Royal Mail shares are posting a 9% jump in early stock trading activity in London today at 255p per share after American bank JP Morgan upgraded the stock from Neutral to Overweight citing a prolonged pandemic tailwind.

This is the highest level the postal company’s shares have reached this year, as the pandemic has increased parcel volumes amid a surge in online shopping during lockdowns.

This uptick in parcel deliveries has helped the business in lifting its revenues during the year, although the company is still struggling to restructure its operations in a way that makes this transition from letters to parcels profitable.

That said, JP Morgan’s cited that a strong resurgence of the virus in the UK and the reintroduction of lockdowns in the country are likely to continue pushing parcel volumes higher over the next coming months – which results in improved top-line expectations for Royal Mail (RMG) for what remains of the year.

The British postal company saw its shares jump nearly 13% in early September after the release of its financial results covering the first six months of the year, as the firm saw a 33% surge in parcel revenues during the period.

This higher demand led to an improved guidance for the firm’s full fiscal year ending on March 2021, with the company now expecting to see sales surging by £139 million in contrast to the £200 million plunge in revenue the management team initially forecasted amid the pandemic.

According to JP Morgan, a prolonged improvement in revenues for the postal company should help alleviate the pressure of pushing cost-savings down the line, at least for now, while also giving the management more headroom to negotiate a deal with the Communication Workers Union (CWU) – an important achievement that could aid the firm’s restructuring.

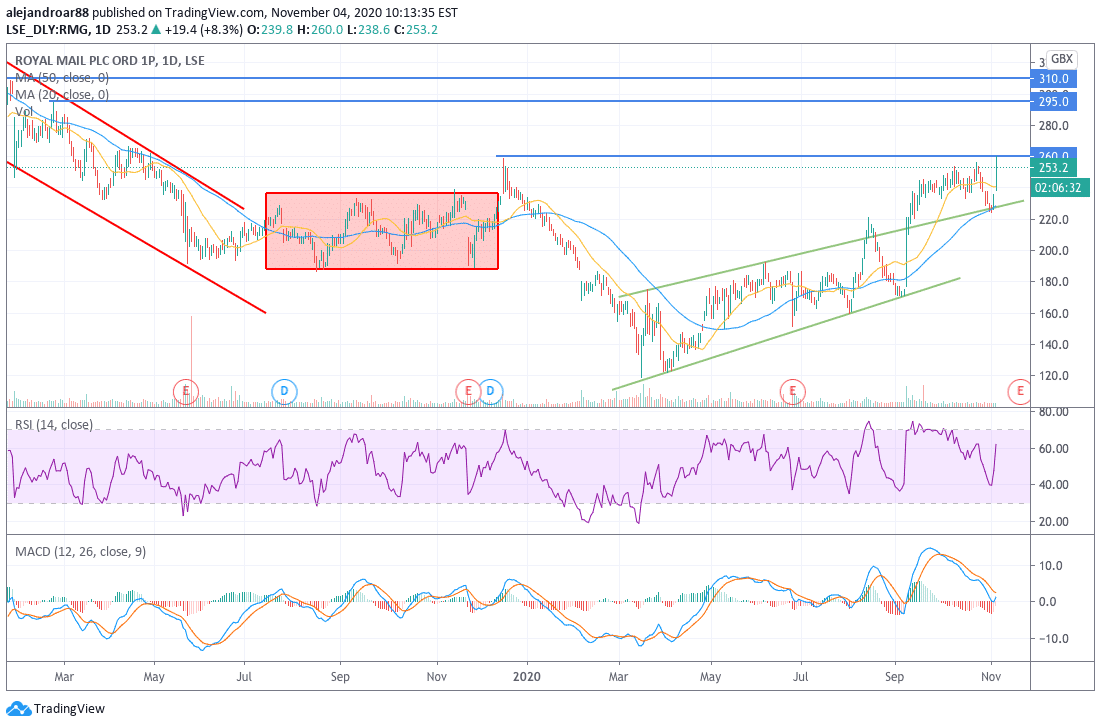

How have Royal Mail shares performed so far this year?

Royal Mail shares have delivered 12% in gains since the year started as the stock bounced strongly off its March lows, posting a 122% jump since then.

That said, Royal Mail shares are still trading at nearly half their value compared to their 2018 peak of roughly 600p per share as the firm’s profitability continues to decline amid a shift from its legacy letter service to parcels due to increased online shopping and a transition towards digital documents.

A portion of this rebound is explained by this increase in revenues coming from parcel shipments – which offsets the decline in letter volumes – but it is also driven by a credibility boost the company received after Czech billionaire Daniel Kretinsky upped his stake in the firm through his investment vehicle VESA from 4% in April to as much as 13% in July this year.

What’s next for Royal Mail shares?

Today’s slap in the back by JP Morgan is boosting the price of Royal Mail shares to their late 2019 highs – a resistance that the stock must now overcome if it were to see some more upside in the weeks to follow.

One positive element that could give strength to a bull run is the fact that the stock bounced off the upper trend line of a price channel shown in the chart – a line that appears to be serving as support now based on this latest price action seen by Royal Mail shares.

By using that 225p level as a floor, the stock could see further upside as the oscillators are just emerging off significantly low levels. That said, the MACD has not yet sent a buy signal since this rebound came out of the blue.

Quite interestingly, today’s strong jump came without a significant uptick in trading volumes. This is not necessarily a bad thing as the markets are so focused on the US election today that buyers may have missed this positive bump but they could come later to jump on board to take advantage of the stock’s renewed momentum.

Question & Answers (0)