Pearson shares jumped during yesterday’s stock trading session after the company assured investors that its full-year results will be in line with the market’s expectation for the period.

This affirmation came as part of Pearson’s full-year 2020 trading update, which highlighted some of the most important figures of the business during a year in which it suffered a strong blow in some of its biggest revenue streams such as Global Assessment and North American Courseware, although a portion of the downturn was offset by a better performance in its the Global Online Learning segment.

According to Pearson, its Global Online Learning unit saw sales surge by 18% during the year, while Global Assessment and North American Courseware sales slipped by 14% and 13%, respectively, amid the impact of test centre and school closures prompted by the pandemic.

Meanwhile, International sales dropped 19% during the same period, resulting in a total 10% slide in the firm’s annual revenues, while the firm’s adjusted operating profits are expected to end the year in a range between £310 and £315 million – in line with analysts’ forecasts.

Pearson’s forecasted adjusted profit indicated that the firm was able to overturn an initial operating loss during the first semester of 2020, partially due to the £60 million it saved through the implementation of a restructuring plan. The company is now aiming to generate an extra £50 million in cost efficiencies by the end of its 2021 fiscal year.

Moreover, Pearson highlighted that the pandemic has accelerated a shift towards online learning, a situation that has prompted the company to speed up its transformation to position Pearson as a leading provider of e-learning solutions, especially in the United States.

In regards to the advance of these efforts, Pearson’s CEO Andy Bird said: “Our broader goal is to become a more consumer-focused company, targeting the incredible opportunity that exists to have a direct relationship with millions of lifelong learners. We look forward to sharing more details at our Preliminary Results in March”.

The company will be releasing its financial results for its 2020 fiscal year in March.

How have Pearson shares reacted to the update?

Pearson shares advanced as much as 8.5% after the report was released, pushing the price to their highest level since the pandemic started.

Meanwhile, the stock took a breather this morning, retreating 2.3% while closing the session at 720p per share as market players continued to digest the numbers.

During 2020, the stock delivered an 11% gain for investors, effectively outpacing the FTSE 100 index by roughly 24% as the firm slightly benefitted from the pandemic, amid a forced shift towards e-learning prompted by lockdowns.

A big portion of the late 2020 rally was fuelled by a recent bullish note from Swiss bank UBS, which raised its 12-month price target for Pearson shares to 750p – 4.1% above the current price – amid a “material opportunity” that the bank has identified for the company within the US higher education market.

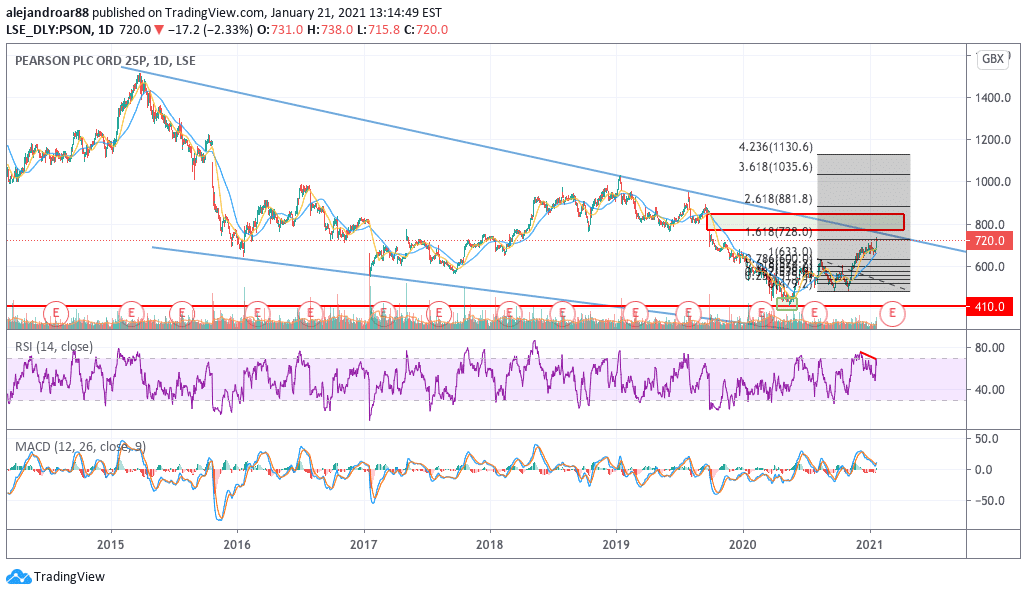

The stock is now approaching crucial resistance that could end up determining if this latest bull run will end up reversing a long-dated downtrend in place since 2015, or if market players will reject the move until more material evidence is provided in regards to the firm’s ability to transform its operations to embrace the digital era.

What’s next for Pearson shares?

The chart above shows how the latest price action has pushed Pearson shares near the upper trend line of a long-dated downtrend that started in 2015, following a series of disappointing acquisitions that undermined the company’s financial performance.

The confluence between the 1.618 Fibonacci extension shown in the chart and this upper trend line is reinforcing the importance of this resistance as a plausible ‘make-or-break’ moment for Pearson shares. A move above will initiate the filling of a bearish price gap left behind in September 2019 after the company issued a profit warning amid a sharp slow down seen by its US higher education revenue segment.

For conservative traders, the filling of this long-dated gap could represent a strong signal that the stock is in full-blown trend reversion mode. Meanwhile, for aggressive traders, a strong move above the 1.618 Fibonacci highlighted in the chart might indicate that the stock is ready for that filling, although there is a material risk a pullback could take place, possibly leading to the stock plunging in short order after hugging the trend line.

This view is supported to some extent by a bearish divergence in the RSI, although the MACD is favouring a bullish thesis as it has sent a buy signal already.

Question & Answers (0)