Tesla (NYSE: TSLA) is usually among the most shorted shares. While the Elon Musk-run company was the most shorted S&P 500 share in July, Super Micro Computers (NYSE: SMCI) was the most shorted crowded share overall, according to Hazeltree.

Hazeltree comes up with a monthly report that has a “crowdedness score” that “represents securities that are being shorted by the highest percentage of funds in Hazeltree’s community in a pre-defined category.”

It also provides an “Institutional Supply Utilization” that tells the share of supply from institutional investors for a particular security that is being lent out.

According to the report, SMCI was the most crowded short trade in July with a score of 99. Energy giant Chevron came second with a score of 97 while Tesla was third was a score of 94.

According to Hazeltree’s analysis, Bloom Energy was the most crowded company in the mid-cap category while Winnebago Industries was the most crowded in the small-cap universe.

Tesla was the most shorted S&P 500 share

Meanwhile, according to S&P Global Market Intelligence, Tesla had a short interest ratio of 3.3% at the end of July which was higher than the 2.5% that it stood at the corresponding period last year, making it the most shorted S&P 500 index share based on the metric last month. Costco was the second on the list followed by Meta Platforms, Visa, and Alphabet.

In its report, S&P Global Market Intelligence said, “Average short interest for the entire S&P 500 index was 2.6% at the end of July, up from 2.2% a year earlier and matching a high for the year.”

It added, “Eleven of the S&P 500’s biggest stocks by market capitalization had higher levels of short interest at the end of July than they did a year earlier, as short sellers correctly anticipated that a decline was nearing.”

Tesla is quite popular among short sellers

Tesla’s share is quite popular among short sellers, even as it is often not a profitable trade. For instance, according to markets analytics firm S3 Partners, Tesla short sellers lost a cumulative $12.2 billion last year as the shares more than doubled in value. Tesla was the most shorted share in 2024 followed by Apple.

While 2023 was a bad year for those shorting tech shares, it was more so for Tesla bears as the losses that short sellers suffered in the share were more than the combined losses that short sellers made in Meta Platforms and Microsoft.

The first half of the year was especially gruesome for Tesla bears and they lost $13 billion. However, Tesla shares eventually fell from their July highs and short sellers made a marginal profit of $771 million in the back half of the year.

Elon Musk frequently mocks short-sellers

Tesla CEO Elon Musk has often mocked TSLA short sellers and in the past, the billionaire has swiped at short sellers like Jim Chanos and David Einhorn. In 2020 launched he the “Tesla short shorts” taking potshots at bears who lost massively betting against the shares.

Musk also poked fun at Bill Gates and last year he tweeted, “Taking out a short position against Tesla, as (Bill) Gates did, results in the highest return only if a company goes bankrupt! Gates placed a massive bet on Tesla dying when our company was at one of its weakest moments several years ago. Such a big short position also drives the stock down for everyday investors.”

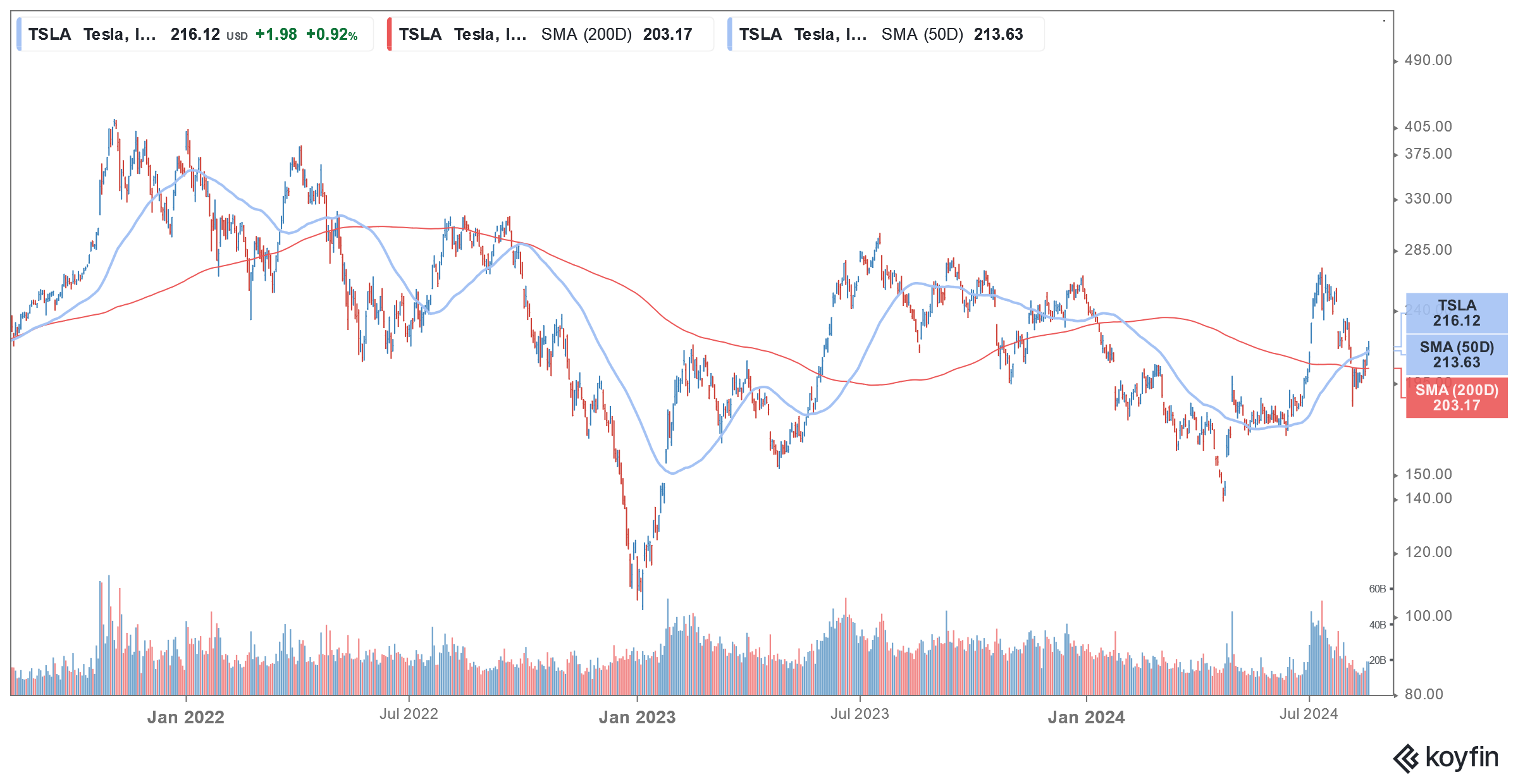

Tesla share has underperformed in 2024

Meanwhile, Tesla share is in the red in 2024 and is underperforming the markets and tech peers by a wide margin. The shares fell over 12% after the company reported an unimpressive set of numbers for the second quarter.

Tesla reported revenues of $25.50 billion in Q2 which was 2% higher YoY and ahead of the $24.77 billion that analysts expected. While Tesla’s Q2 revenues were ahead of consensus estimates, its adjusted EPS of 52 cents fell short of the 62 cents that analysts were expecting. The company’s operating margin was 6.3% which while being higher than the Q1 trough of 5.5% is still well below what it was posting about a year back.

EV demand hasn’t been as strong as markets expected prompting companies to readjust their production plans. For instance, both Ford and General Motors which have committed billions of dollars towards building EV plants are delaying their investments. Startup EV companies have been under even severe stress and are grappling with continued cash burn. Several startup EV companies have either gone bankrupt or are on the verge of doing so.

Tesla, which was once looking to grow deliveries at a CAGR of 50% over the long term has missed that milestone for two consecutive years.

Analysts on TSLA shares

On Friday, Bernstein reiterated Tesla share as an “underperform.” In a note, the firm’s analysts wrote, “We don’t believe that Tesla will be able to regain share or grow materially until it launches all new, lower priced offerings – likely only in 2026 and 2027 – and believe the company’s valuation is increasingly disconnected from prevailing fundamentals.”

Notably, while Tesla expects to begin deliveries of its upcoming low-cost model in the first half of 2025, mass production is not expected at least before 2026. The company has an aging product lineup while the deliveries of its most recent launch – the Cybertruck – have been tepid at best.

AI products

Meanwhile, Musk believes that artificial intelligence products – which include the Optimus humanoid, Dojo supercomputer, and autonomous driving – would drive the next leg of the rally for Tesla.

During the Q2 earnings call, Musk said the Optimus robots are already performing some tasks in Tesla’s factory and early next year the company should start limited production of production Version 1 which again would be deployed internally within the company.

He however added, “But we expect to have several thousand Optimus robots produced and doing useful things by the end of next year in the Tesla factories. And then in 2026, ramping up production quite a bit.”

Question & Answers (0)