Royal Mail shares are trading higher a day after Prime Minister Boris Johnson introduced a countrywide lockdown that seeks to stop the accelerated spread of a new strain of COVID identified in the country.

Investors seem to be responding positively to the thesis that the company would benefit from the lockdown – which is set to last at least until the end of January – as households and businesses will increasingly rely on online shopping, effectively boosting the demand for parcel deliveries for longer than expected.

This measure was implemented after receiving a warning from the National Health Service (NHS) that the surging hospitalisations is a “material risk” to health infrastructure, with hospitals overwhelmed in the next 21 days if no actions was taken.

RMG shares ended the first session of the year with a 1.1% gain while they are up 3.3% so far in today’s stock trading activity at 352p – their highest level in roughly two years.

On 22 December, Royal Mail concluded a two-year dispute with its largest union – the Communication Workers Union (CWU) – clearing the path to upgrade its operations and infrastructure to respond to higher parcel delivery demand.

The deal effectively cleared a big obstacle that prevented the company from making the operational upgrades required to improve the profitability of its parcel business, leaving room for the management to take action on this front to ramp up its financial results over the coming years.

According to the company’s press release, Royal Mail (RMG) expects to “make more frequent revisions to the network and introduce the use of technology to improve both customer service and efficiency”.

These improvements would help in turning around the firm’s financial situation, which has been marked by a sustained decline in profitability over the last five years or more, amid the management’s failure to respond to a shift from its legacy letter business to parcels.

How did Royal Mail shares perform in 2020?

Royal Mail shares delivered an eye-popping 49% return during 2020 as the company benefitted from growing revenues coming from the online shopping boom triggered by pandemic lockdowns.

This positive performance effectively ended the firm’s downtrend, as the stock bounced off an all-time low of 125p per share to as much as 352p today in roughly 9 months.

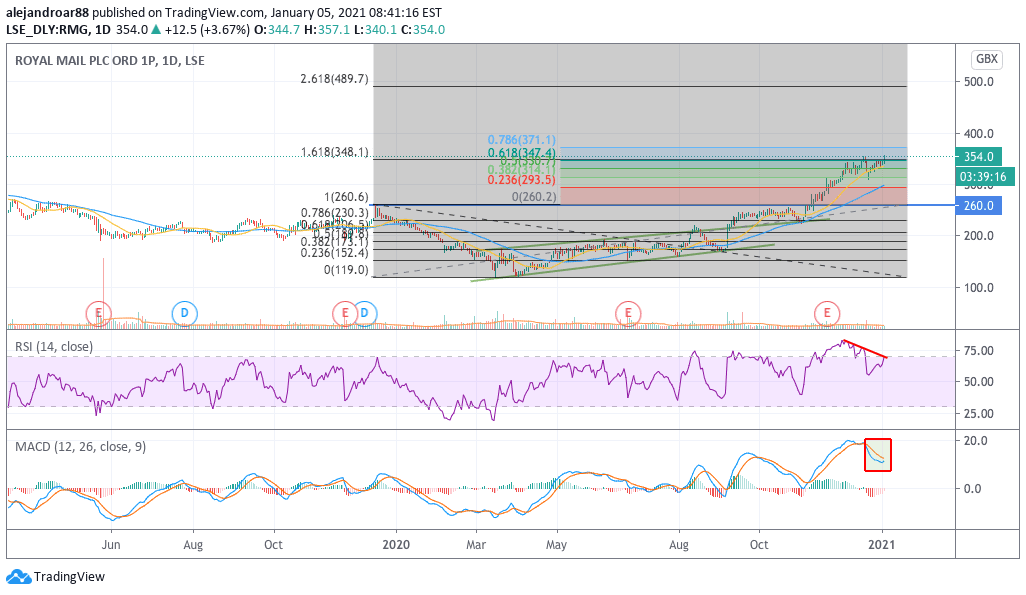

Meanwhile, the stock reached a previous target we laid out in mid-December, hitting the 350p level indicated by its 1.618 Fibonacci extension.

What’s next for Royal Mail shares?

Now that Royal Mail shares have reached this target, it could be argued that the trend is now entering a brand new bullish phase marked by the prospect of an effective turnaround in the firm’s profitability situation.

Using the Fibonacci retracement shown in the chart as the pivot for an upcoming bull run, we could set a first short-term target for the stock at 370p.

However, if that level is broken, a big upside risk could emerge for Royal Mail shares, as traders might start eyeing the 2.618 extension of 490p – a move that would leave behind the highest 12-month price target (410p) currently laid out by analysts.

On the other hand, traders can focus on the positive backdrop that a persisting pandemic is setting for the firm’s shares, which could give the stock price a short-term boost – possibly aiming for that 370p target for a 5% potential upside.

That said, there are some indications of caution in regards to these short-term moves, the first being a pronounced divergence in the RSI oscillator and a downtrending MACD that actually sent a sell signal in mid-December once the 350p was reached.

With all that in mind, holding the stock for the long run sounds far more interesting than a short-term trade at this point given the current technical setup.

Question & Answers (0)