The price of Provident Financial (PFG) shares are plunging today in mid-day stock trading action in London. It comes after the company revealed a concerning situation in regards to its regulatory compliance that could potentially lead to the liquidation of its consumer credit division (CCD).

In a trading update published this morning, Provident Financial Group (PFG) stated that consumer complaints directed to the Financial Ombudsman Service (FOS) targeting its CCD were up 200% during the second half of 2020, compared to the previous 6-month period, which has resulted in a total of £25 million in payments made to customers to settle the claims.

The firm further stated that it plans to set aside a total of £65 million to settle the growing number of claims received by the CCD as part of a Scheme of Arrangement proposed to the Financial Conduct Authority (FCA).

The British regulator has not yet approved such a scheme and the group alerted that if the regulatory body rejects the proposal it could lead to the placing of the CCD into administration or liquidation.

Moreover, PFG said that the FCA has already voiced some concerns in regards to the structure of the scheme, although the regulator is still evaluating the proposal and has not yet announced its final decision.

Regulator investigating Financial Provident

Meanwhile, the company also announced that the FCA has opened a formal investigation into the CCD in regards to its complaint handling procedures, while also assessing the institution’s ability to keep lending from a financial standpoint.

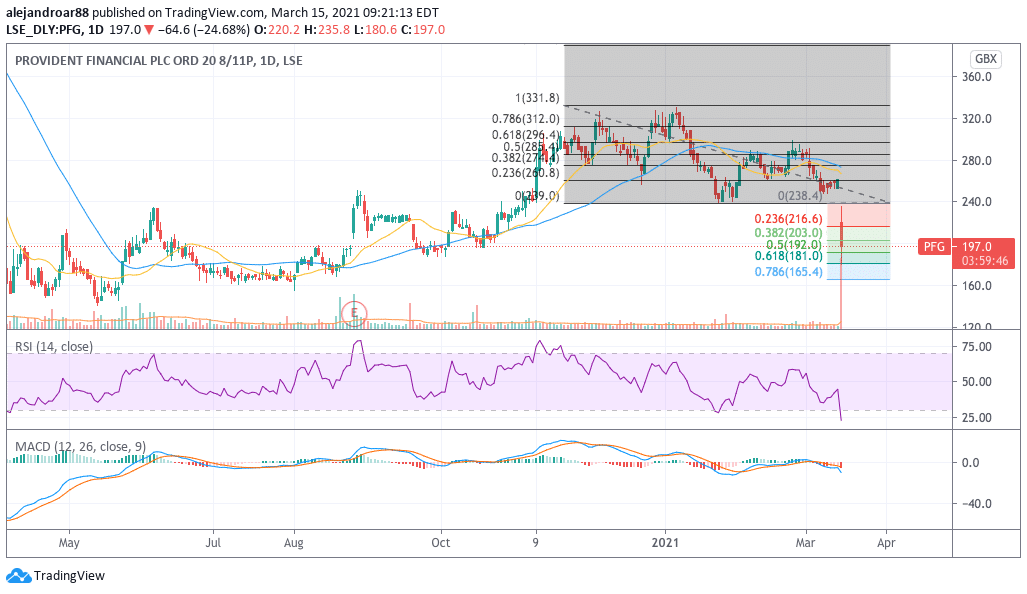

Investors are reacting quite negatively to the development, as the price of Provident Financial shares is plunging 24% at 198p per share.

According to the company’s last interim report, the CCD reported £37.6 million in pre-tax losses by the end of the first six months of 2020 – more than twice the losses the unit saw during the same period in 2019.

Meanwhile, the number of customers dropped 28.6% during the same period, ending the first semester of 2020 at 379,000 while revenues plunged 22.2% at £118.4 million.

According to PFG’s management, if the CCD were to be liquidated or put into administration, the “direct financial or operational repercussions for Vanquis Bank and Moneybarn of an administration or liquidation of CCD would not be significant”.

However, the firm added, the impact that such an event could have on the relationship between the group and its customers, regulators, and suppliers would be “uncertain”.

CCD revenues represented a bit more than a quarter of the group’s total by the end of the first semester of 2020 although its receivables represented less than 8% of the group’s period-end total for that period.

How have Provident Financial shares performed prior to this downtick?

Prior to today’s downtick, the price of PFG shares was down almost 15% for the year as the pandemic dealt a strong hit to small financial institutions in the form of higher loan-loss provisions, a deterioration of the quality of their credit portfolios, and potentially lower future revenues resulting from lower interest rates.

Meanwhile, the firm’s stock dropped as much as 33% last year, while its performance this year has worsened as shares are now retreating 35.5% after today’s meltdown.

Investors might be worried that the situation with the CCD could have a long-lasting and far-reaching impact on the lender’s credibility, which could lead to a wave of account closures.

Meanwhile, the market could also be concerned about regulatory issues possibly expanding beyond the CCD as the unit’s practices cannot be considered as isolated from the Group’s corporate guidelines and policies.

If more negative news were to follow, chances are that PFG’s stock price could drop quite sharply, possibly as the market might expect further expenditures related to litigation costs and regulatory penalties.

For now, if today’s meltdown were to push the stock below the 0.5 Fibonacci extension shown in the chart, chances are that the share price might land near the 165p level on short notice, representing a 16% potential upside for short-sellers who might be betting on a continuation of the downtrend.

That said, both the MACD and the RSI are plunging to their lowest levels in months, which could lead to a short-term technical bounce in the stock price without that necessarily invalidating the bearish target outlined above.

Question & Answers (0)