Sainsbury’s shares were trading lower in early trade today after it released its interim results. While the company raised its guidance, markets were not impressed with higher costs in the first half of the year.

Sainsbury’s total retail sales excluding fuel sales rose 7.1% year over year in the first half of 2020. The like-for-like sales, a key metric for the retail industry, rose 6.9% over the period. Looking at the product categories, its grocery sales increased 8.2% while general merchandise sales increased 7.4%

Sainsbury’s online sales increased

Online sales have helped retailers offset lower sales at stores. Sainsbury reported a 117% year over year rise in online sales in the first quarter. Online sales accounted for 40% of total sales at the UK’s second biggest retailer in the first half of the year.

Tesco, that’s UK’s largest supermarket chain also reported a sharp increase in online sales last month. The company is investing to expand its online delivery infrastructure. However, clothes retailer Primark still prefers to sell only at its stores. Earlier this year, Primark’s sales fell to almost zero as its stores were closed due to the pandemic.

Sainsbury’s reported higher costs

Sainsbury reported a before tax loss of £137 million in the first half. The loss was primarily due to one-time costs of £438 million associated with the closure of Argos stores and other market changes. Sainsbury also incurred costs worth £290 million towards COVID-19 related costs. However, the cost was partially offset by £230 million business rates relief.

Other retailers have also been reporting higher costs due to COVID-19. Costco reported higher costs due to higher salaries that it paid to employees amid the pandemic. eCommerce giant Amazon has also incurred billions in dollars towards COVID-19 related costs this year.

Sainsbury’s raises guidance

Sainsbury’s also raised its full-year guidance and expects full-year underlying profits before tax to be over 5% higher than the last fiscal year. The company attributed higher guidance to strong sales especially at Argos

Sainsbury’s also announced an interim dividend of 3.2p per share coupled with a special dividend of 7.3p per share special dividend. The special dividend is in lieu of the final dividend for the fiscal year 2019-2020.

Meanwhile, higher COVID-19 related costs seem to be outweighing higher guidance for Sainsbury and the share was trading sharply down.

Focus on food products

In its strategy update, Sainsbury said that it is “putting food back at the heart of Sainsbury’s.” It intends to triple the number of new products launches every year and increase its online grocery sales. It also announced that it would close its meat, deli, and fish counters in light of lower consumer demand for these products.

Sainsbury’s is also restructuring its Argos stores business. It intends to open 150 more Argos stores by March 2024 in Sainsbury’s and add another 150-200 Argos collection points. It aims to have an Argos store or a pickup point at every Sainsbury’s supermarket.

Meanwhile, it would also close around 420 Argos standalone stores and would only have about 100 standalone Argos stores in the UK by 2024. The restructuring would also lead to around 3,500 job losses.

Sainsbury’s to close most Argos stores

In its statement, Sainsbury’s said that “Whilst we will aim to find alternative roles for as many colleagues as possible, around 3,500 of our colleagues could lose their roles.” Sainsbury’s chief executive Simon Roberts said that “We are talking to colleagues today about where the changes we are announcing in Argos standalone stores and food counters impact their roles.”

He added, “We will work really hard to find alternative roles for as many of these colleagues as possible and expect to be able to offer alternative roles for the majority of impacted colleagues.”

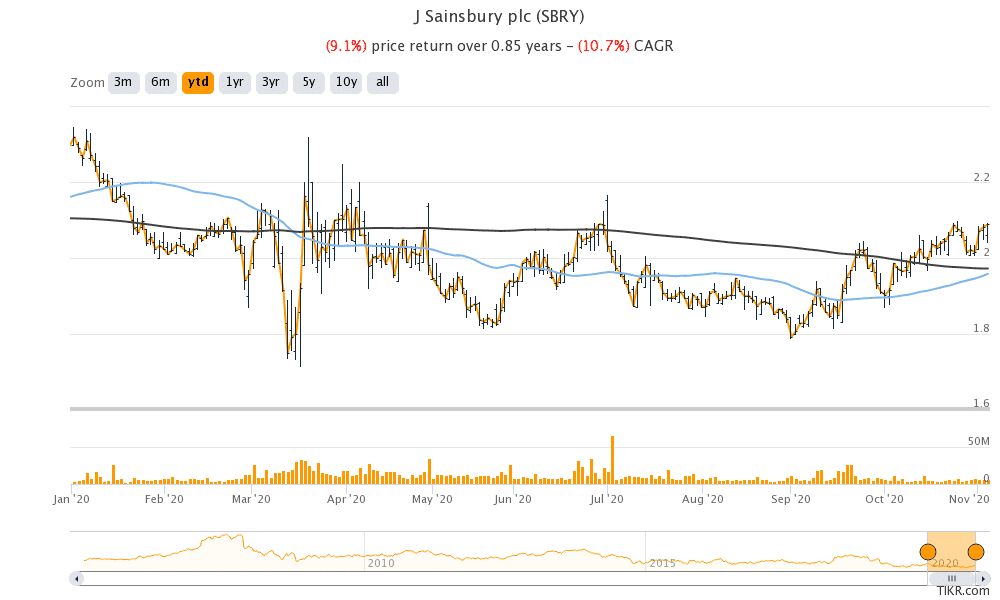

Sainsbury’s shares were trading down 4.7% down at 199.07p at 11:30 AM London time today. The FTSE was up by around half a percentage point at the same time. Looking at the year to date price action, Sainsbury’s shares have fallen over 11%.

Sainsbury’s shares made a 52-week high of 236.7p in December and a 52-week low of 171.19p in March. Currently, the shares are trading almost 14% above their 52-week lows.

Sainsbury’s technical and fundamental analysis

Meanwhile, from a technical trading perspective, Sainsbury’s shares are approaching a key technical level known as the “golden cross.” When a share’s short term moving average crosses above the long-term moving average it is called a golden cross and is a sign of technical bullishness and a buy signal. Typically, we use the 50-day simple moving average for the short term and the 200-day moving average for the long term.

If Sainsbury’s 50-day simple moving average crosses above the 200-day simple moving average, bulls might take charge.

Sainsbury’s shares trade at an NTM (next-12 months) price to earnings multiple of 10.9x which looks reasonable looking at the risk-return potential.

Question & Answers (0)