Rolls-Royce shares were trading higher in early London price action today after the company released the earnings for the first half of 2021. The industrial giant returned to profits in the quarter but sounded a cautious tone on the outlook.

Rolls-Royce reported underlying revenues of £5.23 billion in the first half of 2021 which was below the £5.41 billion that it had reported in the corresponding period in 2020. It reported an underlying operating profit of £307 million during the period as compared to an operating loss of £1.63 billion in the first half of 2020. Its underlying EPS was 1.76p in the first half of 2021 versus an underlying loss per share of 59.4p in the first half of 2020.

Rolls-Royce earnings

“Our continued focus on the elements within our control, together with a good performance from Defence and order intake recovery in Power Systems have enabled us to deliver solid progress in the first half,” said Rolls-Royce CEO Warren East.

He added, “The benefits of our fundamental restructuring programme in Civil Aerospace are evident in our reduced cash outflow and improved operational efficiency. This leaner cost base together with a strong liquidity position gives us confidence in our ability to withstand uncertainties around the pace of recovery in international travel and benefit from the eventual rebound.”

Civil aviation segment rebounds

Civil Aviation is Rolls-Royce largest segment and was severely impacted by the COVID-19 pandemic. In the first half of 2021, the segment posted an underlying operating profit of £39 million as compared to an operating loss in the corresponding period in 2020. Defence and Power Systems also posted higher operating profits over the period.

Guidance

“We are confident that, when border restrictions are lifted, the recovery of international travel will accelerate,” said Rolls-Royce. It added, “However, based on current industry forecasts for the pace of recovery in international travel, this is likely to occur beyond the initial expected timeframe of 2022.” Notably, while domestic travel has largely resumed, international travel has been a laggard. Also, while leisure travel has rebounded from the pandemic lows, business travel has been a weak spot.

Rolls-Royce expects to become free cash flow positive

Rolls-Royce expects to turn positive on the free cash flow level sometime later this year. However, in the full year, it expects a cash burn of £2 billion as compared to a cash burn of £4.2 billion last year. It added, that it expects “Free cash flow of at least £750m (before disposals) is still achievable in a 12-month period when EFH (effective flying hours) exceed 80% of 2019 levels, supported by our lower cost base in Civil Aerospace which is now a third smaller.”

ITP Aero

Rolls-Royce has been looking to sell non-core assets to raise cash and deleverage. The company is looking at buyers for its ITP Aero business and is now in talks with private equity firm Bain Capital to sell ITP Aero for £1.4 billion. “Rolls-Royce confirms it has decided to enter into exclusive discussions with a consortium led by Bain Capital on a potential sale of the business. There can be no certainty that an agreement will be reached. Rolls-Royce will make a further statement as appropriate,” it said recently. The company has also been taking measures to structurally lower the costs.

Rolls-Royce share price forecast

According to the forecast estimates compiled by the Financial Times, Rolls-Royce has a median price target of 113p, which is a premium of 8.1% over current prices. Its highest price target of 162p is a premium of almost 55% over current prices, while its lowest price target of 52p is a 50% discount to the current share price.

Of the 21 analysts covering the shares, only five have rated the shares as a buy or some equivalent while nine analysts have a hold rating. Seven analysts have a sell rating on the shares.

Technical analysis

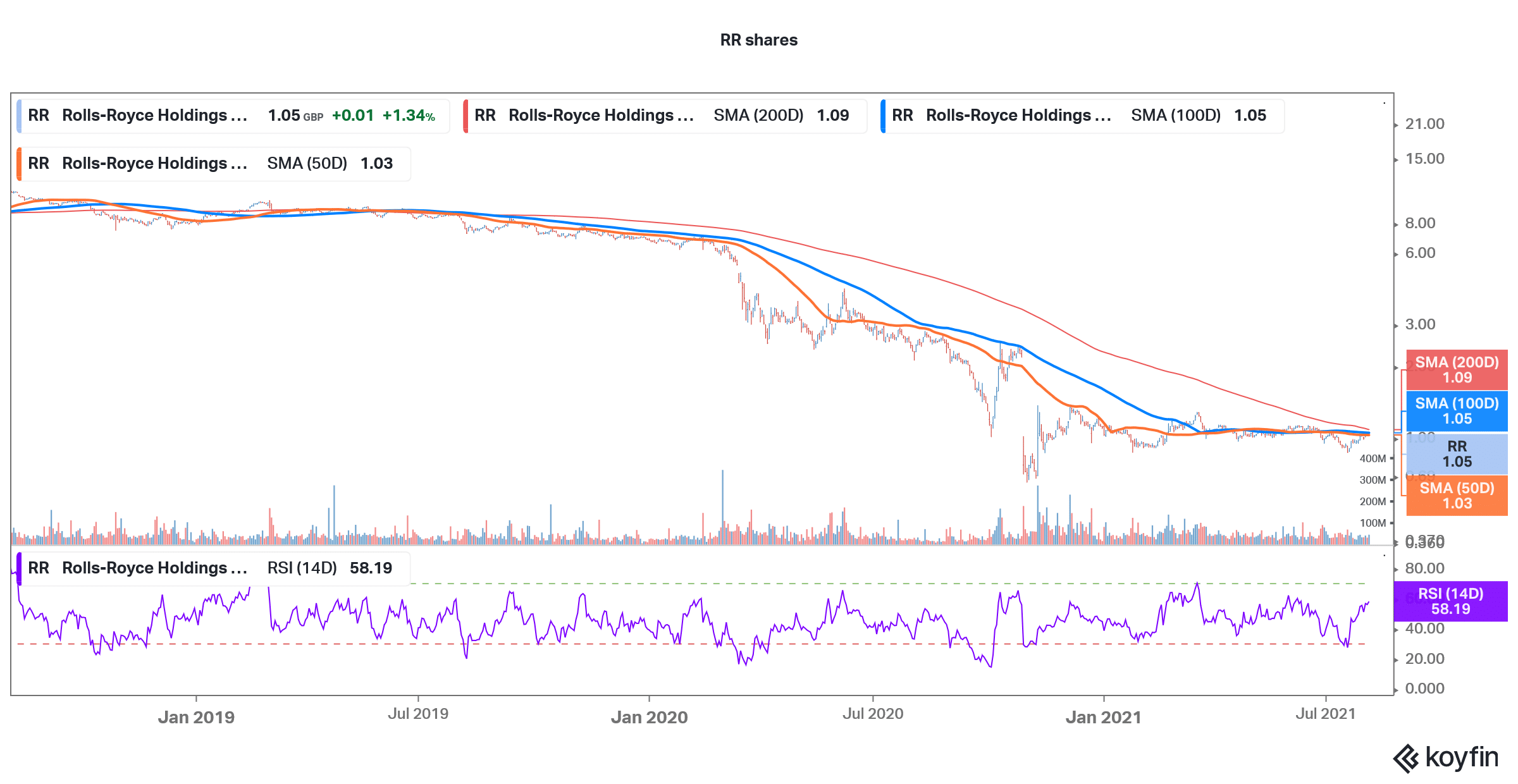

Rolls-Royce shares have been trading sideways for the last couple of months. While they crossed above the 50-day SMA, they have faced strong resistance at the 100-day SMA. The shares have a 14-day RSI (relative strength index) of 58.19 which is a neutral indicator. RSI values above 70 signal overbought positions while values below 30 signal oversold positions. After the spike today, the shares have bounced above the 100-day SMA which is a bullish technical indicator.

Rolls-Royce shares are trading almost flat for the year even as the broader markets, as well as cyclical shares, have surged. The shares did not participate in the rally in industrial and cyclical names as investors have adopted a wait and watch approach towards the company. The shares trade at an NTM (next-12 months) EV-to-sales multiple of 1.08x which is in line with its historical averages. That said, the company’s risk profile has increased over the last year as it took on massive debt to survive the pandemic.

Rolls-Royce shares were trading 3.5% higher at 11 AM London time today. The shares have a 52-week trading range of 34.59p-137.45p.

Question & Answers (0)