Royal Mail shares are heading down this morning in early stock trading action in London a day after the company published its financial results covering its 2021 fiscal year, which seems to have caused mixed reactions among traders.

Revenues for the full year increased 16.6% to £12.64 billion as a result of higher demand for parcel deliveries during the pandemic while operating profits multiplied by almost 11 times compared to a year ago landing at £611 million due to an improvement in cost management. This top-line figure exceeded analysts’ estimates for the year, as compiled by Seeking Alpha, by around £200 million.

Meanwhile, the company’s higher operating profits were partially influenced by £133 million that the company managed to save as a result of its restructuring efforts, even though a portion of those savings were offset by pay awards granted to front-line workers during the pandemic.

Royal Mail (RMG) plans to distribute a dividend of 20 pence per share during its next fiscal year while it will be distributing a one-off 10 pence dividend for this past fiscal year.

The management highlighted that the situation for the business in the United Kingdom has changed, as the company expected to report losses for that particular geographical segment but the pandemic effectively turned around that situation as adjusted operating profits landed at £144 million – up 194% compared to a year ago.

Moreover, the management team now believes that its goal of achieving an adjusted operating profit margin of 5% by 2023-2024 has become the low end of its forecasts due to what appears to be a long-lasting tailwind for the firm if parcel volumes remain high even once the pandemic situation is in the rearview mirror.

Finally, earnings per share (EPS) for the British postal company landed at 61.8 pence – up 284% compared to a year ago.

The outlook for RMG’s business remains uncertain

The management team declined to provide revenue guidance for the current fiscal year as they cited significant uncertainty about the business’ post-pandemic performance.

In this regard, the Chief Financial Officer of Royal Mail, Mick Jeavons, commented the following during a phone call with Reuters: “We’re likely to have quite a strong first quarter this year but then the uncertainty beyond that becomes really difficult”.

The most challenging area for Royal Mail remains cost management as the firm has to struggle to keep losses in check at its legacy letter business even though major changes have been underway including negotiations with its union – the Communication Workers Union (CWU) – and the implementation of technological improvements to its infrastructure and logistics.

Last year, the company reported a total of £1.173 billion in operating cash flows and around £346 million in capital expenditures including the purchase of intangible assets. Meanwhile, capital expenditures for next year are expected to go up to £400 million as a result of higher investments in automation and technology to keep increasing productivity at the company’s parcel and letter processing facilities.

What’s next for Royal Mail shares?

Analysts expect to see revenues landing at Royal Mail at around the same level as this year, possibly as a result of a long-lasting pandemic tailwind. Meanwhile, based on the company’s adjusted operating margin for its full fiscal year 2021-2022 of 5% and using a free cash flow conversion ratio of 125%, which is in line with the firm’s historical performance, we could estimate Royal Mail’s next twelve-month free cash flow at around £787.5 million

That would result in a price-to-free-cash-flow (P/FCF) valuation multiple of 7 based on the company’s current market capitalisation of £5.25 billion. That multiple appears to be quite attractive but it also reveals that the market is still skeptical about the firm’s ability to turn around a business that has been struggling for years to transition to sustained profitability.

A bet on Royal Mail at this point would be a bet in the management’s ability to cut costs, improve productivity, and, ultimately, deliver higher profits. Therefore, a closer look at the company’s fundamentals and progress in this particular area is required before deciding if the stock is a buy.

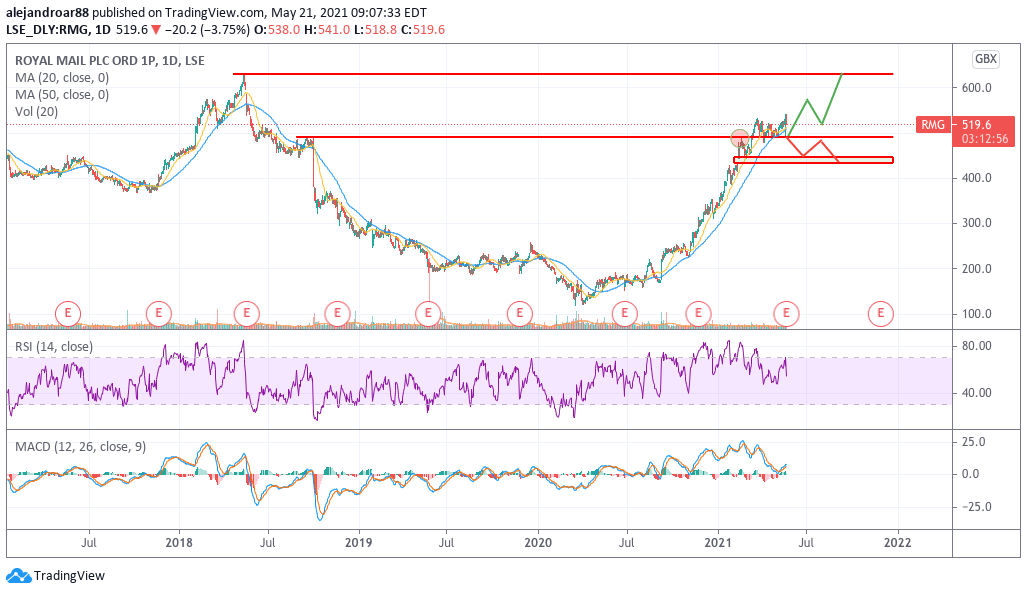

That said, the current technical setup seems quite promising as long as the price holds above the 490p area – a former resistance that should now serve as support.

If the price starts to move higher from that level, chances are that Royal Mail shares could quickly surge to their next area of resistance at 630p, offering a plausible 21% upside potential as long as good news keep coming.

On the other hand, a setback along the way in the management’s intention to keep cutting costs or a significant slowdown in the demand for parcel deliveries that surpasses the market’s estimates could quickly plunge the price below that thresholds – possibly risking a sharp pullback toward the 430p area.

Question & Answers (0)