In June, the EU announced additional tariffs on electric vehicle (EV) imports from China as the bloc continues to battle rising imports from the country that are threatening its domestic industry.

As the October 30 deadline to decide on these tariffs approaches both sides are engaged in discussions. While China has called for these tariffs to be rolled back, and some EU members like Germany and Spain have also called for a rethink, some analysts believe that even these tariffs won’t be enough to stem the flow of cheap Chinese EVs into Europe.

EU has increased tariffs on EV imports from China

For context, in June the EU imposed tariffs of upto 38.1% on EV imports from China. The duties would be on top of the 10% tariff these imports already attract. However, in August it somewhat slashed the tariffs to between 9%-35.3% – with the top end of the range reserves for names like SAIC that did not cooperate with the EU’s probe. The region imposed a 7.8% tariff on Tesla cars made in China.

These tariffs would however need to be approved by the member states post which they would come into effect for five years. However, the bloc is not fully united on the tariffs, and Germany – which is China’s biggest trading partner in the region – has opposed the tariffs. So has Spain, as the member states weigh the individual pros and cons of entering into a trade war with China.

Chinese electric cars are flooding global markets

According to the EU, every one in four cars sold in the region is now Chinese and the percentage has increased significantly over the years. The region alleges that Chinese EV companies get state subsidies which help them sell cars at a lower price. Notably, amid the slowdown in the domestic market, Chinese automakers have been looking at export markets to beat the slowdown at home.

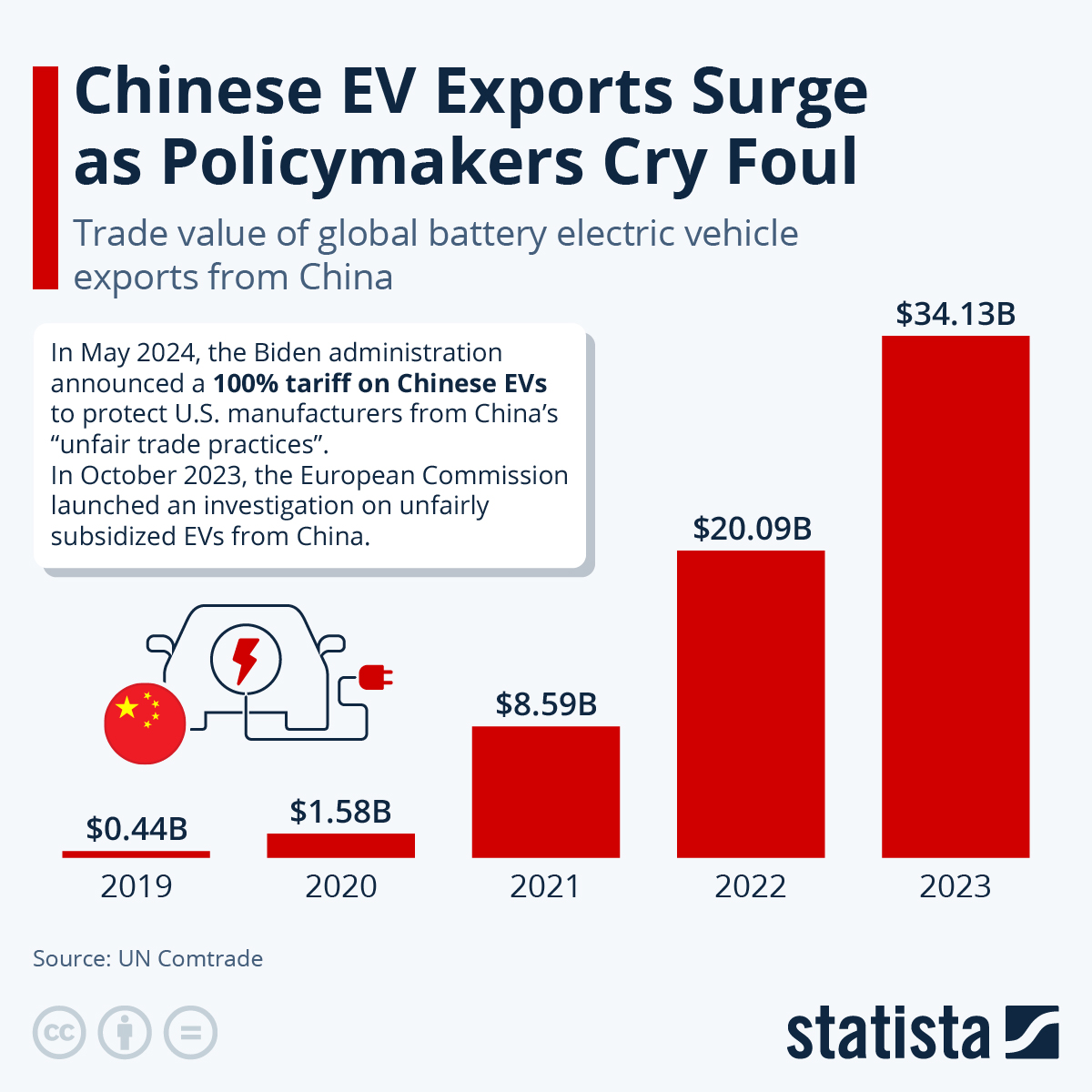

China has an annual automotive production capacity of 40 million units which is much higher than its domestic demand and is good enough to satiate half of the global demand. The country’s auto exports rose 50% last year leaving several countries scrambling to protect their domestic industries from the onslaught of Chinese imports.

To be sure, the EU is not the only region that’s trying to protect its domestic industry from the onslaught of EV imports from China and many other countries have similar worries. Both the US and Canada have imposed a 100% tariff on EV imports from China.

“With extensive subsidies and non-market practices leading to substantial risks of overcapacity, China’s exports of EVs grew by 70% from 2022 to 2023—jeopardizing productive investments elsewhere. A 100% tariff rate on EVs will protect American manufacturers from China’s unfair trade practices,” said the White House in its statement while announcing the crippling tariffs.

Some experts believe EU needs to impose a higher tariff on Chinese electric cars

Meanwhile, some experts believe that the EU needs to increase the tariffs on Chinese EVs further to make them effective and research by the Rhodium group shows that they should be as high as 50%.

Joseph McCabe, president and CEO of global auto research company AutoForecast Solutions has a similar view and said, “Tariffs on Chinese-made EVs will create a hurdle, but not a barrier to entry.”

Notably, the automotive industry in China and Europe is quite interconnected with German giant Volkswagen among the major players in China. McCabe believes that the relatively soft tariffs on Europe “is a delicate balance to promote domestic European production without severely impacting their Chinese operations.”

Chinese EV companies have a cost advantage

Chinese EV companies have a cost advantage with market leader BYD offering models for as low as $10,000 in the domestic market. Earlier this year, BYD announced that its Dolphin model in Europe would cost as little as $21,550. The model, which is a rebrand of the Seagull model that BYD sells in China is priced at less than half of Tesla’s Model 3 – the cheapest model in the company’s stable.

Tesla’s CEO Elon Musk has been all praise for Chinese EV companies and the country’s EV ecosystem. During Tesla’s Q4 2023 earnings call earlier this year he said, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

He added, “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established.”

China and EU held “constructive” talks

Earlier this week, EU Trade Commissioner Valdis Dombrovskis held discussions with Chinese Commerce Minister Wang Wentao over the EV tariffs. After the talks, Dombrovskis tweeted, “Constructive meeting with Minister of Commerce Wang Wentao. Both sides agreed to intensify efforts to find an effective, enforceable and WTO (World Trade Organization) compatible solution.”

China’s Ministry of Commerce meanwhile described the talks as “comprehensive” and said, both sides “expressed their political will to resolve their differences through consultations, agreed to continue to push forward the negotiations on the price commitment agreement.”

Meanwhile, after meeting with Beijing’s commerce minister Wang Wentao in Brussels, the China Chamber of Commerce to the EU said, “Certain Chinese companies noted that if the EU proceeds with the imposition of additional tariffs, their existing investment plans would have to be re-evaluated as their confidence in the EU’s investment environment would be diminished.”

Chinese EV companies are looking to set base in Europe

In order to escape the tariffs in Europe, Chinese EV companies – that currently make their cars domestically and ship them to Europe – are considering setting up a manufacturing footprint in the country.

BYD is setting up a plant in Hungary while Cherry is looking to set up a plant in Spain in partnership with Ebro EV Motors. Xpeng Motors – which counts Volkswagen as among its investors – has also talked about the possibility of manufacturing cars in Europe

Question & Answers (0)