Oil futures remain on a downtrend as indicated by what could be the third consecutive lower high in the price of the United States benchmark, the West Texas Intermediate (WTI), amid concerns about a potential slowdown in the recovery of the global economy.

In August, WTI oil futures slid as much as 6.4% at $68.5 per barrel due to increased concerns about the impact that the rapid spread of the Delta variant could have on the demand for crude. Meanwhile, Brent futures lost 4.5% during the same period to settle at $73 per barrel.

On the other hand, even though September was initially kinder to crude prices amid a sustained decline in the value of the US dollar, recent news about major price cuts made by Saudi Arabia have apparently set a downbeat tone among market participants as this decision could indicate a weakness in the demand for crude.

Moreover, the US Labor Department reported weaker-than-expected job numbers only four days ago as the country’s economy reportedly added 235,000 new positions during July or less than half what analysts had estimated for the period.

Analysts cited the spread of the Delta variant – which has led to a surge in cases in the United States and other corners of the world – as the primary cause for this lackluster reading.

“Ultimately, the Delta variant wave is a harsh reminder that the pandemic is still in the driver’s seat, and it controls our economic future”, stated Daniel Zhao, Senior Economist for Glassdoor.

The price of oil has suffered two consecutive losing sessions since the report came out including this morning’s 1.2% drop in WTI futures accompanied by a 0.4% downtick in Brent futures.

Goldman Sachs slashes its GDP forecasts for the US

The American investment bank Goldman Sachs (GS) trimmed its estimates for the United States third-quarter GDP growth from a previous 9% forecast to 5.5% this morning, citing that the impact of the Delta variant on the country’s economy was possibly larger than expected.

However, the bank raised its forecast for the fourth quarter from a previous 5.5% estimate to 6.5% as the services sector should bounce strongly during the last three months of the year after the worst of this latest wave of the virus has passed.

The combination of this downward revision along with Saudi Arabia’s decision to slash its crude prices is reinforcing the view that the oil market remains weak.

“When the Saudi giant cuts its selling prices to Asia for October, signaling it sees the supply-demand relationship slightly shifting, traders can’t but follow down that path today”, said the head of oil markets for Rystad Energy, Bjornar Tonhaugen.

On the other hand, the impact that hurricane Ida has had on the US Gulf Coast may offset some of these bearish catalysts for oil as approximately 1.5 million barrels per day of crude produced by drillers within this region continue to be shut down.

In this regard, data from Baker Hughes released last week showed a significant decline in the number of active rigs in the US, with the total number dropping from 410 to 394 in what has been the worst drop since December 2020.

What’s next for oil futures?

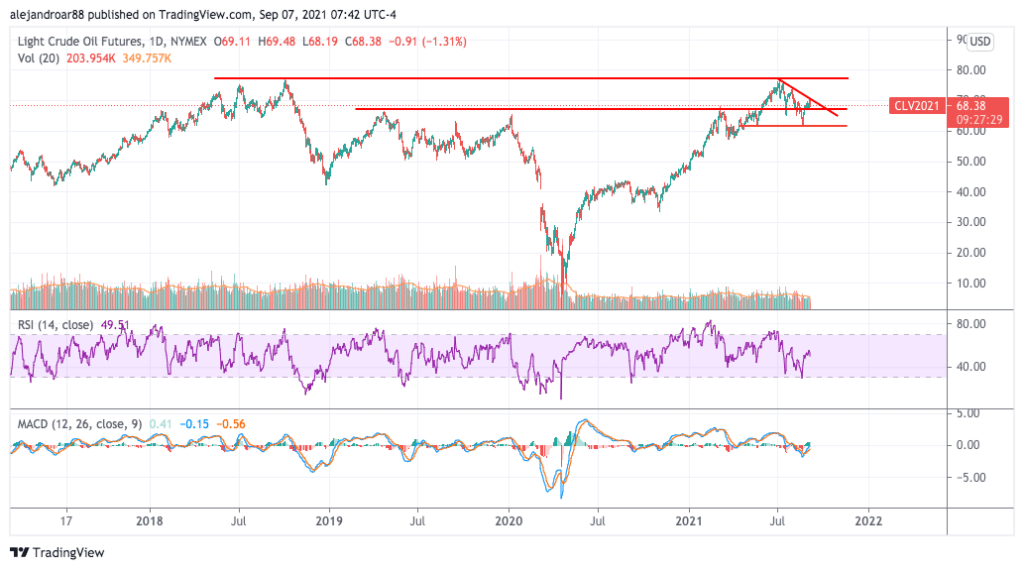

The latest downtrend in the price of WTI futures has resulted in the formation of a descending triangle in combination with the $61.5 support highlighted in the chart above. Meanwhile, trading volumes for WTI futures were elevated during the latest rejection of this trend line resistance and that supports its relevance.

Even though momentum readings have been trending upwards, the MACD has not yet emerged from negative territory while the Relative Strength Index (RSI) remains below 50.

Moving forward, unless this downtrend is reversed, the outlook for WTI oil futures is bearish. That said, the price is currently nearing another key support at the $68 level and how the price action behaves around this level will likely determine the direction that crude prices will take shortly.

A break below could push oil to retest its $61.5 support while a strong bounce off this threshold could lead to a reversal of the recent downtrend.

Question & Answers (0)