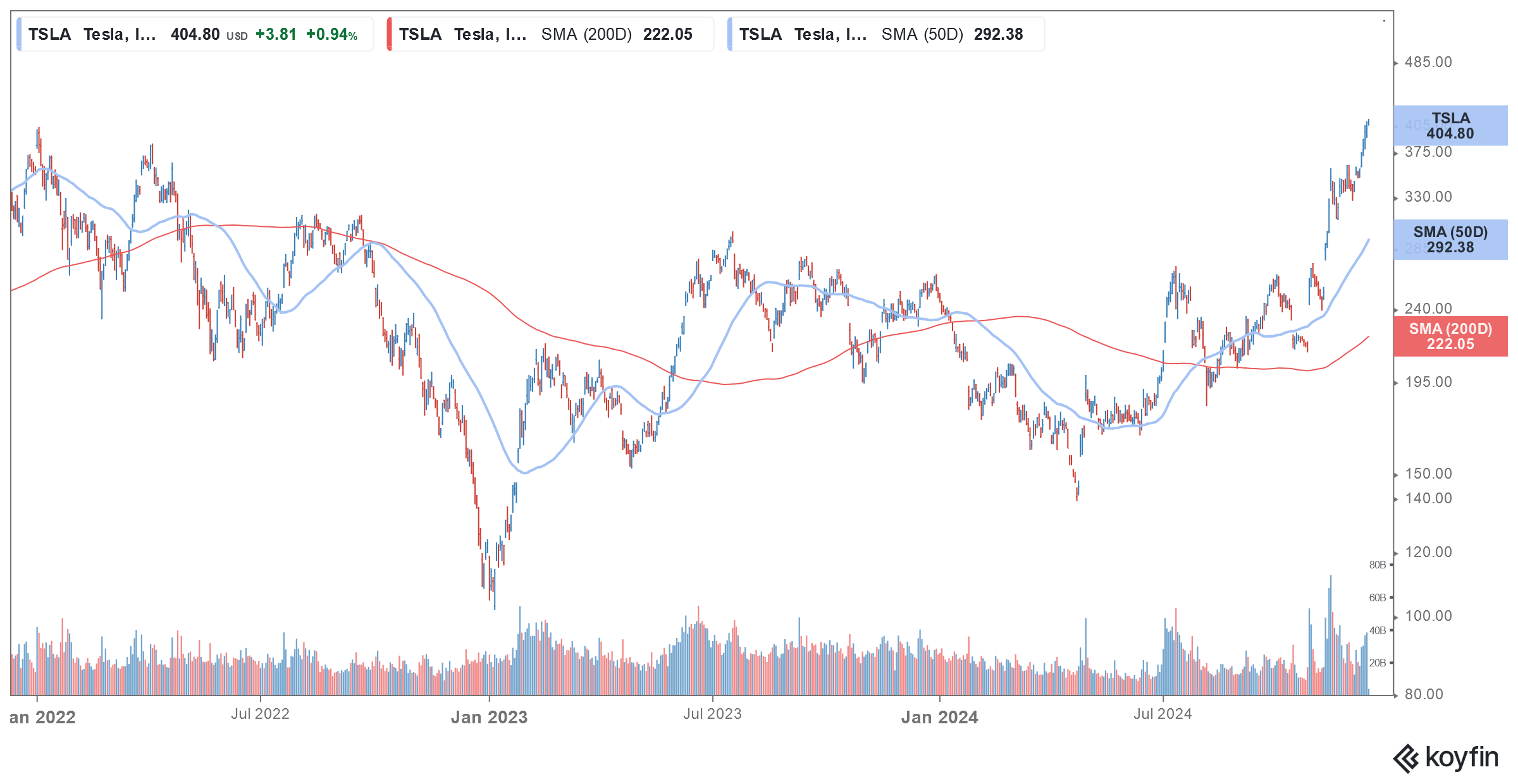

Tesla (NYSE: TSLA) shares have closed with gains for five consecutive trading sessions and are set to close in the green for a sixth day today. The shares are now only a tad short of their November 2021 highs as the rally continues unabated since Donald Trump’s election.

Tesla shares have gained over 60% so far in 2024 based on yesterday’s closing prices and the bulk of the gains have come since the US presidential elections on November 5.

Tesla shares have been rallying since Trump’s election

TSLA rose around 38% in November and had their best month since January 2023. November was the 10th best month overall for Tesla and in absolute terms, the company added more than $300 billion to its market cap. Tesla CEO Elon Musk is a close confidante of Trump and the president-elect has appointed him along with Vivek Ramaswamy to head the Department of Government Efficiency (DOGE).

Notably, while Trump is expected to roll back some of the electric vehicle (EV) friendly policies like the EV tax credit, a section of the market believes that he would ease the regulations for autonomous driving, which by Musk’s own assertion accounts for the bulk of Tesla’s valuation.

TSLA is working on autonomous driving

Tesla markets its advanced autonomous driving as FSD (full self-driving). However, it is worth noting that the nomenclature could be misleading as it is not level 4 autonomous driving, and even Tesla advises drivers to keep their hands on the steering all the time even when it is on the Autopilot. There have been multiple instances of crashes involving Autopilot and the US NHTSA is investigating the company.

Meanwhile, Musk’s proximity to Trump might mean enabling regulations for self-driving technology which is crucial for its upcoming robotaxi.

Wedbush analyst Dan Ives raised Tesla’s target price to $400 last month. “The biggest winner from a Trump White House remains Tesla and Musk which made a strategic big bet on Trump that will pay major dividends for years to come,” said Ives in his note.

According to Ives, “We believe the Trump White House win will be a gamechanger for the autonomous and AI story for Tesla and Musk over the coming years,” said Ives in his report.

He added, “In essence, Musk made a strategic and big bet on a Trump White House win that will be known as a ‘bet for the ages’ for TSLA bulls as now Tesla and Musk are set to reap the benefits from a new friendlier regulatory era in the Beltway ahead.”

Brokerages list Tesla as a top pick for 2025

Morgan Stanley listed Tesla as a top pick for 2025. In its note, the brokerage said, “From our ongoing client discussions, we hear enthusiasm for all things AI, datacenters, renewable energy, robotics and on-shoring. Investors acknowledge the importance of the United States maintaining leadership in such technologies in an increasingly competitive and complex geopolitical environment.”

Deutsche Bank also named TSLA as a top pick for 2025 and said, “While there has been debate over the right approach to achieving full autonomy, our view is that true commercial success in robotaxi is achieved through end-to-end AI. As such, we believe Tesla is well positioned.”

Long-time Tesla bull turns wary

However, not all are convinced that Tesla stands to gain from a Trump presidency. Gerber Kawasaki Wealth & Investment Management president Ross Gerber who had been a long-standing Tesla bull has been selling TSLA shares. “I used to have a 10%, 12%, even 20% stake in Tesla at some point in my life where it was like, Tesla was taking us to the moon kind of thing. And I just think its best days are behind it,” said Gerber.

He said, “I get that Elon is now vice president of the United States, but that doesn’t necessarily help Tesla.”

Gerber is not too sold on Tesla’s self-driving software and added “So the ultimate reality for full self-driving is it doesn’t work, and the precision isn’t good. And vision-only systems have flaws that I don’t think Elon wants to admit.”

TSLA has missed many self-imposed deadlines of reaching full autonomy, most recently in 2023 when Musk said he was confident the company would achieve the feat by the end of the year.

TSLA’s China sales improve

There have been concerns over Tesla’s sales in China, the company sold over 73,000 cars in the country last month making it its best month in the year. Moreover, it sold 21,900 vehicles in the first week of December which was the highest weekly sales this quarter.

Meanwhile, while Tesla was trading sharply higher in early trade today and almost hit its all-time intraday higher, the shares pared gains and could not hold on to the higher price levels.

Bulls believe that TSLA is set to rally further in 2025 after the stellar rally. However, not all buy the story of TSLA benefiting from a Trump presidency. Bernstein – a long-standing Tesla bear – said in its note, “Trump is anti-EVs, but TSLA is on a tear. Tesla’s stock is up 28% since Trump’s election victory, despite the fact that the new administration will likely end IRA consumer and battery manufacturing tax credits, potentially lower emissions standards and could increase tariffs on Chinese batteries.”

Question & Answers (0)