Royal Mail shares are moving 0.3% lower today in mid-day stock trading activity in London. The stock appears to be ready for a breather after a strong five-week rally that ended up pushing the share price to its highest levels in more than two years.

Shares of the British postal company saw their first uptick in the week starting on 7 September, after positive news flow including above-average parcel volumes, an improved outlook for the year, and strong cost-cutting efforts from the firm’s management, lifted investor sentiment towards the stock.

Meanwhile, more recently, Royal Mail (RMG) upped its revenue guidance for the year, estimating that sales could end up surging between £380 million and £580 million by the end of the year – a dramatically better forecast compared to the £75 to £150 million the firm initially communicated to investors in September.

Furthermore, a persisting virus situation in the United Kingdom has also provided a boost for the shares, as the higher demand resulting from increased online shopping activity could last longer than initially expected.

However, with the Pfizer-BioNTech vaccine now being effectively rolled out in the country, en-masse inoculations could fully reach the UK’s entire population by the first quarter of 2021 – a situation that increases the likelihood of a short-term pullback as investors might feel it is time to re-assess where things might be headed as this important tailwind starts to lose steam.

How have Royal Mail shares performed so far this year?

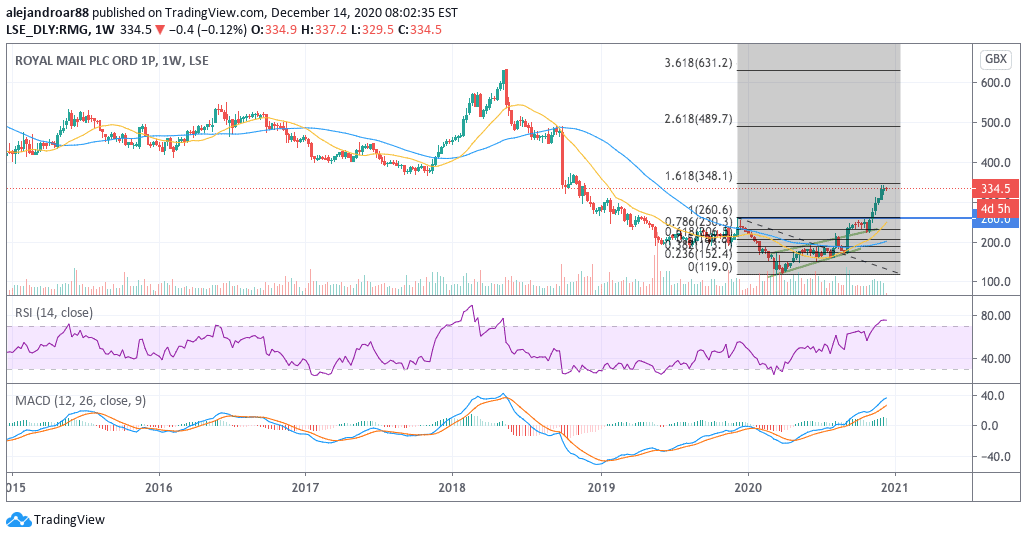

Royal Mail shares have managed to reverse a long-dated downtrend that pushed the price to the low 100s in the first few months of the year, while the stock is on track to post one of its best years since it was fully privatised.

So far, Royal Mail accumulates a 47% gain since the year started as the stock bounced from those lows strongly while delivering an eye-popping 178% return since its 31 March bottom. Meanwhile, the share price has trespassed multiple resistances including a 260p high recorded in December 2019.

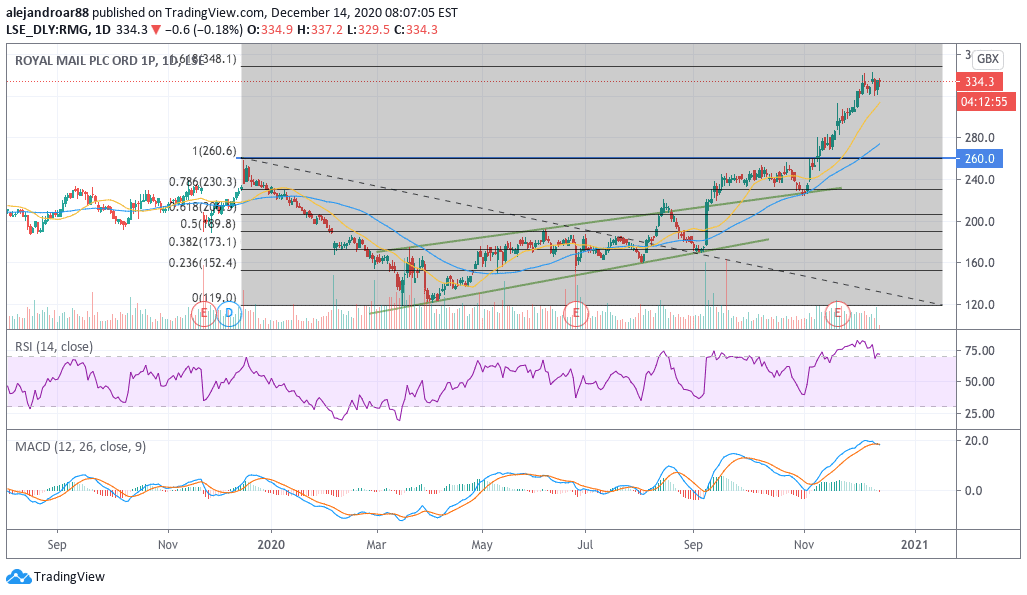

That said, both the daily and weekly charts seem to be signalling a heavily stretched bull run that could end up in a swift short-term reversal for the share price as bulls start to take profits as the end of the year approaches.

What’s next for Royal Mail shares?

The daily chart above shows how the price is currently entering overbought levels in the RSI while the MACD has been surging to heights not seen since the 2018 600p peak.

Although the price action has already cleared multiple strongholds, the fact that the rally has already triggered some warning signals could weigh on the stock’s short-term upside potential as bulls start to consider tightening their stop prices while bears could see an opportunity to reap some short-term gains from a pullback.

As we signalled in a previous article, the short-term target for Royal Mail shares was 350p based on the Fibonacci extension shown in the chart.

At this point, it would be healthy to see the price mildly retreating to give a second stage of the rally some legs. For now, the 320p level has served as support for the past few sessions but a short-term pullback could end up plunging the price to its short-term averages.

Reinforcing this view, the daily MACD has made a U-turn and is almost sending a sell signal although it remains in positive territory.

Question & Answers (0)