Earlier this week, the EU imposed tariffs of upto 38.1% on EV imports from China. The duties would be on top of the 10% tariff these imports already attract. The tariffs were much softer than many fear and significantly below the 100% tariff that the US imposed on Chinese electric cars last month.

SAIC which owns MG faces the top tariff of 38.1%. However, Geely, which also owns a stake in Volvo, faces a tariff of 20%. BYD which is the largest seller of new energy vehicles (plug-in hybrids and battery electric cars) globally, and launched the Dolphin and Seal cars in the EU last year, faces tariffs of 17.1%.

Meanwhile, while the US tariffs won’t hurt Chinese EV companies much as they have a negligible presence in the country, Europe has been an attractive export destination for them.

According to the EU, every one in four cars sold in the region is now Chinese and the percentage has increased significantly over the years. The region alleges that Chinese EV companies get state subsidies which help them sell cars at a lower price. Notably, amid the slowdown in the domestic market, Chinese automakers have been looking at export markets to beat the slowdown at home.

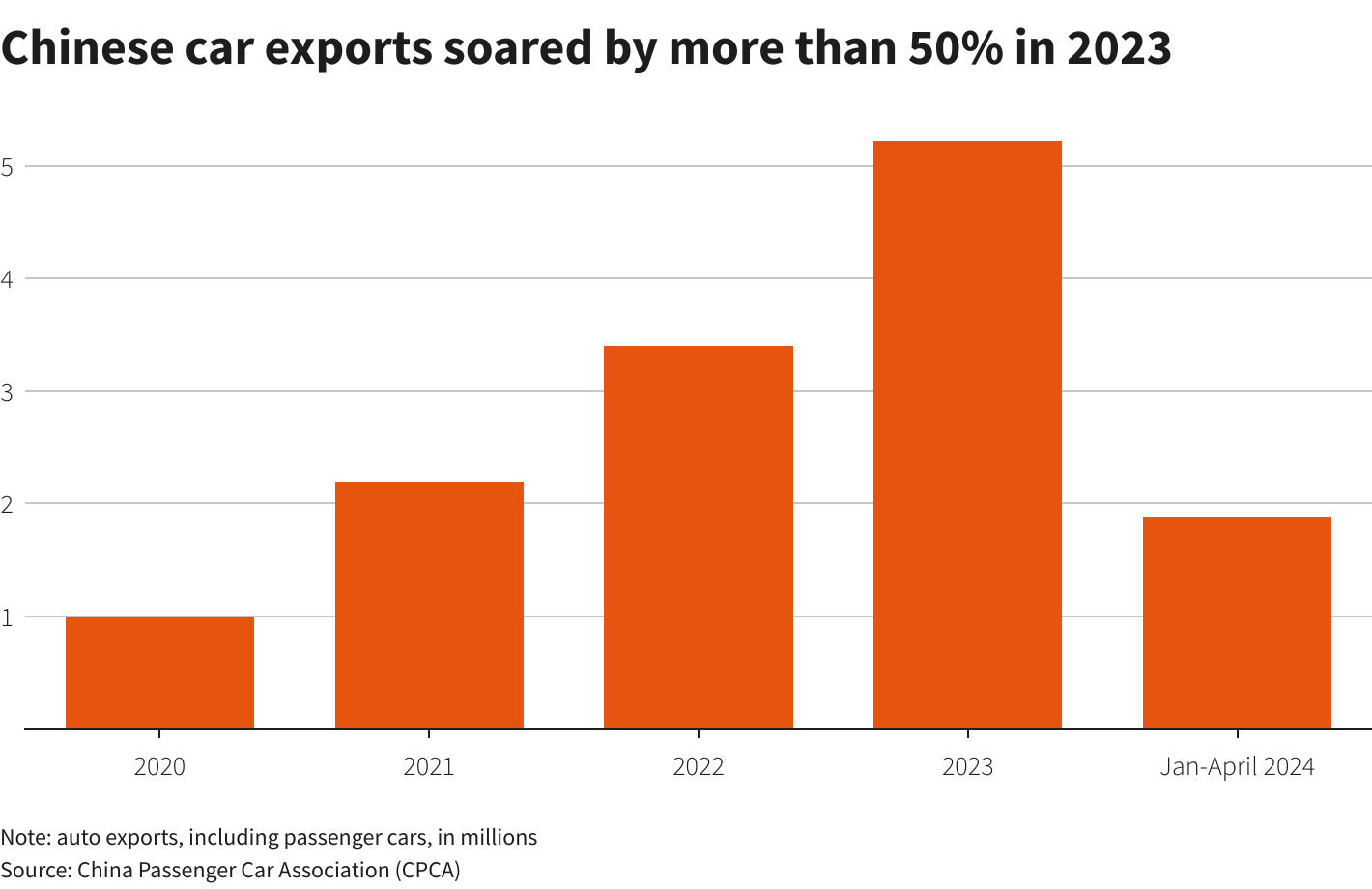

China has an annual automotive production capacity of 40 million units which is much higher than its domestic demand and is good enough to satiate half of the global demand. The country’s auto exports rose 50% last year leaving several countries scrambling to protect their domestic industries from the onslaught of Chinese imports.

China has threatened to retaliate against EU tariffs

There are fears that the EU tariffs on Chinese EV imports would lead to a tit-for-tat trade war between the two regions. We already have a trade war between the US and China as most Chinese imports attract a tariff in the US.

China has called upon the EU to reconsider its tariffs. “We urge the EU to listen carefully to the objective and rational voices from all walks of life, immediately correct its wrong practices, stop politicising economic and trade issues, and properly handle economic and trade frictions through dialogue and consultation,” said Lin Jian, a Chinese foreign ministry spokesperson.

He Yadong, a spokesperson for China’s Commerce Ministry, termed the EU’s tariffs as “blatant protectionism,” and said that they might violate the WTO rules.

Germany reportedly wants the tariffs to be softened

Reportedly, Germany which is China’s biggest trading partner in the EU, wants the tariffs to be softened. The country’s Economy Minister Robert Habeck is set to visit China next week and while he might not discuss the EV tariffs, the recent tariffs are yet another setback to the trade relations between the EU and China.

German transport minister Volker Wissing stated, “Nobody wants a trade war with China.” He added, “It would be a catastrophe for Germany and it would not be beneficial for the European Union either.”

In a sign of escalating trade tensions, Chinese companies have called for an anti-dumping probe into pork imports from the EU. However, the choice of pork suggests that China is also trying not to antagonize Germany.

According to Chim Lee, a senior China analyst at the Economist Intelligence Unit, “China’s investigation on EU pork can be interpreted as a specific choice to avoid hurting Germany, which is helping to prevent or soften EU tariffs. Spain and France, which are major pork suppliers, were pro-tariffs.”

Elon Musk has opposed the tariffs on Chinese EV companies

The EU tariffs on EV imports from China would also hit Tesla. While the company has one of its Gigafactories in Berlin, it also imports cars from its Gigafactory in China, which is its most productive plant.

Tesla CEO Elon Musk had previously also opposed the US tariffs on EV imports from China.

Speaking at the VivaTech conference in Paris, Musk opposed the US tariffs and said, “Neither Tesla nor I asked for these tariffs.” He added, “In fact, I was surprised when they were announced.”

Notably, China is the second biggest market for Tesla after the US. The company has a Gigafactory in Beijing which is regarded as the company’s most efficient plant.

However, relations between Tesla and China have soared somewhat and the company hasn’t been able to get permission to expand its Berlin factory.

Notably, last year, the Communist country chided Musk after he replied to a tweet about a report about the COVID-19 pandemic’s connection to China.

The billionaire has meanwhile been all praise for Chinese EV companies and the country’s EV ecosystem. During Tesla’s Q4 2023 earnings call earlier this year he said, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

He added, “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established.”

What’s next for Chinese EV companies?

If the EU tariffs on Chinese EV imports get enforced, the country might approach the WTO. Also, producing their cars in the continent could be an option they might look at. Xpeng Motors, which has partnered with Volkswagen, previously said that the company might consider producing the cars in the EU.

Also, Chinese companies have built a presence in other countries which could help them beat the tariffs. MG for instance has a plant in Thailand which it can use to supply to the EU. Also, since the tariffs only apply to EVs, Chinese companies could still import hybrid vehicles without the additional tariffs.

All said, the EU tariffs on EV imports from China is yet another sign of growing unrest in the West about China’s excess industrial capacity which the country has been exporting overseas, allegedly aided by state subsidies.

Question & Answers (0)