best broker for this purpose. You’ll be able to trade everything from stocks and indices to forex and commodities – all on a commisison-free basis. The minimum deposit is just £20 and the process of opening an account takes minutes!

Your capital is at risk.