UK travel stocks dropped sharply yesterday after the British government removed Portugal from its green list due to concerns about the spread of a new variant of COVID-19 in the country, known as the Delta variant.

The decision from the British government prompted a wave of cancellations from tourists who had planned trips to the European country as they would be forced to undergo a 10-day quarantine once they come back from their journey along with presenting negative test results.

Portuguese travel and leisure businesses were dramatically affected by the measure as a big portion of the tourists traveling to the country come from the UK. In regards to the government’s decision, the Portuguese Tourism Confederation stated: “The recovery that started in past weeks with the arrival of British tourists will be abruptly interrupted and all the investments made in hiring staff and reinforcing supply has been lost”.

Meanwhile, UK travel stocks, especially airline stocks, suffered from the news, with the price of Tui AG (TUI) dropping 4.5% alongside shares of IAG Group (IAG) and EasyJet (EZJ) which dropped more than 5% during yesterday’s stock trading session.

Moreover, stocks of hotel operators such as Intercontinental Group (IHG) were also down while leaders of the industry voiced their discontent about the decision.

In an emailed statement, EasyJet (EZJ) management wrote that “this decision essentially cuts the UK off from the rest of the world”. Moreover, the airline emphasized that in a verbal interaction with the UK Department for Transport the company was informed that no more countries will be added to the green list for now – a decision that made “no sense” to the airline.

According to data from 2017, British tourists spent around £33 billion per year to travel to other countries within the continent. Therefore, the decision from the UK government to impose these restrictions would have a significant impact beyond its borders as many travel and leisure businesses will see their top-line reduced by lower demand during a crucial summer season.

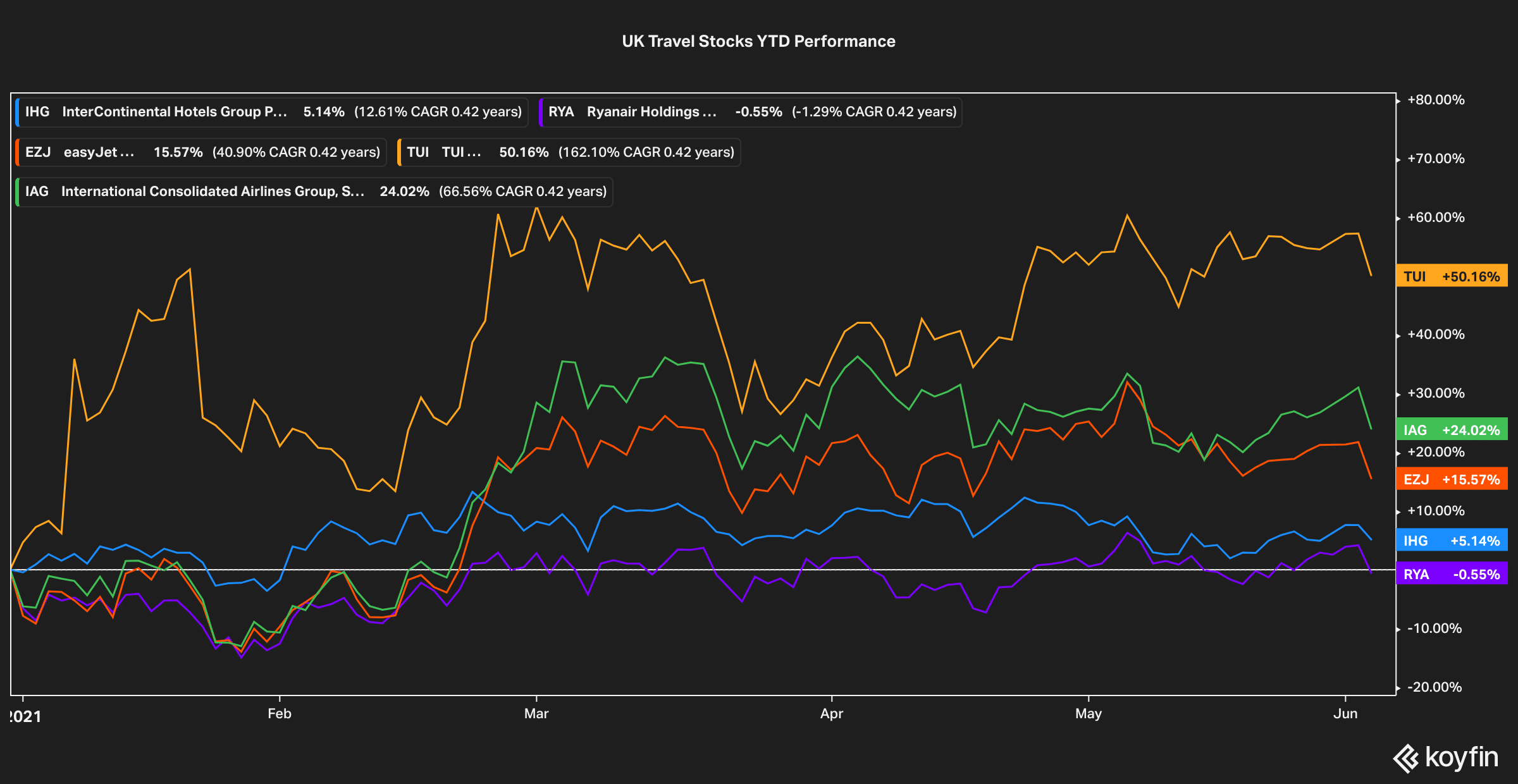

How have travel stocks performed so far this year?

UK travel stocks have been performing quite well this year as the markets continue to hope that vaccinations should help the industry in recovering from the strong blow the virus crisis dealt to international tourism.

So far this year, Tui AG (TUI) appears to be leading the scoreboard as its share price has advanced 50% until today followed by shares of British Airways’ parent company – IAG Group (IAG) – which are up 24% for the year.

That said, the virus crisis continues to be a concern as even though some developed countries have advanced rapidly in vaccinating a significant portion of their population, others have lagged behind, which results in a bumpy and uneven recovery throughout the continent.

Meanwhile, if the government delays too much the inclusion of top destinations to its green list that could seriously harm the top-line performance of these firms. For now, the market doesn’t seem to be too rattled about that scenario but traders should keep an eye on the price action moving forward and especially on analysts’ reactions to the news as they could serve as guidance about how institutional investors are assessing the situation.

What’s next for UK travel stocks?

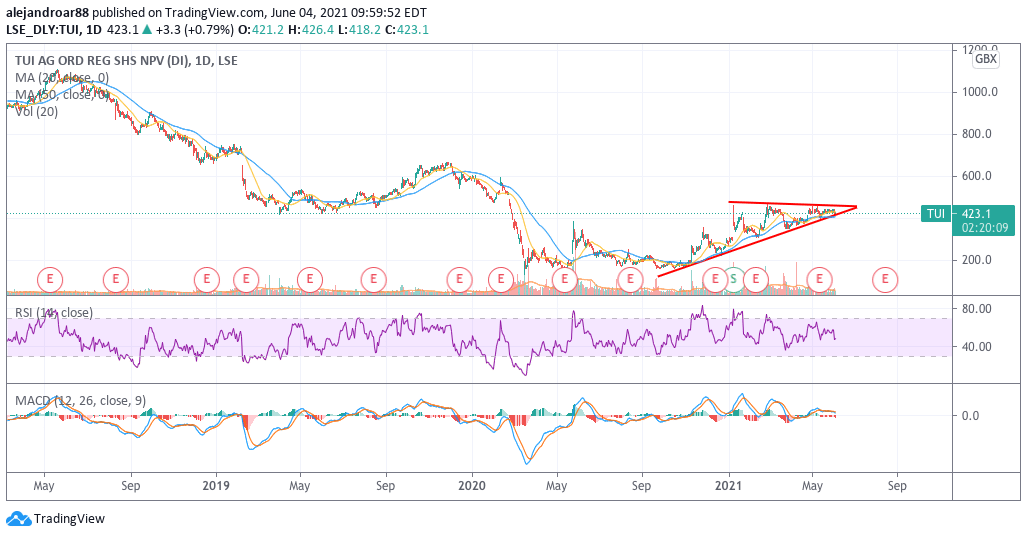

Tui AG emerges as one of the most promising issues in the travel space from a technical perspective as the price action seen by the stock continues to post higher lows. Meanwhile, the stock price appears to be entering what could be the end of its latest consolidation phase, with market participants possibly deciding soon what the future direction for the issue will be.

A break below this ascending triangle formation, especially if short-term moving averages are broken, should confirm a bearish short-term outlook for Tui while a break above the stock’s post-pandemic high of 470p per share should provide confirmation that the share price is ready to take a leap.

Question & Answers (0)