Tesla shares were trading almost 6% higher in pre-markets today. Yesterday the company announced a five-for-one stock split after the close of markets.

According to Tesla, the stock split is intended “to make stock ownership more accessible to employees and investors.” It added: “Each stockholder of record on August 21, 2020 will receive a dividend of four additional shares of common stock for each then-held share, to be distributed after close of trading on August 28, 2020. Trading will begin on a stock split-adjusted basis on August 31, 2020.”

Apple also announced a stock split

Last month, Apple also announced a four for one stock split. Tech shares like Apple, Amazon, and Tesla have rallied this year as investors have poured money into them expecting strong growth. The rise in tech stocks has catapulted the Nasdaq 100 Index to all-time highs. It has risen almost 25% year to date even as other global markets are in the red. UK’s FTSE 100 is down 18% for the year.

Does Tesla’s split make sense?

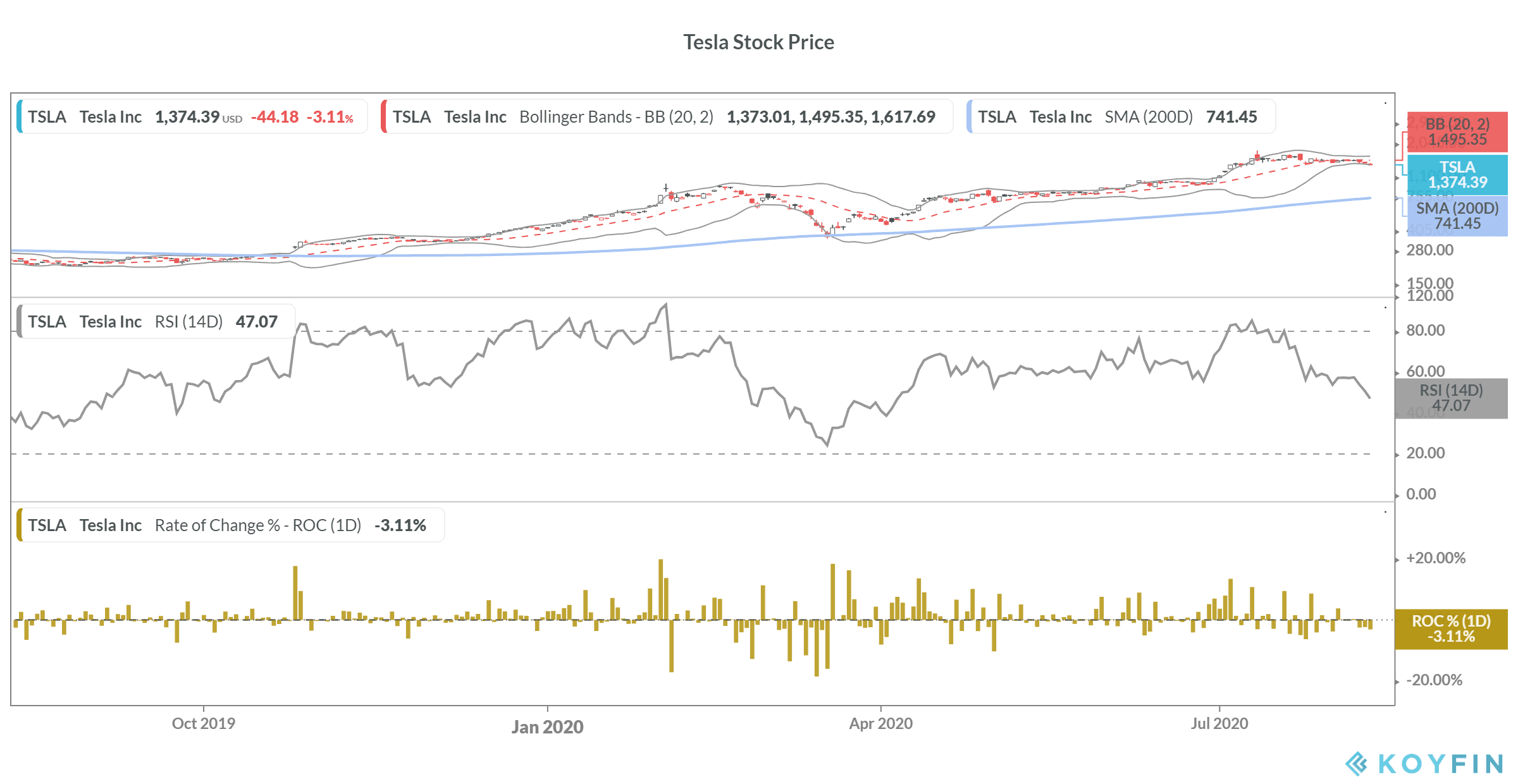

Companies split shares to increase liquidity. Yesterday, Tesla share closed at $1374 making it somewhat expensive for many retail traders. Incidentally, Tesla has a lot of fan-following among retail investors especially young traders. Wall Street has generally been bearish on Tesla shares and the stock has consistently traded above its mean consensus price target since October 2019. Currently, Tesla shares have a mean consensus price target of $1,244, a discount of 9.5% over Tuesday’s closing prices.

Tesla shares in a bear market

Tesla shares have rallied tremendously since October 2019. That month, it posted a surprise net profit in its Q3 2019 earnings. Since then, it has posted a net profit in four consecutive quarters making it eligible for inclusion into the S&P 500. Tesla shares rallied sharply and in July its market capitalisation soared above Toyota Motors. Tesla sold less than 5% of the cars that Toyota Motors sold last year.

Meanwhile, after rallying sharply, Tesla shares are currently in a bear market. Shares are said to be in a bear market if they fall 20% from their peak. In Tesla’s case, it is down 23.4% from its recent high of $1,795 per share. However, despite the fall, Tesla shares are up 228% for the year.

Tesla needs much more than a stock split

The stock split would help increase liquidity and the markets responded positively to the news as is evident in the price action. However, in the long term, Tesla needs to justify its high valuations by posting commensurate earnings. Despite the recent fall, Tesla’s 2021 enterprise value to revenue multiple is at 6.3x, near its all-time highs.

Ashwath Damodaran, popularly known as the “Dean of Valuation” said that to justify its valuation Tesla would need to make revenues similar to Volkswagen with margins like Apple and make investments in manufacturing “like no other manufacturing company has before.”

Investors who are bullish on Tesla justify its valuation on the assumption that it is a tech company. Many however see it as an automotive company. The reality might be somewhere in between. Tesla is predominantly an automotive company but it also has a software side of the business that even rivals like Volkswagen have praised.

Tesla needs earnings to rise considerably to justify the valuation

Although Tesla’s record on profitability has improved, and it has posted a net profit for four consecutive quarters, it fails to instil confidence. If we leave aside the regulatory credits, Tesla’s net profit record starts to look dismal.

For instance, second-quarter net profit of $104 million would have been a net loss of $324 million if the regulatory credits hadn’t more than doubled year over year to $428 million. The same holds for the other quarters where Tesla posted a net profit. The company’s operating profit margin would drop to 1% over the last four quarters, down from 5% with the regulatory credits.

Net profit margins for automotive companies as well as solar companies are in single digits. To add to that, these are capital intensive businesses and require recurring investments into plants as well as research and development.

Electric vehicles

Competition is heating up in the electric vehicle industry that’s Tesla’s core product. Over the last year, Tesla has lowered car prices and last month it also cut prices for its newly launched Model Y by about $3,000 while phasing out a low-priced version. While Tesla has maintained on multiple occasions that it is supply-constrained and not demand constrained, the frequent price cuts reflect that after the initial hype, Tesla has to cut car prices to lure customers. That’s not surprising as all products go through a similar lifecycle.

The software can be the differentiator for Tesla

All said, there is the software part of Tesla’s business that includes the FSD (Full Self Driving) option, that currently costs $8,000. Tesla’s CEO Elon Musk expects FSD price to rise to over $100,000 over the long term. Musk also expects Robotaxi and Network App might be coming in some markets next year. These services businesses are expected to enhance Tesla’s earning capacity.

If the future is going to be all-electric, as consensus would have it, Tesla has a competitive lead over its competitors. It is an iconic brand that is synonymous with electric vehicles. The company is setting the stage for explosive future growth with its new factories. While the shares are expensive, investors are willing to pay the premium as they anticipate robust future growth.

Question & Answers (0)