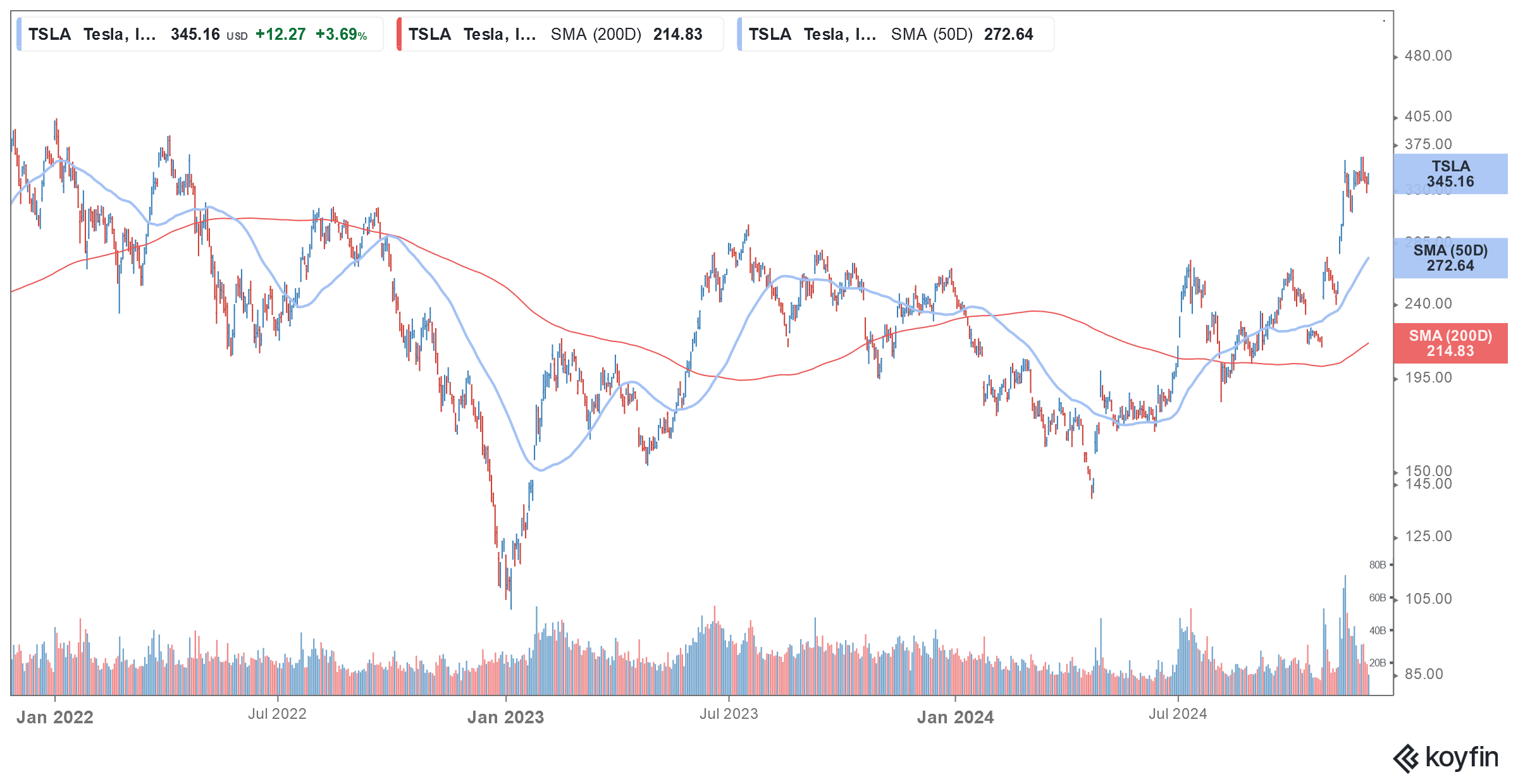

Both the S&P 500 and Dow Jones closed at fresh highs on Friday as the rally in US shares following Donald Trump’s election shows little signs of withering away. One share that has been in the limelight since Trump’s election is Tesla (NYSE: TSLA) whose shares rose around 38% in November and had their best month since January 2023.

November was the 10th best month overall for Tesla and in absolute terms, the company added more than $300 billion to its market cap. Tesla CEO Elon Musk is a close confidante of Trump and the president-elect has appointed him along with Vivek Ramaswamy to head the Department of Government Efficiency (DOGE).

Tesla shares jumped in November

TSLA is the rare green energy company that rallied in November. Trump’s pro-fossil fuel policies are no secret and he has vowed to end the electric vehicle (EV) “mandate” on the very first day of his presidency.

Notably, the Biden administration took a series of steps to spur EV adoption in the country. It committed billions of dollars under the Inflation Reduction Act to building EV charging infrastructure in the country. The administration also broadened the EV tax credit which helped Tesla and General Motors models also eligible for the $7,500 tax credit.

The administration linked the EV tax credit to domestic manufacturing including for battery and critical battery minerals. After the targeted policies, companies like Toyota announced new investments in the US in an apparent bid to make its EVs eligible for the $7,500 EV tax credit.

There are fears that Trump would reverse Biden’s pro-EV policies of Biden and even relax emission norms which could hurt the regulatory credit sales of EV companies including Tesla.

What does Trump’s victory mean for the EV industry?

Analysts are wary of EV shares after Trump’s victory and Bank of America downgraded Rivian shares from a “buy” to “neutral” citing higher regulatory risk under the Trump administration.

However, Tesla has been in a different universe since Trump’s election. A section of the market believes that given Musk’s proximity to Trump, Tesla stands to benefit from enabling regulations from his administration – particularly on autonomous driving.

Tesla might benefit from Trump’s policies on autonomous driving

Wedbush analyst Dan Ives raised Tesla’s target price to $400 last month. “The biggest winner from a Trump White House remains Tesla and Musk which made a strategic big bet on Trump that will pay major dividends for years to come,” said Ives in his note.

According to Ives, “We believe the Trump White House win will be a gamechanger for the autonomous and AI story for Tesla and Musk over the coming years,” said Ives in his report.

He added, “In essence, Musk made a strategic and big bet on a Trump White House win that will be known as a ‘bet for the ages’ for TSLA bulls as now Tesla and Musk are set to reap the benefits from a new friendlier regulatory era in the Beltway ahead.”

Deutsche Bank and Jim Cramer also saw the November rally in Tesla shares as justified.

TSLA bull has been selling shares

However, not all are convinced that Tesla stands to gain from a Trump presidency. Gerber Kawasaki Wealth & Investment Management president Ross Gerber who had been a long-standing Tesla bull has been selling TSLA shares. “I used to have a 10%, 12%, even 20% stake in Tesla at some point in my life where it was like, Tesla was taking us to the moon kind of thing. And I just think its best days are behind it,” said Gerber.

He said, “I get that Elon is now vice president of the United States, but that doesn’t necessarily help Tesla.”

Gerber is not too sold on Tesla’s self-driving software and added “So the ultimate reality for full self-driving is it doesn’t work, and the precision isn’t good. And vision-only systems have flaws that I don’t think Elon wants to admit.”

Tesla markets its advanced autonomous driving as FSD (full self-driving). However, it is worth noting that the nomenclature could be misleading as it is not level 4 autonomous driving, and even Tesla advises drivers to keep their hands on the steering all the time even when it is on the Autopilot. There have been multiple instances of crashes involving Autopilot and the US NHTSA (National Highway Transport Safety Administration) is investigating the company.

TSLA has missed many self-imposed deadlines of reaching full autonomy, most recently in 2023 when Musk said he was confident the company would achieve the feat by the end of the year.

Is Musk spending enough time at Tesla?

Gerber also said that Musk is not spending enough time at Tesla. “We all know where Elon is right now, and he’s at Mar-a-Lago. So, he hasn’t worked at Tesla for a long time,” said Gerber.

Notably, apart from Tesla, Musk also heads several other companies including SpaceX, x.AI, and Neuralink. Also, while he selected Linda Yaccarino to head X (formerly Twitter) he continues to be involved with the company.

Some of the other analysts are also not buying the story of TSLA benefiting from a Trump presidency. Bernstein – a long-standing Tesla bear – said in its note, “Trump is anti-EVs, but TSLA is on a tear. Tesla’s stock is up 28% since Trump’s election victory, despite the fact that the new administration will likely end IRA consumer and battery manufacturing tax credits, potentially lower emissions standards and could increase tariffs on Chinese batteries.”

Question & Answers (0)