US tech shares have been the best-performing major equity sector this year. Even as the COVID-19 pandemic ravaged the US economy, tech shares soared to record highs.

However, US tech shares have come off their September highs and many of them, despite generally strong performances, have cited uncertain or weakening outlooks during this season’s earnings calls with analysts.

Is the mania in US tech shares over or is it just a healthy correction after the sharp rise?

Long US tech shares is the most crowded trade

The July Bank of America Global Fund Managers survey showed that long US tech and growth shares is the most crowded trade of all times. However, US tech shares continued to soar and the Nasdaq hit a new record high in early September. Since then, tech shares have traded sideways with a negative bias. Markets were expecting earnings to bring some relief but the tech earnings have been a mixed bag.

Tech earnings

Yesterday, four FAANG shares (Facebook, Amazon, Apple, Netflix, and Google) released their earnings. Netflix released its earnings last week only. Looking at the market’s reaction to FAANG shares’ earnings, Apple, Amazon, and Facebook were trading lower in pre markets today while Alphabet was trading with gains. Netflix had also tumbled after its third quarter earnings release. Let’s dive into these companies’ earnings to analyse the markets’ reaction.

Apple

Apple posted better than expected earnings and revenues in the quarter. However, its iPhone sales were lower than expected. Also, its sales in Greater China that includes the Mainland, Taiwan, and Hong Kong tumbled 28% year over year in the quarter. To be sure, the delayed launch of the latest iPhone was the key driver behind lower iPhone revenues in Apple’s fiscal fourth quarter 2020. However, markets were not impressed with the justification and sent Apple shares down almost 5% after the earnings release.

Apple is getting valued as a tech company

The valuation for Apple shares is currently at the highest level since 2007. This is partially because of the sharp growth in its services revenues that has seen markets value it as a tech company. However, at such elevated valuations, markets are pricing the shares for perfection. Even the slightest hint of growth slowdown has been punished by the markets.

Amazon

Amazon was trading almost 2% lower in pre markets today. The company shattered earnings estimates and posted earnings per share of $12.37 per share in the quarter which was way ahead of what analysts were expecting. Its guidance for the fourth quarter also looked strong. While some tech shares like Apple have refrained from providing forward guidance citing rising virus cases in Europe and the US, Amazon has provided its guidance despite the pandemic.

Amazon is among the biggest benefactors of the so-called stay at home trade. While the share was down after the results, it looks mainly due to the sharp downwards price movement in Nasdaq futures. As we had noted in our previous article, Amazon looks the tech share to watch as the company’s growth has increased during the pandemic.

The company expects its revenues to rise between 28%-38% in the fourth quarter. While its revenue guidance looked encouraging, its guidance on operating profit where it expects to post between $1-$4.5 billion looked a bit soft at the midpoint.

Facebook’s third quarter earnings

Facebook’s earnings also shattered analysts’ estimates. It reported revenues of $21.47 billion while analysts were expecting it to post revenues of $19.8 billion. Its earnings per share of $2.71 were also higher than the $1.91 that analysts were projecting. Its monthly active users were 2.74 billion was also ahead of analysts’ estimate of 2.70 billion. However, its user base in the US and Canada fell to 196 million users from 198 million.

Earlier this year, there were calls to boycott Facebook over its alleged failure to curb hateful and abusive content. Some advertisers also backed out of Facebook. To add to that, there were concerns over falling ad rates due to the pandemic. Ad revenues are crucial for tech companies like Facebook and Alphabet.

However, Facebook’s third quarter earnings reflect that things aren’t as bleak as the markets were expecting. “If you thought the boycott would hurt them, think again,” said Jim Cramer, host of Mad Money show on CNBC. He also added, “Looks like their advertising business is on fire.”

Alphabet shares on fire

Alphabet shares rose as much as 9% in after hours yesterday after posting a spectacular set of numbers. Its revenues of $46.17 billion were way ahead of the $42.90 billion that analysts were projecting. Its earnings per share of $16.40 also shattered analysts’ estimate of $11.29.

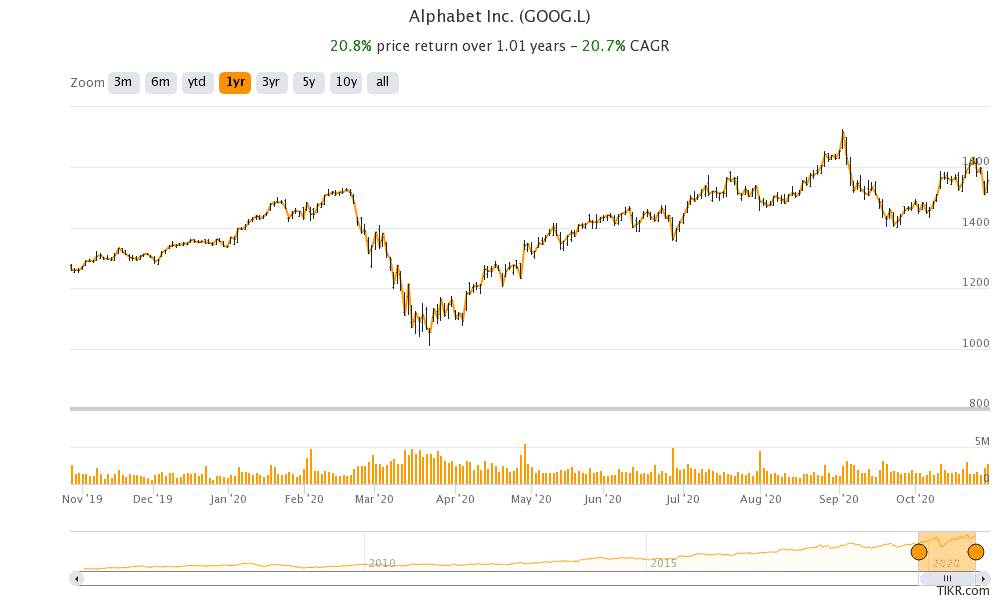

The Google parent’s advertising revenues rose almost 10% year over year with You Tube’s ad revenues up 32% over the period. Alphabet shares are up only 13.4% so far in 2020 and have underperformed other tech shares.

Netflix has fallen after third quarter earnings

Netflix had tumbled after its third quarter earnings release despite posting better than expected earnings. Markets were disappointed with weak subscriber growth in the third quarter and its guidance on fourth quarter subscriber outlook.

Tech shares have come off 2020 highs

Meanwhile, tech shares have come off their 2020 highs. Apple, Amazon, and Netflix have respectively lost 16%, 9.6%, and 12.4% from their 52-week highs based on yesterday’s closing prices. Alphabet and Facebook have also respectively lost 9.6% and 7.8% from their 52-week highs.

For the most part of this year, many analysts have called the rise in US tech shares a bubble waiting to burst. Since tech shares started to fall again after their September highs, the calls have become louder. Many are also comparing the rise in US tech shares to the dot com days.

Are US tech shares in a bubble?

To be sure, the valuation of US tech shares is the highest since the dot com boom days. That said, while there can be pockets of overvaluation, it does not look like a major bubble. The big tech companies of today have strong business models and are generating handsome earnings and cash flows unlike the late 1990s when they were valued based on the number of clicks alone.

Earlier this year, JP Morgan analysts said that “In contrast to the dot-com bubble, the current rally has been supported by strong earnings delivery,”

In August, Keith Lerner, chief market strategist at SunTrust Advisory Services highlighted some intriguing data points. For instance, the Nasdaq Index trades only about 22% above its long-term price trend. In comparison, in 2000, the gap had widened to almost 280%.

Furthermore, the top five tech shares in the S&P 500 contribute 22% of the free cash flows of the S&P 500 which in line with their weightage in the index. In comparison, the top five tech companies in the S&P 500 contributed only 2% to its free cash flows in 2000 while their weightage was 14%.

Tech rally might resume

Given the recent surge in infections in the developed world, we could see the rally in tech shares resume once the markets stabilise. Investors should however wait for the uncertainty over US elections to get over before entering into tech shares. Tech shares would continue to be market leaders once the ongoing sell-off in US stock markets subsides.

Question & Answers (0)