PayPal shares are trading sharply lower in early US price action today after the fintech giant reported its Q4 earnings. While the company’s earnings were better than expected, it spooked markets with its guidance.

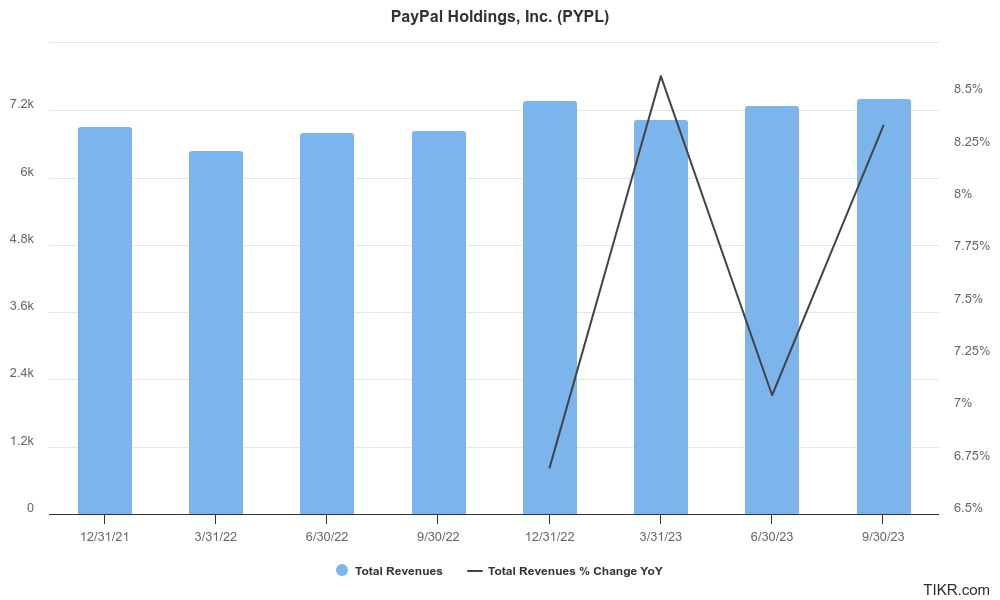

PayPal reported revenues of $8.03 billion in Q4 which was 9% higher YoY and ahead of the $7.87 billion that analysts expected. Its EPS of $1.48 was also ahead of the $1.36 that analysts were expecting.

It reported payment volumes of $409.8 billion in Q4, which was 15% higher than the corresponding quarter last year and surpassing the $405.51 billion that analysts were expecting.

PayPal generated free cash flows of $2.5 billion in Q4 and $4.2 billion in the full year. The company returned $5 billion to shareholders last year in the form of buybacks and ended with cash and cash equivalents of $17.3 billion while it had debt of $11.3 billion on its balance sheet.

PayPal shares sink after Q4 earnings

PayPal CEO Alex Chriss said during the earnings call, “We have made strategic decisions to reinvest cost savings back into our most important initiatives. It is critical that we remain on offense and position ourselves to not only innovate but capture our share of the growth in global commerce.”

He added, “We’re driving significant transformation across our company and are committed to making the necessary changes to our business to drive profitable growth in the years ahead.”

PYPL’s branded business faces headwinds

While PayPal’s unbranded business is doing relatively well, its branded business which includes Venmo faces intense competition which is leading to margin compression. During the earnings call, CFO James Chriss said “accelerating growth in our branded checkout business, improving overall profitability, including that of our high-growth PSP services, unlocking the power of data to create more value for our customers while tapping into new sources of revenue and margin and operating more efficiently” would be the company’s priorities in 2024.

PayPal spooked markets with its guidance

PayPal’s guidance spooked markets and more than overshadowed the earnings beat. It moved from an annual to quarterly revenue guidance and Miller said, “Given the considerable changes underway at the company, we believe it is prudent to guide revenue 1 quarter ahead and provide updates as the year progresses.”

PayPal expects its revenues to rise 7% YoY on a currency-neutral basis in Q1 and forecasts that its adjusted EPS will grow at a mid-single-digit percentage. The company however expects its full-year adjusted EPS to be “roughly in line with prior year EPS of $5.10” and the guidance was significantly below the $5.48 analysts expected

Commenting on the guidance, Chriss said, “We want to be clear-eyed in terms of the potential near-term benefits from our initiatives, which is why our 2024 guidance includes minimal contribution from the innovations we recently announced. We want to see execution and clear results prior to embedding these initiatives into our financial outlook.”

How did analysts reacted to PYPL’s earnings?

Wall Street analysts were not too pleased with PayPal’s earnings report. Wells Fargo analyst Andrew Bauch reiterated his equal weight rating and $60 target price on the shares and said, despite “bold efforts” by the company’s new management the Q4 earnings and 2024 outlook is “more likely to vindicate the perma-bears and leave the want-to-be-bulls in purgatory.”

Bauch added, “We did not hear any compelling answers to PYPL’s existential question into the print.”

He went on to add, “While we appreciate the energy PYPL’s new [management] team brings to the table, for those of us who have intimately documented the last two years, it’s no surprise that turning around the titanic that is PYPL will be no small feat.”

Jefferies analysts said that PayPal hit the “reset” button with its earnings and added, “On one hand, the outlooks for gross profit and EPS should provide a floor for [fiscal 2024] estimates, a prudent move,” while “On the other, there is risk in committing to invest heavily behind efforts to fix problems (namely, branded checkout market share) that may we believe may be irreparable.”

Some analysts praised the company’s new leadership team

During the earnings call, PayPal stressed that it now has a new leadership team that is trying to revive the company’s growth. A section of the market is impressed by some of the actions that the new executives have taken.

Piper Sandler analyst Kevin Barker said, “W]e are encouraged by the change in tone and leadership changes made by newly appointed CEO Alex Chriss.” He added, “He has instituted a series of changes to directly address PYPL’s challenged areas that ultimately could lead to sustained revenue and margin growth.”

Susquehanna analyst James Friedman said that he and his team “applaud” the management team “for increasing the focus on transaction dollars, which ultimately should lift both the margin and the stock price.”

Friedman termed PayPal’s decision to focus on Core PayPal compared to Braintree as “unconventional” and said, “If they’re correct, the upside may be material,” Friedman continued. “But it’s far too soon to tell, and for now, we are trimming estimates on what appears to be no earnings growth in [fiscal 2024] on the same challenge of adverse leverage from business mix.”

Multiple analysts downgraded PayPal in January

In January, multiple analysts downgraded PYPL and the company’s innovation event also fell short of the high hopes that markets had pinned on that event. The company is battling increased competition from Apple Pay and the iPhone maker continues to focus on other growth drivers amid slowing iPhone sales.

Meanwhile, PayPal shares are down in double digits at the time of writing as the once formidable fintech giant continues to remain out of favor with investors.

Question & Answers (0)