Oil stocks are advancing this morning on the back of higher crude prices as the threat of a sharp supply increase coming from Iran is receding, with discussions between the United States and the Middle East oil producer likely to last for longer than expected.

Both countries appear to have reached a certain level of understanding in the past few days through indirect talks, but a formal deal continues to be elusive amid a series of “sticking points” for which the two nations have not yet found a middle ground.

The appointed spokesman for Iran’s Foreign Ministry, Saeed Khatibzadeh, assured reporters yesterday that there has been no impasse but that there was “very little time left” to reach an agreement in regards to the nuclear deal.

Oil markets appear to be taking the news on a positive tone, as the price of futures contracts of the West Texas Intermediate (WTI) and Brent are advancing strongly during today’s early commodity trading action.

Meanwhile, oil stocks, as tracked by the SPDR Energy Select Sector (XLE) exchange-traded fund (ETF), are up 0.6% in pre-market trading in response to the uptick in crude prices.

The latest advance in oil stocks has been aided by both a strong rise in crude prices and higher production levels. According to data from the US Energy Information Administration (EIA) released last week, a total of 359 rigs were active in the United States by the end of May compared to a low of 172 rigs in mid-August last year.

The agency expects a significant jump in supply volumes in the following quarters primarily from members of the Organization of the Petroleum Exporting Countries (OPEC) to keep the pace of the demand, which should continue to grow rapidly as the progressively steps out of the pandemic.

“Additional supply from OPEC+ will be needed over the second half of this year, with demand expected to continue its recovery”, said a report from the European bank ING.

Moreover, markets appear to be expecting what would be the fourth consecutive drawdown in US crude inventories, with the consensus forecast seeing stockpiles drop by 3 million barrels last week following an important 5.24 million barrel drop the week before.

Exxon leads oil stocks higher today

Exxon (XOM) shares are leading today’s uptick in oil stocks as they are advancing 0.76% in pre-market stock trading action at $62.5 following the reiteration of Bank of America’s buy rating for the stock. The bank anticipates a potential increase in the firm’s dividend on the back of improved market conditions. Exxon’s dividend yield is currently sitting at 5.6%.

Exxon and Chevron (CVX) account for almost 43% of the portfolio of the SPDR Energy Select Sector ETF (XLE), which makes their performance crucial for the fund’s advance.

Data from ETF Database shows that since 2021 started, XLE has received a total of $5.38 billion in net inflows from investors, a number that accounts for a bit more than 20% of the fund’s total assets under management to date. During that same period, oil prices have advanced more than 40% while the fund has displayed a remarkable 47% return.

What’s next for oil stocks?

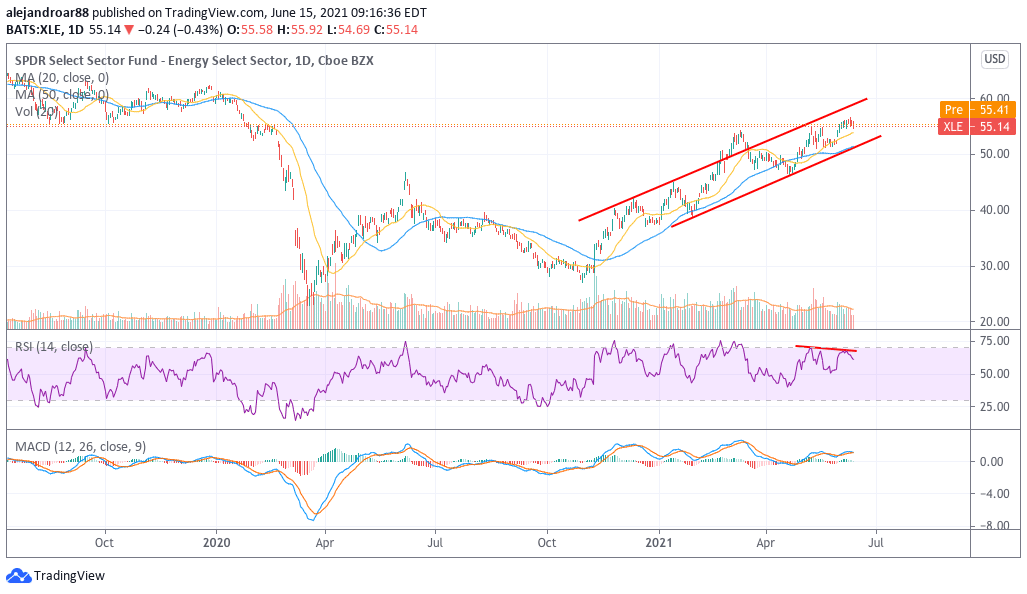

Using XLE as a proxy for the entire sector, the price action seen by oil stocks since November last year, back when the Pfizer vaccine news came out, has been compressed in a tight price channel pointing upwards as the valuation of oil companies has advanced alongside crude prices.

Although any plausible directional forecast would point to the continuation of the current uptrend since there are no indications of a turning point thus far, investors should be aware that the RSI just posted a bearish divergence as oil stocks advanced to a higher high on a lower momentum reading.

These divergences tend to signal an upcoming trend reversal or at least a temporary pullback in the security, which, at this point, could result in a 5.2% retreat of the XLE ETF towards its trend line support at around $52.5 per share.

Meanwhile, investors should expect a high degree of volatility over the coming weeks both in oil prices and the valuation of oil stocks as the market will be keeping an eye on how negotiations between the US and Iran continue to advance while statistics from the upcoming summer season in the North American country should also provide further insights about the pace at which the demand for air travel is recovering.

Question & Answers (0)