Rolls-Royce shares are jumping for the second day in a row, gaining 12.6% so far in late stock trading action in London at 140p per share. The company launched a £1 billion bond offering yesterday as part of its effort to raise as much as £3 billion in capital to strengthen business finances.

The UK-based aero-engine maker said in a regulatory press release that the issue will consist of a set of senior unsecured notes that will be denominated in euros, US dollars, and pounds, with prospective 5-year (2026) and 7-year (2027) maturities.

The company explained in the release that those proceeds will be used in combination with the funds obtained from other sources to recapitalise the business. Rolls-Royce is seeking increase its financial strength given the significant blow that the company’s top-line has taken as the pandemic continues to ravage the commercial aviation industry.

This corporate bond offering comes only a few days after the company addressed media speculation about a capital raise by stating that the firm was evaluating the merits of a rights issue and other forms of equity issuance, while it also disclosed that it managed to secure a £2 billion term loan partially backed by the UK Export Finance as part of its effort to further strengthen its balance sheet.

The firm also said that it is undertaking a major restructuring across its Civil Aerospace business, aiming to save around £1.3 billion in pre-tax expenses by the end of 2020, while also contemplating the disposal of roughly £2 billion in assets over the next 18 months.

This would be the latest effort from the engine maker to remain afloat after the pandemic downturn, which has led to a drop in commercial aircraft orders as airlines have been forced to shut down or downsize their operations as demand dries up.

Rolls-Royce reported a staggering pre-tax loss of £5.4 billion during the first six months of its 2020 fiscal year, which forced the company to cut as much as 9,000 jobs to reduce the impact of this revenue plunge in its bottom line.

Are Rolls Royce shares presenting a buying opportunity at these levels?

The fact is that nobody knows for how long the pandemic situation will endure, and that puts a veil of uncertainty over the future of Rolls-Royce and creates serious doubts as to how far investors – and the government for that matter – are willing to go to keep to help the company survive the downturn.

So far, Rolls-Royce (RR) has been successful at strengthening its liquidity position, but that situation is also creating a debt burden the company will have to deal with once the virus situation is over.

Higher interest expenses, a limited recovery in the demand for new engines, and a gloomy post-pandemic economic landscape will be just a few of the challenges that await Rolls-Royce, which is probably enough justification for the current depressed levels of its stock.

Moreover, the company may end up contemplating further equity capital raises, which could end up diluting the value of its shares.

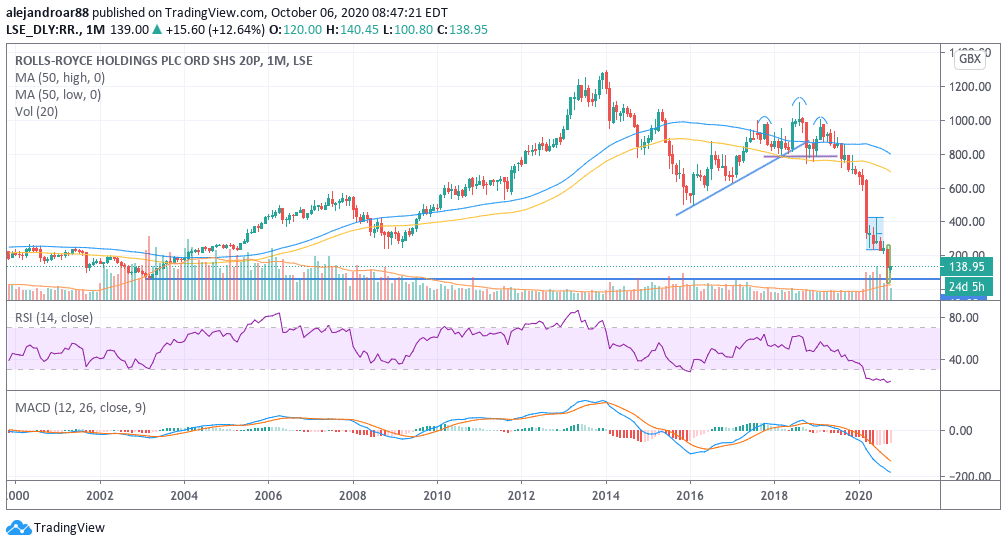

From a technical standpoint, Rolls-Royce shares are trading at levels seen almost 20 years ago, while the stock is also progressively approaching its all-time lows of 63p per share.

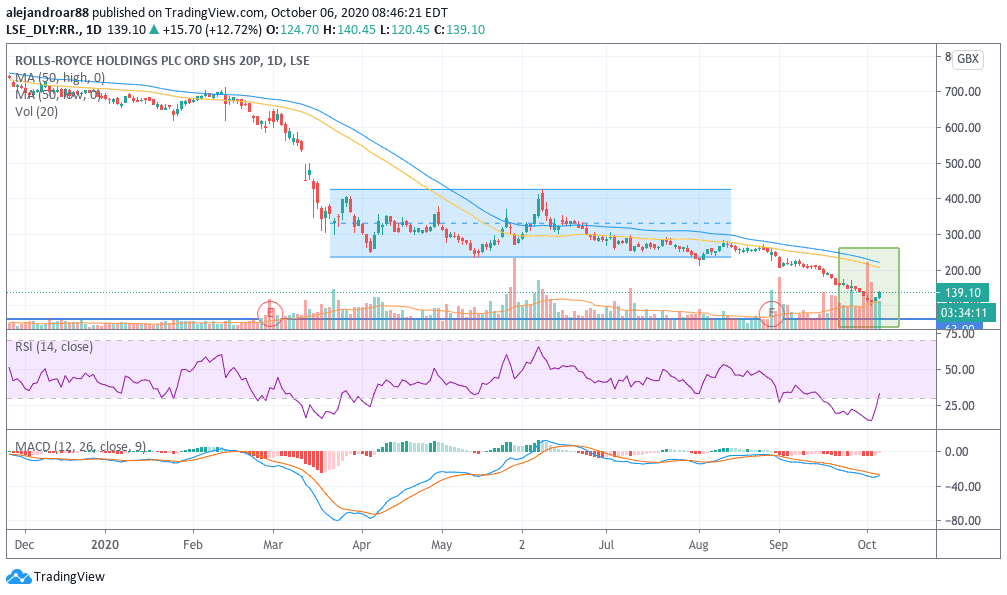

That said, the stock appears to be rebounding from oversold levels in the RSI as indicated by both the monthly and daily charts, as market participants may have renewed their hopes of a potentially brighter future.

Meanwhile, the daily chart also shows heavy trading volumes in the past few sessions, which means that these price levels and the latest news are increasing the interest towards the stock.

A further downward movement accompanied by these volumes could be a signal that market players are actually reacting in a pessimistic way to these latest announcements. On the other hand, a significant push up could mean that more investors are jumping on board of RR shares due to increased optimism about the future of the business.

Question & Answers (0)