Target shares are up in pre-market stock trading action after the company beat both revenues and earnings estimates for its first fiscal quarter of 2021 while the management also provided guidance for the second quarter of the year that exceeded the consensus forecast.

The company led by Brian Cornell reported a 23.3% jump in sales during the first fiscal quarter ended on 1 May, with revenues landing at $23.88 billion compared to $19.37 billion reported a year ago.

This growth rate exceeded the 11.3% jump in sales the firm reported during the first quarter of 2020, back when the pandemic provided a tailwind for the company, which appears to indicate that Target may have strengthened its relationship with customers during the crisis.

The press release highlighted that Target (TGT) gained $1 billion in market share during the first quarter of the year compared to its rivals on top of another $1 billion share gained during the first quarter of last year.

Meanwhile, this top-line figure shattered analysts’ estimates of $21.77 billion for the quarter as store comparable sales increased 18% during the period compared to 0.9% a year ago.

Target earnings 66% higher than analyst forecasts

Moreover, the firm’s adjusted earnings per share (EPS) landed 66.2% higher than analysts’ forecasts at $3.69 per share after excluding the earnings from the sale of Dermstore. This results in a 525% jump compared to Target’s per-share profitability a year ago.

A significant improvement in the firm’s gross margins during the period – which jumped almost 490 basis points to 30.9% – along with a reduction in selling, general, and administrative expenses as a percentage of sales were the primary causes behind this strong uptick in earnings for the retailer.

The Minneapolis-based company ramped up its quarterly dividend by 3% at $0.68 while it spent $1.3 billion in share buybacks during the first three months of its 2021 fiscal year. Finally, free cash flow landed at $599 million excluding a one-time $356 million windfall from the sale of Dermstore to British e-commerce company THG Holdings.

In regards to the future, Target’s management team expects to post mid-to-high single-digit comparable sales growth for the second quarter of its 2021 fiscal year, while operating margins should land in the high single-digit area.

Finally, the company expects to report single-digit growth in comparable sales during the two final quarters of the year with this outlook effectively exceeding analysts’ estimates for the period as Wall Street expected a retreat in sales during the remaining quarters of the year.

How have target sales performed so far this year?

The price of Target shares has climbed 17.7% this year while the stock is trading 2.3% higher in pre-market action this morning at $211.24 as the firm emerged as a pandemic winner due to its positive performance during lockdowns.

This performance is almost doubling that of the S&P 500 index, as the broad-market benchmark has only gone up 9.9% since the year started. Meanwhile, the stock reported gains of 40.5% last year, also outperforming the S&P 500 by as much as 24% as a result of its impressive top-line growth.

The management’s guidance for the remaining quarters of the year is perhaps the most important driver behind this pre-market uptick, as analysts were expecting a drop in revenues compared to a year ago for all of the firm’s 2021 quarters while the situation appears to be the opposite.

More information about the leading causes for this divergence in the outlook of the business versus Wall Street’s estimates will surely be provided during the earnings call that will follow the release of these results.

What’s next for Target shares?

In the past 7 years, Target’s free cash flow (FCF) has expanded from $4.6 billion to $7.88 billion by the end of its 2020 fiscal year, which results in a compounded annual growth rate (CAGR) of 8%. However, during the past two years, the company’s FCF has grown at a faster rate than that, jumping by 19% by the end of its 2019 fiscal year and almost 49% last year.

Meanwhile, the company’s net long-term debt currently stands at approximately $8 billion or roughly 0.9 times Target’s 2020 GAAP earnings before interest, taxes, depreciation, and amortization (EBITDA).

Based on those numbers and considering today’s turn of events, with Target now expecting continued growth for what remains of the year although at a slower rate, chances are that this could be an undervalued stock or at least one that is fairly valued.

If Target manages to post 20% or higher free cash flow growth in the following one to two years and taking into account its current multiple of 22.9 times its forecasted earnings per share for the next twelve months, this would be a stock that is fairly valued.

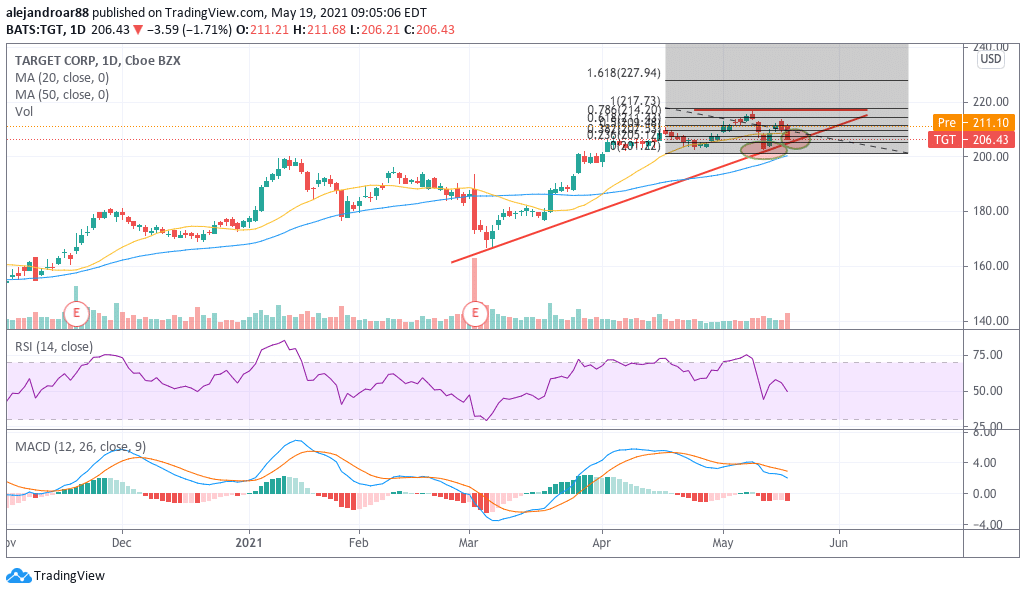

On the other hand, from a technical standpoint, if the stock manages to climb above the $217 resistance highlighted in the chart in the following weeks amid these strong quarterly results, chances are that we could see the continuation of the current uptrend for the shares, possibly aiming for a first target of $227 per share for a 4% short-term upside potential.

Question & Answers (0)