Shells liquefied natural gas (LNG) regasification terminal in Gibraltar 2018, switching from diesel-fuelled power generation to cleaner-burning natural gas. It uses a newly commissioned 80-megawatt gas-fired power plant. An inspector checks on the evaporator.

Royal Dutch Shell shares are diving this morning as the discovery of a highly-transmissible COVID strain in the UK and the announcement of another large asset write-down weigh on the firm’s short-term outlook.

The Anglo-Dutch petroleum giant’s shares are trading 5% lower at 1,270p per share in early stock trading activity in London, after the release of a trading update in which the company unveiled an upcoming post-tax write-down of around $3.5 and $4.5 billion by the end of the fourth quarter of the year.

Shell (LON: RDSA) also expects to post an adjusted loss during the three-month period ended on 31 December amid the “current price environment”, although the effect that this loss will have on the firm’s cash flow will be limited due to non-cash movements related to fluctuations in its deferred tax positions.

Meanwhile, integrated gas production is expected to come in in a range between 900 and 940 thousand barrels – nearly 100,000 barrels above the company’s guidance for this upcoming three-month period – while oil production is expected to land fairly in line with Shell’s estimates, possibly ending the quarter in a range between 2,275 and 2,350 thousand barrels of oil equivalents per day.

Refinery utilisation remained within the boundaries that the firm set forth for the quarter, possibly landing in a range between 72% and 76% as industrial activity around the world keeps recovering, with a similar performance seen by the Chemicals unit, whose results should also end the year fairly in line with the firm’s forecasts.

This latest asset impairment charge is primarily related to asset write-downs, restructuring, and ‘onerous contracts’, whose impact will be reflected during the fourth quarter and they follow a similar string of charges the oil giant has taken recently, including one during the second quarter of the year amid the pandemic, as the portfolio of oil companies continues to suffer from lower commodity prices and weaker-than-expected demand.

Back then, the total charges amounted to roughly $16.8 billion – the biggest impairment recorded by the company to date – while the firm now expects to book a net loss of around $800 and $875 million during the fourth quarter of the year, possibly ending the year with a post-tax loss of $3.5 billion.

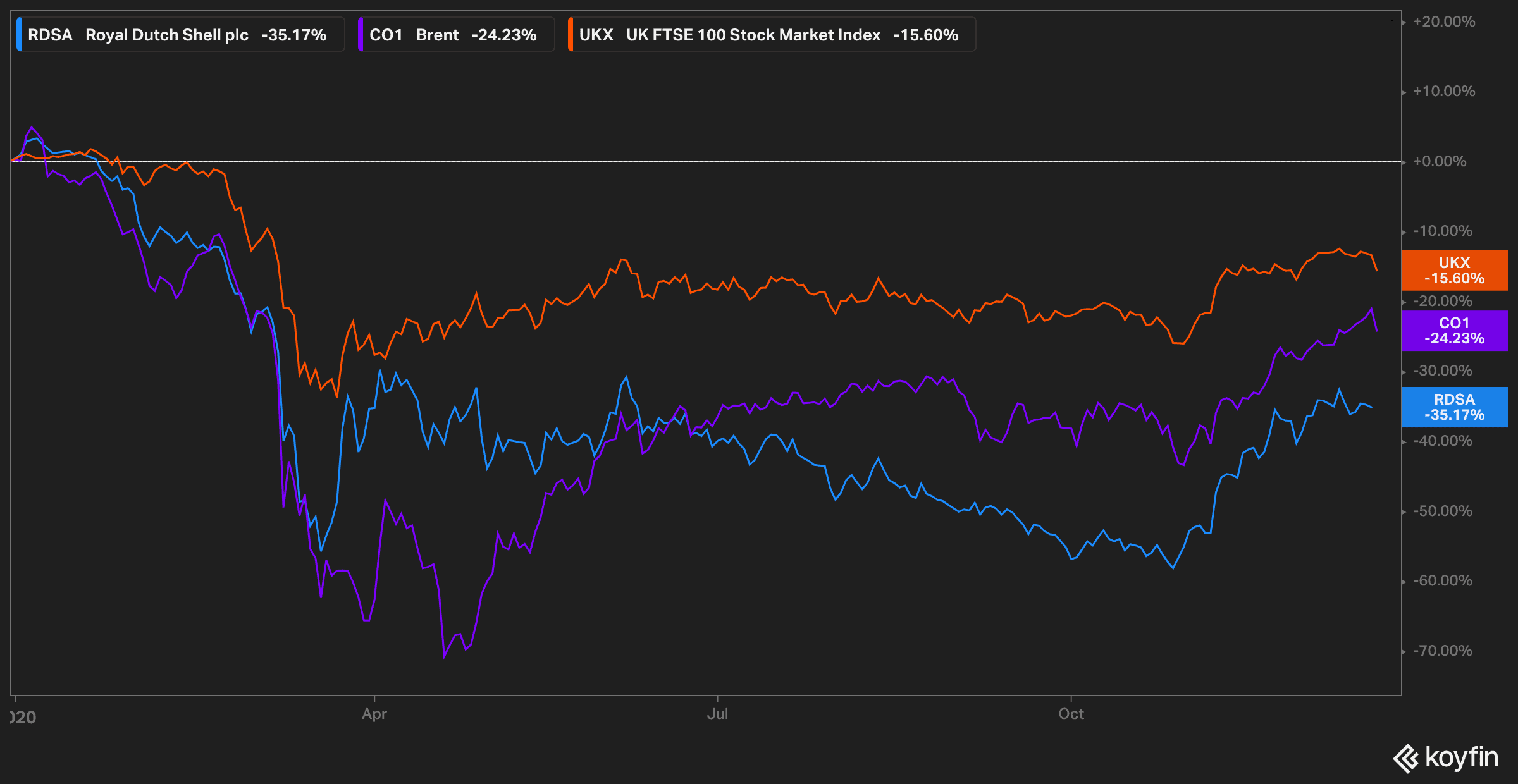

How have Shell shares performed so far this year?

Including today’s downtick, Royal Dutch Shell shares have delivered a 35% loss for investors since the year started as the price of Brent crude has retreated 24% during the pandemic.

Meanwhile, news of a highly-transmissible COVID strain and the reintroduction of Tier 4 lockdowns in London are spooking investors today, as the oil giant’s pains could be prolonged if the virus situation gets out of hand once again.

Brent crude futures are plunging roughly 3.7% today at $50.25 as oil traders fear that this new strain could end up spreading – or just showing up – in other countries, which would affect the pace of the global economic recovery.

What’s next for Royal Dutch Shell shares?

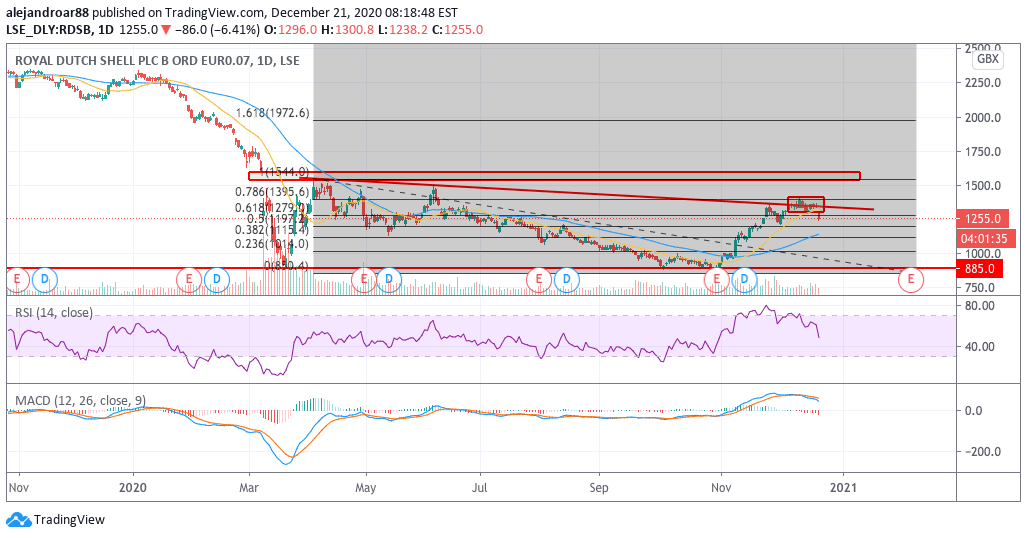

The daily chart above shows how bulls struggled to move the price above the 0.681 Fibonacci during the latest uptick seen by Shell shares, with the price now gapping down amid the news.

The virus situation could be a major catalyst for some further downward momentum, although vaccines are being effectively rolled out in multiple developed countries, which should help limit the extent of the damage caused by the reintroduction of lockdowns – if that were to happen outside the UK.

For now, Fibonacci levels indicate that support might be found at the 1,200p level and then at 1,115p. However, If the price action were to go down further, the downward momentum will likely accelerate amid the breaking of multiple technical thresholds including the stock’s short-term moving averages.

For now, the MACD has already sent a sell signal while the RSI has already moved below 50. The combination of all of these elements seems to reinforce a bearish short-term outlook for RDSA shares.

Question & Answers (0)