UBS shares are ticking higher today after the company revealed an upbeat quarterly earnings report that blew past most of the firm’s targets, while the Swiss bank also said that it expects to purchase a total of $1.1 billion of its own shares during the first quarter of 2021.

During the fourth quarter of 2020, ended on 31 December, Switzerland’s largest financial institution saw its profits before taxes (PBT) rise 122% to $2.06 billion, roughly $1.1 billion more than the firm’s Q4 2019 PBT.

Most of this surge was driven by historically low quarterly loan-loss reserves, which stood at $66 million by the end of the three-month period, while the bank also managed to trim its expenses as reflected by a 74.1% cost/income ratio, representing a 1,270 basis points improvement compared to the 86.8% ratio reported during the last quarter of 2019.

As a result, profits grew across the board for UBS, with the firm’s operating income advancing 15% while its net profits more than doubled, ending the quarter at $1.7 billion, up $986 million compared to a year ago.

Alongside its quarterly results, UBS also provided an update in regards to its full-year financial performance, showcasing that the bank exceeded most of its year-end targets for metrics like the return on CET 1 capital, which ended the year at 17.6% – up 260 basis points from the upper end of the firm’s guidance.

Meanwhile, PBT growth was also 500 basis points higher than the firm’s upper estimate of 15% – landing at 20.4% by the end of the year.

The firm’s chief executive, Ralph Hamers, emphasised the positive performance of UBS’s asset management unit, which received over $100 billion in net capital inflows during the year, currently managing $4.1 trillion for investors around the world.

Moreover, the bank’s top executive said that higher asset prices should continue to boost the firm’s management fees well into the first quarter of 2021, while he also emphasised that negative interest rates and accommodative monetary policies from central banks around the world will continue to weigh on the performance of the firm’s lending activities throughout this year.

It is important to note that UBS’s asset management unit was a positive force behind the firm’s profitability this quarter, as it brought a total of $401 million in profits before taxes – a 123% year-on-year growth – followed by the Global Wealth management unit, the largest for the bank, which grew its PBT by 22% compared to a year ago as well.

How have UBS shares performed lately?

UBS shares posted a shy 8.5% gain during 2020 as investors maintained a cautious attitude towards financial firms during the pandemic.

Meanwhile, the stock price has advanced 3.6% since 2021 started, pushing the Swiss bank’s shares to their highest level since April 2019 during the first few days of the year.

Moreover, today’s positive results and the prospect of upcoming share buybacks could end up boosting the stock’s short-term performance when they are fully deployed, as the size of the program represents roughly 8 times its daily average volume.

What’s next for UBS shares?

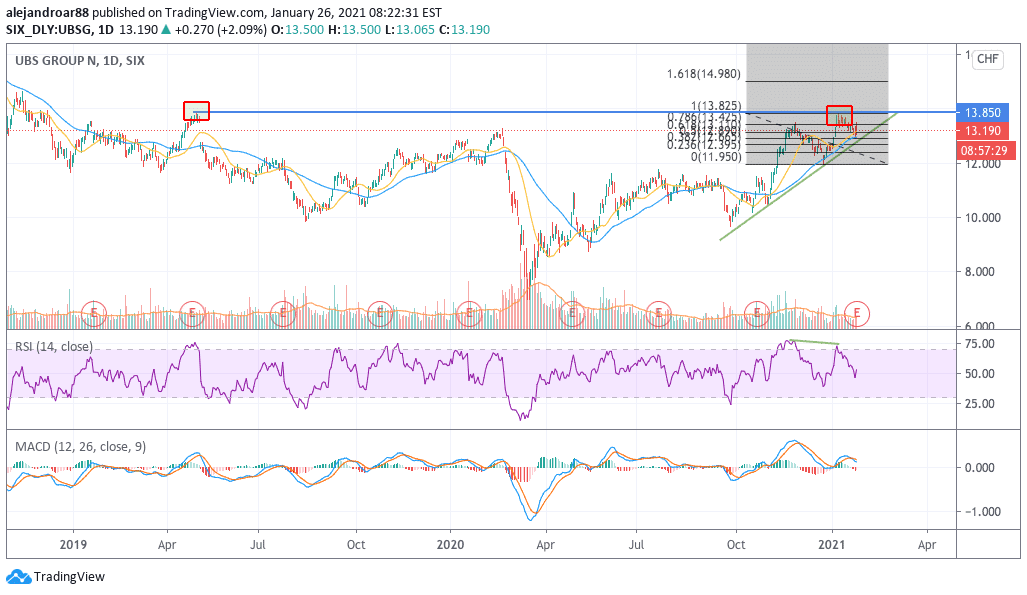

Today’s uptick in UBS shares could be the beginning of another attempt to cross the CHF 13.85 resistance shown in the chart above, although this view is somehow contradicted by the current readings of the RSI and MACD oscillators.

For that reason, a move above that level could be taken as a potential confirmation that a new uptrend is about to emerge, especially after considering that the share price has been posting a series of higher lows since late September last year while the price is progressively closing in that particular target.

The confluence seen by multiple technical studies at that level reinforces the importance of it for the short-term price action, while a first target could be set at CHF 15 per share – a potential 8.3% upside – if the price were to break the resistance in the following days or weeks.

Question & Answers (0)