Travis Perkins shares are down more than 6% today trading at 1,142p per share as the British construction materials supplier reported a 20% plunge in revenues during the first six months of 2020 due to the pandemic.

The company’s sales were primarily affected by shut down construction sites across the UK as the virus situation prompted builders to halt their operations to protect workers.

Sales fell to £2.8 billion from £3.5 billion on the same period last year while Travis Perkins (TPK) reported a loss per share of 45.7p contrasting with the 4.2p in earnings per share it brought during the first six months of 2019.

Nick Roberts, Chief Executive of Travis Perkins, commented on the results: “our financial performance in the first half of 2020 was impacted by the Covid-19 pandemic, and we have had to undertake a restructuring programme in light of the challenging outlook for the Group’s end markets”.

Part of these restructuring efforts include shutting down around 165 branches while laying off approximately 2,500 employees – around 9% of TPK’s workforce – as the company continues to trim down its operating expenses to remain profitable despite a deceleration in construction activity.

Additionally, Travis Perkins slashed its interim dividend and announced that it will be pausing the demerger of its Wickes unit as a result of the unfavorable environment caused by the pandemic.

Other highlights from Travis Perkins interim earnings report

Travis Perkins revealed that it received a total of £45 million as part of the government’s Coronavirus Job Retention Scheme and Business Rates Relief programme, which helped the company in reducing the number of furloughed employees during the first six months of the year.

Additionally, the company’s top management decided to slash their compensation by 20% for a period of three months starting on 1 May to further reduce the firm’s operating expenses.

The company expects to save approximately £120 million this year as a result of all of its cost-cutting measures although the management recognizes that the pace of the recovery for home building and commercial building activity has been slower than expected.

Despite this gloomy outlook, the group believes that the worst of the pandemic may be behind as Travis Perkins reported that July and August sales have returned to last year’s levels.

What’s next for Travis Perkins shares?

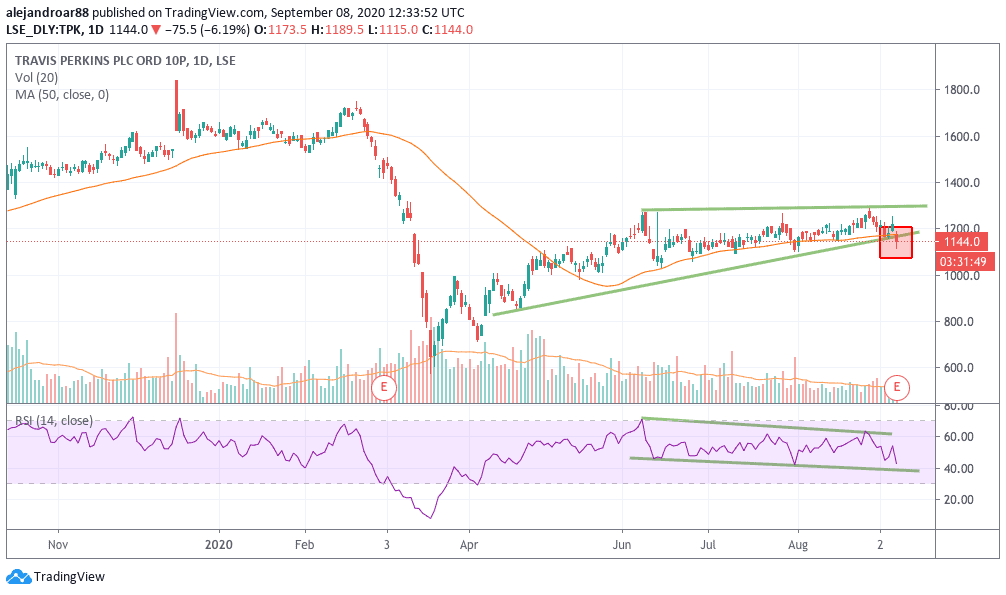

Travis Perkins shares have been on an uptrend since they emerged from their March lows but they have failed to cross the 1,300p level, which is an indication that the stock market is not yet prepared to push the price of its shares higher.

Although the latest price action formed an ascending triangle – which should have led to a break above that resistance – the company’s interim results have actually caused a break below the lower trend line, as shown in the chart above, which could be bad news for Travis Perkins shares in the short run.

Meanwhile, another element pointing to a bearish outlook for TPK is the fact that the RSI has been trending lower although the price trend has been going up. This is known as a bearish divergence and it could be a signal of what may come next for TPK.

More pain ahead for TPK?

If Travis Perkins shares continue to dive in the next few sessions, this trend line break would be confirmed and a further push below could come next for the Northampton-based construction materials supplier.

At this point, traders could keep an eye on the 1,100p level as it should provide a psychological support for TPK. On the other hand, if the price move bellows that threshold, it could signal that more pain is ahead for the firm’s shares as sellers would have taken the lead by then.

One particular driver for this correction could be the recent rise in virus cases seen in the UK, which could result in another wave of shutdowns across construction sites – a situation that would hurt Travis Perkin’s top line for longer than initially expected.

Question & Answers (0)